Multi-national corporations in India

This is a collection of articles archived for the excellence of their content. |

Contents |

Innovations made for India

From: September 16, 2018: The Times of India

From: September 16, 2018: The Times of India

See graphics:

What are innovations made in India- Google- Neighbourly, Areo, Tez; Whatsapp- Out, Why

What are innovations made in India- Uber- Panic button, Cash, Lite; Amazon- App revamp, Shop for you, Quick start

5 SHOP FOR YOU

Staff of offline Google’s Areo app. It’s Google’s first TEZ Mobile payments The max number of chats LITE A 5MB version of stores in tier 2 and 3 cities experiment in home services and service Tez was built to which you can forward the app, stripped of the are trained to help customers delivery, launched without fanfare for India on the govt messages at a time in India map and tiny vehicles, shop on amazon.in and earn UPI platform last OUT WHY? from brought 181 down .4MB for app Indian size commission year. It’s now been The quick forward Violence and lynchings triggered phones with limited QUICK START Tatkal is a rebranded as the more button placed next to by false, incendiary messages had the storage. There’s also a studio-on-wheels to help universal-sounding media messages has govt telling the company web-based version for sellers get online quickly Google Pay to take been removed and the to rein in forwards. At over basic smartphones, an by doing everything from it to the rest of Asia word ‘Forwarded’ appears 200 million users, India is offline feature for limited registration to taking next to texts that aren’t WhatsApp’s biggest market and it network areas photos of merchandise original content can’t afford a PR nightmare

Royalties

2010-16

Sidhartha, Indian cos’ royalty pay under lens, October 29, 2018: The Times of India

From: Sidhartha, Indian cos’ royalty pay under lens, October 29, 2018: The Times of India

Govt Reviews Outgo To Parents, Move Follows Sebi Action For Listed Cos

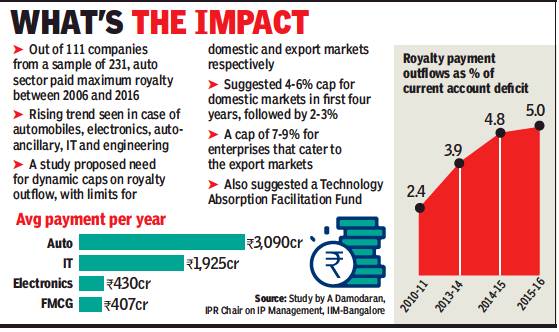

Royalty payment by unlisted companies to their overseas parents is under the lens after data from the income tax department revealed massive payouts to MNCs.

The move at the Centre comes months after the Securities and Exchange Board of India (Sebi) put speed breakers on unbridled outflows from listed companies, mandating that royalty and brand payments beyond 2% of the consolidated turnover needed the backing of a majority of the minority shareholders. This cap was the result of recommendations by a committee headed by Uday Kotak that had proposed a 5% cap.

The move, which will affect several local arms of multinationals such as Unilever and Maruti Suzuki, has already prompted lobbying by some companies, but the market regulator and the government do not appear to be in a mood to offer any relaxation at the moment.

While a committee of officials was already looking at the issue of royalty payments, the work has picked up pace after Sebi’s action this summer. A section in the government is keen that some cap be imposed as was the case prior to 2009. But the entire government is not on the same page, with some suggesting that it will send a wrong signal to international investors.

When the issue was last discussed a few years ago, the finance ministry was of the view that companies should not be mandated to seek prior government approval for royalty payment and all these issues should be left to them.

At the same time, other ministries believe that royalty payment in perpetuity should not be allowed as it is transfer of profits through other means and, given that it is a business income, there is also a loss to the exchequer. “Ideally, it should taper off over a period of time. It cannot be at the same rate for 15-20 years,” said a government official.

In fact, not satisfied with the data submitted to the RBI, the commerce and industry ministry has even requisitioned the number from the income tax department, which shows massive payout by the auto companies. “We discovered that some of the royalty payment has been made under different heads, which is best reflected in the tax data,” a source told TOI.

Some government officials also believe that curbs on royalty will also help check foreign exchange outgo and narrow the current account deficit, which is putting pressure on the rupee.

2015-18

November 8, 2018: The Times of India

From: November 8, 2018: The Times of India

Rising royalty payment by MNCs in India is turning out to be a drag on India’s forex reserves, with the government now having a closer look at those payments. In FY18, amongst the top listed MNCs, Maruti alone has paid more than one and half times of what the combined seven top listed MNCs shelled out.

Subsidiaries in India

2018: some are valued higher than parent MNC

July 19, 2018: The Times of India

From: July 19, 2018: The Times of India

Listed MNCs in India are getting valuations of up to four times higher than their global parents. Higher price-to-earnings valuation means investors expect Indian MNCs to clock faster growth in profits than their parents. Also, given the relative stability of the economy, investors are willing to bet on high-quality MNC stocks here even if they are adequately priced

See also

Global capability centres: India

Multi-national corporations in India