Rich List: India

(→Indians abroad/ Diaspora) |

(→Bangalore's technology billionaires) |

||

| Line 8,367: | Line 8,367: | ||

In terms of regional performance, South America was the stand out, with multi-millionaire growth of 265% over the 10 year period. Other top performers included Australasia (182% growth) and Africa (142% growth). In terms of country performance, countries that registered 200% plus growth included Russia, Brazil, China, India, Indonesia, Vietnam and Angola. | In terms of regional performance, South America was the stand out, with multi-millionaire growth of 265% over the 10 year period. Other top performers included Australasia (182% growth) and Africa (142% growth). In terms of country performance, countries that registered 200% plus growth included Russia, Brazil, China, India, Indonesia, Vietnam and Angola. | ||

| − | =Bangalore's technology billionaires= | + | =2014: Bangalore's technology billionaires= |

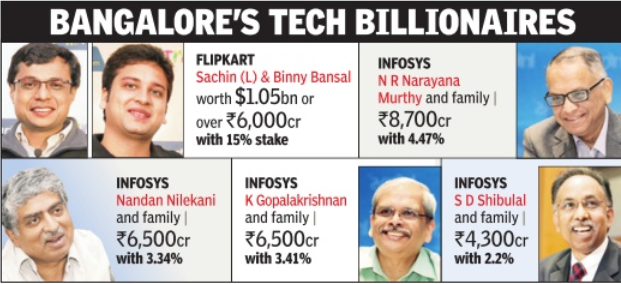

'''See chart''' | '''See chart''' | ||

[[File: Bangalore Technology Billionaires.png|Bangalore Technology Billionaires. Source: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Bansals-nearly-as-rich-as-Infy-co-founders-30072014025054 The Times of India ] |frame|500px]] | [[File: Bangalore Technology Billionaires.png|Bangalore Technology Billionaires. Source: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Bansals-nearly-as-rich-as-Infy-co-founders-30072014025054 The Times of India ] |frame|500px]] | ||

Revision as of 17:51, 3 March 2015

2013:Indian millionaire households: 15th

India ranks 15th on global wealth list

New York PTI Jun 11 2014

According to Boston Consulting Group's report, India had 175,000 millionaire households in 2013 and is projected to become the seventh wealthiest nation by 2018

India had 175,000 millionaire households in 2013, ranking 15th in the world, according to a wealth report which said the total number of millionaire households in the world rose to 16.3 million last year.

The Boston Consulting Group’s 14th annual report on the global wealth-management industry ‘Riding a Wave of Growth: Global Wealth 2014’ said global private financial wealth grew by 14.6% in 2013 to reach a total of $152 trillion.

The rise was stronger than in 2012, when global wealth grew by 8.7%. The key drivers, for the second consecutive year, were the performance of equity markets.

India ranked 15th last year and had 175,000 millionaire households. Its position improved slightly from 2012 when it had ranked 16 in the world for its number of millionaire households.

India is projected to become the seventh wealthiest nation by 2018. The number of ultra-high-net-worth households in India, those with $100 million or more, stood at 284 last year.

The total number of millionaire households reached 16.3 million in 2013, up strongly from 13.7 million in 2012 and representing 1.1% of all households globally.

2014, Feb: The Hurun Global Rich List 2014 and India

Highlights

i) India ranks #5 on the Global Rich List with 89 billionaires.

ii) The cumulative worth of Indian billionaires is INR17,33,400 Cr.

iii) Mukesh Ambani of Reliance Industries continues to be the richest Indian with a net worth of INR1,11,800 Cr.

iv) Savitri Jindal, 64 of Jindal Steel and Power is the richest woman in India.

v) Glenn Saldana of Glenmark Pharaceuticals and Nirav Modi of Firestar International are the youngest Indian billionaires at 44.

vi) 15 Indian billionaires now reside outside of India, making India the top country to emigrate out of, followed by US billionaires, several of whom have moved out for tax reasons.

vii) Nepal was the only other South Asian country to find a place on this list of 'dollow billionaires.'

viii) USA And China Dominate with 481 And 358 Billionaires Respectively, Making Up Half The Hurun List. Russia, Uk And India Follow.

ix) US Most Attractive Country For Immigrant Billionaires with 42. China And India Top Countries Producing Billionaires, Which Have Migrated Out, With 99 And 15 Respectively.

Details

On 25 February 2014 Hurun Report today released in Beijing, China the Hurun Global Rich List 2014, a ranking of the US dollar billionaires currently found in the world. Wealth calculations are a snapshot of 17 January 2014. These are the notes on billionaires from India and should be used in context with the Hurun Global Rich List 2014. For any discrepancies in these notes with the Global Rich List, the Global Rich List should prevail.

India ranks #5 on the Global Rich List with 89 billionaires, of which 70 currently reside in India while the rest have migrated to other countries. The billionaire’s considered for the list include those who currently reside in India or are of Indian origin. The cumulative worth of Indian billionaires is INR17,33,400 Cr. The average net worth of India’s richest is INR18,600 Cr; INR6,200 Cr less than the global average. The preferred sectors are manufacturing, TMT and real estate. The sector that rewarded its investors the most was pharma which saw the billionaires invested in it increase their wealth by an average 25%. The average age of the India’s billionaires at 65 is one year older than the average age of the global billionaires. It is very interesting to note that 60% of India’s billionaires are self made.

Mukesh Ambani continues his reign as the richest person in India with a net worth of INR1,11,800 Cr, despite going through a relatively bad year with Reliance Industries stock falling 5% ,combined with rupee depreciating. His wealth came down by INR18,600 Cr in comparison to last year. He dropped 14 positions in the Hurun Global Rich List coming down from #27 to #41.

Lakshmi N Mittal retains his number two position with a net worth of INR1,05,600 Cr. He slipped 13 positions and is currently the 49th richest person in the world. His stock in ArcelorMittal dropped 6% bringing down his wealth by INR6,200 Cr. Lakshmi Mittal is one of the few billionaires who is featured on the top three position of two separate country rich lists - UK and India. Though currently residing in UK, Mittal is of Indian origin therefore shows up as the second richest man in India as well.

Dilip Sanghvi of Sun Pharma had a good year with Sun Pharma stocks going up by 52%. His wealth saw an increase of INR31,100 Cr making him the third richest in India with a personal wealth of INR83,900 Cr along with Azim Premji of Wipro.

Savitri Jindal, 64 of Jindal Steel and Power is the richest woman in India with a net worth of INR32,900 Cr followed by Indu Jain of Bennett Coleman with INR14,300 Cr and Malika Srinivasan of Tafe, who is a new entrant to the list with a net worth of INR6,800 Cr, taking the number of Indian women in the Global Rich List to three.

Glenn Saldana(INR8,100 Cr, rank 1459) of Glenmark Pharmaceuticals at 44 years of age ties for the position of youngest Indian billionaire on the list with Nirav Modi(INR6,200 Cr, rank 1752) of Firestar International, a world famous name in the diamond jewellery industry.

Brijmohan Lall Munjal & Family of Hero MotoCorp is the oldest Indian billionaire at 91 years with a net worth of INR23,600 Cr ,ranking 437 in the world.

There are 25 notable newcomers to the list led by Rishad Nawroji of Godrej with a net worth of INR13,000 Cr, rank 901.

The report said that during the past year the Indian rupee weakened 12 per cent against the US dollar, making it harder for Indians to make the cut-off.

Despite the currency fluctuations, India has improved its position over last year. In the 2014 Hurun global rich list, the country is ranked fifth with 70 billionaires, 17 more than 2013.

Ukrainian-born Leonard Blavatnik and India-born Lakshmi Mittal are the richest people living in the UK.

India: Up one place to No 5 with 70 billionaires, 17 more than 2013. Manufacturing, pharma and TMT are the preferred sectors with 17, 12 and 10 billionaires respectively. Combined wealth of the Indians billionaires comes to US$390bn. Mumbai is headquarters to most of the Indian billionaires.

Mukesh Ambani (US$18bn, rank 41) is the richest Indian. 15 Indians live outside of India, the highest proportion of any country. This past year, the Indian Rupee weakened by 12% against the US Dollar, making it harder for Indians to make the cut-off.

The US has the most number of TMT [Technology, Media and Telecoms] billionaires, followed by China. It is interesting to note that a technology hub like India does not have a TMT billionaire on the Hurun Global Rich List 2014.

Best Performing Industries by Country:

Country | Best performing Industry |Average growth of billionaires for that industry in that country

India | Airlines | 55%

Currency fluctuations against the US Dollar –

Country | % Drop in Currency Vs the US Dollar |Change in average wealth of billionaires from each country

India | 11% | -12%

The Indian rupee was the eighth worst performer among the countries that have dollar billionaires

The seven major countries whose currencies depreciated more than India’s were: Argentina 25%, Indonesia 20% ,Turkey 19%, South Africa 18%, Australia 15%, Japan 15% and Brazil 15%.

The vast majority of India’s billionaires are self-made

60% of India’s billionaires are self-made. Among the notables are Lakshmi N Mittal of ArcelorMittal, Shiv Nadar of HCL Technologie, Sunil Mittal of Bharti Airtel and Dr. Cyrus S Poonawala of Serum Institute. It is worth noting that Dr. Poonawala’s privately held Serum Institute generates profits in excess of IN1,700 Cr annually, sells world’s cheapest vaccines. Were his vaccines to be marked up to market prices his contribution to philanthropy would be quite significant.

The biggest gainers of 2014 amongst Indians in the rich list are Dilip Sanghvi and Shiv Nadar, each adding INR31,100 Cr to their wealth from 2013. Shiv Nadar’s HCL Technologies has gone up in excess of 100% in the past year. KP Singh of DLF has recorded the biggest loss of wealth having lost INR18,600 Cr owing to a 48% drop in the stock prices of DLF bringing him down from #236 to #412 in the Global Rich List.

Of India’s 89 billionaires 61 have their wealth associated with publicly traded companies while 28 are still privately held.

2014: The complete Hurun Rich list of Indian billionaires

|

India Rank |

Global Rank |

Name |

Net worth INR Cr |

Net worth USD Bn |

% Change in USD net worth |

Source |

Country of Residence |

Brought up country |

|

1 |

41↓ |

Mukesh Ambani |

1,11,800 |

18 |

-12.2% |

Reliance Industries |

India |

India |

|

2 |

49↓ |

Lakshmi N Mittal |

1,05,600 |

17 |

-5.6% |

ArcelorMittal |

UK |

India |

|

3 |

77↑ |

Dilip Shanghvi |

83,900 |

14 |

53.4% |

Sun Pharma |

India |

India |

|

3 |

77↑ |

Azim Premji |

83,900 |

14 |

28.6% |

Wipro |

India |

India |

|

5 |

93↑ |

Pallonji Mistry |

74,600 |

12 |

53.8% |

Tata Sons |

India |

India |

|

5 |

93↓ |

SP Hinduja & family |

74,600 |

12 |

-7.7% |

Hinduja Group |

UK |

|

|

7 |

105↑ |

Shiv Nadar |

68,300 |

11 |

71.9% |

Hcl |

India |

India |

|

8 |

170↓ |

Kumar Birla |

47,200 |

8 |

0.0% |

Aditya Birla |

India |

India |

|

9 |

202↓ |

Sunil Mittal & family |

42,200 |

7 |

-16.0% |

Bharti Airtel |

India |

India |

|

10 |

223↓ |

Anil Ambani |

39,800 |

6 |

12.3% |

Reliance Capital |

India |

India |

|

11 |

261↑ |

Dr Cyrus S Poonawalla |

34,800 |

6 |

124.0% |

Serum Institute |

India |

India |

|

12 |

281↓ |

Savitri Jindal & family |

32,900 |

5 |

-15.9% |

Jindal Steel & Power |

India |

India |

|

13 |

290↑ |

Micky Jagtiani |

32,300 |

5 |

26.8% |

Landmark Group |

UAE |

India |

|

14 |

307* |

David Reuben |

31,100 |

5 |

11.1% |

Global Switch |

UK |

India |

|

14 |

307* |

Simon Reuben |

31,100 |

5 |

11.1% |

Global Switch |

UK |

India |

|

16 |

356↓ |

Uday Kotak |

28,000 |

5 |

4.7% |

Kotak Mahindra |

India |

India |

|

17 |

392* |

Jamshyd Godrej |

26,100 |

4 |

50.0% |

Godrej |

India |

|

|

17 |

392↓ |

Adi Godrej |

26,100 |

4 |

-39.1% |

Godrej |

India |

India |

|

19 |

412↓ |

KP Singh |

24,900 |

4 |

-39.4% |

DLF |

India |

India |

|

20 |

437↓ |

Brijmohan Lall Munjal & family |

23,600 |

4 |

5.6% |

Hero Moto Corp |

India |

Pakistan |

|

20 |

437↓ |

Gautam Adani |

23,600 |

4 |

-9.5% |

Adani Enterprise |

India |

India |

|

22 |

514↑ |

Desh Bandhu Gupta |

20,500 |

3 |

37.5% |

Lupin |

India |

|

|

23 |

569↓ |

Rahul Bajaj |

18,600 |

3 |

-14.3% |

Bajaj Auto |

India |

India |

|

24 |

623* |

Ravi Ruia |

17,400 |

3 |

-31.7% |

Essar |

India |

|

|

24 |

623* |

Shashi Ruia |

17,400 |

3 |

-31.7% |

Essar |

India |

|

|

24 |

623↓ |

Subhash Chandra |

17,400 |

3 |

-9.7% |

Zee Entertainment |

India |

India |

|

27 |

652↓ |

Anil Agarwal |

16,800 |

3 |

-12.9% |

Vedanta Resource |

UK |

India |

|

28 |

717↑ |

Prakash Lohia |

15,500 |

3 |

92.3% |

Indorama Ventures |

UK |

India |

|

28 |

717↓ |

Romesh T Wadhwani |

15,500 |

3 |

8.7% |

Symphony Technology |

USA |

India |

|

30 |

761↓ |

Pankaj Patel |

14,900 |

2 |

-7.7% |

Cadila Healthcare |

India |

India |

|

31 |

796↑ |

Indu Jain |

14,300 |

2 |

43.8% |

Bennett Coleman |

India |

|

|

31 |

796↓ |

Ajay Kalsi |

14,300 |

2 |

9.5% |

Indus Gas |

India |

India |

|

31 |

796↓ |

Yusuf Hamied |

14,300 |

2 |

0.0% |

Cipla |

India |

India |

|

31 |

796↓ |

Kalanithi Maran |

14,300 |

2 |

-23.3% |

Sun Network |

India |

India |

|

35 |

853↓ |

Kavitark Ram Shriram |

13,700 |

2 |

-21.4% |

|

USA |

India |

|

36 |

901* |

Rishad Naoroji |

13,000 |

2 |

New |

Godrej |

India |

India |

|

36 |

901↓ |

Malvinder & Shivinder Singh |

13,000 |

2 |

-8.7% |

Fortis Healthcare |

India |

|

|

38 |

954* |

GV Prasad |

12,400 |

2 |

25.0% |

Reddy's Lab |

India |

India |

|

38 |

954↓ |

MA Yousuf Ali |

12,400 |

2 |

5.3% |

Emke Group Of Companies |

UAE |

India |

|

40 |

1056* |

Madhukar Parekh |

11,200 |

2 |

12.5% |

Pidilite |

India |

|

|

40 |

1056↑ |

Vinod Khosla |

11,200 |

2 |

80.0% |

Khosla Ventures |

USA |

India |

|

40 |

1056↓ |

N R Narayan Murthy |

11,200 |

2 |

20.0% |

Infosys |

India |

India |

|

40 |

1056↓ |

Benu Gopal Bangur |

11,200 |

2 |

0.0% |

Shree Cement |

India |

India |

|

40 |

1056↓ |

Rajan Raheja |

11,200 |

2 |

-10.0% |

Hathway Cable |

India |

India |

|

40 |

1056↓ |

Venugopal Dhoot |

11,200 |

2 |

-30.8% |

Videocon |

India |

India |

|

46 |

1137↑ |

Kapil & Rahul Bhatia |

10,600 |

2 |

54.5% |

Indigo |

India |

India |

|

47 |

1209* |

Ravi Pillai |

9,900 |

2 |

New |

Ravi Pillai Group |

UAE |

India |

|

47 |

1209* |

Sudhir & Samir Mehta |

9,900 |

2 |

New |

Torrent Group |

India |

India |

|

47 |

1209↓ |

Manoj Bhargava |

9,900 |

2 |

14.3% |

5 Hour Energy |

USA |

USA |

|

47 |

1209↓ |

Murali Divi |

9,900 |

2 |

14.3% |

Divi's Lab |

India |

|

|

47 |

1209↓ |

Ajay Piramal |

9,900 |

2 |

0.0% |

Piramal Enterprise |

India |

India |

|

47 |

1209↓ |

Ashwin Dani |

9,900 |

2 |

0.0% |

Asian Paints |

India |

|

|

53 |

1282* |

Suhail Rizvi |

9,300 |

2 |

New |

Rizvi Traverse Capital |

USA |

USA |

|

53 |

1282* |

Sunny Varkey |

9,300 |

2 |

New |

Gems Education |

UAE |

UAE |

|

53 |

1282* |

Swraj Paul |

9,300 |

2 |

New |

Caparo Group |

UK |

India |

|

53 |

1282↓ |

Nandan Nilekani |

9,300 |

2 |

15.4% |

Infosys |

India |

India |

|

57 |

1379* |

Vijay Chauhan |

8,700 |

1 |

New |

Parle Products |

India |

India |

|

57 |

1379↓ |

Senapathy Gopalakrihsnan |

8,700 |

1 |

7.7% |

Infosys |

India |

India |

|

57 |

1379↓ |

Brij Bhushan Singal |

8,700 |

1 |

0.0% |

Bhushan Steel |

India |

|

|

60 |

1458* |

Baba Kalyani |

8,100 |

1 |

New |

Bharat Forge |

India |

India |

|

60 |

1458* |

Samprada Singh |

8,100 |

1 |

New |

Alkem Laboratories |

India |

India |

|

60 |

1458* |

TS Kalyanaraman |

8,100 |

1 |

New |

Kalyan Jewellery |

India |

India |

|

60 |

1458* |

Vikram Lal |

8,100 |

1 |

New |

Eicher |

India |

|

|

60 |

1458↓ |

G M Rao |

8,100 |

1 |

18.2% |

GMR |

India |

India |

|

60 |

1458↓ |

Glenn Saldanha |

8,100 |

1 |

8.3% |

Glenmark Pharmaceuticals |

India |

|

|

60 |

1458↓ |

Harsh Mariwala |

8,100 |

1 |

-7.1% |

Marico |

India |

|

|

67 |

1540* |

Bhupendra Kumar Modi |

7,500 |

1 |

New |

Spice Group |

Singapore |

India |

|

67 |

1540* |

Ravi Jaipuria |

7,500 |

1 |

New |

RJ corp |

India |

India |

|

67 |

1540↓ |

Ashwin Choksi |

7,500 |

1 |

0.0% |

Asian Paints |

India |

|

|

67 |

1540↓ |

Gautam Thapar |

7,500 |

1 |

0.0% |

Crompton Greaves |

India |

India |

|

71 |

1641* |

B.R.Shetty |

6,800 |

1 |

New |

NMC Group |

UAE |

India |

|

71 |

1641* |

Lachman Das Mittal |

6,800 |

1 |

New |

Sonalika Group |

India |

Pakistan |

|

71 |

1641* |

Mallika Srinivasan |

6,800 |

1 |

New |

TAFE |

India |

India |

|

71 |

1641* |

Mangal Prabhat Lodha |

6,800 |

1 |

New |

Lodha Developers |

India |

India |

|

71 |

1641* |

Mofatraj Munot |

6,800 |

1 |

New |

Kalpataru |

India |

India |

|

71 |

1641* |

Qimat Rai Gupta |

6,800 |

1 |

New |

Havells India |

India |

India |

|

71 |

1641* |

Rakesh Jhunjhunwala |

6,800 |

1 |

New |

Rare Enterprise |

India |

India |

|

71 |

1641↓ |

Abhay Vakil |

6,800 |

1 |

-8.3% |

Asian Paints |

India |

|

|

71 |

1641↓ |

Aloke Lohia |

6,800 |

1 |

-60.7% |

Indorama Ventures |

Thailand |

India |

|

80 |

1751* |

Dhingra Brothers |

6,200 |

1 |

New |

Berger Paints |

India |

|

|

80 |

1751* |

K Dinesh |

6,200 |

1 |

New |

Infosys |

India |

|

|

80 |

1751* |

Kuldip & Gurbachan Singh Dhingra |

6,200 |

1 |

New |

Berger Paints |

India |

|

|

80 |

1751* |

Niranjan Hiranandani |

6,200 |

1 |

New |

Hiranandani group |

India |

|

|

80 |

1751* |

Nirav Modi |

6,200 |

1 |

New |

Firestar International |

India |

Belgium |

|

80 |

1751* |

Ratan Tata |

6,200 |

1 |

New |

Tata Sons |

India |

India |

|

80 |

1751* |

Sanjay Singal |

6,200 |

1 |

New |

Bhushan Power & Steel |

India |

|

|

80 |

1751↓ |

Anand Mahindra |

6,200 |

1 |

0.0% |

Mahindra & Mahindra |

India |

India |

|

80 |

1751↓ |

Chandru Raheja |

6,200 |

1 |

-9.1% |

Shoppers Stop |

India |

India |

|

80 |

1751↓ |

Shyam & Hari Bhartia |

6,200 |

1 |

-23.1% |

Jubilant Life Science |

India |

|

↑ Rank increase YOY ↓ Rank decrease YOY - No Rank change y * New to Top 20

Source: Hurun Rich List 2014 sponsored by Star River

Indian city list by number of resident billionaires

<

|

Rank |

City of residence |

% of Billionaires |

|

1 |

Mumbai |

49% |

|

2 |

New Delhi |

22% |

|

3 |

Bangalore |

6% |

|

4 |

Ahmedabad |

4% |

|

4 |

Gurgaon |

4% |

|

4 |

Pune |

4% |

|

7 |

Chennai |

3% |

|

7 |

Hyderabad |

3% |

|

9 |

Hisar |

1% |

|

9 |

Hoshiarpur |

1% |

Mumbai is home to the most number of billionaires with 33 of the nine zero club residing there, followed by 15 from Delhi and 4 from Bangalore.

Lists end

Religion-wise beak-up

In the list of 88 Indian ‘dollar billionaires’ all religious minorities were represented, most of them in greater proportion than their share of the population. It would be incorrect to show the Hindus, Jains and Sikhs separately because, apart from centuries of ties, shared places of worship, shared religious practices and festivals, inter-marriages, and common caste- and surnames, there are on the list billionaires who do not wear turbans but have beards and offer prayers at Guudwaras.

Christian

Glenn Saldanha

Jewish

David Reuben

Simon Reuben

Muslim

Azim Premji

Yusuf Hamied

MA Yousuf Ali

Suhail Rizvi

Parsi

Pallonji Mistry

Dr Cyrus S Poonawalla

Jamshyd Godrej

Adi Godrej

Rishad Naoroji

Ratan Tata

2014: Knight Frank's Wealth Report ranks India at no. 6 with 60 billionaires

India to have 4th highest number of billionaires by 2023: Report

Nauzer Bharucha,TNN | Mar 6, 2014

MUMBAI: Number of ultra high net worth individuals in India expected to double over next 10 yrs, rising by 126 per cent in Mumbai alone and around 118 per cent in Delhi. Mumbai is on the 4th spot with a 126 per cent growth among all global cities which is expected to increase from 577 to 1,302 by 2023.

Mumbai retains its position as 16th most expensive city in luxury home sector, according to Knight Frank's 8th edition of the Wealth Report released just now.

"By 2023, only 3 countries in the world, USA, China and Russia will have more billionaires than India," Samantak Das, chief economist and director research, Knight Frank India.

India is now on 6th spot [according to Knight Frank’s Wealth Report] in the top 10 countries for billionaires as of 2013 with 60 billionaires. This number is expected to increase to 119 with a 98 per cent growth by 2023, according to a Knight Frank Wealth Report.

The 2014 Wealth Report, an annual global perspective on prime property and wealth by property management firm Knight Frank, projected that the number of billionaires in India will grow by an exponential 98 per cent to 119 in the year 2023 from 60 billionaires last year.

India will rank fourth after US, China and Russia in 2023 and will have more billionaires than the UK, Germany and France, according to the report.

"Wealth creation in India, the world's third-biggest economy, is also expected to accelerate, with the number of Ultra High Networth Individuals (UHNWIs) forecast to nearly double over the next decade," the report said.

"This reflects the more positive outlook for India's economy after 2013 was marked by capital outflows and a sharp devaluation of the rupee. This tough environment for wealth creation and preservation was reflected in the one per cent decline in the number of UHNWIs in the country during the year," it said.

The report said the number of centa-millionaires (those with $100 million in disposable assets) in India is also projected to grow 99 per cent to 761 in 2023 from 383 last year.

The country will further see an increase of 99 per cent in the number of UHNWIs to 3130 in 2023 from 1576 last year.

The growth of UHNWIs in China and India, coupled with a whopping 144 per cent increase in Indonesia and 166 per cent hike in Vietnam, will help push the total number of UHNWIs in Asia up by 43 per cent to 58,588 by 2023, overtaking the total number in North America.

The number of billionaires in Asia is also forecast to overtake the number in Europe over the next decade.

Asian cities are also expected to see the fastest growth in the number of ultra wealthy individuals over the next decade.

Mumbai will see the fourth highest rate of growth in its UHNWI population between 2013 and 2023, with this number increasing 126 per cent to 1302 in 2023 from 577 last year.

Delhi will closely follow Mumbai and will record the fifth highest growth in its UHNWIs population, which will increase 118 per cent from 147 last year to 321 in the next decade, according to the report.

By 2024, Mumbai is also projected to figure in the top 10 global cities, a ranking which it does not currently have, the report said.

Terrorism tends to occur in densely populated cities and New York, London, Moscow and Mumbai are more risky than Beijing, according to the report

2014, Sept: Forbes

Vijay Mallya drops out of India's 100 richest club

PTI | Sep 25, 2014

i) Fortunes of India’s uber-rich have seen a significant growth since 2013. The combined net worth of India's 100 wealthiest is USD 346 billion, up from more than a third from USD 259 billion in 2013, thanks to soaring stock markets which have gained 28 per cent since January 2014.

ii) With a record USD 1 billion as the minimum net worth in 2014, as many as 11 persons dropped out of 2014's list

iii) UB Group chairman Vijay Mallya is no longer a member of India's 100 richest club.

iv) The drop-offs in 2014 also include, Brij Bhushan Singal, whose Bhushan Steel's shares tanked after son Neeraj was arrested in a corruption scandal, Forbes said.

2014: India no. 8 in multi-millionaires

India ranked no. 8 on global list of multi-millionaires

Kounteya.Sinha@timesgroup.com London

The Times of India Aug 06 2014

India has more multi-millionaires than Australia, Russia or France.

The latest wealth index by New World Wealth that looks at multi-millionaires globally -an individual with net assets of at least $10 million -has ranked India eighth in the global rich list below countries like US, China, Germany and UK.

India is home to 14,800 multi-millionaires of which Mumbai is home to the highest number -2,700 -as many as in Munich.

Interestingly, Mumbai is the only Indian entry in the top 30 cities for multi-millionaires. Hong Kong is the city with the largest number of multimillionaires -5,400 followed by New York (14,300), London (9,700), Moscow (7,600), Los Angeles (7,400) and Singapore (6,600).

As far as countries are concerned with the highest number of multi-millionaires, the United States tops the list with 1,83,500 people worth over $10 million followed by China (26,600), Germany (25,400), UK (21,700), Japan (21,000), Switzerland (18,300) and Hong Kong (15,400). Over the past 10 years, worldwide millionaire and multi-millionaire numbers have grown at vastly different rates. Millionaire numbers worldwide have gone up by 58% during this period, whilst multi-millionaire numbers have gone up by 71%. There are currently just over 13 million millionaires in the world (as of June 2014).

Approximately 495,000 of these individuals can be classified as multi-millionaires.

Mere millionaires

Interestingly , when it comes to millionaires, US tops the list followed by Japan and then the UK.

China and India are both significantly lower on this list than they are on the multi-millionaire list and perhaps most notably, Russia which ranks 9th in the world for multi-millionaires, only ranks 18th in the world for millionaires (outside the top 15). The report says “The higher growth of multi-millionaires can be put down to a number of factors including: a widening wealth gap at the top-end, a rising rate of conversion of millionaires into multi-millionaires and strong growth in countries that have a high multi-millionaire to millionaire ratio (the likes of Russia and India)“.

In terms of regional performance, South America was the stand out, with multi-millionaire growth of 265% over the 10 year period. Other top performers included Australasia (182% growth) and Africa (142% growth). In terms of country performance, countries that registered 200% plus growth included Russia, Brazil, China, India, Indonesia, Vietnam and Angola.

2014: Bangalore's technology billionaires

See chart

2014: Indians abroad/ Diaspora

The UK

2014 Hinduja brothers among UK's top 3 richest families

Kounteya Sinha,TNN | Mar 17, 2014

London-based Indian family - Srichand and Gopichand Hinduja of the Hinduja Group, a multinational conglomerate with a presence in 37 countries with businesses as diverse as trucks and lubricants to banking and healthcare, are among the five richest families in the UK which have together amassed more wealth than 20% of entire British population.

Together worth $10 billion, the Hinduja family along with four other British families have been shown to have more wealth than 12 million poorest Brits.

Britain's five wealthiest people boast a collective worth of £28.2 billion, while the total accumulated by the bottom 20% sat at £28.1 billion.

Top taxpayers: 2007-08

City Resident Ranks No. 1 With Rs 121cr; Ambani Bros Not In Top 200

Maya, SRK among top taxpayers

Pradeep Thakur | From the Archives of ‘‘The Times of India’’: 2008 August 3, 2008 2008

New Delhi: Mayawati is the top taxpayer among politicians and, in fact, ranks among the 20 top taxpayers in the country. In 2007-08, the Dalit leader shelled out Rs 26.26 crore as income tax, according to the I-T department’s compilation of the top 200 taxpayers’ list.

And King Khan is the top taxpayer among actors. Placed at No. 13, five slots higher than Mayawati, Shah Rukh paid Rs 34.2 crore as income tax in 2007-08. The next actor who is cited among taxpaying notables is Akshay Kumar, who ranks at No. 40 in the list, and paid Rs 13.5 crore as tax.

Sachin Tendulkar is the only cricketer to figure in the top-200 list. He coughed up Rs 8.8 crore as tax, reinforcing the belief that he earns way more than other cricketers as the country’s top sporting brand. Placed 81 in the top-200, Sachin is just ahead of industrialist Kumarmangalam Birla who paid just Rs 48,271 less than the master blaster.

Talking of industrialists, conspicuous by their absence in the top-200 list are the Ambani brothers, Mukesh and Anil. Their mother, Kokilaben, barely makes it to the list at 195, having paid Rs 4.46 crore as tax. The top taxpayer among industrialists is Max’s Analjit Singh who is No. 15 in the list having paid Rs 31.49 crore as tax.

Otherwise, the top taxpayers of the country are not public figures, but obviously guys rolling in the stuff. The country’s top taxpayer is from Delhi who forked out Rs 121 crore as income tax. In the top-10, five are from Mumbai and two from Delhi. Income-tax officials requested TOI not to make public identities of top taxpayers as they are not protected by their celebrity status, and often attract the attention of extortionists.

Coming back to Mayawati, her income, year after year, ostensibly comes from ‘‘gifts’’ from her admirers. Having paid a tax of Rs 26 crore, her personal income this year is estimated in the region of Rs 75-80 crore.

Salman, Ash among top-200 taxpayers

New Delhi: It may be recalled that Mayawati faces a CBI case for holding assets disproportionate to her known income.

The other interesting names featuring in this year’s list of top-200 taxpayers are, cardio-surgeon Naresh Trehan (Rs 8.4 crore), actor Salman Khan (Rs 7 crore), stamp-paper scamster Abdul Telgi (Rs 6.5 crore), Sanjay Dutt (Rs 5.8 crore), Aishwarya Rai (Rs 5.6 crore), Abhishek Bachchan (who paid just Rs 75,192 less than his wife), industrialist Nandan Nilekani (Rs 5.16 crore), music director-singer Himesh Reshammiya (Rs 4.89 crore), top lawyer Mukul Rohtagi (rs 4.85 crore), actor Aamir Khan (Rs 4.72 crore) and Wipro boss Azim Premji (Rs 4.68 crore).

February 2015: Sanghvi no. 1

The Times of India Feb 20 2015

Partha Sinha

Dilip Shanghvi, the 59-year-old promoter of Sun Pharma, appears to have overtaken Mukesh Ambani (57) of Reliance Industries Ltd as the richest Indian if one goes by promoter holdings in the listed companies of the two groups. The Gujaratborn and Kolkata-educated Shanghvi, by virtue of his over 63% holding in three companies -Sun Pharma, Sun Pharma Advanced Re search and Ranbaxy Labs -is worth about Rs 1.46 lakh crore ($23.42 billion at an exchange rate of 62.34 per dollar).

In comparison, Ambani, through his 45% holdings in two group companies -RIL and Reliance Industrial Infrastructure -was worth Rs 1.32 lakh crore ($21.2 billion), according to data compiled by TOI from the Bombay Stock Exchange (BSE).

If one adds the 23% stake in wind energy major Su zlon, that Shanghvi and his family is in the process of acquiring, his wealth would be nearly Rs 1.48 lakh crore ($23.7 billion).

However, Bloom berg's Billionaire Index still ranks the RIL boss as the richest Indian and 33rd globally with a net worth of $21.9 bn, and Sanghvi as the second richest (39th globally) at $19.7 bn, ahead of Azim Premji ($18 bn) and Pallonji Mistry (16.6 bn). In the last one year the Sun Pharma stock has gained 50% to become the most valued pharmaceuticals company in India and one of the top five in the world. As a result Shanghvi, who started the company in 1982 with a seed capital of Rs 10,000, has become the richest drug maker in the world.

His fortunes were also boosted by his acquisition of Ranbaxy Labs from its Japanese owners and sharp gains in Sun Pharma Ad vanced Research, the group drug R&D arm that was hived off as a separate company from the group's flagship a few years ago. In the last one month, while the Sun Pharma stock has gained about 5% to its current price of Rs 918, Sun Pharma Advanced Research jumped 50% to Rs 374. Ranbaxy too has gained about 10% to Rs 709 to add to Sanghvi's wealth at a fast clip.

During the same period, RIL has gained about 3% while Reliance Industrial Infra has fallen marginally .

According to Hurun India rich list published last year, Ambani held on to his position as the richest man in India with a fortune of Rs 1.65 lakh crore, up 37% from last year.Shangvi shot up to No 2, overtaking L N Mittal for the first time, after seeing his wealth grow 43% to Rs 1.29 lakh crore.

See also

Celebrity List: India Rich List: India Rich List: Nepal