Defence production, India: 1

This is a collection of articles archived for the excellence of their content. |

Contents |

Hyderabad in Defence Production

The Times of India, Aug 15 2015

Swati Rathor

Hyd-tech puts aerospace, defence mfg in new orbit

Not many would be aware that the cabin of the Sikorsky S-92 chopper that ferries the US President Barack Obama is made in Hyderabad, as also some crucial components powering Isro's interplanetary craft to Mars, Mangalyaan. When Andhra Pradesh lost the Tata Nano project in 2008, it came as a blessing in disguise for the state. Hyderabad's aerospace and defence manufacturing sectors were propelled into a new orbit as Ratan Tata promised the government that he would park a project no less prestigious in the state.

Tata kept his promise, and that's how Tata Advanced Systems Ltd set up its facility at India's first aerospace SEZ at Adibatla on Hyderabad's outskirts putting the city on the global defence and aerospace map through joint ventures with Lockheed Martin and Sikorsky of US, and Swiss player RUAG investing, over Rs 4,000 crore.

Hyderabad's second wave of investments in this sector have made it the biggest challenger to Bengaluru's supremacy in aerospace and defence sectors.

While Bangalore emerged as aeronautics hub thanks to HAL (which has a small presence in Hyderabad), Hyderabad has a stronger missile base. Its foundation was laid after the 1962 Sino-Indian border war when premier institutes like Defence Research and Development Organisation (DRDO), Defence Research and Development Lab oratory (DRDL) and Research Center Imarat (RCI), among others, were set up in the city , considered “safe“ for its distance from the country's then troubled borders.

“Small and medium enterprises making components for these defence institutions have now started building sub-systems as well as systems for them. These institutions have also ensured a steady flow of talent for the sector which requires highly-skilled manpower,“ said G Satheesh Reddy , scientific adviser to the defence minister. Over 70% of components for Akash missiles too are being sourced from Hyderabad SMEs, Reddy added.

In fact, Hyderabad's strong base of over 1,000 SMEs coupled with IT firms catering to the aerospace segment have proved to be a major draw for global aerospace giants. This is also what perhaps prompted Boeing to bet on Hyderabad in partnership with the Tatas.

“Hyderabad's strategic advantages are its emerging industrial base, infrastructure and availability of skilled manpower,“ said Boeing India president Pratyush Kumar.“All these are critical to develop a competitive aerospace and defence base, and we took this into consideration while signing a framework agreement with TASL to collaborate in aerospace and defence, including UAVs,“ Kumar added.

Boeing is currently working with Hyderabad-based Avantel on mobile satellite systems for the P-8I military aircraft and Cyient Ltd (formerly Infotech Enterprises) for many of its commercial airplane projects.

This ecosystem is also giving wings to the multi-billion dollar maintenance, repair, and overhaul (MRO) sector in the city. In May 2015, Air India set up its Rs 80-crore MRO at the Hyderabad International Airport, even as the 250-acre GMR Aerospace Park SEZ housing GMR's MRO Facility services narrow bodied aircraft like Airbus A 320 and Boeing 737, among others.

“Hyderabad is important also from the maintenance perspective as it has been a base maintenance station of erstwhile Indian Airlines from very early days,“ said HR Jagannath, CEO, Air India Engineering Services Limited (AIESL).

“The required manpower and higher level of tools, equipment, processes and systems necessary to carry out higher level checks on the aircraft were already available.Hyderabad is now being seen as a major maintenance hub for captive work load of Air India as well as third party business,“ Jagannath added.

Now, US-based Pratt & Whitney is gearing up to launch its third global centre after US and China for training aircraft engineers and technicians near Hyderabad airport.

To keep the sector cruising, the Telangana government is not only setting up the state's second aerospace park spread over 1,000 acres at Elimenidu on Hyderabad's outskirts, but is also giving finishing touches to an aerospace policy to be announced in November, said Telangana IT secretary Jayesh Ranjan.

Indigenous defence production

2016-17: Defence production

2016: the status of indigenous defence production

Defective equipment

Jan 05 2015 Chethan Kumar

Rs 449 cr items sent back for rectification in 3 years

The Modi government, which has given a war cry for `Make in India' in the defence sector, has a major battle to win within the country before guarding the borders with home-made equipment. For, 429 types of defence equipment worth Rs 449.40 crore have been sent back to domestic ordnance factories in the past three years due to quality issues.

According to documents TOI has accessed, this includes 162 types of weapons, which can range from rifles to rocket launchers, 16 categories of combat vehicles, and 52 types of ammunition, the shortage of which has been worrying the world's second largest land army .

The defence ministry said the Directorate General of Quality Assurance, which provides second-party quality assurance, has returned these equipment for rectification.

Each of these categories could have seen thousands or lakhs of units being sent back.“Let's take an example of a bullet for an assault rifle.Lakhs of such bullets would've been procured and all of them rendered useless if they didn't meet the quality requirements,“ a Lieutenant Colonel told TOI.

The documents revealed that as of the third week of December 2014, the ammunition had quality issues, severely affecting the forces' ability at a time when ceasefire viola tions by Pakistan and intrusions from China pose threats.

“The fact that the Ordnance Factory Board and the factories cleared them is a matter of concern,“ another officer said.

In 2013-14, equipment worth Rs 144.65 crore was returned for rectification (RFR), an increase of Rs 12.06 crore from 2012-13. The cost of equipment under RFR in 201213 (Rs 132.59 crore) had seen a considerable drop from 201112 (Rs 172.16 crore).

Private sector production

Rajat Pandit, December, 10 2014

Share of private sector in providing equipment just 4% in last 3 years

From Boeing to Lockheed Martin, BAE Systems to Airbus, the private sector dominates arms production the world over. The reverse is true in India, with the public sector continuing to huff and puff but still failing to rid the country of the dubious tag of being the world's largest arms importer. Latest statistics, tabled by defence minister Manohar Parikkar in Parliament on Tuesday show the share of the Indian private sector in providing equipment to the armed forces was a measly 3-4% over the last three years.

If we consider the Rs 36,918 crore spent on capital acquisitions for the IAF in 2013-2014.While the imports stood at Rs 20,928 crore (56.69%), the public sector delivered equipment worth Rs 15,447 crore (41.84%), with the private sector contributing just Rs 544 crore (1.47%). Similarly, the private sector's share for the Army was just 1.91% in 2013-2014.

Experts say greater participation by Indian private sector companies, alone or in joint ventures with global firms, is required if India wants to build a strong defence-industrial base (DIB).

The Modi government promises to do just that. With India attracting a paltry Rs 24.36 crore ($4.94 million) as FDI in the defence sector in the last 14 years, the FDI cap has now been hiked to 49% and the “Make in India“ policy is being aggressively pursued.

The defence ministry is working towards streamlining the complicated “Make“ procedure for indigenous R&D, development and production of weapon systems.

But it will take a lot of doing. On one hand, DRDO and its 50 labs, five defence PSUs, four shipyards and 39 ordnance factories continue to fail to deliver goods for the armed forces. On the other, the private sector is yet to make a substantial contribution.

Private sector, role for: 2017

To Start With Jets, Copters, Subs & Tanks

The broad contours of the long-awaited “strategic partnership“ policy to boost the Indian private sector's role in production of cutting-edge weapon systems, in collaboration with global armament majors through joint ventures, was finalised by the Centre.

The defence acquisitions council (DAC), chaired by defence minister Arun Jaitley , also gave the green signal to the Army to go ahead with its long-term plan to induct three squadrons (39 choppers) of attack helicopters for its three “strike“ corps, among other modernisation proposals, said sources.

The main takeaway was the strategic partnership policy under the “Make in India“ thrust of the Modi government, which initially opens up four major segments of fighter jets, helicopters, submarines and ar moured vehicles (tanks and infantry combat vehicles) for private sectors players.

TOI was the first to report that the policy would be cleared by the DAC this month as a major step towards building a robust domestic defence-industrial base.

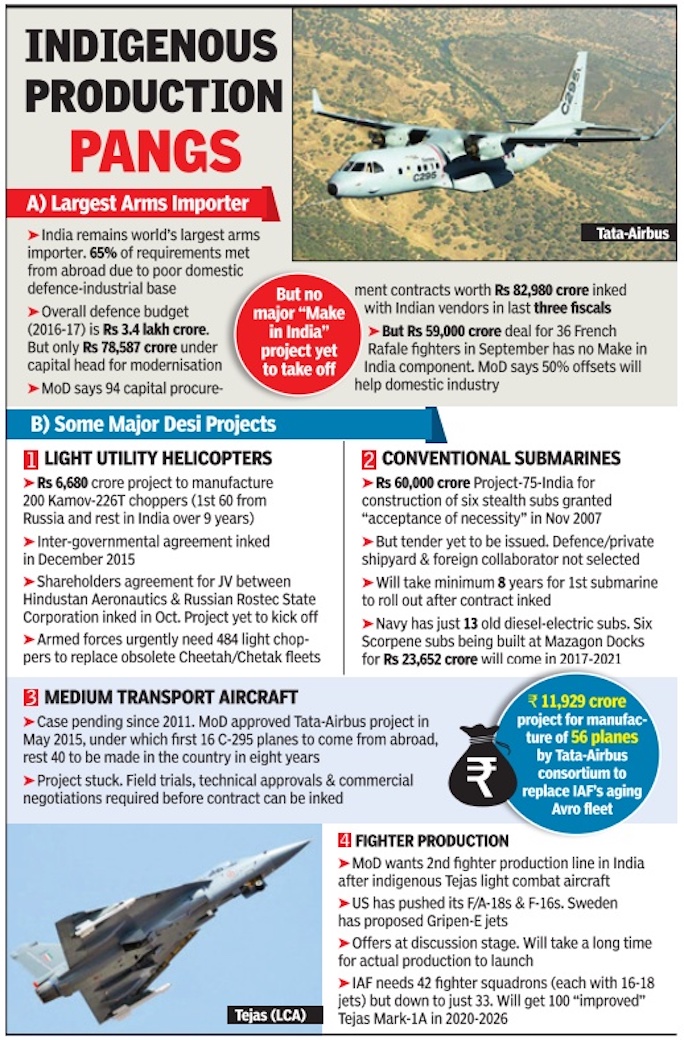

India still imports 65% of its military requirement and can be strategically choked by foreign powers in times of conflicts.

The policy , which will now go to the cabinet committee on security for final approval after the “smaller details“ are worked out, is a clear message to the DRDO and its 50 labs, five defence PSUs, four shipyards, and the 41 factories under the ordnance factory board (OFB) that they have largely failed to deliver the goods over the decades. However, due to the stiff resistance put up by the public sector lobby against the SP policy, defence against the SP policy , defence PSUs, shipyards and OFB will also be eligible to compete with private sector companies for selection as SPs in the submarine and armoured vehicle segments.

As per the SP roadmap, which will take almost a year to unfold, officials said only one company will be selected as the SP at a time in each of the four segments in “a transparent and competitive process“ for the longterm partnership.

The defence ministry will select the companies on the basis of adequate financial strength (Rs 4,000 crore in annual turnover over the last three fiscals, capital assets of Rs 2,000 crore etc), demonstrable manufacturing and technical expertise, existing infrastructure and the ability to absorb technology from their foreign partners. A company's record of “wilful default, debt restructuring and non-performing assets“ will also be taken into account by the defence ministry .

The foreign companies or original equipment manufacturers (OEMs) will be selected, in a separate but parallel process, primarily on the basis of the “range, depth and scope“ of the transfer of technology (ToT) they are willing to offer. Other criteria will include the indigenous content, eco-system development, supplier base and future R&D, among other things.

“The policy is aimed at developing the defence in dustrial ecosystem in the country through the involvement of major Indian corporates as well as the MSME sector. It will give a boost to the `Make in India' policy and set the Indian industry on the path to acquire cutting-edge capabilities which will contribute to the building of self-reliance in the vital sector of national security requirements,“ said an official.

“The Indian industry partners would tie up with global OEMs to seek technology transfers and manufacturing know-how to set up domestic manufacturing infrastructure and supply chains,“ he added.

The SP policy was to be part of the new Defence Procurement Procedure (DPP), which came into effect in April 2016. But it could not be finalised till now, further delaying the proposed projects for a new fighter production line and the Rs 70,000 crore project to build six new-generation stealth submarines.

See also

Defence production, India: 1