Real Estate (Regulation & Development) Act (RERA)

This is a collection of articles archived for the excellence of their content. |

Contents |

The evolution of the Real Estate (Regulation & Development) Act

2016: Some states dilute provisions, give builders exemptions

Dipak Dash, UP, Gujarat dilute new realty law, Nov 04 2016 : The Times of India

Make It Builder-Friendly By Giving Exemptions To Ongoing Projects

States led by UP and Gujarat have begun diluting provisions of the Real Estate (Regulation & Development) Act, which notify the rules for regulation of the sector. Both states have let off most ongoing real estate projects which have been delayed for long and remain a worry for thousands of home buyers awaiting delivery .

While UP has come up with four exemptions to exclude incomplete projects from the category of “ongoing projects“, Gujarat has exempted all projects launched before notification of the rules. This means such projects won't have to be registered with the real estate regulator in these states.

On the contrary , the law enacted by the Centre earlier this year provides for manda tory registration of all “ongoing projects“ that have not received completion certificate. “The central law, which is binding on all states, does not differentiate between ongoing and future projects for registration. However, it provides for registration of incomplete projects within three months from the commencement of the Act,“ said an official here.

The norms notified by UP excluded projects in which services had been handed over to the local authority for maintenance, common areas and facilities that had been handed over to RWAs for maintenance and where development work had been completed and sale and lease deeds of 60% houses execu ted. “This dilutes norms laid down in the law and will help builders avoid the mandatory regulatory provisions,“ the central government official said.

Defending their move, a Gujarat government official said, “We have notified the rules primarily for setting up the regulator ahead of the October 31 deadline. Once the operative part of the law comes into effect, we may revisit the norms“.

But central government sources said states must notify specific rules in compliance with the law and it wouldn't take not more than a couple of days to make all provisions operative.

On its part, the Uttar Pradesh government has also provided a handle for developers to retain some land in their projects under the guise of commercial activity rather than hand over such land to house owners.

While the central law clearly says that all community and commercial facilities in a project will be treated as common areas, rules notified by UP says, “Community and commercial facilities shall include only those facilities, which have been provided as common areas.“

2017: States dilute rules

Dipak Dash, States & UTs dilute RERA to favour realtors, May 1, 2017: The Times of India

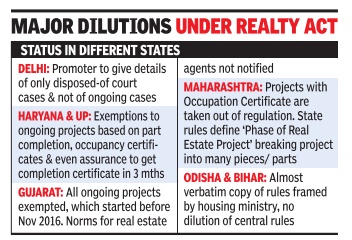

The Union housing ministry may claim that implementation of the real estate regulation law, popularly called RERA, will usher in a new era for home buyers, but the rules put forward by states have diluted many provisions, keeping most of the ongoing projects outside the ambit of the law that would come into effect.

States such as Odisha and Bihar have notified rules that are completely in sync with the one notified by the Union housing and poverty alleviation ministry . But in contrast, Haryana's draft rules, notified last week, have completely left out disclosures by builders on the sanctioned plan, layout and specifications at the time of booking with all subsequent changes till date.“This omission will give legal colour to all unilateral changes done by builders and will give them an escape route to avoid paying compensation to home buyers,“ said Abhay Upadhyay , president of Fight for RERA, the nationwide home buyers' body which campaigned for the law.

Similarly , in Maharashtra, a provision has been included to allow builders to ta ke out or divest from a project after occupancy certificate has been issued. This means, the builder can pull out its entire investment before completion of common areas, facilities and amenities.

In UP, the norms related to compounding of offences have been diluted as no specific amount has been mentioned. “There is provision for `up to' (a certain amount), which means it may even be zero. This will encourage corruption as quantum of money to be paid will be at the discretion of the authority,“ Upadhyay said.

Even the urban development ministry has allowed relaxation in Delhi, where rules specify that promoters need to provide details of only those court cases which have been disposed of during the last five years. This is despite the housing ministry clearly stating that builders need to provide details of all pending cases.

Till Saturday , 13 states and Union territories had notified their final rules. “With many states intentionally keeping most of the ongoing projects out of RERA's coverage, there will be little relief for lakhs of home buyers,“ Upadhyay said.

RERA compliance: a checklist

The Real Estate (Regulation and Development) Act, 2016 (RERA) came into force on May 1, 2017 in the entire country. Since then there has been confusion and buyers find it difficult to make a decision. Many buyers are baffled on how to ascertain if their projects are RERA-compliant or not.

One such buyer Baladhitya wonders, "Will RERA bring any hope for home buyers? I am looking for properties for my own use, should I wait for some more time?"

On May 1, 2017 Maharashtra notified the Act. The state launched its website and uploaded all relevant details as per the state's RERA rules. The law mandates that once a project is registered, the developer will have to upload project details on the RERA website and provide updates on construction progress, commencement, occupation and other certificates before the flats are handed over to buyers.

"The situation is one where the positive aspects are apparent, and yet, there is an element of 'wait and watch' on the part of both home seekers as well as developers. RERA is a reality and has to be accepted. For stakeholders in real estate, the post-RERA necessary changes are being implemented. These are early days and we should see things firming up in the next few weeks," says Dr Niranjan Hiranandani, co-founder & chairman, Hiranandani Group.

If you are a confused buyer and want to know whether your project is RERA compliant or not then you can check the following before you park your hard-earned money.

Legal Title

You need to check that your developer has the legal title of the land on which the development is proposed, or has legally valid documents with authentication of the title if such a land is owned by another person. RERA has done away with the age-old practice where someone without having a legal title would sell to home buyers. Now buyers have to be cautious and see whether the project they are buying is RERA-compliant or not.

Detail of encumbrances

Is the land free from all encumbrances? Check the details of the encumbrances on such a land, including any rights, title, interest or name of any party in or over such land along with details.

Possession Date

RERA mandates that all projects have to be delivered as per the possession date mentioned by the developer. So, don't forget to check the time period within which he promises to complete the project or its phase. With RERA becoming a reality, it is important for developers to prepare for the changes promptly. "We believe that improved project planning will help developers avoid delays and manage project funds efficiently. It would be prudent to hire planning professionals to ensure timely project completion. Making such preparations early should give developers an edge over rivals and boost buyer's trust," said Surabhi Arora, Senior Associate Director, Research, Colliers International India.

Escrow Account

Seventy per cent of the amounts realised for real estate projects from allottees, from time to time, shall be deposited in a separate account. This account has to be maintained in a scheduled bank to cover the cost of construction and other costs related to construction. This means that the developer has to use the money for the same project for which the funds have been collected. If your developer has deposited the money it means he is willing to complete and deliver the project on time.

Applicability of RERA

Rera is applicable to ongoing projects: HC

Builders Can Get More Time In Rare Cases

In a victory for home buyers, the Bombay high court has upheld the constitutional validity of the Real Estate (Regulation and Development) Act (Rera) and its applicability to ongoing projects across states. The law intends to make homebuying a transparent and speedy transaction with powers of redressal.

The judgment, however, offered a breather to builders too. It expanded powers under Rera to grant more time in exceptional cases to a builder to complete a project. The additional time is meant to be granted in compelling circumstances on a case-by-case basis.

A division bench of Justices Naresh Patil and R G Ketkar gave separate but concurrent findings. The extension would go beyond the statutory one-year extension after the deadline for completion, which the Act requires the project’s promoter to mention during registration.

The pronouncement is the first such verdict in the country on challenges raised by builders in various HCs. The Supreme Court had tasked the Bombay HC in September to set the path.

Arbitration panels under RERA

2017: Maharashtra first to form conciliation committee

Nauzer Bharucha, Maha first state to form RERA arbitration panel, Sep 18, 2017: The Times of India

Maharashtra will be the first state in the country to form a conciliation committee under the new Real Estate (Regulation and Development) Act, comprising a panel representing builders and consumer groups to arbitrate complaints.

It will mediate between the two parties and help resolve issues so they can avoid taking the dispute before the housing regulator.Only in case the dispute is not settled can the party lodge a complaint with the state regulator.

“The panel should start functioning in the next three months,“ said state RERA chairman Gautam Chatterjee, adding that it would help build trust between purchasers and developers. Last week, leading developers and consumer activists met state RERA officials to iron out the committee's operations. “Talks have progressed very well,“ said consumer activist Shirish Deshpande of Mumbai Grahak Panchayat (MGP). “MGP is presently in consultation with organisations representing developers like Naredco and Credai-MCHI to work out the conciliation scheme on which an enabling provision exists in the RERA Act,“ he said.

Deshpande said the proposed scheme will be an Alternate Disputes Redressal mechanism to facilitate “settlements between aggrieved homebuyers and builders without having to resort to... litigation“. Officials said the conciliation can only be initiated when both the complainant and builder willingly agree to it.

Developer Rajan Bandelkar, vice-president of Nared kar, vice-president of Naredco, said majority of the disputes are minor and can be resolved through mediation. The draft scheme envisages two panels of conciliators one will be of builders in which a total of ten persons will be nominated by Naredco, Credai-MCHI.On the other panel, MGP will nominate 10 members.

“Since it will be a mutual settlement and will be authenticated by MahaRERA, it will have sanctity , authenticity and finality,“ said Deshpande.Experts said this will reduce the pressure on MahaRERA as well as consumer courts.Officials said most of the over 13,300 projects registered in the state are ongoing ones and only 450 are new projects.

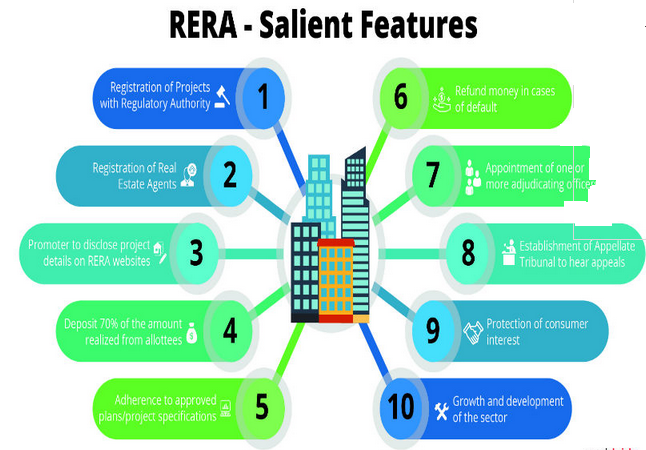

Provisions/ benefits of RERA

Real Estate Regulation Law: 10% interest rate for delayed housing projects

Prabhakar Sinha, RERA pushes for 10% interest clause, May 5, 2017: The Times of India

No Registration Of Project Unless Builder Agrees To Pay Penalty At This Rate

Buyers of delayed housing projects will get interest on the invested amount for the delay period at the Real Estate Regulatory Authority's (RERA) prescribed rate as against Rs 5 per sq feet to Rs 10 per sq feet contracted in the sales agreement, said chairman of Madhya Pradesh RERA Anthony de Sa.RERA's prescribed rate comes out to be 10% at present.

Meanwhile, developers have not been barred from advertising and marketing existing projects, said regulators and officials of MP, Punjab, Haryana and Delhi. Dispelling builders' doubts, officials said they need to apply for registration for ongoing projects only by July 31.

Additional chief secretary of housing urban development, Punjab, Vini Mahajan, who has also been appointed as the interim regulatory authority under RERA, while addressing a conference organised by FICCI, clarified that the existing projects need not wait for registration to advertise. They can continue all their activities as usual. However, those projects for which application for registration is not made even by July 31 to the regulatory authority cannot market their projects. “So far, 14 states and UTs have implemented this law. There are 14 more states which are in process of notifying the rules. We hope that they will do it soon,“ said joint secretary of housing ministry Rajiv Ranjan Mishra at the FICCI conference.

Anthony de Sa said that delayed ongoing housing projects will be registered with RERA only if the deve loper is ready to pay the buyer interest at the authority's prescribed rate, which is 2 percentage points above SBI's MCLR (marginal cost of fund based lending rate), and not the contractual rates of Rs 5 per sq ft to Rs 10 per sq ft which builders had accepted to pay when the sales agreement was signed.

At present, as SBI's MCLR is 8%, developers will have to pay 10% interest on the paid amount to the buyers. At the same time, buyers will also pay the same interest at 10% on delayed pay ment of their dues and not the penal rates of 12% to 18% as mentioned in the sales agreement.

Member of RERA Haryana committee and chief town planner of Haryana government Dilbag Singh Sihag, who is entrusted with the responsibility of finalising the RERA Rules for the state, said justice demands for the same interest rate to be paid by developers as they are charging buyers on delayed payment on outstanding dues.

Normally , developers charge a high rate of 12% to 18% while they pay only Rs 5 per sq feet to Rs 10 per sq feet on a project which costs Rs 4,000 to Rs 5,000 per sq feet. Sihag said this mismatch can be resolved by asking both parties to pay the RERA prescribed rates. He, however, added that no final view has been taken so far.

Mahajan said that existing buyers will get respite under RERA, clarifying that the authority is bound by the act and rules while taking the decision.

So, it can only enforce the contract signed between buyers and developers in light of RERA rules, which cannot go beyond the act.

Developers of delayed ongoing projects will get one more chance to regularize them. Regulators said that while registering ongoing projects, developers can set their own deadline to complete them. The deadline, however, should be reasonable. Anthony de Sa said that if a project was launched eight years back and the developer returns for registration seeking another four years for completion, it cannot be granted. There is no hard or fast rule to fix the deadline, which will depend on the existing condition and stage of implementation of the project.

But once the developer has given the deadline to complete the project and is unable to meet it, the regulator will take a very harsh view -he will either have to return the money to the buyers with interest or face consequences, including even a jail term, said Sihag.

RERA will help facilitate completion of projects so that all buyers can be satisfied. Only if developers are unable to achieve this goal will the regulators take stern action.

See also

Real Estate (Regulation & Development) Act (RERA)