Soft drinks, colas: India

This is a collection of articles archived for the excellence of their content. |

Contents |

A shift from colas to healthier beverages

2016

New Delhi: Coca-Cola's growth plans in India have hit a bottleneck as sales of its beverages in the third quarter (July-September) have been dragged down by rising health concerns over sugary drinks and wary consumer spending.

The Atlanta-based company, maker of drinks such as Thums Up, Sprite, Maaza and Minute Maid, said its sales volume in India declined by 4% in Q3. In the same period last year, Coca-Cola's sales in India grew by 4%.

"The company needs to diversify into more categories here other than sugary carbonated beverages, as sales of soft drinks in India is following a different trajectory than in other markets," said Arvind Singhal, founder and chairman of retail consultancy Technopak. "Coke's rival PepsiCo has done reasonably well by building a successful food business."

At present, fizzy drinks account for less than 25% of PepsiCo's global revenues. Earlier this month, PepsiCo's chairman and CEO Indra Nooyi unveiled ambitious plans to reduce the amount of sugar in its beverages, signalling a larger global trend that shows a slowdown in sales of sugar-sweetened beverages.

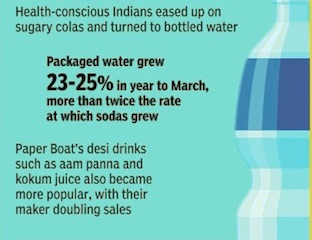

In India, while Coca-Cola and PepsiCo control around 80% of the soft drink market, the carbonated category, (worth Rs 14,000 crore) consisting of colas and lemony drinks such as Pepsi and Sprite, accounts for more than 70% of the overall market, according to Nielsen. However, the widespread availability of health-based drinks such as packaged lassi, aam panna and soya milk among others have dented the growth of fizzy beverages in India. Coke re-entered the dairy category in January with its flavoured milk brand Vio.

"While Indians in their thirties and above are shifting to healthier beverages, children are still consuming soft drinks," said nutritionist and author Pooja Makhija. "However, as they are well-exposed to what's happening around them, they will also realize the health concerns of consuming colas soon."

Apart from a growing negative perception of sweetened beverages, increased taxation of sugary drinks in many markets, including India, have led beverage companies to pass on the extra cost to consumers, making their products dearer in price-sensitive markets.

2016, 2017

John Sarkar, Coke, Pepsi lose share in non-fizzy too, November 23, 2017: The Times of India

From: John Sarkar, Coke, Pepsi lose share in non-fizzy too, November 23, 2017: The Times of India

It’s not only the carbonated (fizzy) soft-drinks category that has got multinational beverage giants Coke and PepsiCo worried. In the non-fizzy segment too, homegrown brands such as Parle Agro’s Frooti and Dabur’s Real have eaten into market shares of Coca-Cola’s Maaza and PepsiCo’s Slice, revealed market research firm Nielsen’s data for a 12-month period ending September 2017.

For instance, Dabur’s Real has entered the top three nonfizzy beverages chart in India, overtaking PepsiCo’s Slice, according to senior industry executives who quoted Nielsen’s data for Juices, Nectars and Still Drinks (JNSD) category. Dabur India marketing head for foods, Mayank Kumar, said, “In developed markets globally, juices and nectars category is far bigger than other non-fizzy drinks. India is also following this trend. With growing health consciousness, the market for healthy beverages has expanded exponentially.”

Dabur’s Real ended the 12 months to September 2017 with a market share of 9.8% compared to 9.2% a year earlier in JNSD category. Real is already the market leader in the over Rs 2,000-crore packaged juices market with a share of 54%, claimed a Dabur India spokesperson. When asked about the reason behind Frooti’s year-on-year growth in market share, Parle Agro joint MD & CMO Nadia Chauhan said taste played an important role. “I don’t want to comment on competition,” she said. “But we have kept the taste of Frooti consistent.”

PepsiCo India’s VP in nutrition category, Deepika Warrier, said the company has reduced its investments on commoditised, low-margin segments, including low juice content segments and has instead increased focus on its juice brand Tropicana.