Foreign exchange reserves, expenditure: India

(→2011, Nov to 2018, Oct) |

(→2018, April 6: $424.9bn) |

||

| Line 1,582: | Line 1,582: | ||

Expressed in the US dollar terms, the foreign currency assets include the effect of appreciation or depreciation of the non-US currencies such as the euro, the pound and the yen held in the reserves. | Expressed in the US dollar terms, the foreign currency assets include the effect of appreciation or depreciation of the non-US currencies such as the euro, the pound and the yen held in the reserves. | ||

| + | |||

| + | ==2020, June: $501.7 billion== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2020/06/13&entity=Ar01916&sk=7DBA2117&mode=text Mayur Shetty, June 13, 2020: ''The Times of India''] | ||

| + | |||

| + | [[File: Foreign exchange reserves in India, vis-à-vis other Asian economies, Russia, as in 2020 June.jpg| Foreign exchange reserves in India, vis-à-vis other Asian economies, Russia, as in 2020 June. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2020/06/13&entity=Ar01916&sk=7DBA2117&mode=text Mayur Shetty, June 13, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | The country’s forex reserves rose by $8.2 billion during the week ended June 5 to cross the half-a-trillion-dollar mark for the first time. Forex reserves rose to $501.7 billion from $493.5 billion a week earlier. The increase was due to an $8.4-billion jump in foreign currency assets to $463 billion. Of the other components of the reserves, the value of gold declined by $329 million to $3.2 billion, and reserve position in the International Monetary Fund rose by $832 million to $4.2 billion. | ||

| + | |||

| + | Bankers attributed the increase in reserves to dollar inflows arising out of deleveraging by Indian corporates. Reliance Industries has been selling large chunks of its holding in Jio Platforms to global investors and has received a commitment of Rs 97,885 crore. Bharati Telecom too raised $1 billion selling stake through a block deal. GSK sold $3.3 billion in Unilever. Bankers say that large deals, even the ones in local markets, end up drawing foreign investor interest. | ||

| + | |||

| + | “The RBI has been buying dollars since governor Shaktikanta Das took charge in 2018. With forex reserves, the more you have, the less the need to sell. The forex market knows that the RBI can easily sell $50 billion to ward off speculative attacks,” said Bank of America Securities India economist Indranil Sen Gupta. He added that as a result, forex markets have avoided testing the rupee even as other currencies like Brazil, South Africa, Turkey, and Indonesia have come under pressure. | ||

| + | |||

| + | But banks say that high reserves does not mean that all is well on the external front. “The dollar bond yield on Indian credit is still higher than pre-Covid level. Yields have come down of late because of easing dollar liquidity, but they are still away from pre-Covid levels. The reason for the underperfor mance is how the macros are stacking up, plus uncertainty in respect of the infection and associated costs,” said DBS head (treasury) Ashhish Vaidya. “The positive is that there is a larger coverage of imports, which makes India less vulnerable. The corporate deleveraging also reduces the overall risk in the corporate sector,” said Vaidya. | ||

| + | |||

| + | Gupta said the collapse in oil prices has helped offset the outflows in foreign portfolios. India is the only country among the top five — in terms of forex reserves — to have a current account deficit. What this means is that unlike others where the reserves are an outcome of intervention aimed at preventing currency appreciation, India builds its reserves since a large part of the foreign inflows are liabilities that have to be repaid at some point. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|F | ||

| + | FOREIGN EXCHANGE RESERVES: INDIA]] | ||

| + | [[Category:India|F | ||

| + | FOREIGN EXCHANGE RESERVES: INDIA]] | ||

= Purchase of foreign exchange (by India)= | = Purchase of foreign exchange (by India)= | ||

Revision as of 11:19, 6 October 2020

This is a collection of articles archived for the excellence of their content. |

Contents |

Increases and decreases over the years

1950-1951 to 2013-2014: Foreign Exchange Reserves in India

|

Year (as at end-March) |

SDRs## |

Gold* |

Foreign Currency Assets* |

'Reserve 'Tranche Position (RTP) |

Total Reserve | |||||

|

Rs. in Crore |

USD Million |

Rs. in Crore |

USD Million |

Rs. In Crore |

USD Million |

Rs. in Crore |

USD Million |

Rs. in Crore |

USD Million | |

|

1950-51 |

- |

- |

118 |

247 |

911 |

1,914 |

- |

- |

1,029 |

2,161 |

|

1951-52 |

- |

- |

118 |

247 |

747 |

1,568 |

- |

- |

865 |

1,815 |

|

1952-53 |

- |

- |

118 |

247 |

763 |

1,603 |

- |

- |

881 |

1,850 |

|

1953-54 |

- |

- |

118 |

247 |

792 |

1,664 |

- |

- |

910 |

1,911 |

|

1954-55 |

- |

- |

118 |

247 |

774 |

1,626 |

- |

- |

892 |

1,873 |

|

1955-56 |

- |

- |

118 |

247 |

785 |

1,648 |

- |

- |

903 |

1,895 |

|

1956-57 |

- |

- |

118 |

247 |

563 |

1,184 |

- |

- |

681 |

1,431 |

|

1957-58 |

- |

- |

118 |

247 |

303 |

637 |

- |

- |

421 |

884 |

|

1958-59 |

- |

- |

118 |

247 |

261 |

548 |

- |

- |

379 |

795 |

|

1959-60 |

- |

- |

118 |

247 |

245 |

515 |

- |

- |

363 |

762 |

|

1960-61 |

- |

- |

118 |

247 |

186 |

390 |

- |

- |

304 |

637 |

|

1961-62 |

- |

- |

118 |

247 |

180 |

377 |

- |

- |

298 |

624 |

|

1962-63 |

- |

- |

118 |

247 |

177 |

372 |

- |

- |

295 |

619 |

|

1963-64 |

- |

- |

118 |

247 |

188 |

395 |

- |

- |

306 |

642 |

|

1964-65 |

- |

- |

134 |

281 |

116 |

243 |

- |

- |

250 |

524 |

|

1965-66 |

- |

- |

116 |

243 |

182 |

383 |

- |

- |

298 |

626 |

|

1966-67 |

- |

- |

183 |

243 |

296 |

395 |

- |

- |

479 |

638 |

|

1967-68 |

- |

- |

183 |

243 |

356 |

475 |

- |

- |

539 |

718 |

|

1968-69 |

- |

- |

183 |

243 |

394 |

526 |

- |

- |

577 |

769 |

|

1969-70 |

92 |

123 |

183 |

243 |

546 |

728 |

- |

- |

821 |

1,094 |

|

1970-71 |

112 |

148 |

183 |

243 |

438 |

584 |

- |

- |

733 |

975 |

|

1971-72 |

194 |

269 |

183 |

264 |

480 |

661 |

- |

- |

857 |

1,194 |

|

1972-73 |

226 |

297 |

183 |

293 |

479 |

629 |

- |

- |

888 |

1,219 |

|

1973-74 |

230 |

296 |

183 |

293 |

581 |

736 |

- |

- |

994 |

1,325 |

|

1974-75 |

229 |

293 |

183 |

304 |

610 |

782 |

- |

- |

1,022 |

1,379 |

|

1975-76 |

211 |

234 |

183 |

281 |

1,492 |

1,657 |

- |

- |

1,886 |

2,172 |

|

1976-77 |

192 |

217 |

188 |

290 |

2,863 |

3,240 |

- |

- |

3,243 |

3,747 |

|

1977-78 |

170 |

200 |

193 |

319 |

4,500 |

5,305 |

- |

- |

4,863 |

5,824 |

|

1978-79 |

381 |

470 |

220 |

377 |

5,220 |

6,421 |

- |

- |

5,821 |

7,268 |

|

1979-80 |

545 |

662 |

225 |

375 |

5,164 |

6,324 |

- |

- |

5,934 |

7,361 |

|

1980-81 |

497 |

603 |

226 |

370 |

4,822 |

5,850 |

- |

- |

5,545 |

6,823 |

|

1981-82 |

444 |

473 |

226 |

335 |

3,355 |

3,582 |

- |

- |

4,025 |

4,390 |

|

1982-83 |

291 |

291 |

226 |

324 |

4,265 |

4,281 |

- |

- |

4,782 |

4,896 |

|

1983-84 |

248 |

230 |

226 |

320 |

5,498 |

5,099 |

- |

- |

5,972 |

5,649 |

|

1984-85 |

181 |

145 |

246 |

325 |

6,817 |

5,482 |

- |

- |

7,243 |

5,952 |

|

1985-86 |

161 |

131 |

274 |

417 |

7,384 |

5,972 |

- |

- |

7,819 |

6,520 |

|

1986-87 |

232 |

179 |

274 |

471 |

7,645 |

5,924 |

- |

- |

8,151 |

6,574 |

|

1987-88 |

125 |

97 |

274 |

508 |

7,287 |

5,618 |

- |

- |

7,686 |

6,223 |

|

1988-89 |

161 |

103 |

274 |

473 |

6,605 |

4,226 |

- |

- |

7,040 |

4,802 |

|

1989-90 |

184 |

107 |

281 |

487 |

5,787 |

3,368 |

- |

- |

6,252 |

3,962 |

|

1990-91 |

200 |

102 |

6,828 |

3,496 |

4,388 |

2,236 |

- |

- |

11,416 |

5,834 |

|

1991-92 |

233 |

90 |

9,039 |

3,499 |

14,578 |

5,631 |

- |

- |

23,850 |

9,220 |

|

1992-93 |

55 |

18 |

10,549 |

3,380 |

20,140 |

6,434 |

- |

- |

30,744 |

9,832 |

|

1993-94 |

339 |

108 |

12,794 |

4,078 |

47,287 |

15,068 |

- |

- |

60,420 |

19,254 |

|

1994-95 |

23 |

7 |

13,752 |

4,370 |

66,005 |

20,809 |

- |

- |

79,780 |

25,186 |

|

1995-96 |

280 |

82 |

15,658 |

4,561 |

58,446 |

17,044 |

- |

- |

74,384 |

21,687 |

|

1996-97 |

7 |

2 |

14,557 |

4,054 |

80,368 |

22,367 |

- |

- |

94,932 |

26,423 |

|

1997-98 |

4 |

1 |

13,394 |

3,391 |

102,507 |

25,975 |

- |

- |

115,905 |

29,367 |

|

1998-99 |

34 |

8 |

12,559 |

2,960 |

125,412 |

29,522 |

- |

- |

138,005 |

32,490 |

|

1999-00 |

16 |

4 |

12,973 |

2,974 |

152,924 |

35,058 |

- |

- |

165,913 |

38,036 |

|

2000-01 |

11 |

2 |

12,711 |

2,725 |

184,482 |

39,554 |

- |

- |

197,204 |

42,281 |

|

2001-02 |

50 |

10 |

14,868 |

3,047 |

249,118 |

51,049 |

- |

- |

264,036 |

54,106 |

|

2002-03 |

19 |

4 |

16,785 |

3,534 |

341,476 |

71,890 |

3,190 |

672 |

361,470 |

76,100 |

|

2003-04 |

10 |

2 |

18,216 |

4,198 |

466,215 |

107,448 |

5,688 |

1,311 |

490,129 |

112,959 |

|

2004-05 |

20 |

5 |

19,686 |

4,500 |

593,121 |

135,571 |

6,289 |

1,438 |

619,116 |

141,514 |

|

2005-06 |

12 |

3 |

25,674 |

5,755 |

647,327 |

145,108 |

3,374 |

756 |

676,387 |

151,622 |

|

2006-07 |

8 |

2 |

29,573 |

6,784 |

836,597 |

191,924 |

2,044 |

469 |

868,222 |

199,179 |

|

2007-08 |

74 |

18 |

40,124 |

10,039 |

1,196,023 |

299,230 |

1,744 |

436 |

1,237,965 |

309,723 |

|

2008-09 |

6 |

1 |

48,793 |

9,577 |

1,230,066 |

241,426 |

5,000 |

981 |

1,283,865 |

251,985 |

|

2009-10 |

22,596 |

5,006 |

81,188 |

17,986 |

1,149,650 |

254,685 |

6,231 |

1,380 |

1,259,665 |

279,057 |

|

2010-11 |

20,401 |

4,569 |

102,572 |

22,972 |

1,224,883 |

274,330 |

13,158 |

2,947 |

1,361,013 |

304,818 |

|

2011-12 |

22,866 |

4,469 |

138,250 |

27,023 |

1,330,511 |

260,069 |

14,511 |

2,836 |

1,506,139 |

294,397 |

|

2012-13 |

23,538 |

4,328 |

139,737 |

25,692 |

1,412,631 |

259,726 |

12,513 |

2,301 |

1,588,418 |

292,047 |

|

2013-14 |

26,826 |

4,464 |

129,616 |

21,567 |

1,660,914 |

276,359 |

11,019 |

1,834 |

1,828,375 |

304,224 |

2011, Nov to 2018, Oct

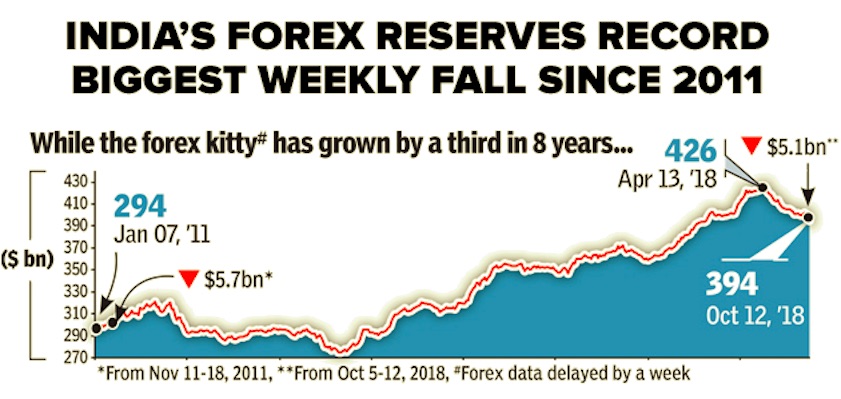

October 23, 2018: The Times of India

From: October 23, 2018: The Times of India

From: October 23, 2018: The Times of India

India’s forex reserves record biggest weekly fall since 2011

India’s foreign exchange reserves dropped by $5.1 billion to $394 billion in the seven days ended October 12, 2018, the biggest weekly decline since November 2011, as the RBI sold dollars to prop up Asia’s worst-performing currency. The rupee has declined for six straight months in a row, its longest losing streak since 2002.

RUPEE HAS DIVED 16% SINCE JAN

The rupee touched a record low of 74.39 on October 9, with a 16% plunge since Jan 1 this year, as rising oil prices fuelled concerns about a widening current account deficit & inflation amid a rout in emerging markets. On Monday, it closed at 73.56 against the dollar.

2012-16: India's foreign exchange reserves

See graphic:

India’s foreign exchange reserves, 2012-16, and comparison with Brazil, Russia, China, South Africa, South Korea and Thailand

2016, Aug: $365.5bn: the then record

Aug 06 2016 : PTI Forex kitty at all-time high of $365.5bn

Country's foreign exchange reserves rose by $2.8 billion to reach a life-time high of $365.5 billion in the week to July 29, helped by rise in foreign currency assets, the Reserve Bank said.

In the previous week, the reserves had dropped by $664 million to $362.7 billion.

Foreign currency assets (FCAs), a major component of the overall reserves, rose $2.8 billion to $341.04 billion in the reporting week, RBI data showed. FCAs, expressed in dollar terms, include the effect of appreciationdepreciation of non-US currencies such as euro, pound and yen held in the reserves.

Gold reserves remained unchanged at $20.6 billion.

The country's special drawing rights with International Monetary Fund increased by $8.5 million to $1.5 billion while the reserve position rose by $13.6 million to $2.4 billion, RBI said.

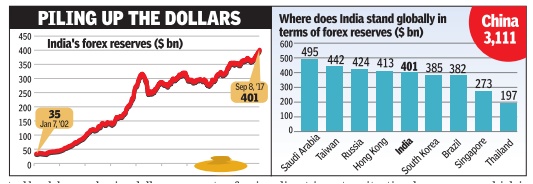

2017: $400bn mark touched for first time

Forex kitty hits $400bn for first time, Sep 16 2017: The Times of India

India's forex reserves crossed the $400-billion mark for the first time on Sep 15, 2017. The latest $100 billion has been added to the reserves in three and a half years after they crossed the $300-billion level on April 2014. At current level, the reserves are enough to fund more than a year of imports. In nominal terms, foreign exchange reserves have increased by $6.6 billion during the first quarter. The reserves have risen by $30 billion since Urjit Patel took charge as RBI governor in September 2016.

An increase in these reserves provides the RBI with ammunition to tackle volatility in the forex market. The forex reserves are built up by the central bank by purchasing dollars from banks. According to RBI data, the reserves -which comprise foreign currency assets (FCAs), gold and special drawing rights with the International Monetary Fund -stood at $400.7 as on September 8.

The highest contribution to the reserves has been from foreign portfolio investors.During the April-September quarter, foreign direct investment surged by $7.2 billion in the reporting period from $3.9 billion in the same period last year. Foreign institutional investment flows increased by $11.9 billion in the first quarter from $1.2 billion in the same period last year.

The central bank's buildup of reserves comes ahead of the US Federal Reserve exiting its stimulus -a move which is expected to result in funds moving back into US dollar assets. Accretion to reserves are expected to slow down with a widening of the current account deficit (CAD) and rising crude oil prices. Foreign institutional investors have pulled out $810 million from the equity market in September on the back of $1.7 billion in August.

2018, April 6: $424.9bn

Forex reserves at record high of $424.9bn, April 14, 2018: The Times of India

The country’s foreign exchange reserves rose by $503.6 million to touch a lifetime high of $424.9 billion in the week to April 6, aided by increase in foreign currency assets, the Reserve Bank said. In the previous week, the reserves had surged by $1.8 billion to $424.4 billion.

It had crossed the $400-billion mark for the first time in the week to September 8, 2017, but has since been fluctuating. In the reporting week, the foreign currency assets, a major component of the overall reserves, rose by $657.7 million to $399.8 billion.

Expressed in the US dollar terms, the foreign currency assets include the effect of appreciation or depreciation of the non-US currencies such as the euro, the pound and the yen held in the reserves.

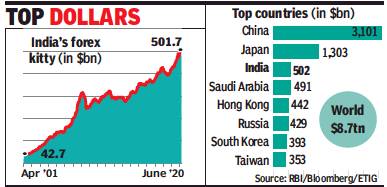

2020, June: $501.7 billion

Mayur Shetty, June 13, 2020: The Times of India

From: Mayur Shetty, June 13, 2020: The Times of India

The country’s forex reserves rose by $8.2 billion during the week ended June 5 to cross the half-a-trillion-dollar mark for the first time. Forex reserves rose to $501.7 billion from $493.5 billion a week earlier. The increase was due to an $8.4-billion jump in foreign currency assets to $463 billion. Of the other components of the reserves, the value of gold declined by $329 million to $3.2 billion, and reserve position in the International Monetary Fund rose by $832 million to $4.2 billion.

Bankers attributed the increase in reserves to dollar inflows arising out of deleveraging by Indian corporates. Reliance Industries has been selling large chunks of its holding in Jio Platforms to global investors and has received a commitment of Rs 97,885 crore. Bharati Telecom too raised $1 billion selling stake through a block deal. GSK sold $3.3 billion in Unilever. Bankers say that large deals, even the ones in local markets, end up drawing foreign investor interest.

“The RBI has been buying dollars since governor Shaktikanta Das took charge in 2018. With forex reserves, the more you have, the less the need to sell. The forex market knows that the RBI can easily sell $50 billion to ward off speculative attacks,” said Bank of America Securities India economist Indranil Sen Gupta. He added that as a result, forex markets have avoided testing the rupee even as other currencies like Brazil, South Africa, Turkey, and Indonesia have come under pressure.

But banks say that high reserves does not mean that all is well on the external front. “The dollar bond yield on Indian credit is still higher than pre-Covid level. Yields have come down of late because of easing dollar liquidity, but they are still away from pre-Covid levels. The reason for the underperfor mance is how the macros are stacking up, plus uncertainty in respect of the infection and associated costs,” said DBS head (treasury) Ashhish Vaidya. “The positive is that there is a larger coverage of imports, which makes India less vulnerable. The corporate deleveraging also reduces the overall risk in the corporate sector,” said Vaidya.

Gupta said the collapse in oil prices has helped offset the outflows in foreign portfolios. India is the only country among the top five — in terms of forex reserves — to have a current account deficit. What this means is that unlike others where the reserves are an outcome of intervention aimed at preventing currency appreciation, India builds its reserves since a large part of the foreign inflows are liabilities that have to be repaid at some point.

Purchase of foreign exchange (by India)

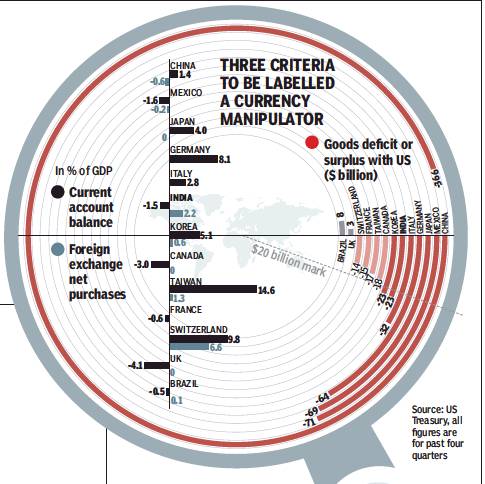

Why the US is keeping an eye on India’s exchange rate policies

Source: US Treasury, all figures are for past four quarters, April 23, 2018: The Times of India

From: Source: US Treasury, all figures are for past four quarters, April 23, 2018: The Times of India

From: Source: US Treasury, all figures are for past four quarters, April 23, 2018: The Times of India

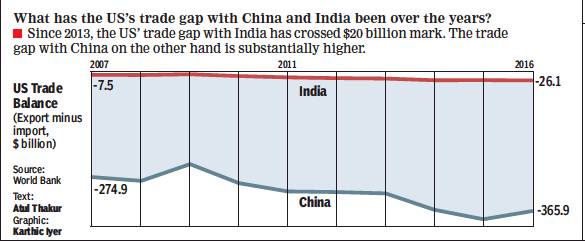

Why the US is keeping an eye on India’s exchange rate policies

Washington, DC, has placed New Delhi on its currency monitoring list — a group of nations the US believes could be manipulating exchange rates to gain an edge over it in trade. A look at how countries can find themselves on the watch list

What is the US’s currency watch list, in which India was recently included?

The American government’s treasury department maintains a monitoring list of exchange rate policies of their country’s big trading partners that fall short of meeting certain criteria laid down by their Trade Facilitation and Trade Enforcement Act of 2015, which came into force in 2016. This act requires it’s treasury to submit a biannual report on the macroeconomic and currency exchange rate policies of its top trading partners to the country’s parliament. In the recent report the treasury put India in the monitoring list. Apart from India, the recent monitoring list also includes China, Japan, South Korea, Germany and Switzerland.

What are the criteria?

The 2015 act has specified three criteria that have to be fulfilled simultaneously to identify currency manipulator countries among the US’s large trading partners. Firstly, there has to be more than $20 billion bilateral trade surplus with the US (the country’s exports to the US has to be at least $20 billion more than its imports). Secondly, the current account surplus (trade surplus, net income from foreign investment and net cash transfers) has to be at least 3% of its GDP. The last criteria states that a country’s net purchases of foreign currency conducted over a 12-month period are at least 2% of its GDP. Any country that fulfils at least two of these three criteria are put in the monitoring list. In India’s case, the first and third criteria are fulfilled. Once included in the list the country will remain there for at least two consecutive reports.

What role does exchange rate play in trade gap? What if a country fulfils all three criteria?

In this context currency manipulation typically means a country is artificially keeping its currency’s exchange rate lower when compared to the American dollar. A lower exchange rate will mean its products will become cheaper while American exports to the country will become expensive, which will further increase the trade gap and harm American companies. There is no immediate consequence even if a country is declared a currency manipulator. Once a country fulfils every criteria, the US treasury is supposed to resolve the problem through oneyear negotiation. If the negotiations fail then the US government could take retaliatory steps that include sanctions and involving the IMF.

Has the US ever declared any of its trading partners a currency manipulator?

Prior to the 2015 Act, currency manipulators were identified by the conditions of Omnibus Foreign Trade and Competitiveness Act of 1988. In 1988, US designated South Korea and Taiwan currency manipulators. The declaration initiated bilateral negotiations, after which both agreed to reform their exchange rate management, let their currency appreciate and got their names removed from the list. From 1992-1994 ,China was labelled a manipulator. The US agreed to resolve its dispute through WTO in 1994 and China was removed from the list. Since 1994 no country has been declared currency manipulator.

Purchase of foreign exchange (by India)

USA found India’s $56 billion purchase in 2017 ‘unnecessary’

April 15, 2018: The Times of India

The US has added India to the currency practices and macroeconomic policies monitoring list, saying New Delhi increased its purchase of foreign exchange over the first three quarters of 2017 which does not appear necessary. India is the sixth addition to the watch list which comprises China, Japan, South Korea, Germany and Switzerland. “India increased its purchase of foreign exchange over the first three quarters of 2017. Despite a sharp drop-off in purchase in the fourth quarter, net annual purchase of foreign exchange reached $56 billion in 2017, equivalent to 2.2% of the GDP,” the US department of the treasury said. The pick-up in purchases came amidst relatively strong foreign inflows it said. “Given that Indian foreign exchange reserves are ample by common metrics, and that India maintains some controls on inbound and outbound flows of private capital, further reserve accumulation does not appear necessary,” it said.

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India