|

|

| Line 1: |

Line 1: |

| − | [[File: i) China-India trade, 2004-15; ii) Chinese FDI in India, 2004-15.jpg| i) China-India trade, 2004-15; ii) Chinese FDI in India, 2004-15; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=27_01_2016_001_061_009&type=P&artUrl=Chinese-investors-betting-big-on-India-27012016001061&eid=31808 ''The Times of India''], January 27, 2016|frame|500px]]

| |

| | {| class="wikitable" | | {| class="wikitable" |

| | |- | | |- |

| | |colspan="0"|<div style="font-size:100%"> | | |colspan="0"|<div style="font-size:100%"> |

| | This is a collection of articles archived for the excellence of their content.<br/> | | This is a collection of articles archived for the excellence of their content.<br/> |

| | + | Additional information may please be sent as messages to the Facebook <br/>community, [http://www.facebook.com/Indpaedia Indpaedia.com]. All information used will be gratefully <br/>acknowledged in your name. |

| | </div> | | </div> |

| | |} | | |} |

| Line 9: |

Line 9: |

| | | | |

| | | | |

| − | [[File: China-India trade.jpg|China-India trade: 2004-14, Chart: [http://epaperbeta.timesofindia.com//Gallery.aspx?id=19_09_2014_018_027_009&type=P&artUrl=China-replaced-envoy-ahead-of-prez-visit-19092014018027&eid=31808 The Times of India ] |frame|500px]]

| + | =The Battle of Basantar/ Lt. General Hanut Singh= |

| − | [[File: chinese investments in india.jpg|Chinese investments in India, year-wise: 2010-2014; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=CASHING-IN-ON-BEIJING-BIZ-13052015012006 ''The Times of India'']|frame|500px]]

| + | |

| − | [[File: indian investments in china.jpg|Indian investments in China, year-wise; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=CASHING-IN-ON-BEIJING-BIZ-13052015012006 ''The Times of India'']|frame|500px]]

| + | |

| − | = Exports from China to India and India to China=

| + | |

| − | ==2014-18: trade gap widens from $48bn to $53bn ==

| + | |

| − | [[File: India-China trade, imports and exports- 2014-18.jpg|India-China trade, imports and exports- 2014-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F03%2F26&entity=Ar01703&sk=44D5C2C4&mode=text Sidhartha, India to seek easier export rules to China, March 26, 2018: ''The Times of India'']|frame|500px]]

| + | |

| | | | |

| − | '''See graphic''': | + | [https://timesofindia.indiatimes.com/india/the-indian-commander-whose-regiments-bravery-was-even-honoured-by-the-enemy/articleshow/79779583.cms Parul Kulshrestha, December 18, 2020: ''The Times of India''] |

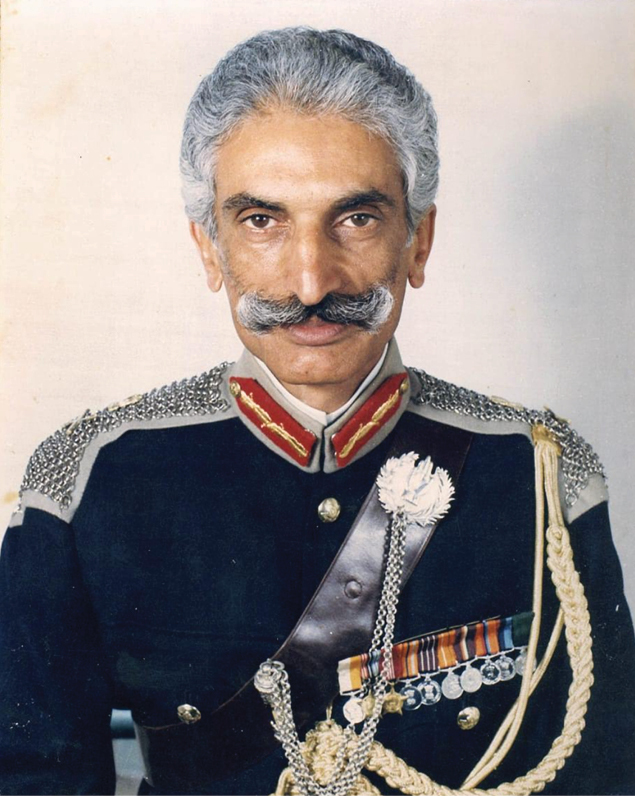

| | + | [[File: Lt. General Hanut Singh.jpg|Lt. General Hanut Singh <br/> From: [[https://timesofindia.indiatimes.com/india/the-indian-commander-whose-regiments-bravery-was-even-honoured-by-the-enemy/articleshow/79779583.cms Parul Kulshrestha, December 18, 2020: ''The Times of India'']|frame|500px]] |

| | | | |

| − | ''India-China trade, imports and exports- 2014-18''

| + | [[File: SWEET VICTORY- (L to R) Daffadar Kushal Singh tank gun loader and radio operator; Daffadar Harjinderpal Singh tank driver; Lt Col Hanut Singh, Commandant The Poona Horse; Daffadar Dalip Singh tank gunner.jpg|SWEET VICTORY: (L to R) Daffadar Kushal Singh tank gun loader and radio operator; Daffadar Harjinderpal Singh tank driver; Lt Col Hanut Singh, Commandant The Poona Horse; Daffadar Dalip Singh tank gunner Photo was taken on the day after the cease fire on Dec 17, 1971 <br/> From: [https://timesofindia.indiatimes.com/india/the-indian-commander-whose-regiments-bravery-was-even-honoured-by-the-enemy/articleshow/79779583.cms Parul Kulshrestha, December 18, 2020: ''The Times of India'']|frame|500px]] |

| | | | |

| − | ==2015: India has a $3,540.5m deficit every month==

| + | [[File: Lt Gen Hanut Singh- The leader whose cool courage inspired his men to remain steadfast and perform commendable acts of gallantry.jpg|Lt Gen Hanut Singh: The leader whose cool courage inspired his men to remain steadfast and perform commendable acts of gallantry <br/> From: [https://timesofindia.indiatimes.com/india/the-indian-commander-whose-regiments-bravery-was-even-honoured-by-the-enemy/articleshow/79779583.cms Parul Kulshrestha, December 18, 2020: ''The Times of India''] |frame|500px]] |

| − | [[File: India and the world, Monthly average trade deficits and surpluses with China from Jan-July 2015.jpg|India and the world, Monthly average trade deficits and surpluses with China from Jan-July 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=PUTTING-INDIA-ON-THE-MAP-27092015015032 ''The Times of India''], September 27, 2015|frame|500px]] | + | |

| − | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=PUTTING-INDIA-ON-THE-MAP-27092015015032 ''The Times of India''], September 27, 2015

| + | |

| | | | |

| − | China's economy is slowing from its double digit growth and many economies around the world are reeling as a result.Its trade partners, including India, have seen once dependable surpluses wither away, or already existing deficits compound.India counts a $3,540.5m trade deficit on average a month, according to data clocked between January and July 2015

| + | [[File: Commemoration of beginning of year-long celebrations of victory of 1971 war against Pakistan at Lt Gen Hanut Singh ji war memorial at Jasol, Rajasthan.jpg|Commemoration of beginning of year-long celebrations of victory of 1971 war against Pakistan at Lt Gen Hanut Singh ji war memorial at Jasol, Rajasthan <br/> From: [https://timesofindia.indiatimes.com/india/the-indian-commander-whose-regiments-bravery-was-even-honoured-by-the-enemy/articleshow/79779583.cms Parul Kulshrestha, December 18, 2020: ''The Times of India''] |frame|500px]] |

| | | | |

| − | ==2016: China no.1 source of India's imports, no.4 destination for exports==

| + | [[File: THE SAINT SOLDIER- After retirement Lt Gen Hanut Singh dedicated his life to books and meditation.jpg|THE SAINT SOLDIER: After retirement Lt Gen Hanut Singh dedicated his life to books and meditation <br/> From: [https://timesofindia.indiatimes.com/india/the-indian-commander-whose-regiments-bravery-was-even-honoured-by-the-enemy/articleshow/79779583.cms Parul Kulshrestha, December 18, 2020: ''The Times of India''] |frame|500px]] |

| − | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-WHY-BANNING-CHINESE-GOODS-MAY-NOT-BE-14102016010016 STATOISTICS - WHY BANNING CHINESE GOODS MAY NOT BE IN INDIA'S ECONOMIC INTEREST, Oct 14 2016 : The Times of India] | + | |

| | | | |

| | + | JAIPUR: The name of Lt. General Hanut Singh resonates with bravery, integrity, fearlessness and compassion. Considered to be one of the greatest commanders of the Indian Army, Battle of Basantar in 1971 was Singh’s finest hour for which he was awarded with the Maha Vir Chakra. |

| | | | |

| − | Calls for boycotting Chinese goods don't sound practical in the present trade scenario. China is the largest source of India's imports while it is the fourth largest destination of our exports. Trade with India is a much smaller fraction of China's total trade volumes

| + | Hanut Singh was born on July 6, 1933 at Jasol in Barmer. His father Col Arjun Singh had served in Jodhpur Lancers and commanded Kachhawa Horse. He was said to be a voracious reader and was very interested in Rajput history and tradition in which he took great pride. After passing out from the Indian Military Academy, Hanut was commissioned into The Poona Horse in 1952. |

| | | | |

| − | [[File: Exports of China to India and India to China.jpg| i) The exports of China and India to each other as a percentage of the other country’s GDP; <br/> i) The imports of China and India from each other as a percentage of the other country’s GDP <br/> [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-WHY-BANNING-CHINESE-GOODS-MAY-NOT-BE-14102016010016 ''The Times of India'']|frame|500px]]

| + | Battle of Basantar is considered to be the fiercest tank battle in Indian military history. While the war was going on in the eastern front, India conducted operations in Shakargarh Bulge on the Western front. Shakargarh bulge in Punjab has always been a strategic area of importance for India as it threatened the road links between Jammu and Indian Punjab. Hence, it was crucial for India to secure the region. When the war broke out December 3, 1971 and by December 15, 1971 The Poona Horse under command of Lt Col Hanut Singh had reached the Basantar River and was tasked to cross the enemy anti tank minefield laid in the dry bed of the Basantar river. |

| | | | |

| − | = Border trade=

| + | The Engineer Corps was given the task to clear the minefield, but till night, it was only partially done on account of the sandy river bed. Realising the gravity of the developing situation Hanut decided to move his regiment across the uncleared minefield on night of 15 December and after sometime, without any causality they were successful. |

| − | ==Sharp dip in imports/ 2016==

| + | |

| − | [[File: The border post of the Tibet- Indian border.jpg| The trading post on the Tibet- Indian border/ 2016 |frame|500px]]

| + | |

| − | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Sino-Indian-border-trade-sees-sharp-dip-in-02112016011027 Prem Punetha, Sino-Indian border trade sees sharp dip in imports this year, Nov 02 2016 : The Times of India]

| + | |

| | | | |

| | + | Major General V K Singh, in his book ‘Leadership in the Indian Army’, describing the battle stated that after crossing the minefield Singh divided A, B and C squadrons in three different sectors in the bridgehead to take on the enemy counter attack. A fierce tank battle was fought on December 16 and 17. |

| | | | |

| − | Pithoragarh:

| + | Hanut ordered his officers “Fight from wherever you are and no tank will move back even an inch.” |

| | | | |

| − | The cross-border trade at ''' Taklakot mandi in Purang ''' district of China's Tibet Autonomous Region where traders from Uttarakhand have traditionally been selling their wares has seen a sharp rise in Indian exports (Rs 5.86 crore) this year, while the Chinese goods they bring back after their five-month stay saw a slump as they amounted to just Rs 64 lakh.

| + | His men, being immensely loyal to him, fought till their last breath. It was during this battle that Second Lieutenant Arun Khetrapal destroyed 10 enemy tanks before achieving martyrdom. During the action Khetrapal was asked by his superior to pull back and leave his tank which had caught fire to which he replied, “Didn’t you hear the CO’s transmission? No tank will pull back even an inch.” He was rewarded with the Param Vir Chakra posthumously for gallantry beyond the call of duty. He was 21 years of age. |

| | | | |

| − | This year saw a wide gap between exports and imports.In 2015, the trade volume with China through ''' Lipulekh Pass ''' was Rs 4.36 crore, of which Indian traders exported goods worth Rs 1.6 crore while imports from China were worth Rs 2.76 crore. In 2014, imports from the local Bhutia traders were worth Rs 2.14 crore, while they sold goods worth just Rs 1.9 crore.

| + | Pakistan’s 13 Lancers and 31 Cavalry, equipped with Patton tanks lost 48 tanks in this action and were operationally crippled. The unprecedented bravery showed by The Poona Horse earned praise from Pakistan army as well that called the regiment ‘Fakhr-e-Hind’. |

| | + | The citation of Singh for the Maha Vir Chakra reads, “Undeterred by enemy medium artillery and tank fire, Lieutenant Colonel Hanut Singh moved from one threatened sector to another with utter disregard for his personal safety. His presence and cool courage inspired his men to remain steadfast and perform commendable acts of gallantry.” |

| | + | After a decade, in 1982, as a Major General, Hanut Singh was posted by Indian army MS Branch to command 17 Mountain Division in Sikkim. Just like today, Chinese were constantly intruding into Indian territory trying to pressurise and overawe the Indian troops deployed there. |

| | | | |

| − | Indian exports from the district include carpets, bamboo, matchboxes and packed sweets, while the traders bring back readymade garments, jackets and raw wool.“A total of 195 trade passes were issued this year, of which 77 were for traders and 118 were for helpers, but no Chinese traders came to the Indian mandi in Gunji,“ said P S Kutiyal, assistant trade officer.The final figures for this ye ar's trade can be calculated only after all the traders reach the Gunji mandi and pay their customs duty , he said.

| + | Major General Hanut Singh took the matter into his own hands. He visited all the brigades in Sikkim where he held Sainik Sammelan. |

| | + | Retired Brigadier of The Poona Horse, Karan Singh Rathore who was also part of that sammelan recalls that they were given orders to open fire on Chinese after three warnings until they vacate Indian territory. “The senior officers present were ordered that if any of them became hesitant in firing which resulted in Indian casualties, he would court martial that person for cowardice,” said Rathore. The message was loud and clear to the Chinese that a new leader had arrived. |

| | | | |

| − | The cross-border business takes place between June and October each year when traders make the journey across the 17,000-foot-high Lipulekh Pass to Purang. The trade time was extended by a month after traders petitioned to the government, saying early closure will lead to financial losses. “The trade for this year closed on October 31 as all the traders and helpers have come back from the Chinese mandi in Taklakot,“ said Kutiyal. The temporary branch of the SBI in Gunji has no facility of currency exchange.

| + | After retirement Hanut Singh shifted to Dehradun, dedicated his life to books and meditation. He passed away on April 11, 2015. |

| | | | |

| − | “Absence of this facility makes the exchange rates costlier as traders have to pay Rs 11 for one Yuan, while the current rate is Rs 9.89 for a Yuan,“ said a trader. “We had submitted a memorandum to the central government and local trade officer to set up a currency exchange centre in SBI Gunji, but nothing has been done in this regard,“ said Garvuyal. Also the Chinese authorities do not allow transport animals like mules or horses after the Lipulekh Pass, which makes the products costly , as traders have to hire Chinese vehicles to carry their goods.

| + | [[Category:Defence|P |

| − | | + | POONA HORSE]] |

| − | =China's investment in Indian start-ups=

| + | [[Category:India|P |

| − | ==2015, 2016==

| + | POONA HORSE]] |

| − | [[File: The investment of Chinese, Taiwanese and Japanese investors in Indian start-ups.jpg| The investment of Chinese, Taiwanese and Japanese investors in Indian start-ups <br/> From: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Other-Asian-firms-investment-in-startups-nowhere-close-20112016012026 Other Asian firms' investment in startups nowhere close to China's, Nov 20 2016 : ''The Times of India'']|frame|500px]]

| + | [[Category:Pages with broken file links|POONA HORSE]] |

| − | | + | |

| − | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Other-Asian-firms-investment-in-startups-nowhere-close-20112016012026 Other Asian firms' investment in startups nowhere close to China's, Nov 20 2016 : ''The Times of India'']

| + | |

| − | | + | |

| − | | + | |

| − | Chinese firms and funds have become big investors in Indian startups, and they are becoming particularly useful now as US funds slow down.Beijing Miteno Communication Technology , a Chinese tech conglomerate, made this year's biggest acquisition in the technology startup space -the $900 million buyout of Media.net, a subsidiary of Mumbai-based Directi, founded by brothers Bhavin and Divyank Turakhia.

| + | |

| − | | + | |

| − | Ecommerce giant Alibaba has made large investments in Paytm and Snapdeal. Didi Chuxing, the equivalent of Uber in China, has invested in Ola. Internet giant Tencent recently led a $175 million funding in messaging app Hike; prior to that, it led a $90 million round in healthcare solutions firm Practo and, through its joint venture with South Africa's Naspers, invested in online travel firm Ibibo Group.

| + | |

| − | | + | |

| − | “There are demographic similarities and both countries are seeing consumer growth for digital firms. Also, Chinese players have experience in market creation and running successful digital companies, so they can play a bigger role than being just financial investors,“ says Ashish Kashyap, founder of Ibibo, which last month merged with rival MakeMyTrip. Alibaba, for instance, is seen to be actively helping Paytm in various aspects.

| + | |

| − | | + | |

| − | Bhavin Turakhia says the Chinese understand the Indian market better than US companies do as the Indian market is on the same evolution path as that of China, but about five to 10 years behind. Chinese companies and funds have become big investors in Indian star tups. Cheetah Mobile, which owns products like Clean Master, invested in fitness app GOQii late last year.

| + | |

| − | | + | |

| − | Ctrip, one of China's largest online travel companies, invested $180 million in MakeMyTrip in January . China-based investment firm Hillhouse Capital has invested in Car Dekho. Smartphone maker Xiaomi led a $25-million funding round in content provider Hungama Digital Media Entertainment in April.

| + | |

| − | | + | |

| − | Web services company Baidu has said it is scouting for investment opportunities in Indian startups.

| + | |

| − | | + | |

| − | Even other Asian companies are nowhere close to investing as much as the Chinese in Indian startups. Japan's SoftBank and Singapore's Temasek are among the few non-Chi nese ones that have made investments. Taiwan's Foxconn has also made several investments, like in Qikpod, Hike and Snapdeal, but some see Foxconn as practically a Chinese company , given that much of its operations is in China.

| + | |

| − | | + | |

| − | What's pushing the Chinese tech companies to make large investments are two things: one, many of them are making big profits in their home market, thanks partly to the restrictions on foreign competi tion; and two, the Chinese economy is slowing down.

| + | |

| − | | + | |

| − | So they want to use their surpluses to expand into what is potentially the world's third largest digital market.

| + | |

| − | | + | |

| − | “There are only two big growing markets where they can invest: India and the United States. Silicon Valley does not respect Chinese capital. So the Indian tech sector becomes attractive to them,“ says Mohan Kumar, executive director at Norwest Ventures, a US-based venture fund that has opera tions in India. Kumar also notes that Chinese investors often value Indian startups at three to five times more than what other seasoned investors do. “So entrepreneurs naturally prefer them,“ he says.

| + | |

| − | | + | |

| − | Higher valuations mean the Chinese investors take lower stakes for the same amount of investment, and founders can hope for an even higher valuation in their next round of fund raising.

| + | |

| − | | + | |

| − | Language and politics are a challenge. May be for that reason, the Chinese are for now preferring partnerships and not outright buys. Even investment firms are building partnerships. Chinese VC fund Incapital has tied up with Indian fund IvyCap Ventures to enable its partner investors to have a closer look at potential investment opportunities in Indian startups.

| + | |

| − | | + | |

| − | China is showing interest in traditional industries too. In July 2016, Chinese pharma compa ny Shanghai Fosun Pharmaceutical Co acquired Indian injectables manufacturer Gland Pharma for $1.27 billion, and in August, Chinese conglomerate Jiangsu Longzhe Technology and Trade Development Co acquired Diamond Power Infrastructure, Vadodara-based manufacturer of cables, conductors, transformers and other power sector equipment, for $125 million. But digital technology looks to be where the biggest action is.

| + | |

| − | | + | |

| − | =FDI=

| + | |

| − | ==2009-20==

| + | |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F07%2F02&entity=Ar00105&sk=4D97A95B&mode=text Sidhartha, Little FDI from China since last yr, July 2, 2020: ''The Times of India'']

| + | |

| − | | + | |

| − | [[File: FDI from China, 2009-20.jpg| FDI from China, 2009-20 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F07%2F02&entity=Ar00105&sk=4D97A95B&mode=text Sidhartha, Little FDI from China since last yr, July 2, 2020: ''The Times of India'']|frame|500px]]

| + | |

| − | | + | |

| − | | + | |

| − | New Delhi:

| + | |

| − | | + | |

| − | Amid apprehensions of a fall in Chinese investment in India, overall flows added up to just $163 million in 2019-20 and no proposal has been filed since the government decided in April to scan all FDI from countries with which India shares a border. “We have ourselves decided to keep close tabs on Chinese investment, which was meant to discourage them, especially because of the takeover threat for our companies. Without our permission, they can’t invest a single yuan in India,” a government source said.

| + | |

| − | | + | |

| − | Officials said some investors may be keen to avoid scrutiny and may be waiting for the detailed clarifications, which will specify things like the definition of “significant beneficial ownership”. The new rules were meant to ensure that Chinese investors do not enter India via a third country.

| + | |

| − | | + | |

| − | ''' China accounts for 0.5% of FDI inflows into India '''

| + | |

| − | | + | |

| − | While state-backed Chinese media suggested that FDI inflows will slow down due to Covid-19 as well as the border skirmishes, government officials were, however, dismissive, arguing that China accounts for 0.5% of FDI inflows into India.

| + | |

| − | | + | |

| − | Official data showed that China was at number 18 in terms of source of FDI with several other countries such as Singapore and Mauritius ahead of it.

| + | |

| − | | + | |

| − | A large number of Chinese investors, such as electronics goods maker Xiaomi, have entered India via Singapore and other countries, which do not reflect in the official numbers. A report by thinktank Gateway House estimated Chinese FDI at around $6.2 billion, with investment in Indian tech companies at around $4 billion. Even at this level, it will be lower than Singapore, Mauritius, US, UK, Germany, Netherlands and Japan, among others.

| + | |

| − | | + | |

| − | The official numbers suggest that of the $2.4 billion FDI from China in the last 20 years, close to $1 billion has gone into the auto sector.

| + | |

| − | | + | |

| − | [[Category:Economy-Industry-Resources|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS | + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | [[Category:India|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS | + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | | + | |

| − | =Imports from China=

| + | |

| − | ==Statistics on imports from China==

| + | |

| − | ===2018: The main items imported===

| + | |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F08%2F10&entity=Ar00502&sk=5666D959&mode=text Sidhartha, 327 items form 3/4th of imports from China, ‘can be alternatively sourced’, August 10, 2020: ''The Times of India'']

| + | |

| − | | + | |

| − | [[File: Imports from China, 2013-18; the main items imported; and alternative sources for these goods. .jpg|Imports from China, 2013-18; the main items imported; and alternative sources for these goods. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F08%2F10&entity=Ar00502&sk=5666D959&mode=text Sidhartha, 327 items form 3/4th of imports from China, ‘can be alternatively sourced’, August 10, 2020: ''The Times of India'']|frame|500px]]

| + | |

| − | [[File: Top import items & share in total imports in % .jpg|Top import items & share in total imports in % <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F08%2F10&entity=Ar00502&sk=5666D959&mode=text Sidhartha, 327 items form 3/4th of imports from China, ‘can be alternatively sourced’, August 10, 2020: ''The Times of India'']|frame|500px]]

| + | |

| − | | + | |

| − | | + | |

| − | Just 327 products — ranging from mobile phones and telecom equipment to cameras, solar panels, airconditioners and penicillin — accounted for nearly threefourths of the imports from China, a study has estimated, while pointing out that it is possible to find alternative sources to get these goods or manufacture them in India.

| + | |

| − | | + | |

| − | A paper by policy thinktank Research and Information System for Developing Countries used UN Comtrade data to estimate the value of these “critically sensitive imports” at $66.6 billion in 2018 in overall imports of a little over $90 billion. In 2018-19, official numbers had pegged imports from China at $76.4 billion.

| + | |

| − | | + | |

| − | A product was considered sensitive if China accounted for over 10% share of imports or if the value of shipments was $50 million or more. “Such export monopoly of China has to be diluted in view of strategic requirements,” the report said.

| + | |

| − | | + | |

| − | | + | |

| − | ''' China not the most competitive producer in 82% imports: Study '''

| + | |

| − | | + | |

| − | A product was considered sensitive if China accounted for over 10% share of imports or if the value of shipments was $50 million or more. ‘Such export monopoly of China has to be diluted in view of strategic requirements,” the report by thinktank Research and Information System for Developing Countries said. In FY19, official numbers had pegged imports from China at $76.4 billion.

| + | |

| − | | + | |

| − | In terms of the number of goods imported from across the border, the share of the 327 sensitive products was less than 10% of the 4,000-odd items that were imported from China. The study, which was shared with TOI, estimated that in case of 82%, or over 3,300 products, China was not the most competitive producer.

| + | |

| − | | + | |

| − | But there are also products where China is the sole exporter. The product base ranges from everyday-use items such as earphones and headphones to microwave ovens and certain types of washing machines. The list also has several types of machinery, some auto components, escalator components, certain acids and chemicals and fertiliser like diammonium phosphate, where China is the sole supplier.

| + | |

| − | “It is possible to produce some of the products domestically if other sources are not immediately available,” RIS director general Sachin Chaturvedi told TOI. The RIS paper suggested taking a strategic view while deciding on alternative sources for imports.

| + | |

| − | | + | |

| − | In fact, since March, the government has started tapping overseas missions to identify alternative sources of import of products. Economists and traders, however, point out that it may not be possible to find the products at the same scale, something that even the RIS report points to.

| + | |

| − | “As China is empowered with scale factor, other competitors lose their grounds when delivery of voluminous trade takes place,” the study noted.

| + | |

| − | | + | |

| − | In recent years, China has emerged as the hub for the production of electronics, pharma and chemicals with global giants setting up manufacturing facilities to not just cater to the domestic market but export to other destinations, including the US and Europe. Following the outbreak of Covid-19, several companies are looking at de-risking their production chains by setting up or relocating facilities to other countries.

| + | |

| − | | + | |

| − | ===2019: Chinese sold India electronics worth ₹1.4L cr ===

| + | |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F06%2F23&entity=Ar01302&sk=C38DC9B1&mode=text Pankaj Doval, June 23, 2020: ''The Times of India'']

| + | |

| − | [[File: Sales of Chinese electronics goods in India in 2019..jpg|Sales of Chinese electronics goods in India in 2019. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F06%2F23&entity=Ar01302&sk=C38DC9B1&mode=text Pankaj Doval, June 23, 2020: ''The Times of India'']|frame|500px]]

| + | |

| − | | + | |

| − | Even as anti-Chinese sentiment gathers steam across the country, the hold of the dragon on the Indian electronics market remains strong. Chinese companies registered sales of nearly Rs 1.4 lakh crore in the Indian electronics market last year as they dominated the fast-growing categories of smartphones, televisions, laptops, and even smart bands and watches. This has been at the cost of Indian brands such as Micromax, Lava, Intex and Karbonn, and MNCs from countries such as South Korea (Samsung & LG) and Japan (Sony).

| + | |

| − | | + | |

| − | In 2019, the Chinese brands closed the year with a share of 71% in the revenue-intensive smartphones category, and this further increased to 81% in the first quarter (January-March) of this year, according to numbers sourced from Counterpoint research.

| + | |

| − | | + | |

| − | While Chinese brands such as Xiaomi, Oppo, Vivo and Real-Me strengthened, it was a sad story for the homegrown Indian brands that finished 2019 with only 1.6% share, which further dipped to under 1% in the first quarter of 2020, Prachir Singh, a research analyst at Counterpoint, said.

| + | |

| − | | + | |

| − | Such has been the onslaught of the Chinese brands that even the well-entrenched Korean Samsung has been made to play second fiddle, much to its discomfort (as it recently also bid adieu to its business in China). Apple is the only other non-Chinese MNC that does business, but even its share remains marginal.

| + | |

| − | | + | |

| − | A Xiaomi spokesperson said, “We witnessed a strong demand for our products during the lockdown and the same is now gradually rising… we continue to ramp up our manufacturing capacities.”

| + | |

| − | | + | |

| − | Phones are not the only category that the Chinese are vying for. Finding India to be a willing market, they are fastexpanding into various other categories such as TVs, smart bands, and smart watches. Companies such as Lenovo already hold a significant share in computers.

| + | |

| − | | + | |

| − | Does India possess the wherewithal to take on the dragon? “Doubtful,” say most of the players involved in the industry. “The anti-Chinese rhetoric is not a long-term solution. We need a fresh strategy to counter the Chinese, but it will take at least two-to-three years to roll out. Till then, we have to depend on China and there is no other strong alternative,” Pardeep Jain, MD of Jaina group and Karbonn Mobiles, told TOI.

| + | |

| − | | + | |

| − | Chinese are also main suppliers of components for phones manufactured in India, and if there is any disruption here, production and new launches will be hit. Navkendar Singh, research director at IDC, said Indian brands lack the profile to stand up to the Chinese. “Without the Chinese, the consumer doesn’t have much choice. In case of any punitive action, consumers and nearly 1.5 lakh multi-brand retailers will be hit.”

| + | |

| − | | + | |

| − | [[Category:Economy-Industry-Resources|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | [[Category:India|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | | + | |

| − | ==Impact of Chinese imports==

| + | |

| − | ===2017-18: Chinese imports shut MSMEs down: Panel===

| + | |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F07%2F27&entity=Ar02802&sk=BFF6D20F&mode=text Chinese imports shut MSMEs down: Panel, July 27, 2018: ''The Times of India'']

| + | |

| − | | + | |

| − | [[File: Impact of Chinese imports on Indian industry, 2017-18.jpg| Impact of Chinese imports on Indian industry, 2017-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F07%2F27&entity=Ar02802&sk=BFF6D20F&mode=text Chinese imports shut MSMEs down: Panel, July 27, 2018: ''The Times of India'']|frame|500px]]

| + | |

| − | | + | |

| − | '' Nearly 2L Jobs Lost In Solar Panel Sector ''

| + | |

| − | | + | |

| − | A Parliamentary panel asked the government to swiftly impose quality standards and check Chinese imports across several sectors — from toys and textiles to bulk drugs and bicycles — while noting that shipments from across the border have taken a toll on the domestic manufacturing sector and pushed several micro, small and medium enterprises (MSMEs) to shut shop.

| + | |

| − | | + | |

| − | “...India has been an easy dumping ground for Chinese goods on account of low price of Chinese goods, poor enforcement and porous border, both at sea and land,” the standing committee on commerce said in a report tabled in Parliament on Thursday. It said the US and the European Union have been “quite aggressive and agitated over the erosion of their domestic industry and loss of employment” and recommended that the government be more “proactive” in trade defence measures, such as anti-dumping and anti-subsidy actions, while imposing other restrictions.

| + | |

| − | | + | |

| − | The panel estimated that dumping of Chinese solar panels in India has resulted in nearly two lakh job losses. Similarly, it pointed out that a large quantity of under-invoiced bicycles were entering the Indian market due to “lax enforcement”. It cited the public bike sharing plan initiated by Smart City administrators as one of the reasons behind surge in shipments from China, which offered cheaper cycles.

| + | |

| − | | + | |

| − | Although Chinese goods have traditionally faced the highest anti-dumping action, the committee believes that they are “relatively few in comparison to the kind of dumping” that has taken place. “The impact of Chinese imports has been such that India is threatened to become a country of importers and traders with domestic factories either cutting down their production or shutting down completely,” it said.

| + | |

| − | | + | |

| − | Over the last few years, the government too has been worried about the widening trade deficit and is seeking that China open up its markets to more Indian goods to reduce the gap between imports and exports. Rice, meat, pharma and information technology are sectors where the government is seeking greater play for Indian companies in China, which has been reluctant to open up.

| + | |

| − | | + | |

| − | The fear of Chinese goods swamping the market has prompted the government to tread carefully on Regional Comprehensive Economic Partnership — the proposed free trade agreement involving India, China, Asean countries, Australia and New Zealand.

| + | |

| − | | + | |

| − | Besides, other countries have shown little interest in giving Indian software professionals, nurses and other service providers easier access to their markets. In a separate report, the panel slammed some of the provisions of the free trade agreement with Asean, such as services where even the government believes that the treaty is lopsided.

| + | |

| − | | + | |

| − | [[Category:Economy-Industry-Resources|C

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | [[Category:India|C

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | | + | |

| − | [[Category:Economy-Industry-Resources|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | [[Category:India|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | | + | |

| − | =Indian goods sold in China =

| + | |

| − | ==2017==

| + | |

| − | [https://timesofindia.indiatimes.com/business/international-business/chinese-appetite-for-indian-brands-hits-new-high-in-annual-shopping-festival/articleshow/61630944.cms Saibal Dasgupta, Chinese appetite for Indian brands hits new high in annual shopping festival, Nov 14, 2017: ''The Times of India'']

| + | |

| − | | + | |

| − | | + | |

| − | '''HIGHLIGHTS'''

| + | |

| − | | + | |

| − | There is a lot of attraction for Indian foods and many other products all over China.

| + | |

| − | | + | |

| − | They are sold by hundreds of Chinese traders through online stores and physical shops.

| + | |

| − | | + | |

| − | Almost every city has a shop selling Indian goods, and some like Shanghai, Guangzhou, Yiwu and Beijing have 2-3 each.

| + | |

| − | | + | |

| − | | + | |

| − | Indian masalas are spicing up the Chinese palate like never before with large numbers of them buying Indian food products during the annual shopping event, the Singles Day.

| + | |

| − | | + | |

| − | The shopping carnival saw online markets doing business exceeding $30 billion as millions of consumers bought a wide range of goods, most of which are manufactured in China. Some foreign-made goods including those produced in India, Europe and the US were hawked and purchased.

| + | |

| − | | + | |

| − | Indian grocery items, ready-made food and Ayurvedic cosmetic brands like Amul, MDH Masala, Gits, Tata Tea, Haldiram, Dabur, Patanjali and Himalaya, were snapped up on Alibaba's Taobao.com, jd.com and several other Internet marketplaces.

| + | |

| − | | + | |

| − | The online market attracts a large chunk of the Chinese population with attractive discounts on the occasion, that is also known as 11/11 Singles day+ because it involves the repeated use of 1 or single four times. However, buyers include both married and singles. The 24-hour buying frenzy has emerged as the world's biggest shopping day eclipsing Black Friday and Cyber Monday in the United States.

| + | |

| − | | + | |

| − | Alibaba reported that its one-day sales reached $25.35 billion on Saturday, a rise of 39 percent from last year. The company said it had sold goods including apparel, mobile phones, imported lobster and infant formula from 140,000 brands during the day.

| + | |

| − | | + | |

| − | JD, which started the discount sales on November 1, said it had sold nearly $20 billion in goods over an 11-day period. It sold 55 million facial masks and 500,000 Thailand black tiger shrimps, JD said. There are several other online shopping firms which have not released all their figures yet.

| + | |

| − | | + | |

| − | "There is a lot of attraction for Indian foods and many other products all over China. They are sold by hundreds of Chinese traders through online stores and physical shops. Almost every city in China has a shop selling Indian goods, and some like Shanghai, Guangzhou, Yiwu and Beijing have two or three each," a Guangzhou-based Indian businessman told.

| + | |

| − | | + | |

| − | The most sought-after Indian goods are spices followed by cosmetics. Textiles and home decoration pieces are also on sale. Buyers include the vast community of expatriates including Indians, Pakistanis, Japanese, Arabs, Africans and even Europeans who are fond of curried food. More than a million expatriates live in different Chinese cities.

| + | |

| − | | + | |

| − | There are more than 100 physical stores selling Indian products in different Chinese cities. These shops, most of whom are run by local traders, also sell online.

| + | |

| − | Indian products usually sell at a premium ranging from 100 percent to 300 percent over the printed prices but this does not deter buyers who want quality products from India.

| + | |

| − | | + | |

| − | "The quality of Indian spices like cardamom and cumin seeds is far superior in India as compared to those sold in local Chinese markets. People start realizing it once they use them. Turmeric has become very popular in China," the businessman said.

| + | |

| − | | + | |

| − | Chinese have emerged as the world's biggest international travellers, which has resulted in an enlarged worldview and a desire to taste the foods of different countries. Thousands of restaurants in Chinese cities now feature "chicken curry" on the menu. They use ready-made spice mixtures comprising turmeric and other Indian masalas. Many Chinese housewives also cook curry at home.

| + | |

| − | | + | |

| − | A wide range of packaged Indian sweets is also on sale at the online markets. They are mostly purchased by foreigners including Arabs, Europeans, and Americans with a sweet tooth because the average Chinese does not have an affinity for intensely sweet eatables.

| + | |

| − | | + | |

| − | The Singles Day has also given a boost to China's clout as an international hub for mobile payments and intelligent logistics, the local media quoted Matthew Crabbe, Asia Pacific research director at consultancy Mintel as saying. The Alipay mobile wallet saw deals at a peak rate of 256,000 transactions per second in China and many foreign countries, according to Alibaba. Robots and algorithms accelerated parcel distribution, it said.

| + | |

| − | | + | |

| − | =India’s trade deficit=

| + | |

| − | ==2010-20==

| + | |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F06%2F23&entity=Ar01312&sk=5A493D4C&mode=text June 23, 2020: ''The Times of India'']

| + | |

| − | | + | |

| − | [[File: India’s trade deficit with China, 2010-20..jpg| India’s trade deficit with China, 2010-20. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F06%2F23&entity=Ar01312&sk=5A493D4C&mode=text June 23, 2020: ''The Times of India'']|frame|500px]]

| + | |

| − | | + | |

| − | India’s trade deficit with China is estimated to have narrowed to $48.7 billion during the last financial year — the lowest in five years — compared with $53.6 billion a year ago, as imports from across the border dropped over 7% to $65 billion in 2019-20.

| + | |

| − | | + | |

| − | Last year’s trade deficit was roughly the same as the level seen in 2014-15, when the Narendra Modi administration first took office, but 34% higher than 2013-14, prompting the government to suggest that the steps taken by it in recent months have yielded results.

| + | |

| − | | + | |

| − | “It is not as if we are taking steps to reduce imports and reduce the trade gap now. We have been working on strategies for the past several months and going forward the results will be better,” said a source.

| + | |

| − | | + | |

| − | Commerce department officials said that the move to opt out of Regional Comprehensive Economic Partnership (RECEP) agreement, the proposed mega free trade agreement, will help it bridge the deficit with other steps such as faster trade remedies against subsidised or dumped goods too coming to the rescue of Indian industry. The fall in imports from China also helped the US extend its lead as India’s largest trading partner. Against trade of $88.8 billion with the US, India’s trade with China was pegged at just under $82 billion.

| + | |

| − | | + | |

| − | [[Category:Economy-Industry-Resources|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | [[Category:India|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | | + | |

| − | =Power sector=

| + | |

| − | ==2016-20==

| + | |

| − | [https://timesofindia.indiatimes.com/business/india-business/chinese-cos-made-inroads-into-indias-td-networks-since-2016/articleshow/77043830.cms Sanjay Dutta, Chinese companies have made inroads into the power sector since 2016, July 19, 2020: ''The Times of India'']

| + | |

| − | | + | |

| − | NEW DELHI: The government move to keep Chinese companies out of power transmission and distribution (T&D) projects couldn’t have come any sooner. Industry data shows Chinese companies have been making steady inroads into the strategic sector, winning contracts for installing intelligent control systems in parts of the national grid and at least 46 city networks between August 2016 and March this year.

| + | |

| − | | + | |

| − | Chengdu-based Dongfang Electric Corporation, one of China’s ‘backbone enterprise groups’ directly administered by Beijing, alone bagged SCADA (supervisory control and data acquisition) contracts for 23 cities across five states and a Union Territory.

| + | |

| − | | + | |

| − | ZTT, Shenzen SDG Information Company and Tongguan Group together won 23 contracts from discoms and state-run PowerGrid, which operates the national transmission network, for installing real-time data acquisition system — also known as ‘reliable communication through optical ground wire’.

| + | |

| − | | + | |

| − | T&D networks form the backbone of any power system. SCADA and real-time communications systems are the nerve centres that make networks ‘smart’. That’s why sanctity of these systems are important for grid security.

| + | |

| − | | + | |

| − | “In connected systems, intelligent equipment talk to each other and exchange data and information, making the system more efficient but at the same time increasing the vulnerability if exposed to suspect individuals, companies and nations which may use such access to their advantage,” Indian Electrical Equipment Manufacturers’ Association director-general Sunil Misra told TOI.

| + | |

| − | | + | |

| − | The power ministry had on July 3 banned equipment imports from China without permission. It also mandated imported T&D equipment be tested at designated laboratories for embedded malware or spyware — a common perception about Chinese gear.

| + | |

| − | | + | |

| − | The move, even though part of economic retaliation against China’s border transgressions in Ladakh, marked an acknowledgement of possible vulnerabilities with Chinese equipment.

| + | |

| − | | + | |

| − | IEEMA had written to the national security adviser and the ministry in 2017 to point out India’s transmission system becoming vulnerable to hacking due to expanding Chinese footprint.

| + | |

| − | | + | |

| − | Later that year, the state power ministers conference decided to conduct a countrywide cyber security audit of T&D systems.

| + | |

| − | | + | |

| − | These warnings followed protests over Chinese companies bagging a slew of big-ticket contracts for power station hardware as India rushed to ramp up generation capacity.

| + | |

| − | | + | |

| − | =Rice from India=

| + | |

| − | ==2020: China buys Indian rice for first time in decades==

| + | |

| − | [https://timesofindia.indiatimes.com/business/india-business/china-buys-indian-rice-for-first-time-in-decades-as-supplies-tighten-trade-officials/articleshow/79528228.cms Reuters, December 2, 2020: ''The Times of India'']

| + | |

| − | | + | |

| − | China buys Indian rice for first time in decades as supplies tighten: Trade officials

| + | |

| − | | + | |

| − | MUMBAI: China has started importing Indian rice for the first time in at least three decades due to tightening supplies and an offer from India of sharply discounted prices, Indian industry officials told Reuters.

| + | |

| − | | + | |

| − | India is the world's biggest exporter of rice and China is the biggest importer. Beijing imports around 4 million tonnes of rice annually but has avoided purchases from India, citing quality issues.

| + | |

| − | The breakthrough comes at a time when political tensions between the two countries are high because of a border dispute in the Himalayas.

| + | |

| − | | + | |

| − | "For the first time China has made rice purchases. They may increase buying next year after seeing the quality of Indian crop," said B V Krishna Rao, president of the Rice Exporters Association.

| + | |

| − | | + | |

| − | Indian traders have contracted to export 100,000 tonnes of broken rice for Dec-February shipments at around $300 per tonne, industry officials said.

| + | |

| − | | + | |

| − | China's traditional suppliers, such as Thailand, Vietnam, Myanmar and Pakistan, have limited surplus supplies for export and were quoting at least $30 per tonne more compared with Indian prices, according to Indian rice trade officials.

| + | |

| − | | + | |

| − | [[Category:Economy-Industry-Resources|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | [[Category:India|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | [[Category:Pages with broken file links|CHINA-INDIA ECONOMIC RELATIONS]] | + | |

| − | | + | |

| − | =Year-wise statistics=

| + | |

| − | ==2019 ==

| + | |

| − | [[File: An overview of China- India economic relations, as in 2019.jpg|An overview of China- India economic relations, as in 2019. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F06%2F20&entity=Ar00200&sk=2A536FB3&mode=image June 20, 2020: ''The Times of India'']|frame|500px]]

| + | |

| − | | + | |

| − | '''See graphic''':

| + | |

| − | | + | |

| − | An overview of China- India economic relations, as in 2019.

| + | |

| − | | + | |

| − | [[Category:Economy-Industry-Resources|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | [[Category:India|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | | + | |

| − | =2020=

| + | |

| − | ==China's central bank buys stakes in Indian companies ==

| + | |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F07%2F07&entity=Ar01310&sk=CAA74A56&mode=text Partha Sinha & Rupali Mukherjee, China central bank slowly buying stakes in Indian cos, July 7, 2020: ''The Times of India'']

| + | |

| − | | + | |

| − | [[File: Stake held by People's Bank of China (PBoC), as in 2020 July..jpg|Stake held by People's Bank of China (PBoC), as in 2020 July. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F07%2F07&entity=Ar01310&sk=CAA74A56&mode=text July 7, 2020: ''The Times of India'']|frame|500px]]

| + | |

| − | | + | |

| − | In mid-April, stock exchange disclosures revealed that the People’s Bank of China (PBoC) had a holding of over 1% in Indian mortgage finance major HDFC. But the Chinese central bank also holds stakes in several other listed companies. However, these are all below the radar since they are less than the 1% threshold limit for open disclosures by companies (see graphic).

| + | |

| − | | + | |

| − | PBoC’s holding in HDFC is worth about Rs 3,100 crore, while in Piramal Enterprises around Rs 137 crore, and in Ambuja Cement about Rs 122 crore. Exactly two years ago, the Chinese central bank had received RBI permission to set shop here. Two recent reports on Chinese investments in India have warned that several funds and investment companies, directly controlled or indirectly influenced by its government, have been eyeing stakes in companies that are strategically important to the economy.

| + | |

| − | | + | |

| − | Market sources said the Chinese central bank also has stakes in the Indian arm of a German manufacturing major and another domestic fertilisers major. But these are not disclosed publicly since all they are below the 1% limit.

| + | |

| − | | + | |

| − | After PBoC’s stake acquisition in HDFC came to light on April 12, the government, through a press note on April 17, amended foreign investment rules into India. According to a leading Sinologist, there is an old Chinese tactic called “loot a burning house”. “The government policymakers should remember this while formulating the FDI policies.”

| + | |

| − | | + | |

| − | A recent Brookings Institute report also put out caveats along similar lines for Indian policymakers. “Chinese companies are emerging as prominent players and investors,” Ananth Krishnan, the author of the report, said. Drawing on several sources within India and from China, the report said that the aggregate Chinese investment in India was a staggering $26 billion with a pledge to invest another $15 billion. However, these figures are likely an underestimation, given the reluctance of the Chinese government to share the data.

| + | |

| − | | + | |

| − | Another report by Gateway House, a foreign relations think tank, pointed out how Chinese companies were using the startup route to invest in leading players in several sectors in India.

| + | |

| − | | + | |

| − | =See also=

| + | |

| − | [[China-India relations: 1899-01]]

| + | |

| − | | + | |

| − | [[China-India relations: 1900-1999]]

| + | |

| − | | + | |

| − | [[China-India relations, 2000 onwards]]

| + | |

| − | | + | |

| − | [[Drugs and Pharmaceuticals: India]]

| + | |

| − | | + | |

| − | [[Category:Economy-Industry-Resources|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

| − | [[Category:India|C CHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONSCHINA-INDIA ECONOMIC RELATIONS

| + | |

| − | CHINA-INDIA ECONOMIC RELATIONS]]

| + | |

JAIPUR: The name of Lt. General Hanut Singh resonates with bravery, integrity, fearlessness and compassion. Considered to be one of the greatest commanders of the Indian Army, Battle of Basantar in 1971 was Singh’s finest hour for which he was awarded with the Maha Vir Chakra.

Hanut Singh was born on July 6, 1933 at Jasol in Barmer. His father Col Arjun Singh had served in Jodhpur Lancers and commanded Kachhawa Horse. He was said to be a voracious reader and was very interested in Rajput history and tradition in which he took great pride. After passing out from the Indian Military Academy, Hanut was commissioned into The Poona Horse in 1952.

Battle of Basantar is considered to be the fiercest tank battle in Indian military history. While the war was going on in the eastern front, India conducted operations in Shakargarh Bulge on the Western front. Shakargarh bulge in Punjab has always been a strategic area of importance for India as it threatened the road links between Jammu and Indian Punjab. Hence, it was crucial for India to secure the region. When the war broke out December 3, 1971 and by December 15, 1971 The Poona Horse under command of Lt Col Hanut Singh had reached the Basantar River and was tasked to cross the enemy anti tank minefield laid in the dry bed of the Basantar river.

The Engineer Corps was given the task to clear the minefield, but till night, it was only partially done on account of the sandy river bed. Realising the gravity of the developing situation Hanut decided to move his regiment across the uncleared minefield on night of 15 December and after sometime, without any causality they were successful.

Major General V K Singh, in his book ‘Leadership in the Indian Army’, describing the battle stated that after crossing the minefield Singh divided A, B and C squadrons in three different sectors in the bridgehead to take on the enemy counter attack. A fierce tank battle was fought on December 16 and 17.

Hanut ordered his officers “Fight from wherever you are and no tank will move back even an inch.”

His men, being immensely loyal to him, fought till their last breath. It was during this battle that Second Lieutenant Arun Khetrapal destroyed 10 enemy tanks before achieving martyrdom. During the action Khetrapal was asked by his superior to pull back and leave his tank which had caught fire to which he replied, “Didn’t you hear the CO’s transmission? No tank will pull back even an inch.” He was rewarded with the Param Vir Chakra posthumously for gallantry beyond the call of duty. He was 21 years of age.

Pakistan’s 13 Lancers and 31 Cavalry, equipped with Patton tanks lost 48 tanks in this action and were operationally crippled. The unprecedented bravery showed by The Poona Horse earned praise from Pakistan army as well that called the regiment ‘Fakhr-e-Hind’.

The citation of Singh for the Maha Vir Chakra reads, “Undeterred by enemy medium artillery and tank fire, Lieutenant Colonel Hanut Singh moved from one threatened sector to another with utter disregard for his personal safety. His presence and cool courage inspired his men to remain steadfast and perform commendable acts of gallantry.”

After a decade, in 1982, as a Major General, Hanut Singh was posted by Indian army MS Branch to command 17 Mountain Division in Sikkim. Just like today, Chinese were constantly intruding into Indian territory trying to pressurise and overawe the Indian troops deployed there.

Major General Hanut Singh took the matter into his own hands. He visited all the brigades in Sikkim where he held Sainik Sammelan.

Retired Brigadier of The Poona Horse, Karan Singh Rathore who was also part of that sammelan recalls that they were given orders to open fire on Chinese after three warnings until they vacate Indian territory. “The senior officers present were ordered that if any of them became hesitant in firing which resulted in Indian casualties, he would court martial that person for cowardice,” said Rathore. The message was loud and clear to the Chinese that a new leader had arrived.

After retirement Hanut Singh shifted to Dehradun, dedicated his life to books and meditation. He passed away on April 11, 2015.