Soft drinks, colas: India

This is a collection of articles archived for the excellence of their content. |

Contents |

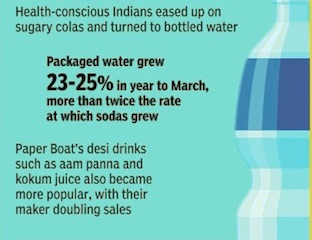

A shift from colas to healthier beverages

2016

New Delhi: Coca-Cola's growth plans in India have hit a bottleneck as sales of its beverages in the third quarter (July-September) have been dragged down by rising health concerns over sugary drinks and wary consumer spending.

The Atlanta-based company, maker of drinks such as Thums Up, Sprite, Maaza and Minute Maid, said its sales volume in India declined by 4% in Q3. In the same period last year, Coca-Cola's sales in India grew by 4%.

"The company needs to diversify into more categories here other than sugary carbonated beverages, as sales of soft drinks in India is following a different trajectory than in other markets," said Arvind Singhal, founder and chairman of retail consultancy Technopak. "Coke's rival PepsiCo has done reasonably well by building a successful food business."

At present, fizzy drinks account for less than 25% of PepsiCo's global revenues. Earlier this month, PepsiCo's chairman and CEO Indra Nooyi unveiled ambitious plans to reduce the amount of sugar in its beverages, signalling a larger global trend that shows a slowdown in sales of sugar-sweetened beverages.

In India, while Coca-Cola and PepsiCo control around 80% of the soft drink market, the carbonated category, (worth Rs 14,000 crore) consisting of colas and lemony drinks such as Pepsi and Sprite, accounts for more than 70% of the overall market, according to Nielsen. However, the widespread availability of health-based drinks such as packaged lassi, aam panna and soya milk among others have dented the growth of fizzy beverages in India. Coke re-entered the dairy category in January with its flavoured milk brand Vio.

"While Indians in their thirties and above are shifting to healthier beverages, children are still consuming soft drinks," said nutritionist and author Pooja Makhija. "However, as they are well-exposed to what's happening around them, they will also realize the health concerns of consuming colas soon."

Apart from a growing negative perception of sweetened beverages, increased taxation of sugary drinks in many markets, including India, have led beverage companies to pass on the extra cost to consumers, making their products dearer in price-sensitive markets.

Market segmentation

Rural vs. metro vs. non-metro/ 2017

John Sarkar, Beverage cos go rural to push healthier drinks, April 19, 2018: The Times of India

CAGR of sales of juices and carbonates, 2013-17.

From: John Sarkar, Beverage cos go rural to push healthier drinks, April 19, 2018: The Times of India

This summer, beverage companies are looking at rural India to push healthier drinks, as the growth of sugary carbonated drinks have started tapering off across the country.

Rural and semi-urban segments currently account for 60% of the juice market in India and have been growing faster than metros, according to data from US-headquartered PepsiCo, which sells Pepsi, 7UP and Mountain Dew.

Along with PepsiCo, companies, including Gujarat-based Manpasand Beverages, Dabur and Bisleri have started packing juices and juicebased drinks into small affordable PET bottles for rural consumption. Traditionally, sugary fizzy drinks priced at Rs 10 were mainstays in rural and semi-urban markets.

“Any shop in rural areas that stocks digestive biscuits will be able to sell juice,” said Abhishek Singh, director of Manpasand Beverages. The Vadodara-based company has developed juices sweetened with honey instead of sugar. “As we are deeply entrenched in semi-urban markets, we have noticed people there have started opting for healthier alternatives, which explains the penetration of digestive biscuits,” he added.

Fresca juices, which has been selling litchi and apple juices in small packs is upping the ante with two-litre family sized packs. “It makes more economical sense for customers in smaller towns,” said Akhil Gupta, MD of Fresca Juices. “We have seen people coming in tractors to pick up crates of juices in villages.”

PepsiCo, which just launched juice-based drinks under the Slice brand has partnered with Ravi Jaipuria-led Varun Beverages to increase its reach in rural and semi-urban areas. It aims to double sales of its juice brand Tropicana by 2020 and is shifting away marketing money from its main carbonated brands. “We have reduced our investments on commoditised, low-margin segments including low juicecontent segments,” said Deepika Warrier, VP-nutrition category at PepsiCo India.

Dabur India marketing head-foods Mayank Kumar said, “With growing health consciousness, the market for healthy beverages has expanded exponentially. On one hand, we are driving our 200ml portion packs in lowpenetration geographies through a mix of demand as well as distribution enhancement and on-ground visibility initiatives. On the other, we have also expanded the range with the launch of a fruit beverage, Real Koolerz at a lower price point.”

Namrata Singh, Fizzy drinks bubble up in rural mkts, June 16, 2018: The Times of India

From: Namrata Singh, Fizzy drinks bubble up in rural mkts, June 16, 2018: The Times of India

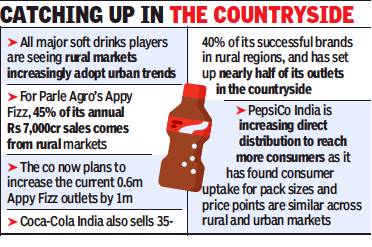

Rural consumers aren’t just going for branded soaps, detergents and biscuits like their urban counterparts. They are also lapping up fizzy drinks — so much so that rural markets contribute in equal measure to sales of some of these brands.

Parle Agro’s Appy Fizz, which has grown to a sizeable Rs 700 crore in annual sales, draws 45% of its turnover from rural markets. Parle Agro joint MD and chief marketing officer Nadia Chauhan said the acceptance of the brand — marketed more for its “attitude” and targeted largely at the youth — has penetrated across the country, irrespective of whether it’s an urban consumer or rural. “Appy Fizz is growing equally well in urban and rural markets,” said Chauhan. In a bid to push the brand, Parle Agro has launched a new Rs-10 stock keeping unit (SKU) in a 160ml bottle and is taking Appy Fizz from the current 0.6 million outlets to 1.6 million.

Experts said aspiration levels are similar among rural consumers. Trends of urbanisation are having a rub-off effect on rural India, with other major soft drinks players witnessing a similar experience. Coca-Cola India and Southwest Asia senior VP (operations) Shehnaz Gill said, “Consumers in rural markets are becoming more discerning and have personal preferences while selecting their choice of beverages. We have, therefore, started out on a journey to broaden our beverage portfolio and offer choices to our consumers across segments in urban, semi-urban and rural markets, which suit their palate and wallet.”

‘Consumers have become conscious about value’

Coca-Cola India said substantial percentage of sales (35-40%) for some of its highest selling brands are from rural markets — approximately 45-50% of Coca-Cola India’s outlets are in rural areas. “Rural sales have been growing for the past three years. We see increased potential in these markets to grow both horizontally as well as vertically,” said Gill.

What’s more, while Indian consumers have traditionally been price-sensitive, companies are seeing a growing base of consumers who are valueconscious. Coca-Cola India’s Minute Maid Vitingo, a formulated product to address micro-nutrient deficiency, comes in single-serving dilutable sachets of 18gm priced at Rs

5. Its newly launched Aquarius Glucocharge, a non-carbonated beverage, on the other hand, is priced at Rs 10 for a 200ml serving.

2016, 2017

John Sarkar, Coke, Pepsi lose share in non-fizzy too, November 23, 2017: The Times of India

From: John Sarkar, Coke, Pepsi lose share in non-fizzy too, November 23, 2017: The Times of India

It’s not only the carbonated (fizzy) soft-drinks category that has got multinational beverage giants Coke and PepsiCo worried. In the non-fizzy segment too, homegrown brands such as Parle Agro’s Frooti and Dabur’s Real have eaten into market shares of Coca-Cola’s Maaza and PepsiCo’s Slice, revealed market research firm Nielsen’s data for a 12-month period ending September 2017.

For instance, Dabur’s Real has entered the top three nonfizzy beverages chart in India, overtaking PepsiCo’s Slice, according to senior industry executives who quoted Nielsen’s data for Juices, Nectars and Still Drinks (JNSD) category. Dabur India marketing head for foods, Mayank Kumar, said, “In developed markets globally, juices and nectars category is far bigger than other non-fizzy drinks. India is also following this trend. With growing health consciousness, the market for healthy beverages has expanded exponentially.”

Dabur’s Real ended the 12 months to September 2017 with a market share of 9.8% compared to 9.2% a year earlier in JNSD category. Real is already the market leader in the over Rs 2,000-crore packaged juices market with a share of 54%, claimed a Dabur India spokesperson. When asked about the reason behind Frooti’s year-on-year growth in market share, Parle Agro joint MD & CMO Nadia Chauhan said taste played an important role. “I don’t want to comment on competition,” she said. “But we have kept the taste of Frooti consistent.”

PepsiCo India’s VP in nutrition category, Deepika Warrier, said the company has reduced its investments on commoditised, low-margin segments, including low juice content segments and has instead increased focus on its juice brand Tropicana.