Income Tax India: Laws

This is a collection of articles archived for the excellence of their content.

|

Contents |

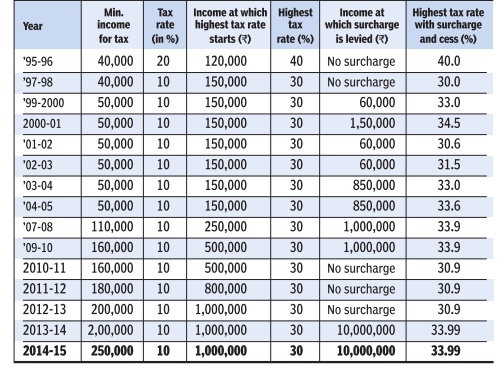

Income tax rates in India: 1995-2015

See the chart on this page

Indian income tax laws: ten things...

...that you should know Adapted from EconomicTimes March 2014

1) The interest earned on a bank fixed deposit is...Interest on FDs is fully taxable as income at the rate applicable to the taxpayer.

2) Travel insurance policies are not tax deductible for salaried individuals.

3) An individual won't get tax deduction for... employer's contribution to PF.

4) Gifts worth over Rs 50,000 in a year are taxed as income of recipient.

5) Any income of a minor child will be clubbed with that of the parent. HRA is not tax-exempt if you pay rent to... Your minor child.

6) A disabled dependant gets you a deduction under Section 80DD. This is an additional tax benefit

7) f you have a second house lying vacant, you have to...

a. Pay tax on rent not received. b. Include in wealth tax. c. Pay property tax on it. All the three conditions apply on a second house lying vacant.

8) If one earns rent on property, how much of it is taxable? Rental income is eligible for 30% standard deduction.

9) Only those with income below the basic exemption are exempt from filing tax returns.

10) The RGESS deduction is available only to first-time investors in equities.

Income Tax returns

Who has to file income tax returns

Salaried persons earning up to Rs 5 lakh annually

Salaried persons earning up to Rs 5 lakh annually will have to file income tax returns: Central Board of Direct Taxes

PTI | Jul 22, 2013

The CBDT had exempted salaried employees having a total income of up to Rs 5 lakh including income from other sources up to Rs 10,000 from the requirement of filing income tax return for assessment year 2011-12 and 2012-13, respectively.

However, for the assessment year 2013-14 and thereafter, salaried persons earning up to Rs 5 lakh annually will have to file income tax returns, Central Board of Direct Taxes (CBDT) said on Monday.

Earlier in May 2013, the CBDT had made E-filing of income tax return compulsory for the assessment year 2013-14 for persons having total assessable income exceeding Rs 5 lakh.

The CBDT said that the exemption has been not been extended as the facility for online filing of returns has been made "user-friendly with the advantage of pre-filled return forms".

These e-filed forms also get electronically processed at the central processing centre in a speedy manner, it said.

For filing returns, an assessee can transmit the data in the return electronically by downloading ITRs, or by online filing.

Thereafter the assessee had to submit the verification of the return from ITR-V for acknowledgement after signature to Central Processing Centre.

Not filing I-T returns?Imprisonment,fine

Not filed I-T returns? You face jail & fine

TNN | Aug 17, 2013-

MUMBAI: Those defaulting in filing income tax returns are liable to prosecution, the I-T department has said.

If the tax evaded exceeds Rs 25 lakh, the defaulter can be sentenced to a minimum imprisonment of six months and maximum of seven years, besides being asked to pay a fine. If the tax evasion amount is less than Rs 25 lakh, the imprisonment could range between three months to two years in addition to fine.

Recently, the additional chief metropolitan magistrate, New Delhi, sentenced a taxpayer to six months' imprisonment in one assessment year and one year imprisonment in subsequent assessment year for repeating the offence of not filing income tax returns.

Income tax: fashion designers

‘Fashion designers are artists, eligible for I-T exemption’ Shibu Thomas

Mumbai: A fashion designer is an artist, the Bombay High Court has said and ruled that they are eligible for incometax exemptions available under the category. Ten years after the income-tax department first objected to tax benefits claimed by one of India’s leading fashion designers, Tarun Tahiliani, a division bench of Justice Dhananjay Chandrachud and Justice J P Devadhar on Monday said the designer should get tax privileges extended to the artists.

Tahiliani opened the country’s first fashion boutique, Ensemble, and is credited with being one of the designers who have brought high couture to India. Tahiliani’s IT woes began in October 2000 when he sought tax exemption for his income of Rs 83.90 lakh. Under Section 80 RR of the Income-Tax Act, a resident of India, who is an an author, playwright, artist, musician, actor or sports person can claim exemption of 75% of his income earned from foreign assignments. Tahiliani said that applying the exemptions, his taxable income for that year would be Rs 53.24 lakh.

The tax department, however, refused to accept that the fashion designer was an artist. It also contested deductions sought by sought by Tahiliani on his taxable income for 1999-2000 and 2001-2002. The income-tax appellate tribunal ruled in Tahiliani’s favour, upholding his claim that he was a creative artist. The IT department challenged the order before the high court.

The department’s lawyer contended that a fashion designer didn’t belong to the creative profession as the vocation was classified under applied arts and not fine arts. The IT department said that the benefit of exemption was granted to aid the artists, who represent Indian culture abroad.

The HC dismissed the IT department’s petition and held that fashion designers were entitled to tax exemptions meant for artists.

In a relief to global energy and petrochemical giant Shell, the Bombay high court on Tuesday ruled that the firm is not liable to pay tax in a transfer pricing case of 2009-10. The potential tax demand on Shell by the I-T authorities was $240 million. The ruling comes after Vodafone’s recent win in the HC in a similar case. The I-T authorities in Mumbai had alleged that there was underpricing of shares which the company had issued to an overseas group entity Shell Gas BV in March 2009.

The company said it had issued 87 crore shares at Rs 10 per share, but the I-T department assessed the value at Rs 180 per share and said there was thus a Rs 15,000-crore under pricing in the transaction, an amount on which tax could be levied. The Bombay HC has now held that these share premiums are not taxable. In case of Vodafone, the HC had then held that issuance of shares in a capital financial transaction did not amount to taxable income. The cellular service major had challenged an order of Income Tax authority in a transfer pricing case.

Several global giants are involved in transfer pricing litigation with the government, whose stand has been criticized.

Investors have been critical of the way the tax department went about slapping notices over the past few years.

“We welcome the High Court decision. Shell has always maintained that equity infusion by a foreign parent company into an Indian subsidiary cannot be taxed as income,’’ said a Shell spokesperson after the verdict was pronounced. “ This is a positive outcome which should provide a further boost to the Indian government’s initiatives to improve the country’s investment climate”.

See also

Income Tax India: Expert advice /

Income Tax India: Laws /