Ice cream (business): India

This is a collection of articles archived for the excellence of their content. |

The state of the business

2014-2019; early 2020

John Sarkar, Ice cream cos start home delivery as sales dive 40%, May 29, 2020: The Times of India

From: John Sarkar, Ice cream cos start home delivery as sales dive 40%, May 29, 2020: The Times of India

The Indian ice cream industry has been hit so hard that major companies from Hindustan Unilever (HUL) to Mother Dairy have started delivering the frozen dessert to consumers’ homes to make up for lost ground.

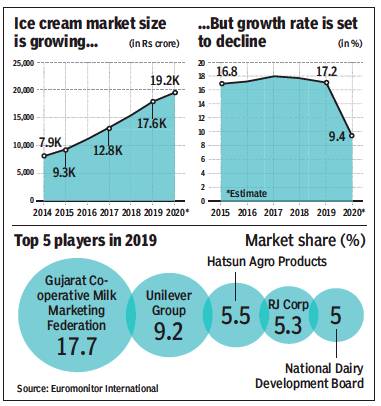

The industry, which was pegged at around Rs 17,639 crore in 2019 by Euromonitor, has lost a major chunk of its yearly sales due to the Covid-19 imposed lockdown and the absence of migrant workers, who man ice cream carts in several markets across the country.

“Around 40% of our yearly ice cream sales are gone, as 60% take place during four months of the year beginning March,” said R S Sodhi, MD of Gujarat Co-operative Milk Marketing Federation, India’s largest ice cream maker that sells products under the Amul brand name.

While Amul has started delivering ice cream in bulk to Residents’ Welfare Associations, India’s second-largest player HUL, too, has followed in its rival’s footsteps. “As a result of the lockdown, our out-of-home channel remains closed. This has resulted in sharp deceleration in some of the discretionary categories such as ice cream. While manufacturing is continuing in limited capacity, sales continue to be low,” an HUL spokesperson told.

Apart from being available in neighbourhood stores, HUL’s Kwality Wall’s is active on food and grocery delivery services, including Swiggy, Bigbasket and Dunzo. The company has also started delivering ice creams directly to consumers, including sending ice cream trucks to housing societies. “But online sales are just a minuscule portion for ice cream players,” said Rajesh Gandhi, MD of Vadilal and president of the The Indian Ice Cream Manufacturers’ Association. “Sales are currently 20% of what they were last year. Most small ice cream makers have shut shop and others, who stocked up on inventory in the beginning of March, are finding it tough to sell.”

“We only have presence in malls that are still shut. For us, the impact has been huge,” said a former senior executive at premium Swiss icecream Movenpick.

In North India, where ice cream carts play a major role, companies have started delivering directly to consumers. Mother Dairy, for instance, is working with distributors to allow consumers to order directly from its website. Ravi Jaipuria-led Devyani Food Industries, which sells ice cream under the Creambell franchise, recently consolidated its operations.

“We have shut one of the smaller plants at Baddi to strengthen our larger ones,” said Jaipuria, who is also the chairman of Varun Beverages, PepsiCo’s second-biggest bottler. “The company also did not entirely let go of the people who man its ice cream carts. We had urged them to stay during the lockdown.”