China-India economic relations

(→China's investment in Indian start-ups) |

(→Exports from China to India and India to China) |

||

| Line 13: | Line 13: | ||

[[File: indian investments in china.jpg|Indian investments in China, year-wise; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=CASHING-IN-ON-BEIJING-BIZ-13052015012006 ''The Times of India'']|frame|500px]] | [[File: indian investments in china.jpg|Indian investments in China, year-wise; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=CASHING-IN-ON-BEIJING-BIZ-13052015012006 ''The Times of India'']|frame|500px]] | ||

= Exports from China to India and India to China= | = Exports from China to India and India to China= | ||

| + | ==2014-18: trade gap widens from $48bn to $53bn == | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F03%2F26&entity=Ar01703&sk=44D5C2C4&mode=text Sidhartha, India to seek easier export rules to China, March 26, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | Amid rising trade tension globally, India and China will meet on Monday to look at ways to strengthen bilateral ties with New Delhi pitching for easier rules for its exports to bridge the massive trade deficit. | ||

| + | |||

| + | Sources told TOI that authorities led by commerce and industry minister Suresh Prabhu will pitch for China to address several of the longpending grievances that include barriers to ship medicines and farm goods even as domestic IT firms haven’t been able to enter the market across the border. | ||

| + | |||

| + | At the same time, there are indications that the government is more open to treat China as a “market economy” for anti-dumping and other actions, an issue which has turned into a trade dispute at the WTO — with Beijing dragging the US and the European Union to the global forum. | ||

| + | |||

| + | India’s trade deficit with China was estimated at over $51 billion in 2016-17 as imports of close to $62 billion entered the domestic market. In contrast, the country’s exports were estimated at just over $10 billion led by chemicals and ores (see graphic). | ||

| + | |||

| + | The commerce department has a long list of demands starting with entry of nearly 250 pharmaceutical products into China. India is suggesting easier entry norms for drugs that are cleared for use in other countries, an issue on which some progress is finally expected in the coming months as China is putting in place a fast-track mechanism for this segment. | ||

| + | |||

| + | Similarly, the government wants an early disposal of its demand for allowing export of bovine meat, where China is blocking access due to fears of foot and mouth disease, a problem afflicting cattle on the other side of the border too. | ||

| + | |||

| + | On non-basmati rice too, India has been pressing for market access in China but the rules are such that authorities will first visit every rice mill in the country before allowing shipments out of here, said officials. “We want China to expedite the whole process as we have been discussing this for at least five-six years now,” said an official. | ||

| + | |||

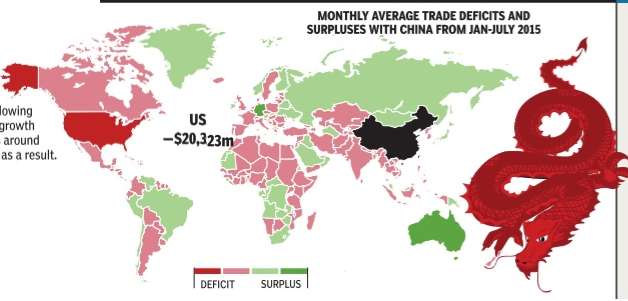

==2015: India has a $3,540.5m deficit every month== | ==2015: India has a $3,540.5m deficit every month== | ||

[[File: India and the world, Monthly average trade deficits and surpluses with China from Jan-July 2015.jpg|India and the world, Monthly average trade deficits and surpluses with China from Jan-July 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=PUTTING-INDIA-ON-THE-MAP-27092015015032 ''The Times of India''], September 27, 2015|frame|500px]] | [[File: India and the world, Monthly average trade deficits and surpluses with China from Jan-July 2015.jpg|India and the world, Monthly average trade deficits and surpluses with China from Jan-July 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=PUTTING-INDIA-ON-THE-MAP-27092015015032 ''The Times of India''], September 27, 2015|frame|500px]] | ||

Revision as of 02:26, 28 March 2018

This is a collection of articles archived for the excellence of their content. |

Contents |

Exports from China to India and India to China

2014-18: trade gap widens from $48bn to $53bn

Sidhartha, India to seek easier export rules to China, March 26, 2018: The Times of India

Amid rising trade tension globally, India and China will meet on Monday to look at ways to strengthen bilateral ties with New Delhi pitching for easier rules for its exports to bridge the massive trade deficit.

Sources told TOI that authorities led by commerce and industry minister Suresh Prabhu will pitch for China to address several of the longpending grievances that include barriers to ship medicines and farm goods even as domestic IT firms haven’t been able to enter the market across the border.

At the same time, there are indications that the government is more open to treat China as a “market economy” for anti-dumping and other actions, an issue which has turned into a trade dispute at the WTO — with Beijing dragging the US and the European Union to the global forum.

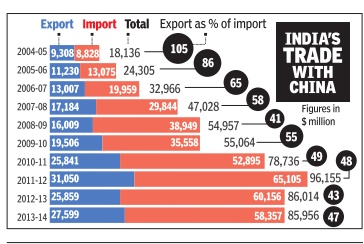

India’s trade deficit with China was estimated at over $51 billion in 2016-17 as imports of close to $62 billion entered the domestic market. In contrast, the country’s exports were estimated at just over $10 billion led by chemicals and ores (see graphic).

The commerce department has a long list of demands starting with entry of nearly 250 pharmaceutical products into China. India is suggesting easier entry norms for drugs that are cleared for use in other countries, an issue on which some progress is finally expected in the coming months as China is putting in place a fast-track mechanism for this segment.

Similarly, the government wants an early disposal of its demand for allowing export of bovine meat, where China is blocking access due to fears of foot and mouth disease, a problem afflicting cattle on the other side of the border too.

On non-basmati rice too, India has been pressing for market access in China but the rules are such that authorities will first visit every rice mill in the country before allowing shipments out of here, said officials. “We want China to expedite the whole process as we have been discussing this for at least five-six years now,” said an official.

2015: India has a $3,540.5m deficit every month

The Times of India, September 27, 2015

China's economy is slowing from its double digit growth and many economies around the world are reeling as a result.Its trade partners, including India, have seen once dependable surpluses wither away, or already existing deficits compound.India counts a $3,540.5m trade deficit on average a month, according to data clocked between January and July 2015

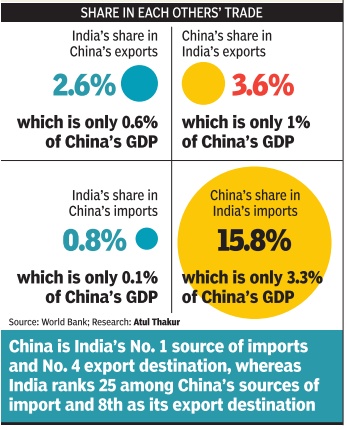

2016: China no.1 source of India's imports, no.4 destination for exports

Calls for boycotting Chinese goods don't sound practical in the present trade scenario. China is the largest source of India's imports while it is the fourth largest destination of our exports. Trade with India is a much smaller fraction of China's total trade volumes

i) The imports of China and India from each other as a percentage of the other country’s GDP

The Times of India

Border trade

Sharp dip in imports/ 2016

Pithoragarh:

The cross-border trade at Taklakot mandi in Purang district of China's Tibet Autonomous Region where traders from Uttarakhand have traditionally been selling their wares has seen a sharp rise in Indian exports (Rs 5.86 crore) this year, while the Chinese goods they bring back after their five-month stay saw a slump as they amounted to just Rs 64 lakh.

This year saw a wide gap between exports and imports.In 2015, the trade volume with China through Lipulekh Pass was Rs 4.36 crore, of which Indian traders exported goods worth Rs 1.6 crore while imports from China were worth Rs 2.76 crore. In 2014, imports from the local Bhutia traders were worth Rs 2.14 crore, while they sold goods worth just Rs 1.9 crore.

Indian exports from the district include carpets, bamboo, matchboxes and packed sweets, while the traders bring back readymade garments, jackets and raw wool.“A total of 195 trade passes were issued this year, of which 77 were for traders and 118 were for helpers, but no Chinese traders came to the Indian mandi in Gunji,“ said P S Kutiyal, assistant trade officer.The final figures for this ye ar's trade can be calculated only after all the traders reach the Gunji mandi and pay their customs duty , he said.

The cross-border business takes place between June and October each year when traders make the journey across the 17,000-foot-high Lipulekh Pass to Purang. The trade time was extended by a month after traders petitioned to the government, saying early closure will lead to financial losses. “The trade for this year closed on October 31 as all the traders and helpers have come back from the Chinese mandi in Taklakot,“ said Kutiyal. The temporary branch of the SBI in Gunji has no facility of currency exchange.

“Absence of this facility makes the exchange rates costlier as traders have to pay Rs 11 for one Yuan, while the current rate is Rs 9.89 for a Yuan,“ said a trader. “We had submitted a memorandum to the central government and local trade officer to set up a currency exchange centre in SBI Gunji, but nothing has been done in this regard,“ said Garvuyal. Also the Chinese authorities do not allow transport animals like mules or horses after the Lipulekh Pass, which makes the products costly , as traders have to hire Chinese vehicles to carry their goods.

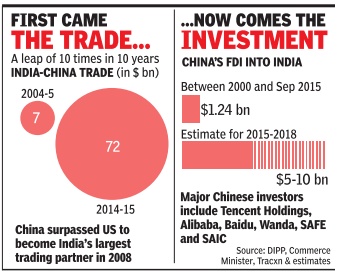

China's investment in Indian start-ups

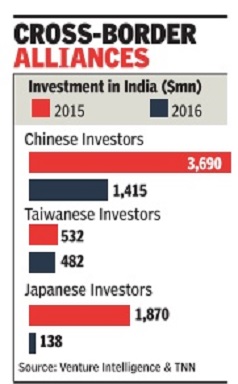

Other Asian firms' investment in startups nowhere close to China's, Nov 20 2016 : The Times of India

Chinese firms and funds have become big investors in Indian startups, and they are becoming particularly useful now as US funds slow down.Beijing Miteno Communication Technology , a Chinese tech conglomerate, made this year's biggest acquisition in the technology startup space -the $900 million buyout of Media.net, a subsidiary of Mumbai-based Directi, founded by brothers Bhavin and Divyank Turakhia.

Ecommerce giant Alibaba has made large investments in Paytm and Snapdeal. Didi Chuxing, the equivalent of Uber in China, has invested in Ola. Internet giant Tencent recently led a $175 million funding in messaging app Hike; prior to that, it led a $90 million round in healthcare solutions firm Practo and, through its joint venture with South Africa's Naspers, invested in online travel firm Ibibo Group.

“There are demographic similarities and both countries are seeing consumer growth for digital firms. Also, Chinese players have experience in market creation and running successful digital companies, so they can play a bigger role than being just financial investors,“ says Ashish Kashyap, founder of Ibibo, which last month merged with rival MakeMyTrip. Alibaba, for instance, is seen to be actively helping Paytm in various aspects.

Bhavin Turakhia says the Chinese understand the Indian market better than US companies do as the Indian market is on the same evolution path as that of China, but about five to 10 years behind. Chinese companies and funds have become big investors in Indian star tups. Cheetah Mobile, which owns products like Clean Master, invested in fitness app GOQii late last year.

Ctrip, one of China's largest online travel companies, invested $180 million in MakeMyTrip in January . China-based investment firm Hillhouse Capital has invested in Car Dekho. Smartphone maker Xiaomi led a $25-million funding round in content provider Hungama Digital Media Entertainment in April.

Web services company Baidu has said it is scouting for investment opportunities in Indian startups.

Even other Asian companies are nowhere close to investing as much as the Chinese in Indian startups. Japan's SoftBank and Singapore's Temasek are among the few non-Chi nese ones that have made investments. Taiwan's Foxconn has also made several investments, like in Qikpod, Hike and Snapdeal, but some see Foxconn as practically a Chinese company , given that much of its operations is in China.

What's pushing the Chinese tech companies to make large investments are two things: one, many of them are making big profits in their home market, thanks partly to the restrictions on foreign competi tion; and two, the Chinese economy is slowing down.

So they want to use their surpluses to expand into what is potentially the world's third largest digital market.

“There are only two big growing markets where they can invest: India and the United States. Silicon Valley does not respect Chinese capital. So the Indian tech sector becomes attractive to them,“ says Mohan Kumar, executive director at Norwest Ventures, a US-based venture fund that has opera tions in India. Kumar also notes that Chinese investors often value Indian startups at three to five times more than what other seasoned investors do. “So entrepreneurs naturally prefer them,“ he says.

Higher valuations mean the Chinese investors take lower stakes for the same amount of investment, and founders can hope for an even higher valuation in their next round of fund raising.

Language and politics are a challenge. May be for that reason, the Chinese are for now preferring partnerships and not outright buys. Even investment firms are building partnerships. Chinese VC fund Incapital has tied up with Indian fund IvyCap Ventures to enable its partner investors to have a closer look at potential investment opportunities in Indian startups.

China is showing interest in traditional industries too. In July 2016, Chinese pharma compa ny Shanghai Fosun Pharmaceutical Co acquired Indian injectables manufacturer Gland Pharma for $1.27 billion, and in August, Chinese conglomerate Jiangsu Longzhe Technology and Trade Development Co acquired Diamond Power Infrastructure, Vadodara-based manufacturer of cables, conductors, transformers and other power sector equipment, for $125 million. But digital technology looks to be where the biggest action is.

Indian goods sold in China

2017

HIGHLIGHTS

There is a lot of attraction for Indian foods and many other products all over China.

They are sold by hundreds of Chinese traders through online stores and physical shops.

Almost every city has a shop selling Indian goods, and some like Shanghai, Guangzhou, Yiwu and Beijing have 2-3 each.

Indian masalas are spicing up the Chinese palate like never before with large numbers of them buying Indian food products during the annual shopping event, the Singles Day.

The shopping carnival saw online markets doing business exceeding $30 billion as millions of consumers bought a wide range of goods, most of which are manufactured in China. Some foreign-made goods including those produced in India, Europe and the US were hawked and purchased.

Indian grocery items, ready-made food and Ayurvedic cosmetic brands like Amul, MDH Masala, Gits, Tata Tea, Haldiram, Dabur, Patanjali and Himalaya, were snapped up on Alibaba's Taobao.com, jd.com and several other Internet marketplaces.

The online market attracts a large chunk of the Chinese population with attractive discounts on the occasion, that is also known as 11/11 Singles day+ because it involves the repeated use of 1 or single four times. However, buyers include both married and singles. The 24-hour buying frenzy has emerged as the world's biggest shopping day eclipsing Black Friday and Cyber Monday in the United States.

Alibaba reported that its one-day sales reached $25.35 billion on Saturday, a rise of 39 percent from last year. The company said it had sold goods including apparel, mobile phones, imported lobster and infant formula from 140,000 brands during the day.

JD, which started the discount sales on November 1, said it had sold nearly $20 billion in goods over an 11-day period. It sold 55 million facial masks and 500,000 Thailand black tiger shrimps, JD said. There are several other online shopping firms which have not released all their figures yet.

"There is a lot of attraction for Indian foods and many other products all over China. They are sold by hundreds of Chinese traders through online stores and physical shops. Almost every city in China has a shop selling Indian goods, and some like Shanghai, Guangzhou, Yiwu and Beijing have two or three each," a Guangzhou-based Indian businessman told.

The most sought-after Indian goods are spices followed by cosmetics. Textiles and home decoration pieces are also on sale. Buyers include the vast community of expatriates including Indians, Pakistanis, Japanese, Arabs, Africans and even Europeans who are fond of curried food. More than a million expatriates live in different Chinese cities.

There are more than 100 physical stores selling Indian products in different Chinese cities. These shops, most of whom are run by local traders, also sell online. Indian products usually sell at a premium ranging from 100 percent to 300 percent over the printed prices but this does not deter buyers who want quality products from India.

"The quality of Indian spices like cardamom and cumin seeds is far superior in India as compared to those sold in local Chinese markets. People start realizing it once they use them. Turmeric has become very popular in China," the businessman said.

Chinese have emerged as the world's biggest international travellers, which has resulted in an enlarged worldview and a desire to taste the foods of different countries. Thousands of restaurants in Chinese cities now feature "chicken curry" on the menu. They use ready-made spice mixtures comprising turmeric and other Indian masalas. Many Chinese housewives also cook curry at home.

A wide range of packaged Indian sweets is also on sale at the online markets. They are mostly purchased by foreigners including Arabs, Europeans, and Americans with a sweet tooth because the average Chinese does not have an affinity for intensely sweet eatables.

The Singles Day has also given a boost to China's clout as an international hub for mobile payments and intelligent logistics, the local media quoted Matthew Crabbe, Asia Pacific research director at consultancy Mintel as saying. The Alipay mobile wallet saw deals at a peak rate of 256,000 transactions per second in China and many foreign countries, according to Alibaba. Robots and algorithms accelerated parcel distribution, it said.