Project finance and India

This is a collection of articles archived for the excellence of their content. |

Lending to energy projects

2017> 18: shift from coal-fired plants to renewables

VISHWA.MOHAN, August 19, 2019: The Times of India

The Top 5 states that attracted project finance for renewables, state-wise

From: VISHWA.MOHAN, August 19, 2019: The Times of India

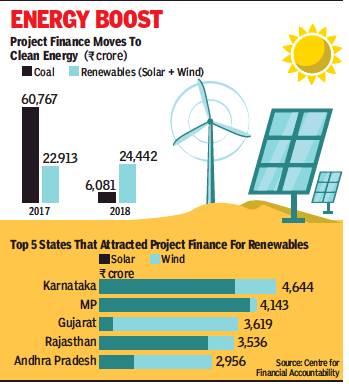

India may be the fastest growing energy market in the world, but its lending to coal power projects saw a massive dip last year as compared to 2017, while renewables (solar and wind) attracted four times more project finance lending than coal-fired plants during the period.

The Coal vs Renewables 2018 report on lending to 54 energy projects that reached financial closure in 2018, released by Delhibased think tank Centre for Financial Analysis (CFA), revealed 90% decline in coal power project finance/lending in 2018 as compared to 2017. Figures show that 80% of all energy project finance went to renewables, while coal received merely 20%.

A total of 49 renewable projects with a combined capacity of 4.7 GW obtained loans of Rs 24,442 crore last year where solar PV attracted 60% of this finance while the remaining 40% went to wind projects.

Though such a push towards solar and wind may be in sync with India’s target to have 175 GW of renewables by 2022, majority government and government-owned financial institutions still preferred financing most of the coal-fired projects in 2018. Privately-owned commercial banks, on the other hand, contributed threequarters of all finance towards renewable projects and this trend is consistent with findings from 2017.

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India

Foreign Portfolio Investors (FPI): India

Private equity investments in India, this page includes statistics that club PE/ VC capital together

Project finance and India