Indian investments abroad

(→2021 Jun vs 2020) |

|||

| (10 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | |||

| − | |||

| − | |||

| − | |||

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

|colspan="0"|<div style="font-size:100%"> | |colspan="0"|<div style="font-size:100%"> | ||

| − | This is a collection of articles archived for the excellence of their content.<br/> | + | This is a collection of articles archived for the excellence of their content.<br/> |

| + | Additional information may please be sent as messages to the Facebook <br/>community, [http://www.facebook.com/Indpaedia Indpaedia.com]. All information used will be gratefully <br/>acknowledged in your name. | ||

| + | </div> | ||

| + | |} | ||

| + | |||

| + | |||

| + | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

=Employment, local, created by Indian firms abroad= | =Employment, local, created by Indian firms abroad= | ||

| Line 33: | Line 29: | ||

India is demanding opening up of computer services during the negotiations so that it is not just easier but there is also a stable regime for Indian professionals. Similarly , the government has demanded easier rules in the audio-visual space, which will help Indian film producers, but the RCEP negotiators are reluctant to agree to it.Further, the proposal to have a travel card for Indian business travellers, allowing for seamless movement, is being blocked although the facility is available to Apec members. | India is demanding opening up of computer services during the negotiations so that it is not just easier but there is also a stable regime for Indian professionals. Similarly , the government has demanded easier rules in the audio-visual space, which will help Indian film producers, but the RCEP negotiators are reluctant to agree to it.Further, the proposal to have a travel card for Indian business travellers, allowing for seamless movement, is being blocked although the facility is available to Apec members. | ||

| − | =Worldwide= | + | =Worldwide investments= |

| − | ==2010-11: | + | ==2000-2016: land purchases== |

| + | [[File: Land purchased by India, China and other top buyers, 2000-2016.jpg| Land purchased by India, China and other top buyers, 2000-2016 <br/> [http://epaperbeta.timesofindia.com/Gallery.aspx?id=27_11_2016_021_045_002&type=P&artUrl=INCREDIBLE-FACT-27112016021045&eid=31808 ''The Times of India'']|frame|500px]] | ||

| + | See graphic, ' Land purchased by India, China and other top buyers, 2000-2016 ' | ||

| + | |||

| + | ==2006- 2015: investments== | ||

| + | [[File: India's international investment position, December 2006-December 2015.jpg|India's international investment position, December 2006-December 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-FINANCIAL-LIABILITIES-ABROAD-RISING-FASTER-THAN-ASSETS-16042016011015 ''The Times of India''], April 16, 2016|frame|500px]] | ||

| + | See graphic, ' India's international investment position, December 2006-December 2015 ' | ||

| + | |||

| + | |||

| + | ==2010-11: Investments abroad== | ||

From the archives of '' The Times of India '' | From the archives of '' The Times of India '' | ||

| Line 53: | Line 58: | ||

In 2014, the outward FDI movement from India was about $2.5 billion. The biggest foreign investments in the year were done by petroleum, real estate, telecom and pharmaceutical companies. The largest chunk of this investment went to Netherlands, Singapore, Jersey and Mauritius, each receiving over $100 million of investments from India accounting for about 80% of the FDI outflow from the country. Indian companies invested in 62 countries last year. Of these, investments exceeded $10 million in only 16 countries. In 26 countries, the investments were less than a million dollars. | In 2014, the outward FDI movement from India was about $2.5 billion. The biggest foreign investments in the year were done by petroleum, real estate, telecom and pharmaceutical companies. The largest chunk of this investment went to Netherlands, Singapore, Jersey and Mauritius, each receiving over $100 million of investments from India accounting for about 80% of the FDI outflow from the country. Indian companies invested in 62 countries last year. Of these, investments exceeded $10 million in only 16 countries. In 26 countries, the investments were less than a million dollars. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | ==2021 Jun vs 2020 == | |

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2021/07/19&entity=Ar01706&sk=165904CD&mode=text July 19, 2021: ''The Times of India''] | ||

| − | The | + | The overseas direct investment of domestic companies more than doubled to $2.8 billion in June this year, according to RBI data. India Inc had invested just under $1.4 billion in overseas ventures in the year-ago month. However, on a month-on-month basis, the investment was lower by over 58% from $6.7 billion in May 2021, according to the RBI data on outward investments by Indian firms. |

| − | + | Of the total investment during last month, $1.2 billion was in the form of issuance of guarantee, another $1.2 billion was given as loan, while the equity investment stood at $427 million. | |

| − | + | Among the major investors were Tata Steel with $1 billion in a wholly owned subsidiary in Singapore, Wipro’s $787.5 million in a wholly owned unit in the US, and Tata Power’s $131.3 million in a fully owned unit in Mauritius. Additionally, RIL invested $56 million in an agriculture and mining based wholly owned subsidiary in Singapore, while Interglobe Enterprises invested $51.5 million in a joint venture in the UK. PTI | |

| − | == | + | === Indian MFs’ global kitty=== |

| − | + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2021/09/16&entity=Ar02101&sk=9711DC96&mode=text Sep 16, 2021: ''The Times of India''] | |

| − | |||

| − | + | Total investments by Indian mutual funds (MFs) in stocks listed abroad jumped over three and half times during financial year 2021, boosted mainly by the record rally in most of the global equity markets last fiscal. This was partially also helped by some new funds that domestic MFs had launched during the year. | |

| − | + | ||

| − | + | ||

| − | + | From Rs 5,808 crore as of end-March 2020, total foreign assets of Indian fund houses jumped to Rs 20,865 crore by end-March 2021, data released by the RBI showed. | |

| − | + | There are several MF schemes in India that invest in stocks listed abroad and the trend has suddenly picked up in the last couple of years. These include pure equity funds that invest part of their corpus abroad, and also international funds that invest abroad through the fund of funds (FoF) and exchange-traded fund (ETF) structure, thematic funds, country-specific funds, etc. | |

| − | + | Geographical diversification, strong market rally in the past few years and appreciation of foreign currencies are among the most compelling reasons for Indian investors to put their money in these funds, industry players said. | |

| − | + | According to the RBI, most of the money invested by Indian MF investors abroad is concentrated in two countries — the US, which accounts for 43.3% of the total corpus, while 42.5% is in Luxembourg. | |

| − | + | ==2022, 2023== | |

| + | [https://indianexpress.com/article/business/outbound-investment-list-odi-beneficiary-financial-year-2023-rbi-data-8937283/ George Mathew, Sep 13, 2023: ''The Indian Express''] | ||

| − | + | [[File: Outward direct investment from India, 2022, 2023.jpg|Outward direct investment from India, 2022, 2023 <br/> From: [https://indianexpress.com/article/business/outbound-investment-list-odi-beneficiary-financial-year-2023-rbi-data-8937283/ George Mathew, Sep 13, 2023: ''The Indian Express'']|frame|500px]] | |

| − | + | Singapore was the largest beneficiary of outward direct investment (ODI) by Indian firms with the country getting Rs 2.03 lakh crore ($ 24.48 billion) or 22.3 per cent of the total ODI during the financial year 2023. Total outward direct investment by Indian firms rose by 19.46 per cent to Rs 9.11 lakh crore ($ 109 billion) in FY2023 as against Rs 7.62 lakh crore last year, data from a Reserve Bank of India study shows. | |

| − | + | The US received Rs 1.24 lakh crore (13.6 per cent share) and the UK got Rs 1.16 lakh crore (12.8 per cent) as ODI from India in FY2023. The top ten countries accounted for as much as 85 per cent of the ODI. Switzerland received Rs 28,228 crore ($ 3.40 billion). | |

| − | + | ||

| − | + | ||

| + | Significantly, three jurisdictions known for tax benefits are in the top ten countries that received Indian ODI. Bermuda received Rs 12,582 crore ($ 1.51 billion), Jersey Rs 11,661 crore ($1.40 billion) and Cyprus Rs 9,985 crore ($1.20 billion), RBI data shows. Bermuda, for example, imposes no taxes on profits, income, dividends, or capital gains. It has no limit on the accumulation of profit, and has no requirement to distribute dividends, according to a PWC report. | ||

| − | + | Meanwhile, the US was the largest source of inward foreign direct investment (FDI) in India in fiscal year 2023, followed by Mauritius, the UK and Singapore with the top ten countries accounting for over 90 per cent of the flows. | |

| + | According to RBI data, the US brought in Rs 8.58 lakh crore ($103 billion) FDI in FY23 as against Rs 8.05 lakh crore in the previous, accounting for 17.2 per cent of the share. FDI from Mauritius was Rs 7.43 lakh crore (Rs 7.79 lakh crore) accounting for a share of 14.9 per cent and the UK Rs 7.08 lakh crore (Rs 5.83 lakh crore). | ||

| − | + | While the total FDI flow in FY2023 was Rs 49.93 lakh crore ($ 601 billion) as against Rs 46.72 lakh crore a year ago, other major FDI contributors included Singapore (Rs 6.59 lakh crore, Netherlands (Rs 5 lakh crore) and Japan (Rs 3.98 lakh crore). Of this, Rs 47.75 lakh crore was by way of equity and the balance was debt. | |

| − | + | The data is from the RBI’s annual census on foreign liabilities and assets (FLA) covering cross-border liabilities and assets of the entities (companies, limited liability partnerships, alternative investment funds and partnership firms) with inward/outward direct investment (DI). Out of the 38,689 entities, which responded in the latest census round, 33,850 reported FDI and ODI in their balance sheet as at end-March 2023. | |

| − | + | ||

| − | + | ||

| − | + | The manufacturing sector continued to attract the largest share of FDI equity, both at market value as well as at face value. Among services, information & communication and financial & insurance activities were the major FDI recipient sectors. | |

| − | + | “Over 97 per cent of the responding DI entities were unlisted in March 2023 and they accounted for a bulk of the FDI equity capital in India,” according to the RBI report. Non-financial companies retained the lion’s share of the FDI equity at face value. The market value of FDI in unlisted firms surpassed that in listed companies. | |

| − | + | [[Category:Economy-Industry-Resources|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | |

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:India|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:UK|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:USA|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

| − | + | =See also= | |

| + | [[Indian investments abroad]] | ||

| − | + | [[Indian investments in the UK]] | |

| − | + | [[Indian investments in the USA]] | |

| − | + | [[US- India economic relations]] | |

| − | + | [[Category:Economy-Industry-Resources|IINDIAN INVESTMENTS ABROAD | |

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:India|IINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:UK|IINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:USA|IINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

| − | + | [[Category:Economy-Industry-Resources|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | |

| − | [[ | + | INDIAN INVESTMENTS ABROAD]] |

| − | + | [[Category:India|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | |

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:UK|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:USA|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

| − | + | [[Category:Economy-Industry-Resources|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | |

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:India|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:UK|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

| + | [[Category:USA|IINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROADINDIAN INVESTMENTS ABROAD | ||

| + | INDIAN INVESTMENTS ABROAD]] | ||

Latest revision as of 09:27, 12 October 2023

This is a collection of articles archived for the excellence of their content. |

Contents |

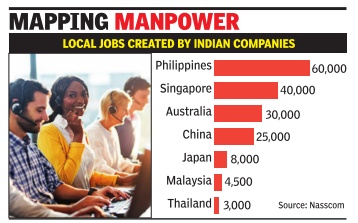

[edit] Employment, local, created by Indian firms abroad

[edit] 1.71 lakh local jobs in Asia-Pacific (Apac)

Amid tightening visa rules across the globe, the government has told countries in the Asia-Pacific (Apac) region that Indian companies have created at least 1.71 lakh local jobs in nine countries with very few Indians requiring work permits. The issue was flagged with countries negotiating the Regional Comprehensive Economic Partnership (RCEP) agreement, including China, Japan, South Korea, Australia, New Zealand and Asean nations, sources told.

While negotiators from these countries are seeking steep reduction in import duties in India, they are unwilling to allow Indian professionals, such as software engineers and architects, on work visas or even commit to easier investment rules for Indian companies. The Indian govern ment is seeking to impress upon these countries, by making a point that not only do Indian professionals contribute to their economies but companies such as Infosys, Wipro, TCS and HCL also create thousands of jobs.

In recent years, visa restrictions have gone up and the go vernment is accusing the Singapore government of going back on its commitment to allow Indian professionals, despi te committing to it in the bilateral trade and investment treaty .Recently , Australia tightened its visa rules in a bid to check foreigners on work visas, prompting PM Narendra Modi to raise the issue with his counterpart Malcolm Turnbull.

Sources said during a recent interaction that the government had with representatives of companies operating in the Philippines, it came out that Indian IT firms had created close to 60,000 local jobs but needed only 1,500-2,000 work permits.

The companies also said despite Philippine Economic Zone Authority allowing 5% foreign nationals to work if exports accounted for 70% of the business of a company , visas were tough to come by for Indians. As a result, companies were forced to wait for15 days to get business visas, often delaying work.

India is demanding opening up of computer services during the negotiations so that it is not just easier but there is also a stable regime for Indian professionals. Similarly , the government has demanded easier rules in the audio-visual space, which will help Indian film producers, but the RCEP negotiators are reluctant to agree to it.Further, the proposal to have a travel card for Indian business travellers, allowing for seamless movement, is being blocked although the facility is available to Apec members.

[edit] Worldwide investments

[edit] 2000-2016: land purchases

The Times of India

See graphic, ' Land purchased by India, China and other top buyers, 2000-2016 '

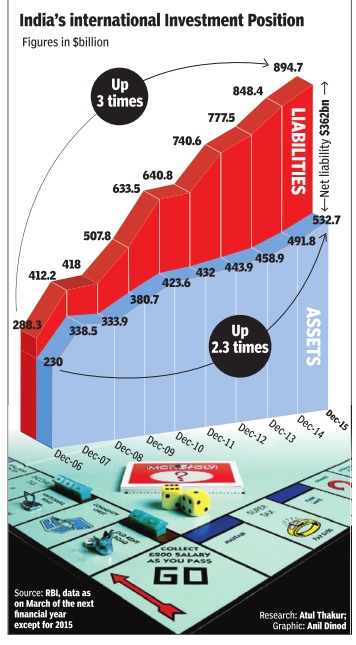

[edit] 2006- 2015: investments

See graphic, ' India's international investment position, December 2006-December 2015 '

[edit] 2010-11: Investments abroad

From the archives of The Times of India

India Inc’s overseas retail biz on high

In 2010-11, Investment abroad was $1,870m, up 78% from 2009-10

While the Congress government may be finding it difficult to get its FDI in multi-brand retail pass the test of Parliament, India Inc has been pledging huge investments in wholesale and retail trade abroad, including in countries like the United States and Britain. In the 2010-11 fiscal year, investments of Indian companies in wholesale and retail trade overseas went up 78%, as compared to the previous year — up from $1,052 million in 2009-10 to $1,870 million in 2010-11. The trend continues with investments in retail trade made so far by Indian firms overseas accounting for $623 million in the first eight months of the current fiscal year (till November). The other sectors that have been attracting attention of desi companies include manufacturing, financial, insurance, real estate and agriculture, forestry and fishing. In agriculture too, where India has opened FDI doors “under controlled conditions”, Indian companies have made significant investments abroad. From$940 million in 2009-10, the overseas investment portfolio of domestic firms reached $1,200 million in the fiscal year, ending March 31, 2011. With the current logjam in Parliament over FDI, it seems the flight of capital would continue for some time before Indian companies find lucrative returns here. On the issue of FDI in multi-brand retail, the opposition has called it a complete sellout to foreign multinationals. The Left and the NDA are claiming that it would lead to job losses and adversely affect the small traders. Industry chambers have, however, supported the government’s decision and have called it a long-awaited reform that would help small and medium enterprises improve supply chains. An industry estimate puts increase in income in the sector to upwards of $30 billion annually over the next decade. Foreign investments in areas like logistics and repackaging alone is likely to add millions of jobs, according to estimates. With big opposition-ruled states against the FDI, it is expected that even if the Centre succeeds in rolling out the reform, nearly half of the 53 cities that qualify for setting up of multinational chains will miss out on opening their stores. Out of 46 cities, which have a population of 10 lakh and above, 25 can qualify for allowing multi-brand retail majors like Wal-Mart to open stores, but political leadership in these cities have announced their opposition.

[edit] 2014

Jan 30 2015

In 2014, the outward FDI movement from India was about $2.5 billion. The biggest foreign investments in the year were done by petroleum, real estate, telecom and pharmaceutical companies. The largest chunk of this investment went to Netherlands, Singapore, Jersey and Mauritius, each receiving over $100 million of investments from India accounting for about 80% of the FDI outflow from the country. Indian companies invested in 62 countries last year. Of these, investments exceeded $10 million in only 16 countries. In 26 countries, the investments were less than a million dollars.

[edit] 2021 Jun vs 2020

July 19, 2021: The Times of India

The overseas direct investment of domestic companies more than doubled to $2.8 billion in June this year, according to RBI data. India Inc had invested just under $1.4 billion in overseas ventures in the year-ago month. However, on a month-on-month basis, the investment was lower by over 58% from $6.7 billion in May 2021, according to the RBI data on outward investments by Indian firms.

Of the total investment during last month, $1.2 billion was in the form of issuance of guarantee, another $1.2 billion was given as loan, while the equity investment stood at $427 million.

Among the major investors were Tata Steel with $1 billion in a wholly owned subsidiary in Singapore, Wipro’s $787.5 million in a wholly owned unit in the US, and Tata Power’s $131.3 million in a fully owned unit in Mauritius. Additionally, RIL invested $56 million in an agriculture and mining based wholly owned subsidiary in Singapore, while Interglobe Enterprises invested $51.5 million in a joint venture in the UK. PTI

[edit] Indian MFs’ global kitty

Sep 16, 2021: The Times of India

Total investments by Indian mutual funds (MFs) in stocks listed abroad jumped over three and half times during financial year 2021, boosted mainly by the record rally in most of the global equity markets last fiscal. This was partially also helped by some new funds that domestic MFs had launched during the year.

From Rs 5,808 crore as of end-March 2020, total foreign assets of Indian fund houses jumped to Rs 20,865 crore by end-March 2021, data released by the RBI showed.

There are several MF schemes in India that invest in stocks listed abroad and the trend has suddenly picked up in the last couple of years. These include pure equity funds that invest part of their corpus abroad, and also international funds that invest abroad through the fund of funds (FoF) and exchange-traded fund (ETF) structure, thematic funds, country-specific funds, etc.

Geographical diversification, strong market rally in the past few years and appreciation of foreign currencies are among the most compelling reasons for Indian investors to put their money in these funds, industry players said.

According to the RBI, most of the money invested by Indian MF investors abroad is concentrated in two countries — the US, which accounts for 43.3% of the total corpus, while 42.5% is in Luxembourg.

[edit] 2022, 2023

George Mathew, Sep 13, 2023: The Indian Express

From: George Mathew, Sep 13, 2023: The Indian Express

Singapore was the largest beneficiary of outward direct investment (ODI) by Indian firms with the country getting Rs 2.03 lakh crore ($ 24.48 billion) or 22.3 per cent of the total ODI during the financial year 2023. Total outward direct investment by Indian firms rose by 19.46 per cent to Rs 9.11 lakh crore ($ 109 billion) in FY2023 as against Rs 7.62 lakh crore last year, data from a Reserve Bank of India study shows.

The US received Rs 1.24 lakh crore (13.6 per cent share) and the UK got Rs 1.16 lakh crore (12.8 per cent) as ODI from India in FY2023. The top ten countries accounted for as much as 85 per cent of the ODI. Switzerland received Rs 28,228 crore ($ 3.40 billion).

Significantly, three jurisdictions known for tax benefits are in the top ten countries that received Indian ODI. Bermuda received Rs 12,582 crore ($ 1.51 billion), Jersey Rs 11,661 crore ($1.40 billion) and Cyprus Rs 9,985 crore ($1.20 billion), RBI data shows. Bermuda, for example, imposes no taxes on profits, income, dividends, or capital gains. It has no limit on the accumulation of profit, and has no requirement to distribute dividends, according to a PWC report.

Meanwhile, the US was the largest source of inward foreign direct investment (FDI) in India in fiscal year 2023, followed by Mauritius, the UK and Singapore with the top ten countries accounting for over 90 per cent of the flows.

According to RBI data, the US brought in Rs 8.58 lakh crore ($103 billion) FDI in FY23 as against Rs 8.05 lakh crore in the previous, accounting for 17.2 per cent of the share. FDI from Mauritius was Rs 7.43 lakh crore (Rs 7.79 lakh crore) accounting for a share of 14.9 per cent and the UK Rs 7.08 lakh crore (Rs 5.83 lakh crore).

While the total FDI flow in FY2023 was Rs 49.93 lakh crore ($ 601 billion) as against Rs 46.72 lakh crore a year ago, other major FDI contributors included Singapore (Rs 6.59 lakh crore, Netherlands (Rs 5 lakh crore) and Japan (Rs 3.98 lakh crore). Of this, Rs 47.75 lakh crore was by way of equity and the balance was debt.

The data is from the RBI’s annual census on foreign liabilities and assets (FLA) covering cross-border liabilities and assets of the entities (companies, limited liability partnerships, alternative investment funds and partnership firms) with inward/outward direct investment (DI). Out of the 38,689 entities, which responded in the latest census round, 33,850 reported FDI and ODI in their balance sheet as at end-March 2023.

The manufacturing sector continued to attract the largest share of FDI equity, both at market value as well as at face value. Among services, information & communication and financial & insurance activities were the major FDI recipient sectors.

“Over 97 per cent of the responding DI entities were unlisted in March 2023 and they accounted for a bulk of the FDI equity capital in India,” according to the RBI report. Non-financial companies retained the lion’s share of the FDI equity at face value. The market value of FDI in unlisted firms surpassed that in listed companies.

[edit] See also

Indian investments abroad