Income Tax India: Expert advice

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents

|

The basics

Filed your I-T return on time? Here's why you can still get a notice

By Sanket Dhanorkar, ET Bureau | 11 Aug, 2014 The Economic Times

Introduction

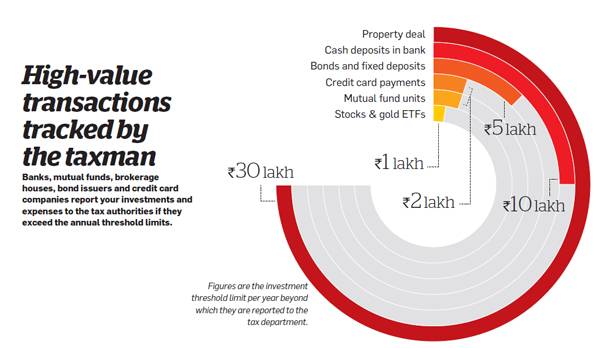

Are you among the more than two crore taxpayers who filed their returns before 31 July? These taxpayers can rest easy because they filed by the due date. However, the dread of the taxman does not end here. It is common for taxpayers to make errors or deliberately conceal income in their returns, which could lead to notices from the tax department. Nudged by the government to enhance revenue collections, the tax authorities are on an overdrive to catch tax evaders. Not only are financial transactions being tracked, but loopholes that allowed tax evasion are also being plugged.

In October 2013, the Central Board of Direct Taxes issued a new rule for claiming HRA exemption. Salaried taxpayers claiming HRA exemption were asked to report their landlord's PAN if the total rent in a year exceeded Rs 1 lakh. Earlier, if the total rent paid was less than Rs 15,000 a month, there was no need to submit the landlord's PAN details.

What is a tax scrutiny?

Scrutiny essentially means evaluating the income tax return for its authenticity. Typically, if a return is picked up for scrutiny, a notice will be served within a period of one year from the month in which the return was filed.

WHAT THE TAXMAN WILL CHECK:

> Bank statements, credit card statements

> Form 16

> Details of your family members who live with you

> Withdrawals and expenses, including those through credit cards

> Any interest-free loans you might have given

Interest income

The declaration of interest income is the most common mistake that taxpayers make.

The interest earned on bank fixed deposits, recurring deposits and infrastructure bonds is fully taxable but many taxpayers skip mentioning it in their tax return. Some think that the newly introduced exemption for bank interest makes this income tax-free. But the exemption under Section 80TTA is only for the interest on your savings bank balance. Interest from other sources, including 5-year tax saving bank fixed deposits, is fully taxable.

The other big fallacy is the TDS. Banks deduct 10 per cent TDS if the interest exceeds Rs 10,000 in a year. If the income is below Rs 10,000 and TDS has not been deducted, you have to add the interest to your total taxable income and accordingly pay tax. Even if TDS has been deducted, it does not mean that your tax liability is taken care of. If you are in the 20-30 per cent tax bracket, you are required to pay more tax on the income.

Don't think you can get away by concealing this income. "Failure to report this is tantamount to concealment of income. The tax authorities can easily detect it as the bank has already deducted the TDS and reported the same along with your PAN details," says Kirit Sanghvi, senior partner, K S Sanghvi & Co.

Also, in case of recurring deposits, no TDS is deducted, irrespective of the quantum of the interest, but the interest income is still fully taxable. Similarly, the interest earned on NSCs and infrastructure bonds is taxable ..

Some taxpayers feel safe from the prying eyes of the taxman if they put money in coperative banks. Till now, interest from fixed deposits in cooperative banks was exempt from TDS. However, there is a rude shock waiting for such taxpayers this year. The Karnataka Income Tax Tribunal recently ruled that if the interest exceeded Rs 10,000 in a year, it must be subjected to TDS. Following this, several cooperative banks have received notices from the Income Tax Department asking them to deduct tax for the year 2013-14.

That's not the only count on which taxpayers go wrong on interest. Even the interest from tax-free instruments, such as the PPF and tax-free bonds, has to be reported in your return. However, this is not a serious transgression and the taxman won't come after you with hammer and tongs if you skipped mentioning this income.

Clubbing income of minor child, spouse

Your earning is not the only income you need to declare in your tax return. If you invested in the name of your minor child or gave money to your spouse for investing, the income from such investments will also be treated as your income. Any income of a minor child (below 18 years) is clubbed with the income of the parent who earns more. There is a tiny deduction of Rs 1,500 per child for up to two children in a year.

Similarly, if you have invested in your spouse's name, the income will be treated as your income and taxed at the applicable rate. If you bought a house in your wife's name and rented it out, the rent will be treated as your income, not hers. Even if the house is transferred to the wife as the gift, this principle would apply. "The entire income would have to be included in the tax working of the original holder of the asset," says Kuldip Kumar, executive director, PwC.

In rare cases, where the spouse is given a remuneration for working in the taxpayer's business, the money given to the spouse will not get clubbed. For instance, if your chartered accountant wife maintains the accounts of your business and you pay her a remuneration which she invests, the income will not be clubbed. But she should have the required qualifications to do the work she is being paid for. "The onus is squarely on the taxpayer. You should be able to prove that your spouse is hired in a professional capacity, not otherwise," says Sandeep Shanbhag, director, Wonderland Consultants.

Not filing tax return

This is another common mistake. Many taxpayers believe that since their salary is subject to TDS, they don't have to file returns. That's not true. If your income exceeds Rs 2 lakh, you have to file your return. Even if the tax liability is reduced to zero after deduction under Section 80C, the return has to be filed. The government has identified the category of non-filers as a key one for tapping unpaid taxes. Last year, the Income Tax Department sent 12 lakh notices for non-filing of taxes.

Non-filers are not the only ones who may get such a notice. Many taxpayers file their returns online but don't complete the process. "A lot of them forget to send the physical copy of the ITR V to the tax department," says Sudhir Kaushik, co-founder and CFO, Taxspanner.com. A taxpayer must submit the ITR V to the Centralised Processing Centre in Bangalore within 120 days of uploading his return. "Until you submit the IT return to the authorities physically and get the acknowledgment of receipt, the return you filed will be treated as invalid," says Kaushik.

Not spending enough

The taxman also gets suspicious if you are investing too much or withdrawing too little. A Mumbai-based individual was asked to explain how she was sustaining herself because her entire salary was flowing into investments.She was using the cash allowances received from her employer for her day-to-day needs and investing the entire salary that came by cheque.

"The tax officer will estimate the household expenditure you are likely to incur based on your earning capacity, family size, lifestyle and number of earning members. If your bank statement does not show commensurate withdrawals for expenses, the question will arise how you are surviving on so little," says Manish Shah, partner, S K Parekh & Company. If you are using cash for purchases and not withdrawing from your bank account, the , the taxman will assume that you have undeclared sources of income.

The taxman can question not only your income but also the expenses claimed. If allowances are being used for day-to-day expenses, it means the taxpayer submitted bogus receipts to claim those allowances. "If you stay in your parents' house and claim HRA exemption for the rent paid to them, your bank statement should be able to validate the payment of rent," says Kumar.

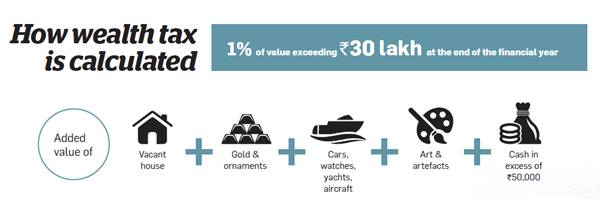

Not filing wealth tax return

Apart from income tax, you may also be liable to pay wealth tax. Most people are blissfully unaware that if they own certain assets, including jewellery, gold or silver bullion, vacant house, non-agricultural land, costly watches, luxury cars and paintings, they have to shell out wealth tax. If the aggregate value of these assets exceeds Rs 30 lakh, they have to pay 1 per cent of the amount by which it exceeds Rs 30 lakh. This also includes .. cash worth over Rs 50,000.

A taxpayer must file his wealth tax return for the same. "One house is exempt from wealth tax. Also, if you have rented out your second home for more than 300 days in the year, it will also be exempt," says Kumar. Also, if the property is used to conduct business, then it is not included for computation of wealth tax. Any loan outstanding against the house will also be subtracted from the market value of the house. However, the valuation of these items is a tedious process. "Only government approved valuers can be approached in this regard," says Kaushik. Perhaps that is why the tax authorities have gone relatively soft on implementing wealth tax provisions so far.

Wealth tax is minuscule in the total revenue collection — it accounts for less than 0.25 per cent of the total direct taxes collected. in the total revenue collection — it accounts for less than 0.25 per cent of the total direct taxes collected. This doesn't mean the taxman will not go after you for not paying it. There is a stiff penalty for evading wealth tax. Incorrect declaration of wealth can invite a fine of up to 500 per cent of the evaded tax. One can also be jailed for up to seven years if the tax due is over Rs 1 lakh.

Reversal of Section 80C benefit

For salaried employees in the in the organised sector, the Employee Provident Fund (EPF) is a great way to save for retirement, but for some, it can also be the reason for a tax notice. Many people withdraw their Provident Fund when they change jobs. The monthly contribution to the EPF is eligible for deduction under Section 80C. If the balance is withdrawn within five years of joining the organisation, the entire deduction claimed in previous years will be reversed. "The amount claimed as deduction will have to be added back to your income for the year in which withdrawal takes place," says Shah. Similarly, if you junk a life insurance policy within two years of buying, the tax benefits claimed under Section 80C will be reversed.

The same holds true if you sell a house within five years. If you availed of tax benefits on the loan, all the deductions claimed in the previous years, including on principal repayment and payment of stamp duty along with registration fees, will be added to the taxable income of the year in which you sell the house.

Since the onus of reversing the benefit and paying the tax for the previous years is on the taxpayer, many people will conveniently skip mentioning it in their tax return. "These issues are not likely to be picked up by the taxman in isolation," says Sanghavi. "But in case your return is picked up for scrutiny, the investigating officer may come across these facts," he adds.

Items received as gifts

Diamonds are a girl's best friend, but if you gift a solitaire diamond ring worth Rs 1 lakh to your friend, she might end up paying a huge tax on it. Gifts from unrelated people are taxable if the aggregate value exceeds Rs 50,000 in a year. "Even gifts received collectively, such as on a birthday or anniversary, but whose combined value exceeds Rs 50,000, will invite tax," says Kumar. The gifts received from blood relatives or on specific ocassions like marriage or under inheritance or by will are not taxable.

The specific assets for which gift tax is applicable include cash, immovable property such as land and buildings, and movable property including financial assets (shares, fixed deposits), jewellery and bullion, art and antiques (paintings, sculptures). Since such instances of gifting occur regularly in our lives, it is a must that one is aware of the tax implications of such activities. "Even when you are the one who is gifting money, you may come under the scanner if the recipient of the gift happens to come under scrutiny," cautions Sanghvi.

How to deal with a tax notice

Here is a checklist of things to do when you get a notice.

> Preserve envelope

The envelope has the Speed Post number, which shows when the notice was posted and served.

>Check PAN details

Maybe the notice was meant for someone with same name. Check your PAN details.

>Make copies of notice

You can't afford to lose the notice, so make photocopies or scan and store it on your computer.

> Check validity

A notice under Section 143(3) for scrutiny assessment has to be served within six months of the end of the financial year in which the return was filed. If served later, it will be deemed invalid. However, a notice served under Section 148 can reopen a case even up to six years if the assessing officer (AO) suspects evasion. If the sum is less than Rs 1 lakh, only 4-year-old returns can be reopened.

> Check sender's details

A notice must have the name, designation, sign, stamp and official address of the sender.

>Organise documents

Some returns are picked up for scrutiny at random. Don't panic, but compile all documents.

> Seek professional help

If it is just a simple demand notice for excess tax, an individual can handle ithimself. If the matter is a little complicated, it is best to take a professional's help. You may be required to appear before the AO to explain any discrepancy in the return or make a clarification. A professional can help you organise your response so that you can provide cogent and specific clarifications.

Economic Times adds: Our intention is not to alarm our readers. If you have missed some income in your tax return or made a mistake in calculating your tax liability, we suggest you file a suggest you file a revised return. You might have to shell out a small amount in tax, but you will be able to sleep easy. You can revise your return as many times as you want. However, a revised return can be filed only if you filed the original return before the 31 July deadline. Now, here's one more reason to file your tax return on time.

Filing tax returns

New rules of filing tax returns (2013)

The tax authorities have introduced several new guidelines for filing returns this year. Find out how these changes are likely to impact you

The Times of India 2013/07/15

First they made it compulsory for businesses to e-file their tax returns. Then they made it mandatory for taxpayers with incomes of over 10 lakh to take the online route. This year, the income tax authorities have cast a wider net and made e-filing compulsory if your taxable income is above 5 lakh a year.

The lowered threshold represents one of the key changes in the tax filing rules this year. Some of these are mere tweaks, such as mentioning your bank’s IFSC number, instead of the MICR code, in the return. However, some of these variations are tectonic, such as the mandatory e-filing for incomes above 5 lakh a year. In the following pages, ET Wealth explains the new rules and how they will affect the way you file your tax return this year.

E-filing tax returns

E-filing of tax returns has grown tenfold since its introduction in 2006. Less than 8% of the 3.37 crore taxpayers efiled their returns in 2007-8. Last year, 45% of the 5 crore taxpayers took the online route. That’s a big jump and the figure is expected to go up significantly this year.

The change has spawned a massive opportunity for tax e-filing portals. These websites charge individual taxpayers between 200 and 4,000 for uploading their tax returns. You can also do it for free on the official website of the Income Tax Department. However, private tax filing portals hand-hold the taxpayer through the process. They guide you while filling the form and even correct you if you make a mistake.

Filing tax returns online is easy. The average taxpayer won’t take more than 30-40 minutes to enter all the details and upload the return. However, the average taxpayer also harbours several misconceptions about e-filing. Mumbai-based Harshad Doshi has fallen in and out of love with online filing during the past three-four years. Doshi started e-filing in 2008, but when he got a scrutiny notice in 2010, he was advised by a relative to desist from the online route. The next year, he reverted to physical returns, but still got a notice. This year, Doshi has no choice but to e-file his returns because his annual income is above 5 lakh. “I have realised that one can get a tax notice, irrespective of whether one files his return online or offline,” he says wryly.

He’s right. Tax returns are picked up for scrutiny through a computerassisted selection procedure that has no human intervention. If the computer detects certain discrepancies in the return, it raises the red flag and the individual gets a notice. In fact, there is a greater probability that a return filed offline will get picked up for scrutiny. The information in your physical return is ultimately fed to the computer by operators. A typing error at this stage can introduce a discrepancy in the return, leading to a notice being sent to you.

This problem can be avoided when you file online because the chances of going wrong are lesser. The e-filing portals further reduce the risk of errors by calculating the tax as you fill in the form. Some e-filing companies, such as Taxspanner, even verify your return for a small fee. If you are ready to shell out 200, the portal will check if you have entered correct information and alert you when you are going wrong. Tax professionals go through your return form, tallying the numbers and cross-checking the information before it is uploaded.

Choose the right form

The online filing data reveals that more than 32% of the 2 crore individual taxpayers used the basic ITR 1, also known as Sahaj, to file their returns last year. Only 11% used the more complicated ITR 2. These statistics indicate that a lot of taxpayers who should have used ITR 2 filed their returns using the simpler Sahaj form. The income level does not matter; what is important is the source of income. For instance, if one had made capital gains or earned rent from more than one house, he should have used ITR 2.

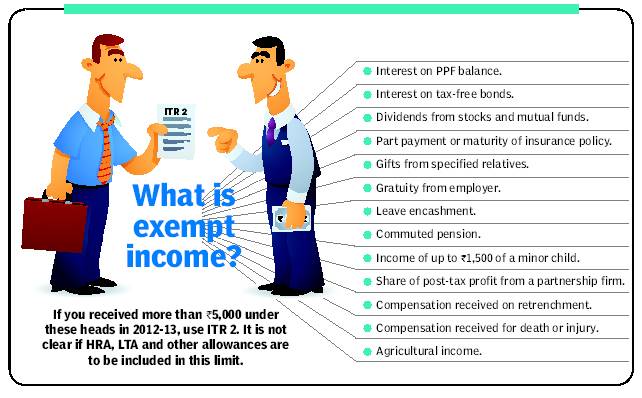

Whether the popularity of ITR 1 was out of ignorance or a deliberate attempt to conceal income is not clear. However, the government has now changed the rules to capture a better picture of the income of taxpayers. If you received more than 5,000 tax-exempt income during 2012-13, you will have to use the ITR 2 for filing your return this year. Exempt income includes tax-free sources of income, such as the interest on PPF, tax-free bonds and dividends (see table). Also, a taxpayer is is not supposed to use ITR 1 if he has foreign assets or has claimed tax relief under any double taxation avoidance treaty.

Experts are divided over the interpretation of exempt income in this regard. “This change will have a big impact on the salaried taxpayers because HRA, LTA or conveyance allowance are commonly availed of by most of them,” warns Kuldip Kumar, executive director of PriceWaterhouse Coopers. This effectively means that a vast majority of salaried taxpayers will have to use ITR 2 this year. Even if they don’t claim HRA exemption, they get LTA, or at least 800 conveyance allowance per month, which is tax free.

However, other experts believe that the 5,000 limit for exempt income does not include HRA, LTA and other allowances that a taxpayer receives from an employer as part of the salary package. More clarity is needed on this aspect.

The stress on disclosure demonstrates the tax department’s resolve to plug the leakages in tax collection. The direct tax collection of 5.58 lakh crore in 2012-13 fell short of the revised target by 7,000 crore. Addressing a meeting of tax officials in May, Finance Minister P Chidambaram exhorted them to “target non-filers and stop-filers to widen the tax base”. Almost 12.5 lakh such “non-compliant” taxpayers have been identified by the Central Board of Direct Taxes, and almost 2 lakh notices are already on their way. The taxpayers who have not filed or s t o p p e d f i l i n g would do well to take heed of the warning. If you have not filed your return for last year as well, you can do so now. A return filed after the due date is a delayed return. If you file your delayed return before you get a notice, you have a better chance of getting away lightly. The taxman will not take you to task for not filing your returns, just give you a mild rap for waking up late.

Automatic choice for e-filers

For some online tax filers, choosing the right form is not an issue. “A taxpayer has to just enter what he has earned under different heads of income and the portal automatically chooses the applicable form,” says Sudhir Kaushik, co-founder and CFO of Taxspanner.com. For instance, if the person has only income from salary and no exempt income, his return will be filed using ITR 1, but if he made some capital gains, has rental income from more than one house or his exempt income exceeds 5,000, ITR 2 will have to be used.

However, taxpayers who upload their returns through the official Income Tax Department website will have to be more careful about the form they use. Delhi-based Kuldip Kaushik used the ITR 1 last year, but since he had dividend income of over 5,000 for the year 2012-13, he will have to use ITR 2 this year.

If a taxpayer uses the wrong form and the mistake is discovered by the tax authorities, the return may be rejected. Every year, thousands of defective returns are sent back to taxpayers. A defective return is not an earth shattering matter. If you get a notice, you will have to file a revised return within 15 days. If you meet the deadline, the return is treated as valid. Get delayed and your return will become invalid and you will have to file afresh.

“If you discover on your own that you have made a mistake in the return or used the incorrect form, you can file a revised return to rectify the mistake,” says Vineet Agrawal, director KPMG. Your new return will overule the previous one if the assessment has not been completed.

Check your TDS details

Before you sit down to file your returns this year, spend a few minutes to check whether the tax you paid for last year has been correctly credited to your name. The Form 26AS has details of the tax deducted on behalf of the taxpayer and can be easily checked online. Noida-based Brijendra Singh wishes he had done so last year. The former army officer got a tax notice because of a clerical error by his bank. The TDS paid on his income from fixed deposits was credited to another PAN by mistake. Though he was eventually given credit for his TDS, Singh is not taking any chances this year. He has diligently matched all his TDS details with his Form 26AS online.

Checking your tax credit details online is child’s play if you have a Net banking account with any of the 35 banks that offer this facility. Otherwise you can go to the official website of the Income Tax Department and click on ‘View Your Tax Credit’. First-time users will have to register but it takes less than five minutes before you can log on and view your details. “It is necessary that taxpayers check their TDS when they file their returns,” says Kuldip Kumar of PwC.

Forms seek more information

If salaried people are feeling jittery about using the more detailed ITR 2, imagine what partners in firms and businessmen are going though. In an attempt to dig deeper for undisclosed income, the government has made it mandatory for partners, professionals and businessmen with an income of over 25 lakh to furnish details of their assets and liabilities. There is a new ‘Schedule AL’ in the ITR 3 and ITR 4. If the taxpayer’s income exceeds 25 lakh during the year, he will have to declare his assets and liabilities.

Don’t forget the ITR V

The most important form in the whole process is the ITR V. This is the acknowledgement of your return. If you file offline, this form has to be submitted along with the ITR. If you file online without digital signature, this form has to be sent to the CPC in Bangalore by snail mail within 120 days of uploading the return. This also means that for a vast majority of efiling taxpayers, the process is not fully online. The CBDT is considering a proposal that will do away with the physical posting of the ITR V. However, till then you will have to send it by ordinary post.

Others feel that the cost of digital signature should be brought down and its usage expanded to cover other areas as well. “If e-filing has been made mandatory, the government should also make the use of digital signatures mandatory,” says Delhibased chartered accountant Minal Agrawal Jain.

Choosing an e-filing portal

Charges should not be the only reason for choosing a portal. Here are some other factors that you should consider.

Is it comprehensive?

The more details sought, the better it is. If the return uses only Form 16, you might lose out on deductions you were eligible for, but didn’t claim.

Assistance in filing

For a small charge some portals guide you in the process to ensure there are no mistakes. Others pick up documents from your office or residence.

Follow-up services

Does the portal help even after the uploading? Some alert you if you forget the ITR V. Others send it to the CPC in Bangalore on your behalf.

Privacy policy

The data in your tax return form is priceless for financial services companies. If it goes out, you will be inundated with calls and spam mail.

Five tax filing mistakes

Five tax filing mistakes to avoid this year

Here’s how to ensure you don’t commit errors and receive a tax notice

The Times of India 2013/07/15

1 Availing of deduction twice

This is a common error that many salaried taxpayers commit. If you had switched jobs during the previous financial year, you might have got the Form 16 from both employers. While the first company may have deducted the tax correctly, the second might have deducted very little. It would have considered only the income for the rest of the year and given you the basic exemption of 2 lakh, as also the deduction under Section 80C. However, these must have already been factored in by the previous company. “You might have to pay additional tax in such a situation,” says Sudhir Kaushik, co-founder of tax filing portal, Taxspanner.com. Don’t think you can escape by ignoring the previous income in your tax return. The computerised scrutiny will immediately detect the discrepancy. There will also be a mismatch in your TDS details because the previous employer would have deposited the TDS on your behalf, along with your PAN and other details. 2

Not mentioning exempt income

Dividends are tax-free. So are longterm capital gains from stocks and equity funds, as well as the interest on your PPF investments and taxfree bonds. There is also no tax to be paid on agricultural income and gifts from specified relatives. Even though these are tax-free, all exempt incomes must be mentioned in the tax return. Ignore this at your peril. The new rules for tax filing announced this year state that if the total exempt income during the year exceeded 5,000, you will have to use ITR 2 to file your return.

3 Not including interest

2012’s budget had introduced a new Section 80TTA, which gives a deduction of up to 10,000 on interest earned on your balance in the savings bank account. Many taxpayers think this deduction also includes the interest earned on bank deposits. The interest earned on fixed deposits and recurring deposits is fully taxable at the normal rate. You have to mention it under the head ‘Income from other sources’ in your tax return. Tax is payable even if the TDS has been deducted. TDS is only 10% (20% if you haven’t submitted your PAN details), and if you are in the 20-30% bracket, you need to pay additional tax. The interest on NSCs is also taxable.

4 Not checking TDS details

Before you file your returns, check whether the tax you had paid for last year has been correctly credited to your name. The Form 26AS has details of the tax deducted on behalf of the taxpayer and can be easily checked online. It is easier if you have a Net banking account with any of the 35 banks that offer this facility. Otherwise, you can go to the official website of the Income Tax Department and click on ‘View your tax credit’. First-time users will have to register, but it takes less than 5 minutes to log on and view your details.

5 Not mailing ITR V in time

The ITR V is the acknowledgment of your tax return. It is to be submitted along with your return if you file offline. If you have e-filed your return without a digital signature, you need to take a print of the ITR V, sign it and send it to the CPC in Bangalore by ordinary mail. This should be done within 120 days of uploading your return. The filing process is complete only after the ITR V is received at the CPC. You can check the status of your ITR V on the official website of the Income Tax Department. If it has not been recieved within 7-10 days of mailing, call up the Ayakar Sampark Kendra or send another copy.

See also

Direct taxes: India / Income Tax India: Expert advice / Income Tax India: Laws / Income Tax India: NRIs / Wealth tax: India