Defence production, India: 1

This is a collection of articles archived for the excellence of their content. |

FDI in defence production

India got just ₹1cr FDI in 2014-18

The country has attracted just Rs 1.17 crore as foreign direct investment in the defence production sector under the ‘Make in India’ framework in the last four years despite the NDA government liberalising the FDI policy and abolishing the Foreign Investment Promotion Board.

“FDI of $0.18 million has been received in defence industry sector from April 2014 to December 2017,” said junior defence minister Subhash Bhamre, in a written reply to Lok Sabha on Wednesday.

To put things in perspective, India in the same timeframe has inked 70 “capital procurement” contracts worth over Rs 1.25 lakh crore with foreign armament majors to acquire radars and missiles from Israel, aircraft and artillery guns from the US, fighters and ammunition from France, rockets and simulators from Russia.

Though Bhamre listed 18 cases of FDI and joint venture proposals approved by the government, the fact remains that the measly FDI amount received is a grim reminder of the country’s continuing failure to build a robust defenceindustrial base (DIB).

Consequently, India remains stuck in the strategically-vulnerable and embarrassing position of being the world’s largest arms importer, with the armed forces still inducting over 60% of their hardware and software requirements from abroad.

The country has floundered in attracting FDI in defence over the years, with it amounting to less than $5 million during the 10 years of the previous UPA regime, as well as getting the domestic private sector to jump into arms production in a major way.

The NDA government, after coming to power in May 2014, made FDI in defence production one of its key measures to build a strong DIB under the ‘Make in India’ framework.

The policy was revised to allow FDI up to 49% under the “automatic route”, and above 49% through the “government route” with the cabinet committee on security’s approval on a case-to-case basis if it was likely to result in access to modern cutting-edge technology. The FIPB was also subsequently abolished to ease the process of approvals.

But these steps have not led to greater FDI inflows. Several global arms majors say they would need “more management control” of the joint ventures to step up investments and provide top-notch military technologies to India. Others, however, contend that fledgling Indian defence firms will be crushed if global companies are allowed unrestricted entry into the domestic defence market.

“Moreover, most countries like the US have strict export control laws in sensitive military technologies. India will not get what it wants to produce here,” said an expert.

Incidentally, no major ‘Make in India’ defence project has actually kicked off in the last three to four years due to lack of requisite political push and follow-through, bureaucratic bottlenecks and longwinded procedures, commercial and technical squabbles, as was reported by TOI in October last year.

Hyderabad in Defence Production

The Times of India, Aug 15 2015

Swati Rathor

Hyd-tech puts aerospace, defence mfg in new orbit

Not many would be aware that the cabin of the Sikorsky S-92 chopper that ferries the US President Barack Obama is made in Hyderabad, as also some crucial components powering Isro's interplanetary craft to Mars, Mangalyaan. When Andhra Pradesh lost the Tata Nano project in 2008, it came as a blessing in disguise for the state. Hyderabad's aerospace and defence manufacturing sectors were propelled into a new orbit as Ratan Tata promised the government that he would park a project no less prestigious in the state.

Tata kept his promise, and that's how Tata Advanced Systems Ltd set up its facility at India's first aerospace SEZ at Adibatla on Hyderabad's outskirts putting the city on the global defence and aerospace map through joint ventures with Lockheed Martin and Sikorsky of US, and Swiss player RUAG investing, over Rs 4,000 crore.

Hyderabad's second wave of investments in this sector have made it the biggest challenger to Bengaluru's supremacy in aerospace and defence sectors.

While Bangalore emerged as aeronautics hub thanks to HAL (which has a small presence in Hyderabad), Hyderabad has a stronger missile base. Its foundation was laid after the 1962 Sino-Indian border war when premier institutes like Defence Research and Development Organisation (DRDO), Defence Research and Development Lab oratory (DRDL) and Research Center Imarat (RCI), among others, were set up in the city , considered “safe“ for its distance from the country's then troubled borders.

“Small and medium enterprises making components for these defence institutions have now started building sub-systems as well as systems for them. These institutions have also ensured a steady flow of talent for the sector which requires highly-skilled manpower,“ said G Satheesh Reddy , scientific adviser to the defence minister. Over 70% of components for Akash missiles too are being sourced from Hyderabad SMEs, Reddy added.

In fact, Hyderabad's strong base of over 1,000 SMEs coupled with IT firms catering to the aerospace segment have proved to be a major draw for global aerospace giants. This is also what perhaps prompted Boeing to bet on Hyderabad in partnership with the Tatas.

“Hyderabad's strategic advantages are its emerging industrial base, infrastructure and availability of skilled manpower,“ said Boeing India president Pratyush Kumar.“All these are critical to develop a competitive aerospace and defence base, and we took this into consideration while signing a framework agreement with TASL to collaborate in aerospace and defence, including UAVs,“ Kumar added.

Boeing is currently working with Hyderabad-based Avantel on mobile satellite systems for the P-8I military aircraft and Cyient Ltd (formerly Infotech Enterprises) for many of its commercial airplane projects.

This ecosystem is also giving wings to the multi-billion dollar maintenance, repair, and overhaul (MRO) sector in the city. In May 2015, Air India set up its Rs 80-crore MRO at the Hyderabad International Airport, even as the 250-acre GMR Aerospace Park SEZ housing GMR's MRO Facility services narrow bodied aircraft like Airbus A 320 and Boeing 737, among others.

“Hyderabad is important also from the maintenance perspective as it has been a base maintenance station of erstwhile Indian Airlines from very early days,“ said HR Jagannath, CEO, Air India Engineering Services Limited (AIESL).

“The required manpower and higher level of tools, equipment, processes and systems necessary to carry out higher level checks on the aircraft were already available.Hyderabad is now being seen as a major maintenance hub for captive work load of Air India as well as third party business,“ Jagannath added.

Now, US-based Pratt & Whitney is gearing up to launch its third global centre after US and China for training aircraft engineers and technicians near Hyderabad airport.

To keep the sector cruising, the Telangana government is not only setting up the state's second aerospace park spread over 1,000 acres at Elimenidu on Hyderabad's outskirts, but is also giving finishing touches to an aerospace policy to be announced in November, said Telangana IT secretary Jayesh Ranjan.

India vis-à-vis the world

2024

Dec 2, 2025: The Times of India

‘3 PSUs among top 100 global arms makers but account for 1.1% of sales’

New Delhi : Indian defence PSUs Hindustan Aeronautics (HAL), Bharat Electronics (BEL) and Mazagon Docks (MDL) continue to figure in the global top 100 arms-producing companies, but together accounted for just a paltry 1.1% of the global arms sales last year.

Global arms revenues rose sharply by 5.9% to reach a record $679 billion in 2024, with the demand being boosted by the Ukraine and Gaza conflicts, global and regional geopolitical tensions, and ever-increasing military expenditures, as per the latest report released by Stockholm International Peace Research Institute (Sipri) Monday.

The top 100 list is dominated by 39 US companies, together accounting for $334 billion. China follows next with eight companies, with a total of $88 billion. HAL was ranked 44th with $3.8 billion in arms sales, BEL 58th with $2.4 billion and MDL 91st with $1.2 billion, an overall increase by 8.2%.

The top five companies in the list were Lockheed Martin (US), RTX or Raytheon (US), Northrop Grumman (US), BAE Systems (UK) and General Dynamics (US). TNN

Indigenous defence production

2016: the status of indigenous defence production

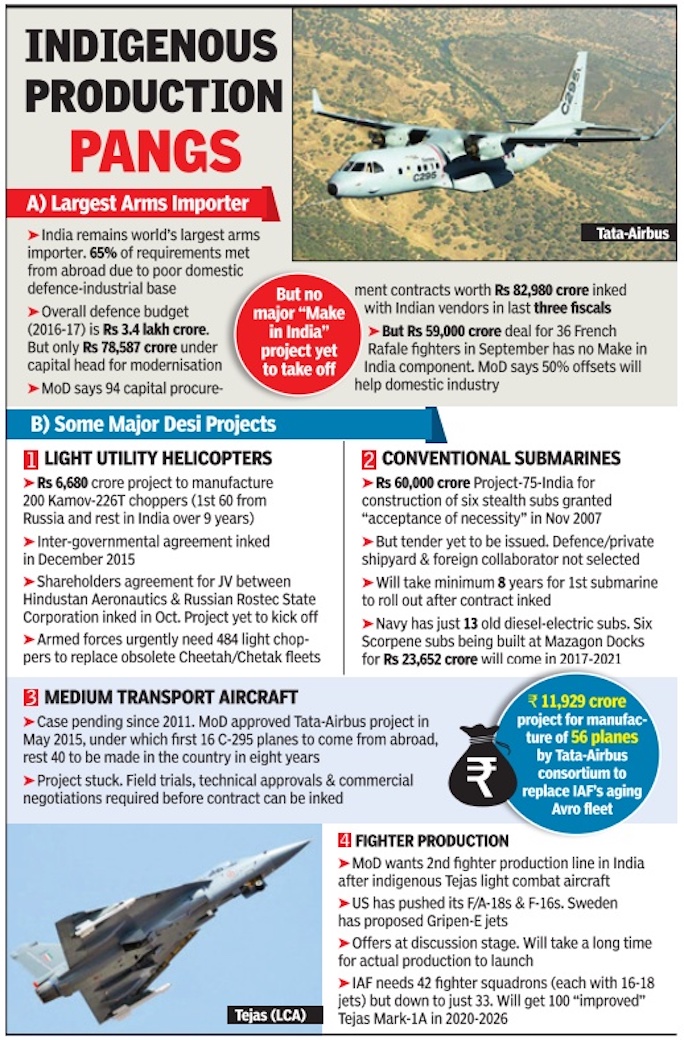

See graphic, The status of indigenous defence production in Dec 2016

2015/ defective equipments worth Rs. 449 cr

Jan 05 2015

Chethan Kumar

Rs 449 cr items sent back for rectification in 3 years

The Modi government, which has given a war cry for `Make in India' in the defence sector, has a major battle to win within the country before guarding the borders with home-made equipment. For, 429 types of defence equipment worth Rs 449.40 crore have been sent back to domestic ordnance factories in the past three years due to quality issues.

According to documents TOI has accessed, this includes 162 types of weapons, which can range from rifles to rocket launchers, 16 categories of combat vehicles, and 52 types of ammunition, the shortage of which has been worrying the world's second largest land army .

The defence ministry said the Directorate General of Quality Assurance, which provides second-party quality assurance, has returned these equipment for rectification.

Each of these categories could have seen thousands or lakhs of units being sent back.“Let's take an example of a bullet for an assault rifle.Lakhs of such bullets would've been procured and all of them rendered useless if they didn't meet the quality requirements,“ a Lieutenant Colonel told TOI.

The documents revealed that as of the third week of December 2014, the ammunition had quality issues, severely affecting the forces' ability at a time when ceasefire viola tions by Pakistan and intrusions from China pose threats.

“The fact that the Ordnance Factory Board and the factories cleared them is a matter of concern,“ another officer said.

In 2013-14, equipment worth Rs 144.65 crore was returned for rectification (RFR), an increase of Rs 12.06 crore from 2012-13. The cost of equipment under RFR in 201213 (Rs 132.59 crore) had seen a considerable drop from 201112 (Rs 172.16 crore).

2019/ Manufacturing unit for AK-203 rifles in Amethi, Uttar Pradesh

Surendra Singh, March 4, 2019: The Times of India

Prime Minister Narendra Modi laying the foundation stone of a manufacturing unit for AK-203 rifles in Uttar Pradesh’s Amethi district on Sunday has finally ended the hunt of Indian security forces for a reliable assault rifle.

Though the Indian military is considered among the top five in the world, it has been yearning for an all-weather durable assault rifle for quite some time as its mainstay weapon INSAS (India Small Arms System) rifle is riddled with problems. For years, the Indian military and paramilitary forces have been trying to find an alternative to INSAS rifle as it has several issues like gun jamming, rifle going into automatic mode when it was set for three-round bursts and oil falling on a user’s eyes during the combat. Even during the 1999 Kargil war, soldiers had complained of INSAS guns jamming or magazine cracking during the combat operation in the freezing temperature and had a tough time taking on enemies.

Frustrated with the quality of the gun, soldiers deployed in counter-terror operations in J&K and northeast have started using either the world’s most reliable AK-47 or imported guns. Even the CRPF has switched over to AK-47 in militancy-infested areas. Special forces like Para commandos, Marine Commandos (popularly known as Marcos), Garud Commando Force (IAF special force) and even National Security Guard (anti-terror force) also rely on German or Israel automatic rifles like Heckler and Koch MP5 sub-machine guns and Tavor rifles. Even Special Protection Group, which provides the inner-layer security cover to VVIPs like the PM, prefer Belgium-made FN F2000 bullpup assault rifle, which is very effective in close-quarter combat.

It is said that INSAS rifle, being manufactured in the Tiruchirappalli ordnance factory, Kanpur small arms factory and rifle factory Ichhapur in West Bengal, was primarily meant to incapacitate enemies, but not to kill. On the other hand, terrorists in J&K, militants in northeast and Naxals in the Red-infested zones have been inflicting heavy casualties on security forces with the use of AK-47, which is primarily made for the kill.

The bullets fired from INSAS have an effective range of 400 metre and the gun magazine can hold 20 rounds. Though its magazine is translucent (one can count the number of bullets left), it some time breaks on falling on ground. Also, INSAS is longer and heavier (4.15kg without magazine & bayonet) and difficult to carry.

On the other hand, AK-203, which India under a deal with Russia will manufacture at the Amethi factory, is an advanced version of AK-47. It’s magazine can hold 30 bullets. The gun has an effective range of 400 metre and is considered 100% accurate. It will be lighter and shorter than an INSAS rifle. It can host an underbarrel grenade launcher or a bayonet and all versions can be equipped with quick-detachable tactical sound suppressors. The 7.62 mm ammunition in AK-203 gun is NATO grade and therefore more powerful. The rifle, which can fire 600 bullets in one minute, means 10 bullets in a second, can be used in automatic and semi-automatic mode. The most important quality of AK-series rifles is they never get jammed. The Kalashnikovs can work under extreme climatic conditions and are effective even in sand, soil and water.

Because of its reliability, militaries of 50 countries use AK-47 and over 30 countries have the licence to manufacture the Russian assault rifle. Being the new series of AK-47, even Russian special forces use AK-203.

Under the ‘Make in India’ programme, the Amethi factory, which was lying idle for quite some time, will churn out over seven lakh units of AK-203 rifles that will replace INSAS + being used by Army and paramilitary forces. Later, state police will also be provided with AK-203 rifles. It is said the Amethi factory will first make the gas chamber and spring of the rifle more advanced before starting the mass production of the desi-version of AK-203.

The ordnance factory board will possess the majority share of 50.5% in the JV while Russian company Kalashnikov Concern will hold 49.5% share. It was during his official visit to India last October that Russian President Putin and PM Modi reached an agreement on producing Kalashnikov rifles in India. In a message on Sunday, President Putin said he is convinced that the commissioning of the new enterprise “will fulfil the needs of national (Indian) security agencies in this category of small arms... and will contribute to stronger defence potential of India”.

Due to its reliability, durability and effectiveness, AK-203 rifle will hopefully become the trustworthy weapon of our soldiers.

Indigenous defence production: ‘Make in India’

2014-19: No major defence project took off

Dec 2, 2019 The Times of India

From: Rajat Pandit, Dec 2, 2019 The Times of India

None of the major ‘Make in India’ projects in the defence arena, ranging from new-generation stealth submarines, minesweepers and light utility helicopters to infantry combat vehicles, transport aircraft and fighter jets, have actually taken off in the last six years.

These long-pending projects, collectively worth over Rs 3.5 lakh crore, are either stuck or still meandering through different stages, without the final contracts to launch production being inked. The relatively new project to manufacture around 7,50,000 Kalashnikov AK-203 assault rifles in a joint venture with Russia at UP’s Korwa ordnance factory, in fact, is poised to kick off first.

TOI in October 2017 had done a stock-taking of six mega Make in India projects to find that bureaucratic bottlenecks, long-winded procedures, commercial and technical wranglings, coupled with lack of requisite political push and follow-through, continued to stymie their launch.

Two years later, the story remains the same for seven major projects. India since then has scrapped the massive fifthgeneration fighter aircraft project with Russia in favour of the indigenous advanced medium combat aircraft (AMCA) project, as was reported by TOI earlier. The defence ministry says several measures have been taken to promote indigenous defence production, which include revisions in the Defence Procurement Procedure (DPP) and FDI policy, simplification of “Make” procedures and offset guidelines, notification of the “strategic partnership (SP)” model and the decision to set up two defence industrial corridors in Tamil Nadu and UP.

“There is a big push to boost indigenous defence production but it will take time to fructify on the ground. Some projects are about to take off. The contract for the AK-203 rifles should be inked by early next year after some delay since the JV with Russia was set up,” said a senior official.

“Similarly, it took a long time to conclude the price negotiations for the Tata-Airbus project to make 56 C-295 aircraft as it was a single-vendor situation but the case will now go to the cabinet committee on Security for clearance,” he said.

But much more clearly needs to be done to rid India of the strategically-vulnerable position of being the world’s largest arms importer. Many insiders contend the much-touted SP policy to boost the role of Indian companies in production of new-generation weapon systems in collaboration with global armament majors has only added further to the delays in executing projects.

The armed forces, for instance, have been demanding new light utility choppers for over 15 years to replace their obsolete single-engine Cheetah and Chetak fleets, which have been dogged by a high crash rate and serviceability problems.

Private sector production

Rajat Pandit, December, 10 2014

Share of private sector in providing equipment just 4% in last 3 years

From Boeing to Lockheed Martin, BAE Systems to Airbus, the private sector dominates arms production the world over. The reverse is true in India, with the public sector continuing to huff and puff but still failing to rid the country of the dubious tag of being the world's largest arms importer.

Latest statistics, tabled by defence minister Manohar Parikkar in Parliament on Tuesday show the share of the Indian private sector in providing equipment to the armed forces was a measly 3-4% over the last three years.

If we consider the Rs 36,918 crore spent on capital acquisitions for the IAF in 2013-2014.While the imports stood at Rs 20,928 crore (56.69%), the public sector delivered equipment worth Rs 15,447 crore (41.84%), with the private sector contributing just Rs 544 crore (1.47%). Similarly, the private sector's share for the Army was just 1.91% in 2013-2014.

Experts say greater participation by Indian private sector companies, alone or in joint ventures with global firms, is required if India wants to build a strong defence-industrial base (DIB).

The Modi government promises to do just that. With India attracting a paltry Rs 24.36 crore ($4.94 million) as FDI in the defence sector in the last 14 years, the FDI cap has now been hiked to 49% and the “Make in India“ policy is being aggressively pursued.

The defence ministry is working towards streamlining the complicated “Make“ procedure for indigenous R&D, development and production of weapon systems.

But it will take a lot of doing. On one hand, DRDO and its 50 labs, five defence PSUs, four shipyards and 39 ordnance factories continue to fail to deliver goods for the armed forces. On the other, the private sector is yet to make a substantial contribution.

Private sector, role for: 2017

To Start With Jets, Copters, Subs & Tanks

The broad contours of the long-awaited “strategic partnership“ policy to boost the Indian private sector's role in production of cutting-edge weapon systems, in collaboration with global armament majors through joint ventures, was finalised by the Centre.

The defence acquisitions council (DAC), chaired by defence minister Arun Jaitley , also gave the green signal to the Army to go ahead with its long-term plan to induct three squadrons (39 choppers) of attack helicopters for its three “strike“ corps, among other modernisation proposals, said sources.

The main takeaway was the strategic partnership policy under the “Make in India“ thrust of the Modi government, which initially opens up four major segments of fighter jets, helicopters, submarines and ar moured vehicles (tanks and infantry combat vehicles) for private sectors players.

TOI was the first to report that the policy would be cleared by the DAC this month as a major step towards building a robust domestic defence-industrial base.

India still imports 65% of its military requirement and can be strategically choked by foreign powers in times of conflicts.

The policy , which will now go to the cabinet committee on security for final approval after the “smaller details“ are worked out, is a clear message to the DRDO and its 50 labs, five defence PSUs, four shipyards, and the 41 factories under the ordnance factory board (OFB) that they have largely failed to deliver the goods over the decades. However, due to the stiff resistance put up by the public sector lobby against the SP policy, defence against the SP policy , defence PSUs, shipyards and OFB will also be eligible to compete with private sector companies for selection as SPs in the submarine and armoured vehicle segments.

As per the SP roadmap, which will take almost a year to unfold, officials said only one company will be selected as the SP at a time in each of the four segments in “a transparent and competitive process“ for the longterm partnership.

The defence ministry will select the companies on the basis of adequate financial strength (Rs 4,000 crore in annual turnover over the last three fiscals, capital assets of Rs 2,000 crore etc), demonstrable manufacturing and technical expertise, existing infrastructure and the ability to absorb technology from their foreign partners. A company's record of “wilful default, debt restructuring and non-performing assets“ will also be taken into account by the defence ministry .

The foreign companies or original equipment manufacturers (OEMs) will be selected, in a separate but parallel process, primarily on the basis of the “range, depth and scope“ of the transfer of technology (ToT) they are willing to offer. Other criteria will include the indigenous content, eco-system development, supplier base and future R&D, among other things.

“The policy is aimed at developing the defence in dustrial ecosystem in the country through the involvement of major Indian corporates as well as the MSME sector. It will give a boost to the `Make in India' policy and set the Indian industry on the path to acquire cutting-edge capabilities which will contribute to the building of self-reliance in the vital sector of national security requirements,“ said an official.

“The Indian industry partners would tie up with global OEMs to seek technology transfers and manufacturing know-how to set up domestic manufacturing infrastructure and supply chains,“ he added.

The SP policy was to be part of the new Defence Procurement Procedure (DPP), which came into effect in April 2016. But it could not be finalised till now, further delaying the proposed projects for a new fighter production line and the Rs 70,000 crore project to build six new-generation stealth submarines.

Government-owned, contractor-managed model

Chethan Kumar, Pvt firms get entry into Army base workshops, January 2, 2018: The Times of India

For the first time, the ministry of defence (MoD) has decided to allow private firms to manage and operate all the Army base workshops (ABWs) in eight cities across six states, including in Delhi, Kolkata, Pune and Bengaluru, and associated station workshops.

Under what is being called the ‘GOCO (government-owned, contractormanaged) Model’, private firms will not even be required to make any investment in land, equipment, machinery or the support system, all of which will be made readily available, internal communications and orders issued by the MoD and integrated headquarters, accessed by TOI, reveal. The decision is based on recommendations by a committee of experts (CoE) constituted to recommend measures to enhance combat capability and rebalance the defence expenditure of the armed forces, and in line with PM Modi’s initiatives to enhance private participation in defence. Explaining the concept, an MoD communication reads: “The government will provide land, infrastructure, plant and machinery, equipment system support, oversight... The contractor operates and utilises the facilities available, manages all types of work and is also responsible to get required licences, certifications and accreditations to deliver mutually agreed targets and maintains the plant machinery and services integral to the venture.”

ABWs were established during World War II to keep the Indian Army operationally ready at all times. Through all these years, the armed forces had not even trusted the ordnance factories to take care of weapons and equipment, and the ABWs functioned directly under the Army.

As of 2025 May

Chethan Kumar, May 17, 2025: The Times of India

From: Chethan Kumar, May 17, 2025: The Times of India

Operation Sindoor has spotlighted India’s evolving military capabilities, revealing the emergence of a robust private defence sector central to the nation’s security.

A decade ago, public sector undertakings and imported technology dominated India’s defence narrative. Today, the private sector drives innovation, not merely filling gaps. Companies such as Tata Advanced Systems (TAS), Alpha Design Technologies (ADTL), Paras Defence & Space Technologies, idea Forge, and IG Drones have transitioned from being niche players to critical partners in delivering cutting-edge systems for modern warfare.

Pvt Push To Defence

TAS, with its legacy in aerospace and defence integration, offers comprehensive solutions, including radars, missiles and UAV systems, for Indian military. In collaboration with Airbus Spain, it produces the C-295 military transport aircraft at India’s first private military aircraft plant in Vadodara, Gujarat. Paras Defence — recognised for its credentials in indigenous design, development and manufacturing — sets benchmarks in electronic warfare, optics and drones.

Similarly, Alpha Design provides a range of systems from radars to tank components and satellite payloads. Other conglomerates like Larsen & Toubro (L&T), Adani Group, and Bharat Forge have significantly expanded their defence portfolios. L&T secured contracts worth Rs 13,369 crore for highpowered radar systems and close-in weapons systems. Adani Defence & Aerospace inaugurated two ammunition and missile-manufacturing facilities in the UP defence corridor, aiming to produce 150 million rounds of small-calibre ammunition annually and meeting 25% of India’s requirement.

It’s A D(r)one Thing

The private sector’s impact is most visible in drone technology. India’s military drone journey began in the 1990s with Israeli UAVs such as the IAI Searcher and Heron. Recognising their strategic value, India started to build its own capabilities. The Kargil War in 1999 highlighted the need for real-time intelligence, prompting DRDO and private firms to accelerate UAV development.

Cut to May 2025 and the Indian armed forces now operate a growing fleet of UAVs, with many more in development. Operation Sindoor underscored the central role of indigenous drones, driven by private firms, in India’s military doctrine covering tactical and high-altitude intel and reconnaissance platforms. idea-Forge’s SWITCH UAV and NETRA V2 quadcopter, co-developed with DRDO, has entered service. Alpha Design’s partnership with Israel’s Elbit Systems produced advanced systems like the SkyStriker loitering munition, enabling precision strikes during Operation Sindoor. Solar Industries’ Nagastra-1 bolstered India’s tactical strike options, while NewSpace Research & Technologies delivered droneswarm capabilities to IAF.

In The Pipeline

The development pipeline includes logistics-focused platforms such as Garuda Aerospace’s Jatayu, a heavy lift drone, and SkyPod for high-altitude resupply in terrains like Siachen. Tactical drones, such as Throttle Aerospace’s Raven and AI-driven swarm control systems from NewSpace and 114AI demonstrate how Indian startups are shaping defence trends.

The Drone Federation of India, representing over 550 companies and 5,500 pilots, has built this ecosystem. It aims to have India as a global drone hub by 2030. IG Drones underlines how the new wave of defence tech firms are specialising in R&D, manufacturing and services. Its collaborations with the Army and other govt bodies integrate private expertise into defence planning and execution. India’s defence exports reached nearly Rs 24,000 crore ($2.9 billion) in FY25, with private firms playing a central role. Govt’s target of Rs 50,000 crore in exports by 2029 depends on sustained private sector growth. The Indian drone market alone is projected to reach $11 billion by 2030, accounting for over 12% of the global share, signalling opportunities for private firms and strengthening national security.

Earlier this month, defence stocks, both public and private, rallied by up to 4% after PM Narendra Modi, referencing Operation Sindoor, called for greater military self-reliance. “We have proven our dominance in new-age warfare,” he stated. “We must lead in defence innovation through indigenous technology.” Operation Sindoor’s success resulted from policy changes supporting private defence manufacturing. Since 2021, the ban on imported drones and the Production Linked Incentive (PLI) scheme, with a Rs 120-crore outlay, turbocharged local innovation. Indigenous defence production reached Rs 1.3 lakh crore in FY24, with a rising share going to private players. Programmes like iDEX (Innovations for Defence Excellence) and SRIJAN (for import substitution) opened doors for both startups and established firms.

Beyond Operation Sindoor

The private sector’s role continues to evolve, with the future focusing on autonomous, AI-driven systems where private companies excel in talent and agility. Operation Sindoor demonstrated that the fusion of private innovation, public sector support, and military vision enables India to assert itself as a high-tech military power. Space-based capabilities will be a key component of this future. Although India lags the US and China in military satellites, it is moving ahead with firms like Digantara (space situational awareness), Pixxel (Earth observation), Dhruva Space (satellites and ground systems), and Ananth Technologies developing key capabilities.

Earlier this year, three private firms based in South India were picked to co-develop 31 satellites under the Space-Based Surveillance-3 (SBS-3) programme, marking the first time private players are building satellites for strategic use. This third phase of the programme, building on previous Cartosat and Risat launches, will enhance India’s space surveillance capacity with 52 satellites in GEO (geostationary) and LEO (low Earth orbit). Isro will develop 21, while the private sector will deliver 31.

Public Sector Undertakings, Defence

2020: Lack of orders, idle production facilities

Rajat Pandit, March 24, 2020: The Times of India

Defence public sector undertakings and shipyards have sounded the alarm over the lack of confirmed orders and under-utilisation of their production capacities, amidst the government touting its “Make in India” policy and setting an ambitious arms export target of $5 billion in the next five years.

At least six of the nine entities (five DPSUs and four shipyards) under the defence ministry, which are often justifiably criticised for huge cost and time slippages as well as shoddy production quality, have warned the bulk of their facilities and manpower are set to become idle over the next couple of years if they do not get firm orders soon.

The armed forces, of course, are themselves grappling with woefully-inadequate modernisation funds, leaving huge operational gaps on several fronts ranging from submarines, artillery guns and minesweepers to fighter jets, light utility helicopters and night-fighting capabilities.

Leading the pack is Hindustan Aeronautics, which makes several types of aircraft from Russian Sukhoi-30MKI fighters under licence to indigenous Tejas jets and Dhruv advanced light helicopters. Despite an existing order book of Rs 59,832 crore, HAL says it has no new orders beyond 2021-22.

The ministry of defence says orders for 83 Tejas Mark-1A jets (for Rs 37,000 crore), 12 Sukhoi-30MKIs and 15 light combat helicopters are in the pipeline. But HAL has told the parliamentary standing committee on defence its “established production capacities will not be fully loaded even with these orders”, and there will be an adverse impact on the country’s defence manufacturing ecosystem and its private sector partners.

Similarly, Bharat Dynamics, with no order executable beyond 2020-21, wants the proposed orders for Akash surface-to-air missiles, Astra air-to-air missiles, and Milan-2T, Konkurs-M and Nag anti-tank guided missiles to be expedited. The two new Akash regiments for Army, for instance, alone are worth Rs 9,133 crore.

Mazagon Docks, in turn, says its extensive submarine-building infrastructure will become idle after it delivers the remaining four of the six French-origin Scorpene submarines (over Rs 23,000 crore) by 2022. MDL, in fact, contends it can immediately begin construction of four major warships and seven more submarines.

Submarine refit facilities at Hindustan Shipyard are already idle after it upgraded INS Sindhuvir, which India plans to hand over to Myanmar, in January. “HSL wants refit and upgrade of all Russian-origin warships but Navy is sending Kilo-class submarines to Russia,” said an official.

Goa Shipyard, on its part, has been hit by the huge delay in the project to build 12 Mine Counter-Measure Vessels (MCMVs), first proposed way back in 2005 at a cost of Rs 32,000 crore. Navy has now cut its requirement to eight MCMVs, while MoD has also put on hold the proposed construction of five fleet support ships for Rs 9,000 crore at GSL, with the help of Anadolu Shipyard (Istanbul), after a diplomatic spat with Turkey.

The GRSE shipyard, too, is constructing 15 warships when it can make 20. BEL, BEML and MIDHANI are only defence entities on a slightly better footing. “Continuity in orders is essential to sustain production growth of DPSUs…Orders in pipeline need to be expedited for optimum use of their construction, building capacities and manpower,” said the parliamentary committee.

Rank of Indian defence companies in world

2020

Dec 6, 2021: The Economic Times

HAL, BEL, Indian Ordnance Factories among top 100 global arms manufacturers in 2020

Domestic procurement has helped in shielding Indian companies against the negative economic consequences of the pandemic, the SIPRI statement noted.

Hindustan Aeronautics Limited (HAL), Bharat Electronics Limited (BEL) and Indian Ordnance Factories were among the top 100 global arms-producing and military services companies in 2020, Stockholm International Peace Research Institute (SIPRI) said on Monday. Their aggregated arms sales of USD 6.5 billion were 1.7 per cent higher in 2020 than in 2019 and accounted for 1.2 per cent of the top 100 total, it mentioned in a statement.

The arms sales of HAL, ranked 42nd, and BEL, ranked 66th, increased by 1.5 per cent and 4.0 per cent, respectively, the SIPRI statement said.

According to it, "Indian Ordnance Factories' (ranked 60th) arms sales rose marginally (by 0.2 per cent)."

Domestic procurement has helped in shielding Indian companies against the negative economic consequences of the pandemic, the SIPRI statement noted.

"In 2020, the Indian Government announced a phased ban on imports of more than a hundred different types of military equipment to support domestic companies and enhance self-reliance in arms production," SIPRI said.

The world's top five arms manufacturers are US-based companies: Lockheed Martin, Raytheon Technologies, Boeing, Northrop Grumman and General Dynamics.

"With a 13 per cent share of total Top 100 arms sales, Chinese arms companies had the second-highest volume of aggregated arms sales in 2020, behind US firms and ahead of British companies," SIPRI noted.

With estimated arms sales of USD 17.9 billion in 2020, NORINCO (ranked seventh) is China's largest arms company and land systems specialist, it mentioned.

Estimated arms sales for AVIC (ranked eighth), China's main military aircraft producer, declined by 1.4 per cent in 2020 to USD 17 billion, according to the statement.

The third Chinese company with arms sales high enough to rank in the top 10 was CETC (ranked ninth), the country's leading producer of military electronics. At USD 14.6 billion, CETC's arms sales fell by 6 per cent in 2020, SIPRI said.

CASIC (ranked 12th), one of China's leading producers of missile and space systems, also recorded a drop in arms sales, it noted. "CASIC's arms sales of USD 11.9 billion in 2020 were 2.8 per cent lower than in 2019."

"The fifth Chinese company in the Top 100 was CSGC (ranked 20th), which manufactures military vehicles," the SIPRI statement mentioned.

CSGC's arms sales rose by 13 per cent in 2020 to USD 5.4 billion, it said.

The border standoff between the Indian and Chinese militaries erupted on May 5 last year following a violent clash in the Pangong lake areas and both sides gradually enhanced their deployment by rushing in tens of thousands of soldiers as well as heavy weaponry.

2022: Three Indian PSUs among world’s top 100

Rajat Pandit, Dec 5, 2023: The Times of India

NEW DELHI: Sales of arms and military services by the 100 largest armament companies in the world totalled $597 billion in 2022, with Russia’s invasion of Ukraine and geopolitical tensions fuelling a major increase in demand for weapons across the globe.

Indian defence PSUs Hindustan Aeronautics (HAL), Bharat Electronics (BEL) and Mazagon Docks (MDL) figure in the list of the top 100 arms-producing companies, which was dominated by US and Chinese companies, as per a report released by Swedish think-tank Stockholm International Peace Research Institute (SIPRI).

HAL was ranked 41st with $3.4 billion in arms sales, BEL 63rd with $1.9 billion and MDL 89thwith $1 billion, all three benefitting from the major orders placed by the 14-lakh strong Indian armed forces. But the three together accounted for just a paltry 1% of the $597 billion global arms sales last year.

Their revenues will, of course, register a jump in the near future. The defence ministry just last week gave preliminary approval for orders worth Rs 1.8 lakh crore (around $22 billion) for HAL, which includes 97 more Tejas Mark-1A fighters and 156 Prachand helicopters as well as upgrade of 84 Russian-origin Sukhoi-30MKI fighters.

SIPRI said though the demand for arms rose sharply around the world in 2022, revenues of the 100 largest companies were 3.5% less than 2021in real terms due to the actual production lagging behind.

“Despite receiving new orders, many US and European arms companies could not significantly ramp up production capacity because of labour shortages, soaring costs and supply chain disruptions that were exacerbated by the war in Ukraine,” it said.

“In addition, countries placed new orders late in the year and the time lag between orders and production meant that the surge in demand was not reflected in these companies’ 2022 revenues,” it added.

The US continues to overwhelmingly dominate the Top-100 list, despite revenues of its 42 companies falling by 7.9% to $302 billion in 2022. Its top five companies are Lockheed Martin ($59 billion arms sales), Raytheon ($40 billion), Northrop Grumman ($32 billion), Boeing ($29 billion) and General Dynamics ($28 billion).

The revenues of arms companies in other parts of the world, like Asia and the Middle East, however, grew significantly. Domestic demand and reliance on local suppliers shielded Asian arms companies from the supply chain disruptions. “Companies in China, India, Japan and Taiwan all benefited from sustained government investment in military modernization,” SIPRI said.

China has eight companies in the Top-100 with total arms sales of $108 billion, accounting for the second largest share as a country in the list at 18%.

China has systematically built a strong defence-industrial base by often reverse-engineering advanced military technologies and now majorly exports arms to Pakistan and several African countries, among others. SIPRI included only two Russian companies in the list due to a lack of data.

As per earlier SIPRI figures, India ($81.4 billion) is the fourth largest military spender in the world, after the US ($877 billion), China ($292 billion) and Russia ($86.4 billion). But the modernization of its armed forces is hobbled by a huge salary and pension bills, as reported by TOI.

Moreover, despite the government’s ongoing major thrust on “Make in India”, India also continues to remain in the strategically-vulnerable position of being the world’s largest arms importer, accounting for 11% of the total global imports in 2018-2022.

Schemes to promote innovation in defence sector

2018/ Innovations for Defence Excellence (iDex)

Department of Defence Production, Ministry of Defence

An innovation ecosystem for Defence titled Innovations for Defence Excellence (iDEX) was launched in April 2018. iDEX is aimed at creation of an ecosystem to foster innovation and technology development in Defence and Aerospace by engaging Industries including MSMEs, Startups, Individual Innovators, R&D institutes and Academia and provide them grants/funding and other support to carry out R&D which has good potential for future adoption for Indian defence and aerospace needs.

iDEX will function as the executive arm of the Defence Innovation Organisation (DIO). The scheme mandates setting up of Defence Innovation Hubs across the country, to provide necessary incubation and infrastructure support to defence startups and innovators.

Defence India Start Up Challenge

Taking the iDEX initiative further, Defence India Startup Challenge "has been launched by Ministry in partnership with Atal Innovation Mission, aimed at supporting Startups/MSMEs/Innovators to create prototypes and/or commercialize products/solutions in the area of National Defence and Security. The vision of the Challenge is two-fold:

i. Help create functional prototypes of products/technologies relevant for national security (prototyping), and spur fast-moving innovation in the India defencesector;

ii. Help new tech products/technologies find a market and early customer (commercialization) in the form of the Indian Defence Establishment.

Schemes to promote innovation in defence sector

2018/ Innovations for Defence Excellence (iDex)

Department of Defence Production, Ministry of Defence

An innovation ecosystem for Defence titled Innovations for Defence Excellence (iDEX) was launched in April 2018. iDEX is aimed at creation of an ecosystem to foster innovation and technology development in Defence and Aerospace by engaging Industries including MSMEs, Startups, Individual Innovators, R&D institutes and Academia and provide them grants/funding and other support to carry out R&D which has good potential for future adoption for Indian defence and aerospace needs.

iDEX will function as the executive arm of the Defence Innovation Organisation (DIO). The scheme mandates setting up of Defence Innovation Hubs across the country, to provide necessary incubation and infrastructure support to defence startups and innovators.

Defence India Start Up Challenge

Taking the iDEX initiative further, Defence India Startup Challenge "has been launched by Ministry in partnership with Atal Innovation Mission, aimed at supporting Startups/MSMEs/Innovators to create prototypes and/or commercialize products/solutions in the area of National Defence and Security. The vision of the Challenge is two-fold:

i. Help create functional prototypes of products/technologies relevant for national security (prototyping), and spur fast-moving innovation in the India defencesector;

ii. Help new tech products/technologies find a market and early customer (commercialization) in the form of the Indian Defence Establishment.

See also

Defence production, India: 1