China vis-à-vis India: Levels of development

m (Pdewan moved page China vis-à-vis India: Economy to China vis-à-vis India: Levels of development without leaving a redirect) |

(→Top 200 companies: China, India) |

||

| Line 12: | Line 12: | ||

[[Category:Economy-Industry-Resources |C ]] | [[Category:Economy-Industry-Resources |C ]] | ||

| − | =Top 200 companies: China, India= | + | =Developmental indicators= |

| + | == Fertility rate, life expectancy, GDP, 1960-2014== | ||

| + | See graphic. | ||

| + | Capt | ||

| + | [[File: India, China, USA and UK, fertility rate and family size, life expectancy, GDP per capita.jpg| China and India vis-à-vis the USA and UK in terms of <br/> i) fertility rate and family size, <br/> ii) life expectancy, and iii) GDP per capita, <br/> in 1960 and 2014., [http://epaperbeta.timesofindia.com/Gallery.aspx?id=04_04_2017_007_031_001&type=P&artUrl=STATOISTICS-HOW-INDIA-CHINA-MOVE-CLOSER-TO-US-04042017007031&eid=31808 The Times of India], April 4, 2017|frame|500px]] | ||

| + | |||

| + | ==GDP per capita, 1978-2015== | ||

| + | See graphic. | ||

| + | |||

| + | =Corporations= | ||

| + | ==Top 200 companies: China, India== | ||

[http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Top-200-Indian-cos-set-to-beat-Chinese-03082016024012 ''The Times of India''], Aug 03 2016 | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Top-200-Indian-cos-set-to-beat-Chinese-03082016024012 ''The Times of India''], Aug 03 2016 | ||

| Line 31: | Line 41: | ||

Poor infrastructure is among the biggest hurdles facing the Indian government's ambitious “Make in India“ programme that aims to turn the country into a top global manufacturing destination, opined S&P . | Poor infrastructure is among the biggest hurdles facing the Indian government's ambitious “Make in India“ programme that aims to turn the country into a top global manufacturing destination, opined S&P . | ||

| + | |||

=See also= | =See also= | ||

[[Automobile industry: India ]] | [[Automobile industry: India ]] | ||

Revision as of 23:29, 27 May 2017

China's economic reforms have worked much better than India's. That's perhaps because before starting its reforms China ensured three things: land reforms, better access to education and slower population growth

The Times of India Oct 29 2016

This is a collection of articles archived for the excellence of their content. |

Contents |

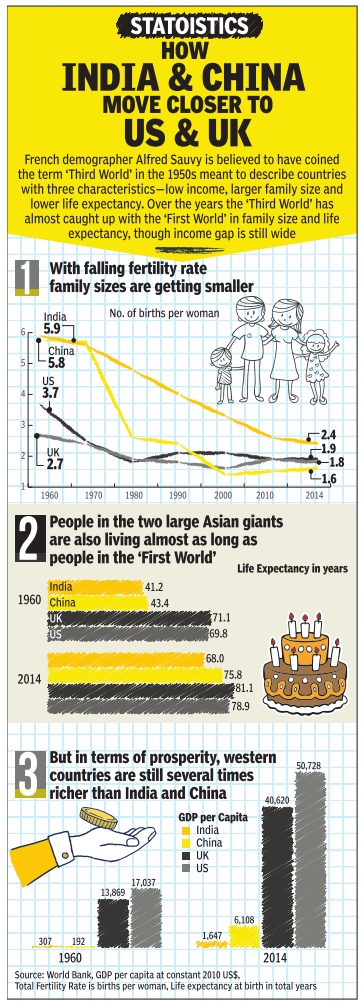

Developmental indicators

Fertility rate, life expectancy, GDP, 1960-2014

See graphic. Capt

i) fertility rate and family size,

ii) life expectancy, and iii) GDP per capita,

in 1960 and 2014., The Times of India, April 4, 2017

GDP per capita, 1978-2015

See graphic.

Corporations

Top 200 companies: China, India

The Times of India, Aug 03 2016

Top 200 Indian cos set to beat Chinese peers

According to a report by S&P Global Ratings. “Our analysis of India's top 200 companies by market capitalisation against their Chinese counterparts shows that government influence is far greater for listed companies in China than in India,“ said S&P Global Ratings credit analyst MehulSukkawala.

“This directly affects companies' flexibility to reduce capital spending, generally results in weaker profitability, and eventually shows up in higher leverage,“Sukkawal said. The difference in the size of the private sectors in India and China is significant. Private entities account for about 75% of net debt and EBITDA (earnings before interest, taxes, depreciation, and amortisation) of the top 200 Indian companies, compared with less than 20% for the top Chinese companies.

Indian private companies outperform both the Indian government-related entities (GREs) and Chinese companies by registering the highest (and relatively stable) returns. Leverage has peaked for Indian companies overall but continues to increase for Chinese GREs. At the same time, India faces the risk of debt concentration.

About 15% of the companies in the sample account for 60% of net debt. India also suffers from a high interest rate environment when compared with other emerging Asian economies.

This reduces the debt servicing ability of leveraged companies in India and can result in financial stress. On revenue growth, S&P expects the performance for India's top companies to improve over the next two to three years, even though revenue growth for companies in both India and China has been trending down.

A better operating environment with increasing government spending and a likely improvement in the domestic economy will support growth. But much of the improvement in operating conditions in India could depend on its infrastructure, which remains inadequate.

Poor infrastructure is among the biggest hurdles facing the Indian government's ambitious “Make in India“ programme that aims to turn the country into a top global manufacturing destination, opined S&P .