Automobile industry: India

The Times of India

This is a collection of articles archived for the excellence of their content. |

After-sales service ranks

2014-2015, company-wise

- Honda and Maruti Suzuki rank highest after-sales customer service

- Maruti Suzuki holds this position for the 17th consecutive year

- Hyundai and Tata rank third in a tie at 888

CHENNAI: Even as automotive manufacturers collectively improve their after-sales service satisfaction for the eighth consecutive year in India, satisfaction levels and service consistency vary greatly across the regions of the country, according to the JD Power 2016 India Customer Service Index (CSI) Study for the mass market segment released on Friday.

Honda and Maruti Suzuki rank highest in satisfaction, in a tie, with after-sales customer service among mass market brands, each with a score of 901. Maruti Suzuki holds this position for the 17th consecutive year, while Honda ranks highest for the first time. Maruti Suzuki performs well across all factors and Honda shows strong improvement across all factors, with the greatest improvements in service initiation and service quality. Hyundai and Tata rank third in a tie at 888, and are the most improved nameplates in the study.

Overall service satisfaction in the mass market segment in India improved by 14 points to 880 on a 1,000-point scale in 2016 from 866 in 2015. Overall satisfaction in the West region is 900, while overall satisfaction in the North region is 857.

Strong differences in customer behavior, preferences and expectations of their after-sales experiences contribute to the substantial disparity in the regional scores. For example, 82% of vehicle owners in the West region schedule an appointment for their service visit, while only 55% of customers in the North region schedule their appointment, affecting dealers' ability to effectively manage unscheduled workload and maximize throughput. Additionally, owners in the North region drive their vehicles an average of 11% more than those in the other three regions in the first 12-24 months of ownership, indicating that dealers in the North region have to account for more wear and tear issues when customers bring their cars in for service.

"In an astoundingly diverse market like India where every region and state has its own unique characteristics and needs, dealers need to capitalize on every customer interaction opportunity to develop points of differentiation and deliver on those expectations," said Mohit Arora, executive director at J.D. Power. "By being attuned to the differing customer needs across the country, dealerships can continuously adapt their service processes to consistently deliver a superior customer experience."

The study finds that dealers are improving in their communication activities with their customers at every service juncture, and that is having a positive impact on overall satisfaction. Nearly nine in 10 (89%) customers say they were reminded by the dealership about their vehicle service, an increase from 86% in 2015. Additionally, 93% of customers say their service advisor ensured that they fully understood the scope of work being performed on their vehicle, up from 90% in 2015. Following their service, 89% of customers say they were informed about when to schedule the next visit, up from 83% in 2015. Overall satisfaction among customers who receive all three of these communications is 899, compared with 818 among those who do not receive such communications from their dealers.

"Dealers are at the frontline of interacting with customers and hence represent the automotive brand that they carry," said Kaustav Roy, director at J.D. Power. "It's critical that every communication milestone is handled properly. Any gap in communication may have the unintended effect of lowering satisfaction, as well as customer loyalty, and the negative impact may be magnified when it gets passed on through word of mouth."

Among customers who are highly satisfied with their dealer service (overall satisfaction scores of 980 and above), 92% say they "definitely would" revisit their service dealer for post-warranty service, compared with only 44% of dissatisfied customers (818 or lower). Furthermore, 93% of highly satisfied service customers say they "definitely would" recommend their service dealer to family and friends. In contrast, only 50% of dissatisfied customers intend to recommend their dealer.

Now in its 20th year, the study measures new-vehicle owner satisfaction with the after-sales service process by examining dealership performance in five factors (listed in order of importance): service quality; vehicle pick-up; service advisor; service facility; and service initiation. The study examines service satisfaction in the mass market segment. Satisfaction is calculated on a 1,000-point scale.

The 2016 India Customer Service Index (CSI) Study is based on responses from 7,843 new-vehicle owners who purchased their vehicle between May 2014 and August 2015. The study was fielded from May through August 2016

Automobile hubs in India, state-wise

The Times of India, September 11, 2016

Swaminathan S AnklesAria Aiyar

Tata shifted its Nano plant from Singur to Sanand, Gujarat. Can acquisition of land at Sanand be struck down as not serving a public purpose? Many states competed to attract the plant. Gujarat won by offering cheap land, tax breaks and concessional finance. Can all these be struck down too? Gujarat has long been highly industrialised but dominated by oil and chemical industries creating few jobs. Narendra Modi as chief minister visualized the Sanand plant as not just a Tata factory but an incubator of auto ancillaries and skills that would make Gujarat a major auto hub with lakhs of jobs, like Delhi, Maharashtra and Tamil Nadu.

Events have vindicated him. The Nano itself was a giant flop, and Tata will have to shift to other models.But the project created many auto ancillaries and skills that have indeed attracted several other auto majors, and converted Gujarat into an auto hub. Tata may have failed but Gujarat has succeeded.

Ford built its first plant in Tamil Nadu but moved to Gujarat in 2015 for its second plant. Honda and MarutiSuzuki, both of which began with car factories near Delhi, are now building new plants in Gujarat.Maruti-Suzuki will be by far the biggest investor, with an initial capacity of 250,000 carsyear rising to 1.5 millionyear with an outlay of a whopping Rs 18,500 crore. AMW Motors has built a heavy truck plant with a capacity of 50,000 heavy trucks per year. Atul Auto, a producer of commercial three wheelers, is planning a second plant near Sanand.

Honda Motorcycle and Scooters India has set up a plant producing 1.2 million Activa scooters per year.Hero MotoCorp is constructing a plant with an initial capacity of 1.2 million two-wheelers, to be raised to 1.8 million. Gujarat will span the full range from two-wheelers to cars to trucks.

The Nano factory initially spawned 41 auto ancillary plants. The number is projected to rise to 350, mostly in the Sanand-Mandal-Becharaji region. The big names include Canada's Magna International, Germany's Bosch and Switzerland's Oerlikon. Old-time tyre-makers Apollo and Ceat have been joined by newcomers like Taiwan's Maxxis Tire, Yokohama Tyres and MRF.

These successes more than compensates for the failure and likely closure of the state's first auto plant of General Motors at Halol. This was in any case too small to spark an auto hub. Sanand has the requisite scale.

In sum, forced acquisition is usually wrong, and Gujarat has rightly shifted mainly to negotiated land purchases. But there can be exceptions that justify acquisition, and the auto hub in Gujarat is one such example.

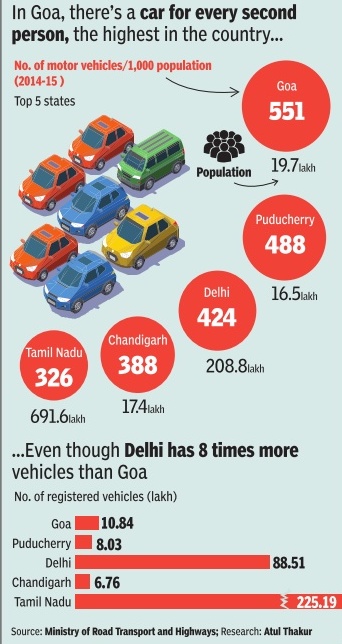

Vehicle density in the states, 2014-15

The Times of India, December 20, 2016

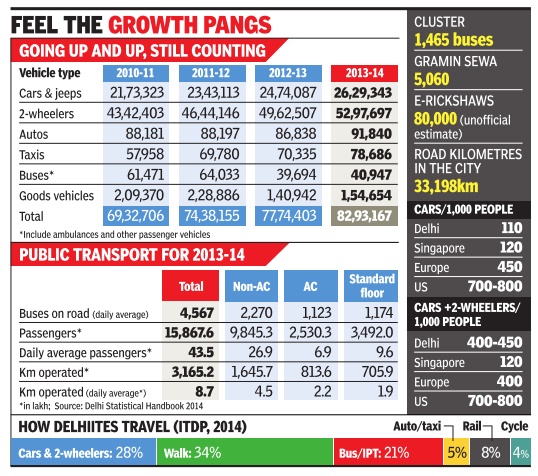

Number of vehicles, city-wise

Please see: Graphics

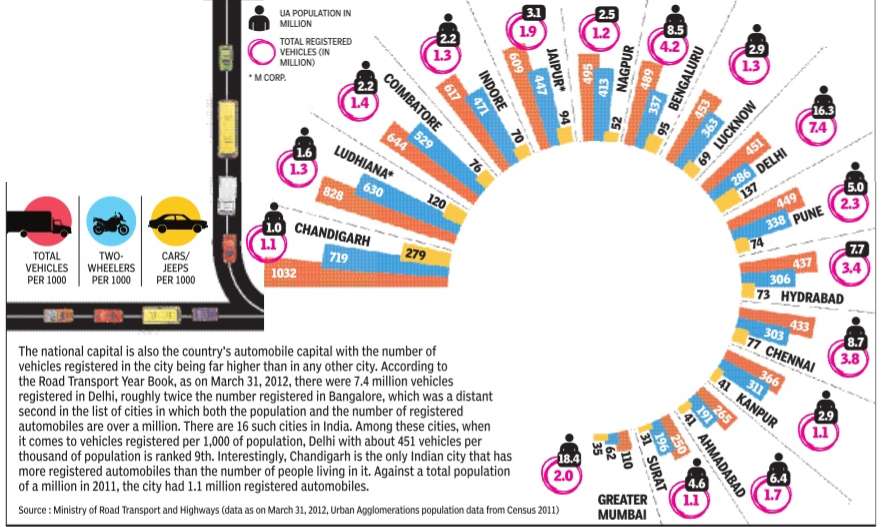

Delhi, with its 88.5 lakh registered vehicles, usually springs to mind first when one talks of vehicular population in states. But in terms of vehicle density or registered vehicles per 1,000 people, Delhi actually ranks third, behind Goa and Puducherry

2015, Jan- Aug: Types of vehicles registered in Delhi

Car density per km.; total numbers in metros

The Times of India, Jun 20 2016

Somit Sen

At 430|km, Mumbai has highest car density

Mumbai's roads are bursting at the seams as 172 cars are added daily , while the length has remained close to 2,000km for few years.In six years there has been a 56% rise in private cars, which occupy 85% of road space and are an impediment for growth of public transport. There are 8.6 lakh private cars in the city at present.

Public vehicles have a population of 1.64 lakh and density of 82 vehicleskm of road. It is 19% of the total number private of cars plying on any stretch in the city .“Private cars will keep growing unless there are good alternatives and a robust public transport system of AC buses and metros,“ said expert Sunil Mone. “The Ghatkopar-Versova metro has dissuaded many from using cars along east-west corridor.“

Private cars have also become affordable for the middle class.Mumbai Transport Forum coconvener Rishi Aggarwal said, “It is easy to get a loan with comfortable EMIs of Rs 5,000-8,000 for a hatchback. Parking will become a nightmare if the car population goes unchecked.“

Ashok Datar of the Mumbai Environmental Social Network said, “Public transport can never grow unless we remove cars par ked on the road at least on major arteries. About 20% road space is used for car parking.“

Aggarwal said the government should also encourage aggregator AC buses, with each carrying 40-45 passengers, freeing up significant road space. “Another issue is noise and air pollution. For 25 years, the government has only been talking about green fuel, imposing restrictions on polluting vehicles and encouraging public transport. But the problem on the ground level remains unchanged,“ said activist Anil Galgali.

Experts said people aged 25-30 are more into buying cars as they are not guaranteed good public transport to travel to office. Last year, US transportation secretary Anthony Foxx stressed the need for an effective mass transit system and creation of more travel options for people commuting in the same space. Former transport commissioner V N More had proposed restricting private cars, and new registrations should be done only if there is an “assured parking space“ in the housing society . He had also proposed a hefty cess on petrol and diesel for cars and exorbitant parking charges in commercial areas.

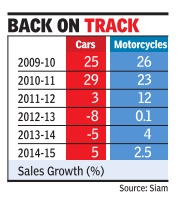

Automobile sales

2009-15: 5% growth

Apr 11 2015

Pankaj Doval

Car sales up after 2 yrs of decline

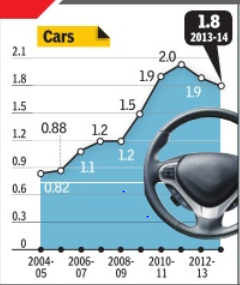

After two successive years of decline, car sales registered a 5% growth in the financial year (2014-15). But the revival may not be sustained in the current financial year due to an adverse impact on the rural economy after unseasonal rains.

Car sales fell 5% in 2013-14 and 8% in 2012-13 as high interest rates and growing fuel prices had dampened buyer sentiment.

The car industry has started showing some positive traction after entry of the Narendra Modi government in May last year. Modi's entry , which revived hopes of an economic turnaround, also coincided with a cut in fuel prices and a marginal reduction in interest rates. These positive factors, coupled with a low base year, led to a growth in sales numbers.

But a weak rural economy may play spoilsport. The difficult journey of the rural economy started last year with a deficient monsoon. This year also, unseasonal rains have damaged rabi crops.

The impact of an affected rural economy is already visible on the sales of motorcy cles, which grew only 2.5% in 2014-15, lagging a 25% growth witnessed by scooters. Sales of bikes fell 6% during the last quarter of 2014-15. Analysts said with rural economy playing an increasingly bigger role in the sales of small cars and motorcycles, an adverse demand impact here could hit the overall sales momentum.

“We are already feeling the pressure of a slowdown in the rural economy ,“ Vishnu Mathur, DG of industry body Society of Indian Automobile Manufacturers (Siam), told TOI.“Sales in the rural regions are critical for growth in some of the important categories, especially motorcycles.“

According to some estimates, rural economy accounts for around 30% to total sales of car makers -especially in case of mass-market manufactur ers like Maruti and Hyundai, while in motorcycles, the share has reached nearly half.

“Market sentiment in some rural areas has been impacted due to various factors, including the curtailment of national rural employment guarantee act (NREGA) spends, poor crop realisation and moderating wages,“ an official at top twowheeler maker Hero MotoCorp said. “The industry has, therefore, felt some impact in retail off-take in markets such as Bihar and Madhya Pradesh and sugar cane-growing areas in Uttar Pradesh and Maharashtra.“

The scooter category , however, is somewhat insulated from the agri pressure as it has abig share of the urban market.

The weak trends in rural India are worrisome for car manufacturers, which had turned their focus on agri-led regions.

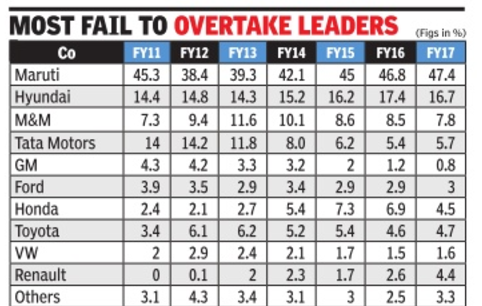

[http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Top-car-cos-maintain-mkt-share-growth-15072017025042 Nandini Sengupta|Top car cos maintain mkt share growth|Jul 15 2017: The Times of India (Delhi)]

Big gets bigger, small becomes smaller: The Indian passenger vehicle market has become a losing market share game for the vast majority of players apart from the top 3 and the rare exception of Renault.According to SIAM data, market leader Maruti has seen a steady upswing in market share since FY12. Arch rival Hyundai too has remained on the upward curve, though it did slip a little in FY17. M&M has been up since FY11, but has gone flat negative in the last three fiscals. As for the rest, even big MNC names like Toyota and Ford have remained flat market share-wise, even as Honda and Volkswagen have slipped.Tata Motors has been one of the biggest losers, seeing its market share come down to less than half (see table). Maruti's market share climb -up to 50.4% by June 2017 -is on the back of its product pipeline. Between February 2014 and March 2017, it has rolled out seven new products -Celerio, Ciaz, S-Cross, Baleno, Vitara Brezza, Ignis and Baleno RS. In FY 17-18, too, it plans to bring two new models and two upgrades. Unsurprisingly , Maruti has outpaced the industry in growth for five years.

Said K Ayukawa, MD & CEO, Maruti Suzuki, “There are over 18 players in the market. Our target is to focus on our business and achieve our target of 2 million unit sales in 2020. Our endeavour will be to study our customers' demands and offer them a range of products. If we listen to them carefully, market share will follow.“

Top officials say that's because Hyundai has not had any mass-market launches in FY17.Its only launch Tucson is a high-end niche SUV . Said Rakesh Srivastava, senior VP (sales & marketing), Hyundai Motor India, “Building processes and services to consistently gain customer confidence, building an aspirational premium brand, product launches in the volume segment with high price-value proposition and strong, extensive channel partners -this is the recipe to gain market share in India.“ Brands that are floundering are doing so because they don't tick one or more of these four boxes.

Indeed, Renault's jump from 1.7% in FY15 to 4.4% in FY17 has been driven by the success of the Kwid.

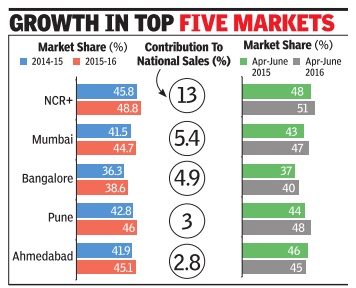

The Times of India, Sep 10 2016

Nandini Sengupta

A new focus on utility vehicles, a premium channel in Nexa and marketing aggression has helped Maruti Suzuki increase its marketshare in all the top 11 cities that form the creamy layer of the passenger vehicle market in India. The company has gained between 1-3% across the top car cities in India --DelhiNCR region, Mumbai, Bengaluru, Chennai, Pune, Ahmedabad, Hyderabad, Kolkata, Kochi, Jaipur and Lucknow.Collectively these top 11 cities comprise 40% of Maruti's total domestic sales.

“Enhancing market share in the top cities has been one of Maruti Suzuki's major achievements in the recent past. Our network is these markets is much stronger. Nexa has redefined the purchase and ownership experience. But it is our products that have played a key role: the design, features, safety and technologies like mild hybrid and AMT have made our vehicles much more appealing for urban customers,“ said R S Kalsi, executive director, marketing & sales, Maruti Suzuki.

The highest gain has been in the Delhi-NCR region whe re the company's marketshare has risen from 45.8% in FY15 to 48.8% in FY16 and 51% in Q1 of FY17 (see table). In Mumbai, Maruti's marketshare has increased from 41.5% in FY15 to 44.7% in FY16 and 47% in Q1 of this fisccal.Marketshare in Bengaluru is up from 36.3% fiscal before last to 38.6% last financial year to 40% this Q1. Collectively, these three cities comprise over 23% of Maruti's national sales. There are 17 auto companies jostling for a footprint in the passenger vehicle market.

The urban focus has helped Maruti gain marketshare at a time when poor rainfall caused rural markets to shrink. The Nexa network not only strengthened the urban focus but also helped aggressively sell vehicles to suit the changing taste of these markets.

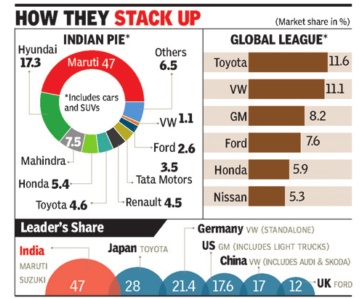

2012-15: Three manufacturers dominate

The Times of India, January 28, 2016

Nandini Sengupta

Top 3 auto cos hold 70% mkt share'

India is the only country in the world where the top three auto manufacturers increased their market share to 70% for April-December 2015 compared to 67% in 2012, as per industry data. The pecking order has largely remained unchanged in the last five years. Also, the share of the top 10 models in the total sales has remained more than 50% for the last three years. The only change in the pecking order has been Mahindra & Mahindra moving into the third slot in 2013-14, ousting Tata Motors. Auto marketers say this overwhelming dominance of a few players in a market, which has 18 car and SUV manufacturers, is something peculiar to India alone. R S Kalsi, ED (marketing & sales), Maruti Suzuki India, said, “There is no other example of this trend anywhere else and the highest marketshare by a single company , apart from Maruti in India, is Toyota in Japan with around 30%.“

The top two's dominance of the market becomes obvious when one considers that their incremental volumes are more than what some of their competitors sell in a year. Rakesh Srivastava, senior VP (sales and marketing), Hyundai Motor India, said, “Last year, our sales went up 16% to 4.76 lakh units in the domestic market and this incremental increase is higher than the annual sales volume of 10 auto companies in India.“

Experts say part of this is due to the early mover advantage and the ability to focus on a solid distribution channel. Maruti Suzuki, for instance, has 1,750 showrooms and 3,000 workshops, while No. 2 player Hyundai has 1,070 showrooms, 370 used car outlets and 335 rural sales outlets.

But part of it also has to do with the existing car pool and the Indian customer's comfort level with a productbrand that has strong resale value. Indeed the three years of slowdown has reinforced the customer's tendency to go with what's tried and tested. “Typically Indian customers are willing to experiment during an economic growth phase, but in a slowdown they stick to tested and trusted products,“ Srivastava said.

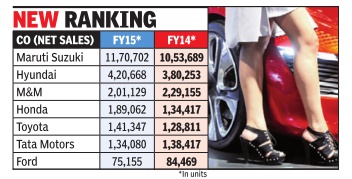

2014, 2015: Car sales, company-wise

The Times of India, Jun 23 2015

Nandini Sengupta

Toyota Replaces Tata Motors As Fifth Largest Car Maker

M&M lone Indian auto co in top 5

There has been a shift in the pecking order of car and SUV companies in India with the fourth, fifth and sixth spots showing significant changes. According to statistics from the Society of Indian Automobile Manufacturers (SIAM), the top five passenger vehicle companies in India by sale are Maruti, Hyundai, Mahindra & Mahindra, Honda and Toyota. Tata Motors, which was in fourth place in fiscal 2014, slipped to sixth place in FY2015. Ford India is the seventh company in the top sellers' list. As a result of this rejig, M&M is now the only Indian brand among the top five passenger vehicle companies in India.

Indeed, Maruti, Hyundai and M&M have retained their earlier positions in FY2015 as well. Maruti, with 11,70,702 units in sales, remains top seller in FY2015 as well, increasing its tally from 10,53,689 units the year before.

Hyundai, in second position with 4,20,668 units, has also increased its tally from 3,80,253 units in FY14. M&M in third position, though, is lower in terms of sales at 2,01,129 units, down from 2,29,155 units in FY14.

The real change though is in the fourth, fifth and sixth slots. Honda, with 1,89,062 units, is the biggest gainer in the fourth position. It was in the fifth position with 1,34,417 units in FY14. Toyota, at fifth position with 1,41,347 units, has also jumped a slot in FY15. The year before it was sixth with 1,28,811 units.

Tata Motors lost two slots in FY15. With 1,34,080 units, it is now in sixth place whereas in FY14 it was fourth with a nearly similar tally of 1,38,417 units. Ford has remained number seventh, though with a reduced tally -75,155 units in FY15 compared to 84,469 units in FY15.

Industry experts say the change in pecking order is part of a larger churn in the industry as India readies for new emission and safety regulations in two years. N Raja, senior VP & director sales & marketing, Toyota Kirloskar Motor, said, “Customers have started to appreciate and demand safety features in cars, which becomes an important buying parameter. At Toyota, we are happy to contribute to the globalization of the automobile products sold in the country rather than merely chase numbers.“

Others say that individual performances depend more upon the value proposition of the vehicle models and technology will not be market barrier for companies. Vishnu Mathur, director general, SIAM, said, “Once the mandatory regulations come in, the higher technology will be a benchmark for everybody with price-increase a possible small differentiator.“

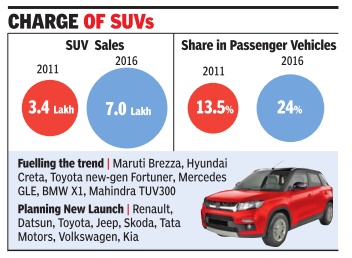

Purchasing patterns

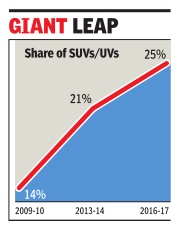

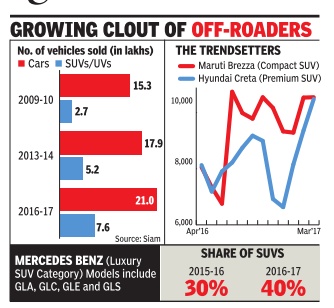

25% cars sold are off-roaders

Pankaj Doval, 1 of every 4 cars sold is off-roader, Jan 12, 2017: The Times of India

The love of Indians for SUVs is getting stronger by the day and one out of every four cars sold in the country is now an off-roader.

The lure of off-roaders -with high ground clearance, macho looks and relatively-powerful engines -is so strong that their sales volumes have more than doubled over the last five years, outpacing the growth of other segments in the car market, such as compact cars and mini sedans.

Rapidly changing lifestyles, increased inter-city travel and proliferation of newer, and budget-friendly models have fuelled the surge, say companies. “It is a disruptive segment, and it is only going to grow bigger and stronger,“ sa id Rakesh Srivastava, senior VP (sales & marketing) at Hyundai India. The company has tasted success with Creta that now accounts for sale of nearly 8,000 units on a monthly ba sis. “The SUV category is attracting buyers even from sedans and MPVs,“ he added.

Officials say that a higher stance, and patchy road conditions prompt many to opt for SUVs. “Even the prices of the vehicles have been coming down over the years, and they have entered the mainstream of the car industry,“ an official with a leading company said.

Maruti's Brezza, which was launched in March last year, is a case in point. The model has quickly raced on to become one of the fastest-growing cars in the market. It has seen sales of 80,000 units in the nine months of its launch, and boasts of a waiting period, that runs into a few months.

N Raja, director of sales & marketing at Toyota Kirloskar, said that people are “bored“ of hatchbacks and mini sedans.

Mercedes Benz's GLE (priced upwards of Rs 50 lakh) and BMW's X1 (starts around Rs 30 lakh) have seen strong demand in the market too.

2016: car sales

See graphic.

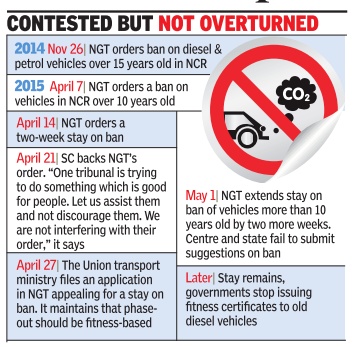

Ban on old vehicles

Scrapping policy: MHCVs, before 2001

The Indian Express, December 16, 2016

Amitabh Sinha

Scrapping 15-yr-old vehicles: Plan is to exempt cars, phase out buses, trucks

The ministry cites a study by AT Kearney which shows that there are 11.2 lakh MHCVs which are more than 15 years old and contribute to 34 per cent of the pollution.

According to the Motor Vehicles Act, LMV is defined as a transport vehicle with an unladen weight that does not exceed 7,500 kg, a definition that covers the entire range of passenger cars and SUVs and MUVs that are currently available.

The Ministry of Road Transport plans to retire only medium and heavy commercial vehicles (MHCVs) — and not passenger cars — that are more than 15 years old under a proposed vehicle scrapping policy submitted to a Committee of Secretaries for approval.

“In respect of LMVs (light motor vehicles), it is estimated that about 40 lakh cars are plying on the road that are more than 15 years old. These vehicles are estimated to contribute about 3 per cent of vehicular pollution. Since the overall contribution of cars to emissions is significantly less, hence they are not being considered under this programme,” says the Ministry. Watch what else is making news:

According to the Motor Vehicles Act, a light motor vehicle or LMV is defined as a transport vehicle with an unladen weight that does not exceed 7,500 kg, a definition that covers the entire range of passenger cars and SUVs (sports utility vehicles) and MUVs (multi utility vehicles) that are currently available. This includes the Toyota Innova (weight of 1870 kg for the heavier auto version), Mitsubishi Pajero (1,935 kg), Ford Endeavour (2,357 kg) and Mercedes Benz GL Class (2,535 kg). All vehicles weighing more than 7.5 tonnes are MHCVs.

The ministry cites a study by AT Kearney which shows that there are 11.2 lakh MHCVs which are more than 15 years old and contribute to 34 per cent of the pollution. In all, MHCVs accounted for 2.5 percent of country’s total fleet but contributed over 60 per cent of the air pollution, it says. Vehicle emissions contribute to rise in levels of toxic carbon monoxide, hydrocarbons, nitrogen oxides and particulate matter. Since it would be very difficult to impose a mandatory retirement of vehicles, the ministry argues, it plans to provide some respite and encourage retirement in this segment by proposing a voluntary vehicle modernization programme followed by a regulation on the life of vehicles.

For the first two years, vehicle owners would be given incentives in the form of scrap value, direct transfers capped at 4-5 per cent of the cost of basic model as well as cash discounts of 4-5 percent from the original equipment manufacturers. In effect, these would amount to a benefit of about 15 per cent in lieu of surrendering an old 16-tonne truck, says the illustration in the proposal. The previously proposed incentive by way of 50 per cent exemption in excise duty has been removed as the Finance Ministry has said that it would not be practical in view of the country’s shift towards a GST regime.

However, the 15-per cent incentive would be limited to the first two years to help in “smooth progression to regulatory regime of capping the life of the vehicles by the transport industry”. Then on, vehicle owners would be given sufficient time to look for viable replacements through a phased capping of the life of MHCVs to 18 years as on April 1, 2018; 16 years as on April 1, 2019 and finally at 15 years from April 1, 2020. Section 59 of The Motor Vehicles Act empowers the government to specify the life of a motor vehicle reckoned from the date of its manufacture. At present, an owner pays a one-time tax for lifetime but needs to get the fitness certificate renewed after 15 years to continue running it.

The government had told the Supreme Court this July that a new policy to combat pollution including scrapping of old vehicles and a scheme to replace about 28 million automobiles registered before March 31, 2005 was underway and would be implemented soon.

State-wise

Kerala (urban): 10-year-old diesel vehicles nixed

The Times of India, May 24 2016

10-year-old diesel vehicles to go off Kerala city roads

Mahir Haneef & MK Sunil Kumar1

The National Green Tribunal's bench at Ernakulam ordered that no diesel vehicle older than 10 years should be allowed to ply in the six major cities of Kerala. It also temporarily banned registration of new diesel vehicles over 2,000cc. Looking at possible alternatives, it asked the government to inform it whether enough CNG is available for running vehicles in the state.

Cities mentioned in the order are Thiruvananthapuram, Kollam, Kochi, Thrissur, Calicut and Kannur.

The tribunal's order made it clear that any vehicle found violating the directive after 30 days would be liable to a fine of Rs 5,000 per violation as environmental compensation. Such compensation can be collected by traffic police or State Pollution Control Board. Funds so collected should be maintained separately by the pollution control board and spent only for betterment of environment in the cities where the ban would be in force, the order stated.

The directions were issued in an interim order by Justice Swatanter Kumar and expert member Bikram Singh Sajwan in response to a plea filed by Lawyers' Environmental Awareness Forum through advocate Jacob Abraham.

In cities like Kochi and Kozhikode, privately owned buses are the main mode of public transport and constitute a major chunk of vehicles on the road. Of around 16,000 private buses in the state, 9,000 are above 10 years old. Around 85% of the 90,000 trucks in the state are above 10 years old.

Behaviour of car buyers

Indians, Chinese vs. the rest/ 2017

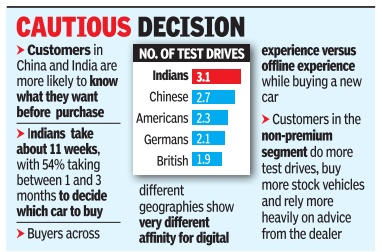

Indian car buyers like to try out the maximum number of test drives before buying the vehicle of their choice. At 3.1, Indian buyers top the list followed by the Chinese (2.7), Americans (2.3), Germans (2.1) and the British (1.9). Those are the findings of a recent study by consultancy firm Bain & Co, which tracked the behaviour of car buyers between digital and offline experiences across different auto markets globally .

The study -titled `The Future of Car Sales Is Omnichannel' -also found that car buyers in India and China have more touch points throughout (about 7.5 and 7 on average, respectively , compared with about 6 in mature markets) and assign different importance to individual touch points. Customers in China and India are also more likely to know what they want before they go in for a purchase, with up to 75% of all premium customers saying they were fully determined on brand, model and price before visiting the dealer.

The study has shown that car buyers across different geographies show very different affinity for digital experience versus offline experience while buying a new car. Consumers in developing economies like China and India generally show a strong affinity for online touch points, but they tend to start their buying episodes offline, and more than a third start at the dealer. In the US, 54% of episodes start online, and in the UK the percentage is nearer 60%.

Their online and offline preferences also determine other consumer behaviour, including time taken to decide on what car to buy. Buyers in the US are the fastest to decide according to the study (8 weeks on average, 51% in less than a month). Germans take more time (10 weeks, with 47% taking between one and three months), followed by Indi ans (11 weeks, with 54% taking between one and three months).In developed markets, younger buyers take longer to decide, while in China and India differences among age groups were less significant, said the study. The study also found that premium car customers like to engage more with dealerships than mass-market customers.“Premium car customers have about 25% more interactions during their buying episodes than mass-market customers,“ said the Bain study.

In contrast, non-premium customers are less decided on specific brands, with 10-15% of non-premium buyers in Germany, the UK and the US completely open to brands, compared with only about 5% of premium buyers who are similarly flexible.Also, customers in the non-premium segment do more test drives, buy more stock vehicles and rely more heavily on advice from the dealer -perhaps because they are more price-sensitive and thus more likely to accept the most attractive offer, said the study.

BS IV

2017/ SC bans sale, registration of BS-III vehicles

AmitAnand Choudhary, 8.2L Unsold Units To Be Exported Or Scrapped, Mar 30, 2017: The Times of India

SC bans sale, registration of BS-III vehicles from April 1

Drawing a strong line on environmental issues, the Supreme Court banned the sale and registration of Bharat Stage III (BS-III) vehicles from April 1, when BS-IV emission norms will come into force across the country , saying that health of citizens is more important than commercial interests.

In a major setback to automobile manufacturers, a bench of Justices Madan B Lokur and Deepak Gupta decided to take the “drastic“ step, saying that BS-III vehicles could aggravate the already deteriorating air quality in the country and such a step was needed to handle the menace of pollution.

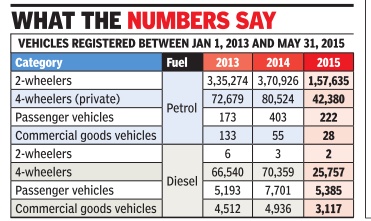

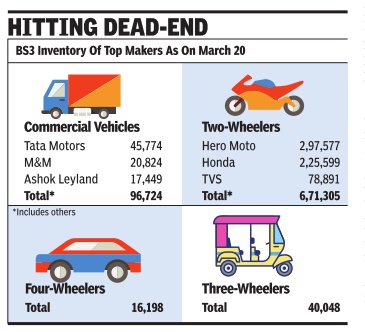

Holding that the health of millions of people is more important, the court dismissed the plea of automakers to allow them to dispose of existing stocks of 8.2 lakh BS-III vehicles. The companies have a stock of 8,24,275 BS-III vehicles, which include 96,724 commercial vehicles, 6,71,308 two-wheelers, 40,048 threewheelers and 16,198 cars. Now, the companies have no option but to export the vehicles or turn them to scrap. They admitted that it is not possible to make old stocks BS-IV compliant. Though the Centre had backed the companies and told the court that manufacturers be allowed to sell stocks as its notification was confined to a ban on manufacturing of BS-III vehicles after March 31 and was not meant to restrain them from disposing of existing stocks of BS-III vehicles, the court remained unmoved.

Except Bajaj Auto, all companies, including their association -Society of Indian Automobile Manufacturers (SIAM), opposed the plea for banning the sale of their stocks and sought 6-7 months to sell stocks. They contended that companies were allowed to sell their stocks with old emission norms when new technology was introduced twice in 2005 and 2010 and court should permit the same.

Advocating a complete ban, the amicus curiae (impartial adviser to the court) said BS-IV trucks are 80% cleaner than BS III and if the polluting vehicles are sold, they would keep polluting the environment for the next 10-15 years.

The apex court refused to grant relief to the companies. It said the manufactur ers were fully aware way back in 2010 that BS-IV norms would be enforced from April 1 but they chose to sit back and not take sufficient pro-active steps.

Auto makers defied BS-III exit, tried to defer it

Jayashree Nandi, How auto makers tried to beat BS-III exit, Mar 29, 2017: The Times of India

Most Didn't Scale Down Output Despite April 1 Deadline For BS-IV Switch: EPCA

The Environment Pollution Control Authority (EPCA) has found that most vehicle manufacturers didn't prepare for the April 1deadline for a nationwide rollout of BSIV norm by scaling down their production of BS-III vehicles.

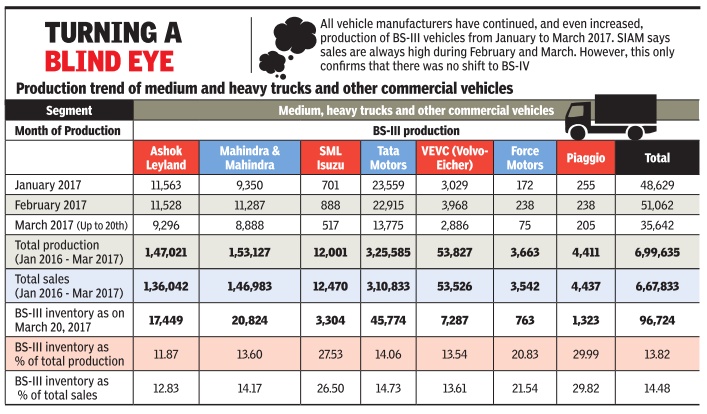

An analysis by EPCA of BS-III vehicle inventories, which Society of Indian Automobile Manufacturers (SIAM) had submitted to the SC recently , reveals that many companies continued production of BS-III vehicles in large numbers between January and March 2017.

“All vehicle manufacturers have continued and even increased production of BS III vehicles in the last quarter. SIAM has explained this by saying that sales are always high from February to March. However, this only confirms that there was no shift to BS IV . Ashok Leyland, for example, produced 10,935 vehicles in January 2016 whereas it was 11,563 vehicles in January 2017,“ the analysis said. The inventory for heavy commercial vehicles as on March 20, 2017 is 96,724.This is far higher than SIAM's earlier submission to EPCA wherein it had claimed that 75,000 vehicles would remain to be sold on April 1, 2017.

Experts said the concern is more with heavy diesel vehicles because of their heavy pol lution potential. According to EPCA, there can be up to 80% reduction in particulate matter (PM) emissions from trucks if they move to BS-IV stage. “The commercial vehicle manufacturers will have 13.82% of the annual production in stock as of March 20, 2017. Almost 15% of their annual sales will be in stock as of March 20, 2017. Ashok Leyland, Mahindra, Tata and Eicher-Volvo will have 95% of the BS-III inventory ,“ the ana lysis revealed.

Production of BS-III cars had more of less tapered off in the last quarter. The BS-III inventory as on March 20, 2017 is about 16,198.

The three-wheeler sector, however, is far from meeting the deadline. “This sector shows a complete disregard for the shift to BS-IV stage. SIAM had submitted to EPCA that 45,000 vehicles would remain as of March 31, 2017. This included figures for Bajaj, which has the largest market share in the segment. Now, the estimates are that 40,048 threewheelers would remain in stock, which is 13% of the annual production,“ the analysis said.

The total stock of two-wheelers by March 20, 2017 is 6,71,305, which is roughly 4% of total production from January 2016 to March 20, 2017.

The stand-off on the rollout of BS IV norms started in October 2016 when EPCA had directed that vehicle manufacturers exhaust their stock of nonBS-IV vehicles before April 1, 2017.But when the SC-mandated authority called another meeting in early February 2017, SIAM said manufacturers were not ready to meet the EPCA deadline.

The ministry of road transport and highways in its 2015 notification talks about manufacturing only BS-IV compliant vehicles from April 1, 2017. It doesn't mention when registration of BS III vehicles is to be stopped.

Impact on two-wheeler industry

BS-III ban to shave Rs 600 crore off two-wheeler makers' margins, Apr 3, 2017: The Times of India

HIGHLIGHTS

The two-wheeler industry offered huge discounts on BS-III compliant models recently after the Supreme Court ban.

A Crisil report suggests the two-wheeler industry would have lost approximately Rs 600 crore due to the discount sales.

Supreme Court had banned sale of BS-III vehicles from April 1.

The two-wheeler industry would have lost Rs 600 crore due to the discount sales and incentives offered to meet the apex court ban on selling BS-III models+ from the new financial year, says a report.

The impact is comparatively low as many of the companies like Bajaj Auto, Yamaha and Eicher had already upgraded to BS-IV from January 2017, while market leader Hero MotoCorp, and the No. 2 Honda and also TVS Motors have upgraded most of their models before the ban set in, says a Crisil report on the impact on the Supreme Court ban. When the ruling came the two-wheeler industry had an inventory of 6,70,000 units of BS-III models, amounting to Rs 3,800 crore which is half of monthly sales of the industry. But 10-30 per cent discounts and freebies+ helped the dealers clear most of the stock in the last three days of March.

"Total discounts offered work out to be around Rs 600 crore, of which the two-wheeler makers would be sharing over 70 per cent of the incentives, taking a total hit of Rs 460- 480 crore, while the remaining losses would be absorbed by the dealers," says the Crisil report.

This will lead to a 150-200 bps erosion in the aggregate fourth-quarter Ebitda margin of listed players (Hero, Bajaj and TVS) in fiscal 2017, with the industry leader Hero taking a higher impact due to its large BS-III inventory.

Impact on Bajaj's profitability will be much lower due to its lower inventory and lower discounts offered considering the export option. Relative to annual revenues, this works out to 50 bps impact in fiscal 2017 Ebidta margins on Bajaj. As the Ebidta margins of listed two-wheeler players trended 40 bps higher than last fiscal on YTD basis, there is likely to be a 10 bps dip to 15.9 per cent in fiscal 2017.

On the positive side the wholesale deliveries for the industry will remain steady unlike the truck and bus makers, which are expected to fall due to the price hike on new models. This is also because the two-wheeler makers did not replenish channel inventory in the last three days of March, except in a few states like Punjab where 30 per cent of the sales were billed to dealers.

Channel inventory at end March was trending at 25 days' sales (lower by 5-10 days from annual average) and is expected to be replenished gradually over the next few months. "We, however, expect the gradual inventory build-up to be offset by slower retail sales momentum as much of the demand got pre-poned to March," says the report.

Meanwhile the report said carmakers are largely unscathed, while there will be a marginal hit on the three- wheeler makers. For car companies, with the BS-III inventory at just 16,000 units, the impact is marginal. On top of it, given the steep discounts offered in the last three days March, much of this stock is expected to have been cleared. For three-wheelers, since BS-III inventory could not be cleared due to limited number of permits, there will be a marginal impact for Piaggio and TVS while Bajaj will be unscathed as it had already transitioned to BS-IV.

Car recalls

2012-16

The Times of India, Jun 05 2016

The Volkswagen Group will roll out its massive recall programme in India from July to fix a software following the global emissions scandal discovered in the US in September 2015. The German auto major had said in December 2015 that it would call back as many as 3.24 lakh cars from VW, Audi and Skoda brands. It will kick off the recall with 1.98 lakh cars in the VW brand. After that, 88,700 cars from Skoda and 36,500 cars from Audi across various models will be recalled. Volkswagen had ad mitted use of defeat device in 11 million diesel engine cars sold in the US, Europe and other global markets that allowed manipulation of emissions tests by changing the performance of the vehicles to improve results.

Most of the major models sold by the VW group will be covered in the recall exercise as the spiked machines carry 1.2-litre, 1.5-litre, 1.6-litre and 2-litre diesel engines. These are derivatives of the EA189 diesel engine family where the cheating software was installed globally . A source within the VW group said Polo, Vento, Jetta and Passat are among the vehicles from the VW stable that will be im pacted by the recall. For Audi, the models to be recalled include the A4 and A6 sedans and the Q3 and Q5 SUVs. The affected Skoda models include Fabia compact and Rapid, Laura and Superb se dans and the Yeti SUV .

“Starting from the second half of 2016, Volkswagen will recall 1.90 lakh cars and continue till 10 months,“ Volkswagen India head of marketing Kamal Basu said. “Since recall was done in the US to fix the emission software, the company decided to do the same in India too to stay updated with the changes made outside,“ he added, without giving details about the mod els covered in this round.

Sources in the group told TOI that Skoda and Audi recall would begin around the same time. Customers will be intimated regarding the exercise which the VW offi cial said was “purely voluntary in nature“.

The company was found to be using a cheating device in the US to mask higher emissions, which gradually erupted into a global scandal.

2015: The big Volkswagen recall

The Times of India, Dec 02 2015

Pankaj Doval & Dipak Dash

VW recalls 3.2L cars, may halt sale of diesel models

Embattled German auto major Volkswagen Group may halt the sale of a number of its diesel engine models in India across brands like VW , Audi and Skoda over the global diesel emissions cheating scandal that saw it recall 3.24 lakh cars on Tuesday, making it the biggest-ever such exercise. Weeks after a government testing agency saw various models of the group spewing higher levels of pollutants than lab results -similar to the results in the US where the scandal first broke out in September this year -the VW Group refused to admit to fixing an emission cheating software. But soon after a meeting with government officials on Tuesday afternoon, VW announced the “voluntary recall“.

Company sources indicated that the group will fall in line, although there was no official comment on the issue. Most of the major models sold by the VW group will be covered in the recall exercise as the spiked machines carry 1.2-litre, 1.5litre, 1.6-litre and 2-litre diesel engines. The engines are derivatives of the EA189 diesel engine family where the cheating software was installed globally to buck tough emission norms and achieve higher efficiencies.

For Audi, the models where the recall will be announced included the A4 and A6 sedans and the Q3 and Q5 SUVs.For Skoda, the affected models include Fabia com pact and Rapid, Laura and Superb sedans and the Yeti SUV . The cars impacted are those that have been sold between 2008 and till the end of November this year.These are approximately 198,500 cars from VW, 88,700 cars from Skoda and 36,500 cars from Audi across the various models.

An official source said that the group was “nearly made to admit guilt“ as the government presented it with the findings of Automotive Research Association of India (ARAI).

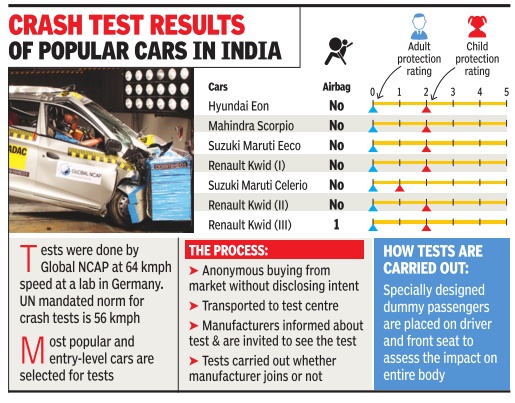

Crash tests

2016: 5 models fail UK crash tests

The Times of India, May 18 2016

Dipak Dash

Five popular Indian cars failed the Global NCAP test. The ratings are based on the impact of the crash on the occupant, including on the driver and passenger's head, neck, chest and knees.

Over the three years, Global NCAP has tested 14 models and only two vehicles with airbags -Vokswagen Polo and Toyota Etios -have so far received four star rating for adult safety . Other models tested earlier included Maruti Swift, Datsun Go, Ford Figo, Tata Nano, Hyundai i10 and Maruti Alto.

The first edition of the tests drove the government to finally make crash-testing mandatory from next October although the bar has been set at 56 kmph instead of Global NCAP's 64 kmph. India has settled for the speed which is the norm set by the UN. A road transport and ghways ministry official highways ministry official said he has raised the issue that there is no point to conduct a crash test of a vehicle that doesn't have an airbag since it is bound to fail.

Responding to why the tests were conducted at 64kmph while the UN's regulatory norm is 56 kmph, Ward said nine NCAPs across Europe, Latin America and ASEAN followed the same norm.

The car firms concerned, however, refused to read much into the tests. While Maruti said its products are safe when looked at from the perspective of present-day norms, Hyundai said its cars meet norms set by Indian regulators. Renault India said it is geared up to meet any stricter standards, and Mahindra & Mahindra said its Scorpio failed the test as the non-airbag variant was tested.

Diesel vehicles, restrictions on

The Times of India, Aug 13 2015

NGT cited apex court order upholding ban

The ban on diesel vehicles over 10 years old in NCR stays, as the National Green Tribunal declined to change its order. It said Delhi government and states that are part of NCR may decide whether to continue to take action against old vehicles. Additional solicitor general Pinky Anand, appearing for the road transport ministry , sought that the order be modified “in public interest“, saying if truckers went on strike -as they were mulling -it would impact supply of essentials to the capital. The government shouldn't be expected to challan them as long as the matter was pending, she urged.

The bench headed by NGT chair Justice Swatanter Kumar responded, “We decline to vary our earlier order. Till disposal of application... it's for the state to challan diesel vehicles or not to prevent... non-supply of essential articles to Delhi.“ ASG Anand had ap proached NGT appeal ing for a modification to NGT's earlier order: “In public interest, at least the state may not be held responsible for challaning of diesel vehicles during the pendency of the application.“ Anand said, “If the transport associations or truckers go on strike because of authorities not issuing them fitness certificates, common people will suffer. That is why we are appealing that the order be withdrawn or modified for the time being,“ Anand said.

The All India Motor Transport Congress in a meeting on August 10 had decided to abandon their commercial vehicles more than 10 years old at the entry point of Delhi at Ghaziabad, Gurgaon, Badarpur and Noida. The purpose was to protest against the nonissuance of re-registration and fitness certificates of diesel vehicles that are over 10 years old by the state govern ments of Delhi, Uttar Pradesh and Haryana, in response to NGT's order of banning these old vehicles.

The tribunal also said the ban on the vehicles over a decade old has been upheld by the Supreme Court and the tribunal cannot go against the apex court's decision.

Anand told the bench that truck operators were mulling a strike and protesting against governments of Delhi, Haryana and UP for not is suing fitness certificates to diesel vehicles more than 10 years old. A strike could mean disruption of the supply of essential services to the city.

In the weeks following NGT's order to ban, Delhi traffic police had impounded about 2,000 polluting diesel vehicles. These were released later on. No more vehicles have been impounded since.

The Centre had moved NGT seeking a stay on the ban order. The ministry has also sought a time of six months to suggest measures to address air pollution. In its application, the ministry had claimed only 7% of the vehicles in the capital are over 10 years old and that any “stringent measure of ad-hoc nature to ban vehicles on the basis of age will not provide any holistic solution to the pollution problem.“

It subsequently submitted several IIT Delhi studies and documents to argue that the transport sector is not responsible for the majority of emissions.

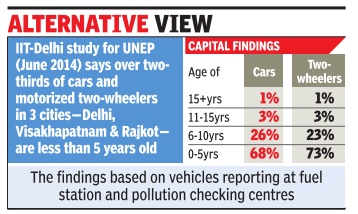

Durability of cars

Average age of cars on road

Transport min says ban unfair on owners

Dipak Dash The Times of India Dec 03 2014

The findings of a study by IIT (Delhi) for UN Environment Programme showed that on average, less than one percent cars which are over 15 years old are plying on Delhi roads. The findings were same for two-wheelers. The findings were based on vehicles reporting at fuel stations and pollution checking centres. While the sample size for cars was 2,231, it was 1,570 in the case of two-wheelers. The survey found that the average age of cars on road was 4.4 years and the average age of two-wheelers was 4.7 years.

The study also covered two other cities Visakhapatnam and Rajkot and the findings were not much different.

Referring to a study conducted by central roads research institute (CRRI) in 2007, the report has mentioned how the vehicle registration date in Indian cities is an overestimation of the actual number of vehicles plying. This is because private vehicle owners pay a life time tax on the purchase of the vehicle and don't have to register their vehicle annually .

Exports

Mexico: 2015-16

Udit Mukherji | TNN | Sep 5, 2016

Mexico is top destination for India’s automobile exports

Mexico has emerged as the top destination for India's automobile exports, making a compelling case for the Indian engineering exporters to further push forward in the growing south American markets, according to EEPC India.

The EEPC India, which would be organising India Pavilion at Expo National Ferretera 2016 to be held in Guadalajara (Mexico) later this week, came up with an analysis which found that the neighbouring US occupied the highest slot for outward shipments of the automobile components, according to April-July data analysis by the engineering exports body EEPC India. JK Tyres to up exports with Mexico plant Of the total automobile exports of $2.78 billion between April and July this fiscal, as much as $501 million were shipped to Mexico, followed by Nepal at $157 million and UK at $130 million.

These exports to Mexico saw a phenomenal rise of 110 per cent while for Nepal, the increase was even more impressive at 120 per cent for the period under review. For the UK exports, the rise was 22 per cent.

"Auto exports to Mexico were not constrained by a vast distance that our shipments have to cover. Mexico has come to account for as much as 18 per cent of India's total automobile exports. This is significant," chairman of the apex body of the engineering exporters, T S Bhasin said. While total engineering exports for the April-July 2016 period slipped by 5.82 per cent to $20.27 billion from $21.52 billion in the same period last fiscal, the total automobile exports increased by four per cent to $2.78 billion for the period under review.

Even though shipments fell to destinations like Sri Lanka, South Africa and Bangladesh , they continue to remain important destinations for the auto exports accounting for $158 million, $151 million and Bangladesh $102 million respectively, the EEPC India analysis showed. For the automobile components, the US remained the top destination, followed by Turkey with shipments at $345 million and $116 million. These exports to the US increased by over eight per cent and Turkey by 1.30 per cent. Total global exports of Indian automobile components aggregated to $1.48 billion during April-July 2016, growing by 4.54 per cent on annualized basis.

This government is really doing an excellent job. The credit should go to Shri Narendra Modi, who is incessantly putting up hard work--he works 16-18 hours a day and hardly taken a day off from dutie... Read More

Automobiles and automobile components form a major part of India's overall engineering exports and are among the few sectors showing positive trend this fiscal. A large number of Indian IT and pharmaceutical firms including TCS, Infosys, Wipro, Sun Pharma and Dr Reddy's Labs have set up their facilities in Mexico for their stronger presence in Latin America, Bhasin added.

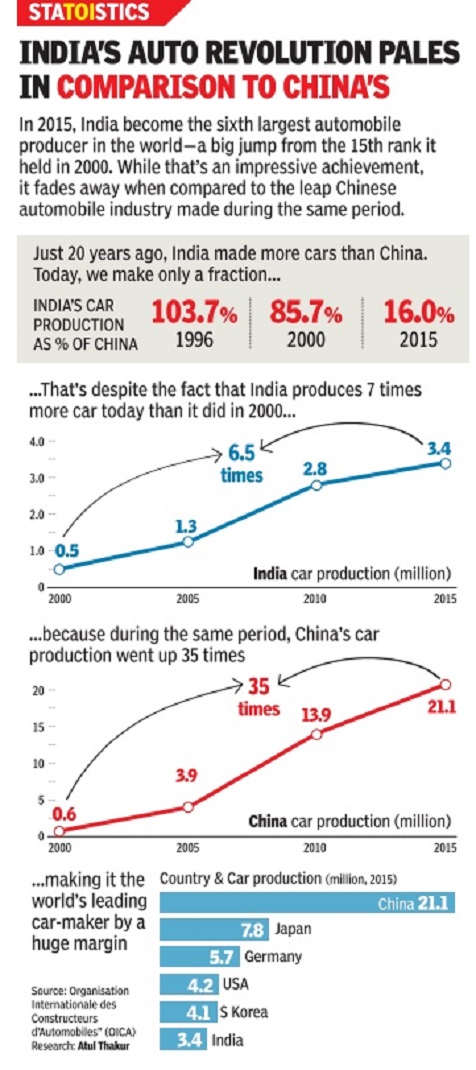

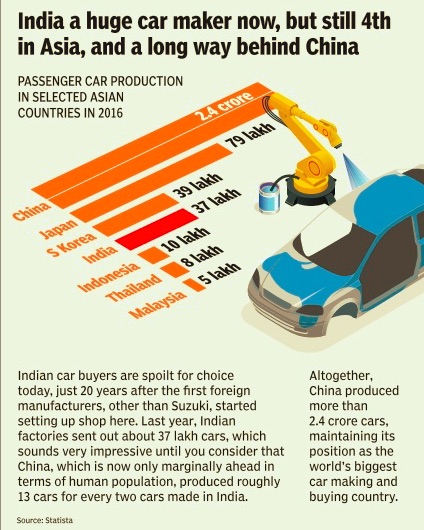

India’s rank among automobile manufacturers

2008: India 8th automaker in the world

From the archives of The Times of India: 2008 ‘India figures in top 15 automakers’

New Delhi: With a burgeoning auto industry to boast of, India has made it to the top 15 automakers of the world and occupies the fourth position in the leading developing countries' category of motor vehicle manufacturers, a UNIDO report has said.

According to the UNIDO International Yearbook of Industrial Statistics 2008, India ranks 12th in the list of world's top 15 automakers, which is led by Japan followed by the US and Germany. Other countries making it to list are Mexico, France, Korea, UK, Canada, Spain, Iran, Sweden, Brazil, Italy and Indonesia.

In the leading developing countries category, India ranks fourth. The list is topped by Mexico, followed by Korea, Iran. Brazil holds the fifth position followed by Indonesia, Turkey, Argentina, Thailand, Singapore, China, China (Taiwan Province), Malaysia, UAE and Columbia.

India also figures among the world's top 15 producers of chemicals and chemical products, electrical machinery and apparatus, basic metals, coke, refined petroleum products, nuclear fuel, non-metallic mineral products (glass and glass products, cement, lime and plaster, ceramic products), machinery and equipment, leather, leather products and footwear and textiles, the report said.

The country ranks fifth among the top 15 textile producers in the world. China has captured the top slot followed by the US, Italy, Japan, Mexico, Thailand, Indonesia, Pakistan, Germany, Korea, UK, Brazil, Turkey and Bangladesh.

The Yearbook is the 14th issue of UNIDO's annual publication and is based on 2006 data. It follows the International Standard for Industrial Classification that categorizes the automobile sector as manufacture of motor vehicles, bodies (coachwork) for motor vehicles, trailers and semi-trailers and manufacture of parts and accessories of motor vehicles and their engines.

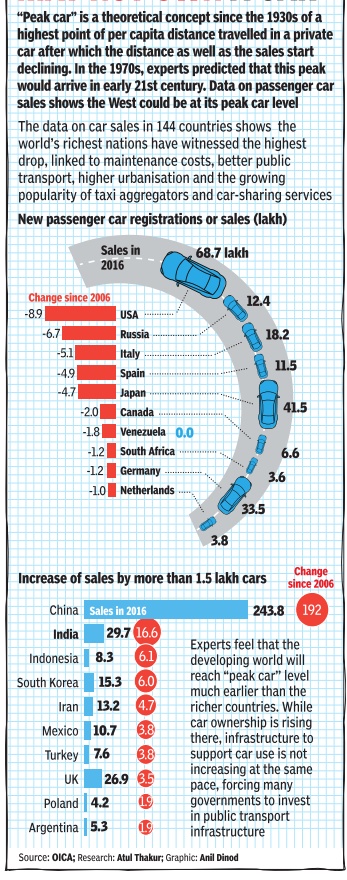

2016/ production of passenger cars, India and the world

See graphic

Inspection and certification

2016: 68% of vehicles fail test, centre vandalised

The Times of India, Jun 17 2016

Dipak Dash

68% of vehicles fail test in Nashik, centre vandalised

In a glaring example of how changes made to bring transparency do not go down well with private players, the central government's first automatic vehicle inspection and certification (I&C) centre in Nashik was vandalised in May after 68% of the vehicles failed the IT-based tests conducted between October 2015 and April 2016. Data available with TOI show the failure percentage was as high as 94% in November, 2015. The vehicles failed both in equipment tests as also visual tests. The centre was launched October 2015 and the government has an ambitious plan of setting up dozens of such automated I&C centres to bring in a transparent regime for vehicle-testing.

The centre is equipped to carry out a range of checks including for pollution, speedometers, brakes, suspension, wheel toe-in and toe-out, headlight aligner and under-body inspection using machines.

“We held a meeting with the top officials of the Maharashtra government. They have assured us that law and order will be maintained for making this centre operational,“ a road transport ministry official said. TOI has learnt that the damage caused to the centre is estimated to be around Rs 10 lakh.

Former director general of Automotive Research Association of India (ARAI) Balraj Bhanot said there have been hardly any instances of vehicles failing such tests in the past as everything was done manually .“Moreover, less than 40% commercial vehicles report for testing and this serves the purpose of enforcement agencies. The more the number of untested vehicles, the more is the scope for corruption,“ he said.

Sources also said that the operator of the Nashik centre has sought government help to ensure agents and touts are not allowed to come close to the campus.

“The government should focus more on strengthening this system rather than going for retiring of old vehicles, which suits the automobile industry ,“ said S P Singh of IFTRT, a think tank on transport issues.

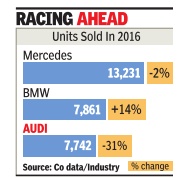

Luxury segment

2016: Mercedes Benz remains first

Pankaj Doval, Audi loses number 2 spot to BMW , May 3, 2017: The Times of India

Audi's sales in India crashed by over 30% in 2016 as the company lost its second ranking in the luxury market to fellow German compatriot BMW , which staged a revival on a 14% growth. Mercedes Benz, however, maintained its top billing in the category.

Slide for Audi continued in the first quarter (JanuaryMarch) of this year as numbers slipped by 22% year-on-year. Its volumes fell to 2,131units as against 2,738 units in the same period last year, sources told.

When contacted, Rahil Ansari, head of Audi in India, refused to confirm the numbers, but conceded that 2016 “was a challenging year“.

“Although 2016 was a chal lenging year in general for the industry , we utilized this period to consolidate our business in India,“ Ansari said, adding that, “We do not discuss our sales data in media. However, we can confirm that we had a good start to the year (2017). We are ahead of our planned targets and expect to close the year with double-digit growth.“

Ansari took charge of Audi's Indian unit in February 2016, succeeding Joe King, who was moved back to the company's headquarters in Germany .“We want to be at the top spot as we belong there. We do not have to do it overnight but in a sustainable manner -when we reach the top, we will stay there,“ Ansari said. Sources said the slide in Audi's volumes was being seen as “worrisome“ by the company's management, considering that it was top luxury carmaker in India just two years back.

BMW, on the other hand, has been making a slow progress towards getting its mojo back in India. Once a strong force, the company had lost its drive over the past few ye ars. It made a comeback in 2016 -although on a small base -giving it a reason to cheer.

BMW's revival was led by Frank Schloeder, who was the acting president of the India operations last year. “2016 has not been an easy year for the automotive industry and that applies equally to BMW Group India... Despite a challenging business environment, BMW Group India has increased sales and market share,“ Schloeder, now posted out of India, said on the company's performance.

Ansari said India is a “small but strategic market“. “There are short-term constraints like high taxes and duties but the GST regime seems to offer a simpler approach with fewer layers, which will probably make easier to do business.“

Premium compact segment

Nov, Dec 2015: Baleno vs. i20

The Times of India, January 19, 2016

Pankaj Doval

Baleno No. 1 premium compact, beats i20

The battle between Maruti Suzuki and rival Hyundai is getting intense.Maruti's premium compact `Baleno', within months of launch from a new retail format Nexa, has overtaken Hyundai's best-seller `Elite i20'.The new Baleno is one of Maruti's most ambitious products and is the mainstay for Nexa channel at present, which is aimed at premium and upmarket customers.

Maruti Suzuki sold 10,572 Baleno in December compared to 10,379 Elite i20 by Hyundai, numbers released by industry body Siam showed. In November, Maruti sold 9,074 Baleno as against 10,074 Elite i20 by Hyundai.

Maruti's surge in the category comes at a time when it is set to challenge the Korean ri val in the SUV category as well. While Hyundai has been going strong with newly-launched `Creta', Maruti will un veil `Vitara Brezza' at the Delhi Auto Expo next month. It plans to commercially launch the SUV around March.

The Baleno -which carries a 1.2-litre petrol engine and a 1.3-litre diesel variant with key safety features such as dual air bags and ABS as standard -was launched by Maruti on October 26 with an aggressive entry price of Rs 4.99 lakh (ex-showroom Delhi) for the entry petrol variant (this went up to Rs 5.11 lakh after a price hike earlier this month). The base diesel variant costs Rs 6.21 lakh.The Elite i20's base petrol variant costs Rs 5.36 lakh, while the diesel version comes for Rs 6.47 lakh.

When contacted, Maruti officials said the Baleno now commands a waiting period.“The response has been strong, and we expect that the demand will remain robust in the coming months as well,“ said Partho Banerjee, senior VP at the company , who heads the Nexa channel.

Projects, company-wise

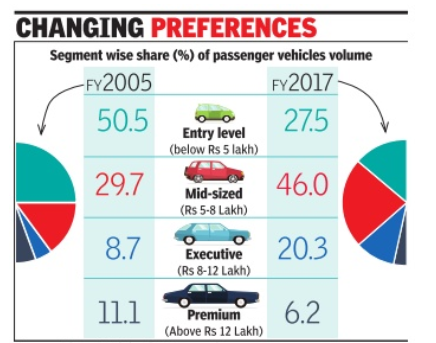

2005-2017: Changing preferences

Nandini Sengupta|Premium cars eat into entry-level pie|Jul 21 2017 : The Times of India (Delhi)

Cheap and cheerful no longer works on Indian roads. Desi car buyers' fascination with SUVs and automatic transmission has had an impact on the bottom end of the pyramid in Motown. The entry-level segment -comprising cars priced at less than Rs 5 lakh -has shrunk by nearly 50% in the last 12 years. According to SIAM data, the entry segment -which used to be 50.5% of the passenger vehicle market in 2005 -is down to 27.5% in FY17. The Rs 8-lakh and above segments, on the other hand, have grown from 19% to 26.5% in the same period even as the bulk of the market has shifted to the midsized segment in the Rs 5-8 lakh range. Given that a recent BCG study says the ` Aspirer, Affluent & Elite' segments in India's middle class -with annual income of Rs 5 lakh and above Source: Siam & Edelweiss Resea have collectively jumped from 13% in 2005 to 24% in FY16 and is expected to hit 36% by 2025, this premiumisation trend will continue say marketers.

Car marketers say one of the big reasons why the entry segment is shrinking is the lack of best-seller launches.

Although Alto is still the hig hest selling model in India, clocking around 20,000 units on average, it's a17-year-old brand.

A number of competitors have been phased out. Among the re cent entry-level models in the market, only Renault Kwid is clocking substantial numbers.

“The trouble is this seg ment is very focused on after sales service, so it is very diffi cult to crack this market witho ut a distribution network back up,“ said a senior marketer with one of the top mass-mar ket car companies. “Only Ma ruti, Hyundai, M&M and Tata Motors can crack the entry-le vel game. Newcomers will find it impossible.“

Said Rakesh Srivastava, se nior VP (sales & marketing), Hyundai Motor India, “The entry-level car buyer is highly price-sensitive but not willing to be identified as buying the cheapest in the market. This presents a challenge to auto . makers of working out a subRs 3 lakh product which is aspi, rational and meets current and future emission and safety re. quirements. Hyundai is cons cious of this demand and would love to introduce a product in this segment.“

Bajaj and Renault-Nissan

Bajaj’s small car with Renault-Nissan Alliance, unviable

The Times of India, July 16, 2011

Bajaj Auto’s ultra low-cost car plans with Renault-Nissan Alliance hit a new low as the company’s MD Rajiv Bajaj termed the project “unviable”, though the company later clarified that the troubled project was on.

Bajaj, speaking to reporters after announcing the company’s quarterly results, was quoted as saying by a news wire, “We don’t intend to get into the low-margin (passenger car) business.” He also told the news conference that from 2007 to 2009, “we had an initial plan with Renault and Nissan to develop a low-cost small car which would be like the Nano.” But sometime in November 2009, Bajaj informed Carlos Ghosn, chief executive of both Nissan and Renault, that the minicar project was “unviable”, to which Ghosn agreed, the agency reported. However,just as the statement by the Indian partner created ripples, the company issued a clarification, saying the project was still intact. “We would like to clarify the Bajaj-Renault-Nissan project is very much on,” S Ravi Kumar, Bajaj Auto’s senior V-P for business development, told another news wire in an emailed statement.

“The new four-wheeler platform, which will have commercial and passenger applications, will be showcased to Renault-Nissan in January 2012… Bajaj Auto will remain in the commercial space of the business while Renault-Nissan, if they decide to go ahead with the project, will be responsible for the personal transportation application,” he said. Bajaj and his executives did not respond to calls and text messages sent by TOI. A spokesperson for Renault refused to comment.

The conflicting statements, within hours of each other, however, did not come as a surprise as the partners have been having differences right from the time they came together. Conflicting statements, and doubts, over the viability of the project have been expressed by the partners from time to time. Things came to a boil in May when Renault India chief Marc Nassif said that the French auto major might pull out of the project if the car being developed and manufactured by Bajaj did not meet the alliance’s expectations.

Nassif followed this up in June by saying that Renault could even go solo on the project as “creating new ideas is in the DNA” of the company. This probably would have prompted Bajaj to go public with his statement on the split.

The ambitious project has been slow to take off since the very beginning. Delays, differences and constant bickering saw the partners often caught on the wrong foot in how they perceived the way forward for the development of the car. The troubles were very much visible after the partners never agreed to sign a joint venture despite the grandiose nature of the project.

HANGING IN BALANCE

2008

Bajaj does a one-up and unveils the prototype two days before the unveiling of the Tata Nano Carlos Ghosn-led Renault and Nissan join the ultra low-cost project, fix 2010 as the timeline for the model’s launch

2009

Differences surface between the partners. Colin Dodge, the global V-P for Nissan, says it is turning out to be a “very difficult’’ project Later in the year, Ghosn and Rajiv Bajaj meet on the sidelines of the World Economic Forum and try to sort out the differences. Ghosn says engineering, design and manufacturing expertise will come from Bajaj and Renault-Nissan will handle marketing and distribution

2010

Bajaj officials say early in the year that the partners are “aligned to the project and to the agreed objectives” and the “broad contours” had been agreed to Partners bury differences and sign an MoU.

2011

Tired of the slow progress and rising differences, Renault sounds non-committal to the project, saying it may pull out if the car developed by Bajaj does not meet expectations Rajiv Bajaj says he has informed Ghosn that the project is “unviable”.

Types of vehicles sold

2016: 25% were SUVs

Pankaj Doval, 1 of every 4 vehicles sold is an SUV , April 12, 2017: The Times of India

The green lobby may see them as giant polluters, but SUVs have powered their way into the Indian passenger vehicles industry , accounting for one out of every four new vehicles sold in the market.

The data for vehicle sales, released by industry grouping Society of Indian Automobile Manufacturers, shows the growing clout of SUVs and utility vehicles when it comes to new purchases, a trend that seems to be getting stronger with each passing year.

Against a 14% share in the overall passenger vehicle sales at the end of March 2010, the same has crossed 25% at the end of March this year.And this is only going to get stronger in the coming years, if the trends and new model launches are any indication. The pace of growth in the demand for SUVs -where diesel is the preferred engine option -has been nothing short of spectacular. SUV sales shot up by 30% in 2016-17, a remarkable performance when compared to the 4% growth in sales of cars.

“SUVs are a global trend and very much liked in India as well. The large and varied spread of the country , with strong challenges when it comes to road infrastructure, makes them a necessity when one wants a stronger, safer and high-seating vehicle,“ said Rakesh Srivastava, senior VP (sales & marketing), at Hyundai India.

“This trend will continue and I feel that the share of SUVs will rise to nearly 30% over the next one year.“

The appetite for the off-roaders, which come with higher ground clearance and an extra punch of power to manipulate tougher terrains, has been seen across price points. So, while there has been a strong growth in the compact SUV segment (priced under Rs 10 lakh and having models such as Maruti Brezza and Ford Ecosport), an equally robust buyer pull has been there in the bigger segments for vehicles such as Hyundai's Creta, which is priced above Rs 10 lakh. Companies have recog nised the trend and are tailor-making products that smack of SUV cues.Nothing signified this more aptly than the Renault Kwid, a small car that sports an “SUV-like“ design. “It is known as the chhota (mini) Duster in the market,“ a leading industry official said, linking the Kwid's success to its bigger sibling, the Duster SUV . And while auto-purists may complain that all products selling in the market do not carry original SUV characteristics -brute raw power, giant proportions and 4X4 (all-wheel drive) capability -the general population does not share the sentiment.

So, cross-overs and miniSUVs (powered by smaller diesel engines and less than four metres in length) are in great demand. “They seem to fit the bill as they are easy on the pocket when it comes to affordability, and also give a sense of off-roaders in their shape and design. The trick works with buyers and we are happy to ride the wave,“ an official with a top company said, requesting anonymi ty. A slew of new launches are also planned for the category, and these include vehicles by companies across all segments, ranging from Hyundai and Renault in the mass segment to Toyota and Audi in the premium segment.

Quadricycles

The Times of India, Jun 29 2015

Nandini Sen Gupta

Crash test must for quadricycles: Gauhati HC

In an interesting twist to the quadricycle saga, the Gauhati high court has in an interim order directed the central government not to permit auto manufacturers to release and sell small fourwheelers with a mass of up to 1,500kg and quadricycles without putting them to crash-test and emission test. The order says that since the quadricycle is “also a motor vehicle coming within the definition of M1 category,“ the emission norms applicable to the M1 category should have been made applicable to it and not the norms relating to two-wheelers and three-wheelers. The order is important because the quadricycle's crash and emission norms have been a bone of contention in the au to industry. The M1 category comprises passenger vehicles with not more than eight seats in addition to the driver's seat whereas N1 covers goods vehicles having a maximum mass of 3.5 tonnes.

Quadricycles are lightweight four-wheel vehicles meant for intra-city travel. Since the government notified this new category of vehicles on February 19, 2014, several high courts across the country have issued stay orders on their introduction which is why these vehicles have not yet hit the roads in India. However, in March 2015, the Supreme Court transferred to it self several petitions related to the launch of quadricycles and also extended a stay imposed on the orders of several high courts, including those of Delhi, Karnataka and Andhra Pradesh. Its final decision is still awaited.

The Gauhati high court order, delivered by Chief Justice (acting) K Sreedhar Rao and Justice PK Saikia, not only raises the safety and emission requirements for quadricycles but also covers all four-wheeler vehicles-both passenger and goods -with a mass up to 1,500kg. “It is the contention of the petitioners that the small passenger cars produced by the manufacturers in India do not conform to the safety standards,“ said the order.Referring to the European New Car Assessment Programme (ENCAP) test con ducted on Indian vehicles late last year, the order said: “The requirement of air bags and the sturdy frontal body are said to be primary conditions for safety of the driver and other inmates in the vehicle. However, in the test conducted by the ENCAP in November 2014, it is said that all small cars -four-wheelers in particular -of the M1 and N1 categories sold in India have not passed the crashtest and do not conform to the standard of emission test.“

The government recently made it mandatory for new models to meet the minimum frontal and side crash test as well as pedestrian protection test from October 2017 onwards. These norms mean that auto companies will have to install airbags and the anti-lock brake system in all vehicles.