Foreign Portfolio Investments (FPI): India

This is a collection of articles archived for the excellence of their content. |

Contents |

Rules, norms

Revised KYC norms/ 2018

Sebi issues revised KYC norms for FPIs, September 22, 2018: The Times of India

Markets regulator Sebi issued revised KYC norms for foreign portfolio investors (FPIs), wherein resident as well as non-resident Indians (NRIs) have been permitted to hold non-controlling stake in such entities.

Two circulars pertaining to KYC requirements and eligibility conditions for FPIs have been issued. These norms have been put in place weeks after a panel suggested various changes to the guidelines proposed earlier, amid concerns in certain quarters that overseas funds might face difficulties in ensuring compliance.

NRIs, overseas citizens of India (OCIs) and resident Indians (RIs) have been permitted to hold non-controlling stake in FPIs. There would also be no restriction on them to manage non-investing FPIs Sebi-registered offshore funds as well as registered investment managers, according to the regulator.

These entities would be allowed to be constituents of FPIs subject to certain conditions. If single and aggregate NRI/OCI/ RI holding is below 25% and 50%, respectively, of the assets under management (AUM) in the FPI, then such entities would be permitted to be constituents of the FPI.

According to Sebi, FPIs can be controlled by investment managers (IMs) — which are controlled and/or owned by NRIs, OCIs, or RIs. In this regard, the conditions include that the investment manager is appropriately regulated in its home jurisdiction and registers itself with Sebi as non-investing FPI.

Among others, a non-investing FPI can be directly or indirectly owned or controlled by an NRI, OCI or RI.

Year-wise developments

Private equity investors

2010-17

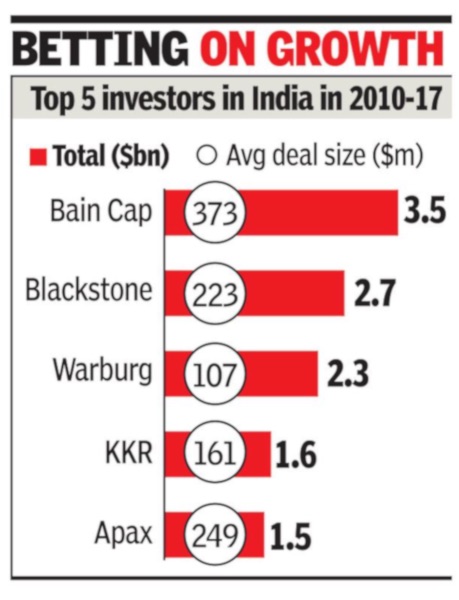

From: Boby Kurian, Bain tops global peers with $3.5 billion in 7 years, September 25, 2018: The Times of India

Bain Capital has made the biggest deployment of funds among private equity investors in India since 2010, signalling its commitment to Asia’s third-largest economy, said John Connaughton, co-managing partner of the firm controlling $95 billion in assets globally.

Bain invested about $3.5 billion in select large deals — including its $1-billion deals in private lender Axis Bank and BPO major Genpact — ahead of its more prolific global peers Blackstone and Warburg Pincus.

“We are not momentum investors flying in and out. We have built one of the largest teams in India with four managing directors, which has stayed on with the firm since joining. India (along with Japan & China) comprise a core market as part of our Asia-Pacific investment strategy,” Connaughton said in an interview last week.

“We work with the managements of the top-three leading companies in any sector to help them achieve their full potential. We follow a certain discipline and rely on insights to offer fundamental value-added strategies to the managements,” he added, while in Mumbai to mark the Boston-headquartered firm’s 10th anniversary of Indian operations. Connaughton said Bain was bullish about its biggest bet — $1.06 billion made in Axis Bank last year — as it “demonstrates our conviction” on prospects of private sector lenders in a high-growth economy. “We have provided them with capital to help them with provisioning in line with RBI guidelines, and grow in order to ultimately improve ROE (return on equity).”

He added, “It’s still early days, especially since the bank is in the midst of top-level changes, but we are hopeful about it delivering to our expectations.” Earlier this month, Axis Bank announced Amitabh Chaudhary, who spearheaded HDFC Standard Life previously, as the new CEO to succeed Shikha Sharma. Connaughton said the firm’s playbook of discipline, relying on insights beyond the obvious and large cheques meant there could be long periods of no deal activity. Bain Capital India MD Amit Chandra said, “This helps us to cut out the noise and lean in or lean back. You may see us doing a deal once in 12 or 18 months, and not do a deal every six months or so.”

Bain’s average Indian deal size was $373 million compared to $249 million of Apax Partners and $223 billion by Blackstone. The data is based on pure-play private equity deals in the last seven years and excludes investments in infrastructure and real estate. Bain’s other Indian deals were in two-wheeler giant Hero MotoCorp, engineering services company Quest Global and Emcure Pharma. Limited Partners or LPs — an industry parlance for sovereign wealth, global pension plans and university endowments providing firepower to private equity funds — co-invested with Bain in some of its bigger deals.

Bain Capital launched its credit unit through a joint venture with Ajay Piramal Group last year as India Inc and lenders grapple with more than $200 billion of non-performing loans. It invests in a full spectrum of credit strategies such as leveraged loans, distressed debt, special situations and structured products. Bain Capital Credit and the Piramals were in the midst of raising a fund currently.

Connaughton said Bain was following the market dislocations caused by the distressed debt pile-up in the country. “We look out to fix balance sheet issues in fundamentally good assets that are under-performing and help them become productive again,” he added. In context, he said India’s Insolvency and Bankruptcy Code offered a workable and practical framework that didn’t exist previously.

“But like everywhere, enacting laws and practising them are entirely different things,” he said, while adding that frameworks, implementation and setting of precedents were all equally important in making the bankruptcy code a success.

Private equity investments in India touched a record high of $25 billion across 639 deals in 2017, up from $16.5 billion from 829 deals in the previous calendar, according to PwC data.

There has been a nearly 50 per cent upswing in average deal value as private equity investors write larger cheques in chasing unprecedented buyout opportunities in the country. A Bloomberg report said Indian M&A deals have already crossed $100 billion in the current calendar as private equity, along with sovereign wealth and global pension funds, join a slug fest with strategic buyers to snap up assets in the world’s fastest growing major economy.

2015-17

Indian mkts get $30bn foreign inflows in 2017, December 18, 2017: The Times of India

From: Indian mkts get $30bn foreign inflows in 2017, December 18, 2017: The Times of India

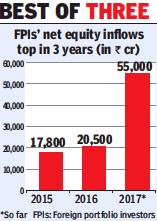

Foreign investors are flocking to the Indian capital markets in a big way with a net inflow of over $30 billion (nearly Rs 2 lakh crore) of so-called ‘hot money’ in 2017, with equities alone getting over $8 billion (over Rs 50,000 crore) — an amount bigger than the cumulative investment of the previous two years.

The Indian stock market seems to have regained its status as one of the most favoured destinations for foreign portfolio investors (FPIs), as they have taken their net investment position in equities so far in 2017 to Rs 55,000 crore — the highest in three years after Rs 20,500 crore in 2016 and Rs 17,800 crore in 2015.

But this remains a far cry from the heady levels seen earlier — Rs 97,000 crore in 2014, Rs 1.13lakh crore in 2013 and Rs 1.28 lakh crore in 2012. However, a sharper turnaround was seen in 2017 in terms of FPI inflows into debt markets where the net investments soared to a staggering Rs 1.5 lakh crore ($23 billion) after a net outflow of about Rs 43,600 crore in 2016.

Although marketmen believe that this kind of FPI flows may not continue in 2018 as the withdrawal of liquidity and rate hikes in developed economies pick up. Also, the inflation cycle is likely to turn following increase in commodity prices and recovery in consumption demand. The capital poured in by FPIs is often called ‘hot money’ because of its unpredictability, but these overseas entities have still been among the most important drivers of Indian stock markets. In terms of sectors, banking, housing finance and auto have seen consistent FPI inflows.

2018: 5 stocks favoured by FIs

From: July 27, 2018: The Times of India

See graphic :

2018: 5 Indian stocks favoured by Foreign investors

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India