Foreign Institutional Investment (FII): India

This is a collection of articles archived for the excellence of their content. |

Contents |

YEAR-WISE DEVELOPMENTS

2010- 22: inflows

From: February 2, 2023: The Times of India

See graphic:

Foreign institutional investment VIS-À-VIS domestic fund inflows in India, 2010- 22

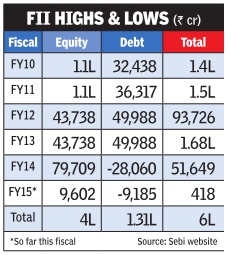

2014

2015: Private equity and FII investments

The Times of India Jan 01 2016

TIMES NEWS NETWORK

Total private equity (PE) investment in India in 2015 rose to its highest in eight years and almost equalled the total foreign direct investment (FDI) in equity inflows three years back, according to a report.

Investments from PE firms rose 67% to $21 billion in 2015, from $12.5 billion, a year earlier.The previous high was $18 billion, recorded in 2007, the report from VCCEdge said. The data excludes real estate and venture debt. A separate report from the same research firm had earlier said that PE funds invested about $2.4 billion in the real estate sector, across 53 transactions, in the first nine months of 2015, This was higher compared to $2.1 billion that they invested in 2014 across 80 deals.

FDI in equity inflows for 201213 was $22.4 billion, out of the total $34 billion the country received. Last year, India received total FDI investments of $44.3 billion, according to latest figures from the department of industrial policy & promotion (DIPP).

The report said angel and venture capital inflows helped early-stage investments. “It was an action-packed 2015 for early-stage investment in India as Angel and Venture Capital investments were the prime drivers of capital inflow. Angel and seed investments grew 64%, increasing to $327 million from $200 million in 2014,“ according to the report.

Venture capital funding also saw a rise, recording the highest ever jump to cross a new milestone in 2015. Overall 473 VC deals were registered during the year, up from 307 recorded in 2014. Deal value too more than doubled, shooting up to $5.4 billion during the year, compared with $2.3 billion a year earlier.

2019: Equity flows improve

From: Dec 7, 2019: The Times of India

See graphic:

In 2019: FII equity flows improved

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India

Foreign Portfolio Investors (FPI): India

Private equity investments in India, this page includes statistics that club PE/ VC capital together