Private equity investments/ Venture Capital Funding in India

(→See also) |

(→2018> 2019 Feb) |

||

| Line 100: | Line 100: | ||

Sequoia Capital’s open market stake sale in Ujjivan Financial Services worth $17 million, and SaaS startup Indix’s acquisition by US-based Avalara were a few significant exits. Among internet and digital enterprises, foodtech unicorn Zomato’s raise of $40 million in a round led by US-based Glade Brook Capital, $35 million raised by logistics tech startup Rivigo from Warburg Pincus and SAIF Partners, and $9.8-million funding by VC firm A91 Partners in beauty ecommerce entity Sugar Cosmetics were a few top deals. | Sequoia Capital’s open market stake sale in Ujjivan Financial Services worth $17 million, and SaaS startup Indix’s acquisition by US-based Avalara were a few significant exits. Among internet and digital enterprises, foodtech unicorn Zomato’s raise of $40 million in a round led by US-based Glade Brook Capital, $35 million raised by logistics tech startup Rivigo from Warburg Pincus and SAIF Partners, and $9.8-million funding by VC firm A91 Partners in beauty ecommerce entity Sugar Cosmetics were a few top deals. | ||

| + | |||

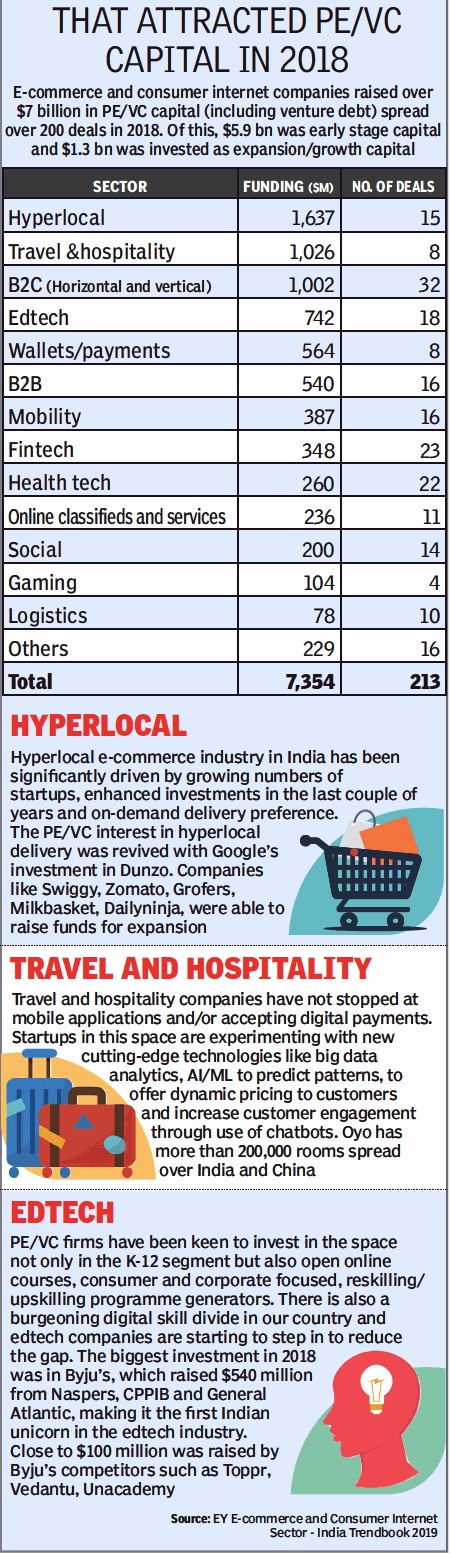

| + | ===Sector-wise=== | ||

| + | [[File: Major sectors that attracted PE, VC capital in 2018.jpg|Major sectors that attracted PE, VC capital in 2018 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F03%2F17&entity=Ar01909&sk=617AA107&mode=image March 17, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''Major sectors that attracted PE, VC capital in 2018'' | ||

=Returns on exited investments= | =Returns on exited investments= | ||

Revision as of 21:57, 17 March 2019

This is a collection of articles archived for the excellence of their content. |

Contents |

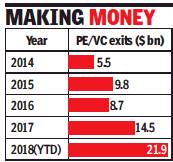

Exit of private equity/venture capital (PE/VC)

2014-18

From: Aparna Desikan, At $22bn, 2018 sees most exits by PE/VCs till date, September 8, 2018: The Times of India

Calender 2018 is turning out to be the biggest year for private equity/venture capital (PE/VC) exits. Driven by the Walmart-Flipkart deal, the year has so far seen nearly $22 billion worth of exits till date through more than 160 deals, according to data from research firm Venture Intelligence. While 2017 saw $14.5 billion for the whole year, previous years saw less than $10 billion.

Analysts point out that while the Flipkart deal contributed to a chunk of the deal size in terms of value, the mood among investors also favours exits. “IPOs, M&A exits and acqui-hires have contributed to the 165 deals so far. Among IPOs, the engineering firm Varroc went public where Tata Capital sold its entire stake in the company. AU finance saw Kedaara Capital and Warburg making a partial exit,” said Venture Intelligence MD Arun Natarajan.

With unicorns raising funds and consequently giving exits to smaller investors, there is an emergence of funds such as TR Capital and Madisson that concentrate mainly on secondary investments, paving the way for more exits. Fashion e-commerce player Nykaa saw TVS Capital sell its stake to Lighthouse Ventures in a Rs 113-crore deal and edtech startup Unacademy gave an exit with 150% internal returns to Waterbridge, which had invested $1 million in 2016.

Prime Venture Partners managing partner Sanjay Swamy said, “Additionally, investors from China and Japan entering the scene have increased the scope for early stage investors to see greater returns.”

And it is not just secondary and strategic investors that give profitable exits. Mature startups that acquire stakes for inorganic growth also have a role to play. Natarajan added even as exits remain on the higher side, the sentiment would be dependent on the behaviour of the Indian rupee and the public markets.

2009-17

Investment intensity in India and other emerging markets, 2009-17

From: December 2, 2018: The Times of India

See graphic:

Private equity growth, 2009-17, presumably in India

Investment intensity in India and other emerging markets, 2009-17

Private equity investments in India

2003-17

From: November 25, 2018: The Times of India

See graphic:

Private equity investments in India, 2003-17

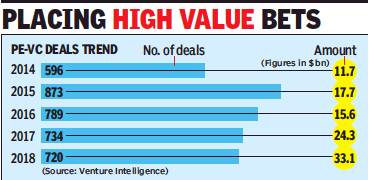

2014-18: Private equity-VC investments in India

From: Sindhu Hariharan, PE-VC fundings close ’18 at record high of $33bn, January 2, 2018: The Times of India

See graphic:

Private equity-VC investments in India, 2014-18

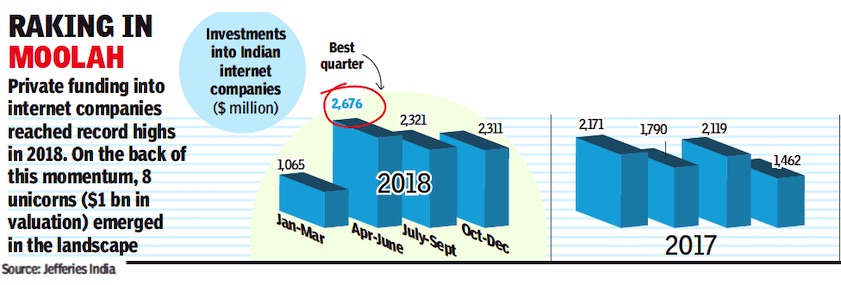

2015-18: Funding internet companies

From: January 12, 2019: The Times of India

From: January 12, 2019: The Times of India

See graphics:

Private investments into internet companies in India, 2015-16

Private investments into internet companies in India, 2017-18

2018

From: July 16, 2019: The Hindu

From: July 16, 2019: The Hindu

Indian startups ended 2018 at an all-time high, as total value of Private Equity (PE) and Venture Capital (VC) investments in 2018 clocked a record amount of $33 billion.

Data from research firm Venture Intelligence showed a 36% increase in PE-VC investments during 2018 across 720 deals, compared to $24.3 billion invested across 734 deals in 2017. The country’s startup ecosystem entered a state of maturity in 2018 as investors were more selective with deals, but made higher value bets. There were 81 investments valued at $100 million or more in 2018, making up 77% of the total value. This tally stood at just 47 transactions in 2017. Among these 81 deals, 40 were larger than $200 million each, compared to just 30 such investments in the year-ago period, according to Venture Intelligence data.

The eventful year also saw eight startups across the B2C and B2B sectors — such as Oyo, PolicyBazaar, Swiggy, Byjus, BillDesk, Freshworks and others — enter the elite unicorn club. While historically, deal announcements are subdued at the year-end, Venture Intelligence data showed that December 2018 alone saw 43 deals valued at $3.2 billion, almost double the value of investments raised in the same period last year.

“The midyear Walmart-Flipkart deal clearly re-energised international investors’ appetite for mega bets in Indian internet and mobile companies,” Ärun Natarajan, founder, Venture Intelligence, said. “This has helped offset slowdown in investments in sectors like financial services, manufacturing and infrastructure towards the year end triggered by nervousness in the public markets and the IL&FS scare,” he added.

The year brought about an inflection point for the PE-VC industry in terms of exits as well. Value of exits achieved by investors during the year stood at $25.4 billion- a 78% increase from the exits clocked in 2017.

In line with previous years, IT and IT-enabled services companies accounted for close to 33% of the investment pie, thanks to Swiggy’s $1 billion raise in December from Naspers and others, and Oyo closing a $1 billion raise from SoftBank Vision Fund and others.

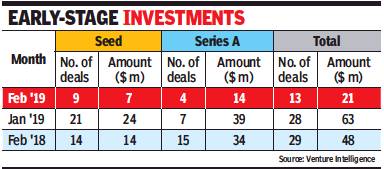

2018> 2019 Feb

Sindhu Hariharan, PE, VC funding up 14% on big-ticket push, March 5, 2019: The Times of India

From: Sindhu Hariharan, PE, VC funding up 14% on big-ticket push, March 5, 2019: The Times of India

Big-ticket deals in energy and infrastructure helped private investments hold their ground in February despite volatility in public markets, even as early-stage investments continued to lag.

Private equity (PE) and venture capital (VC) investments grew 14% in February to $1.96 billion worth of transactions across 38 deals, data from research firm Venture Intelligence said. Sequentially, PE-VC deals amounted to $1.71 billion from 56 deals in the previous month of January. High-value growth capital infusion in Greenko Energy, Aadhar Housing Finance, Ayana Renewable Power and others helped increase the investment value by 40% compared to February 2018, even as deal count fell 38% from the 62 investments recorded in the year-ago period.

“Private investments in February emerged as a positive ‘surprise’ given the volatility in the public markets,” Venture Intelligence founder Arun Natarajan said. “It is nice to see significant PE investments go into the energy and infrastructure space as we get closer to the elections.” Hyderabad-based energy firm Greenko Group picked up $550 million from sovereign funds GIC Holdings of Singapore and UAE’s Abu Dhabi Investment Authority (ADIA). Blackstone’s investment of close to $385 million in Aadhar Housing Finance, giving the PE firm 100% stake in the NBFC, also aided total growth.

Early-stage startups, however, continued to feel the pinch, as total value of seed and series-A investments declined 56% from the same month last year, and deal counts almost halved. Nine seed-stage deals and four series-A investments of $7 million and $14 million, respectively, were recorded in February.

Regulatory hurdles such as the angel tax and the overall investment climate among the angel investment community continues to impact seed and early-stage capital flow, Natarajan said. “Bigger, but fewer cheques being written for both startups and scale-ups indicates investors are getting more selective,” he added.

AI legal startup SpotDraft’s seed funding of $1.5 million from 021 Capital and other angels, and $4.5 million in series-A round raised by banking tech startup Open Financial Technologies from Beenext, 3ONE4 Capital and others were some of the top early-stage deals. Others in this segment included a $1-million pre-series-A round raised by fintech startup HomeCapital from Astarc Ventures and others.

Sequoia Capital’s open market stake sale in Ujjivan Financial Services worth $17 million, and SaaS startup Indix’s acquisition by US-based Avalara were a few significant exits. Among internet and digital enterprises, foodtech unicorn Zomato’s raise of $40 million in a round led by US-based Glade Brook Capital, $35 million raised by logistics tech startup Rivigo from Warburg Pincus and SAIF Partners, and $9.8-million funding by VC firm A91 Partners in beauty ecommerce entity Sugar Cosmetics were a few top deals.

Sector-wise

From: March 17, 2019: The Times of India

See graphic:

Major sectors that attracted PE, VC capital in 2018

Returns on exited investments

8% in 2006–2008; 22% in 2012–2014

Sindhu Hariharan, PEs’ returns jump to 22% from 8% in 5 yrs, December 4, 2018: The Times of India

From: Sindhu Hariharan, PEs’ returns jump to 22% from 8% in 5 yrs, December 4, 2018: The Times of India

Buyout Deals Most Rewarding, Finds Study

As optimism grows about the Indian alternate investment landscape, the country’s private equity (PE) industry is getting more rewarding for investors, a report has said. More specifically, PE investments in the last five years have fetched higher returns than ones made earlier.

“Average returns on exited investments have risen from 8% from the 2006–2008 vintage to 22% in the 2012–2014 vintage,” says the ‘Indian Private Equity: Coming Of Age’ report by McKinsey, which analyses a dollar internal rate of return (IRR) for a sample of 654 PE exits between 2003 and 2017.

The report also notes that buyout strategies (a deal in which majority ownership is acquired) earned the best returns for PE players with median returns at 21%. “Several private equity firms shifted focus from minority positions to buyouts, where they have greater control of strategy and talent as well as influence on the manner and timing of exits,” the report says. From 2015 to 2017, almost a quarter of total PE investments were in buyouts — up sevenfold in value from the 2009-2011 period.

Consumer goods, financial services, healthcare, IT/BPO, machinery & industrials and telecom collectively accounted for 83% of total PE investment from 2015 to 2017, compared to 44% share during the 2009-2011 period. Sectors that contributed the most to improving returns were financial services, consumer goods and machinery products as median returns in these were in the 15-21% range, with telecom pulling down performance for PE investors by recording a 3% median IRR.

The study also observes a trend of out-performance among companies backed by PE capital. In a reinforcement of the industry’s hunt for “alpha” ventures, the report says businesses with PE backing grew faster than industry averages, raising revenue and profit on an average 27% faster than their peers.

EY India partner and national leader for PE services, Vivek Soni, believes there is a high degree of correlation between fund managers closing follow-on funds and industry performance. “Those general partners (GPs) that are able to deliver returns will find it easier to raise follow-on funds, and this along with increasing numbers of total funds under management with GPs is an indication of improving returns,” he says.

“The growing pace of exits in the last few years with sustained growth is a big positive as Limited Partners previously cited the lack of exits as perhaps the biggest issue faced by them when investing into India,” says IVCA chairman and Tata Opportunities Fund managing partner Padmanabh Sinha. “The fact that exits are being achieved through a balanced mix of capital markets, strategic sales and sales to financial sponsors is also reassuring the availability of multiple exit options,” he adds.

For instance, industry watchers see recent exits’ track record of PE firms like Chrys Capital and Kedaara Capital as indicators of improving performance. Further, a fund-raise of around $600 million by True North Capital (one of the country’s earliest homegrown PE funds) for its latest Fund VI also supports the trend.

However, accessing performance data on PE and VC funds continues to be a challenge as regulations on disclosing returns are not too well developed. EY’s Soni considers the space to be “evolving” in that aspect, and says the trait of “survivor bias” currently characterising the space could change as the market matures.

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India

Foreign Portfolio Investors (FPI): India

Private equity investments in India, this page includes statistics that club PE/ VC capital together