Rich List: India

2007-08: Top taxpayers

City Resident Ranks No. 1 With Rs 121cr; Ambani Bros Not In Top 200

Maya, SRK among top taxpayers

Pradeep Thakur | From the Archives of ‘‘The Times of India’’: 2008 August 3, 2008 2008

New Delhi: Mayawati is the top taxpayer among politicians and, in fact, ranks among the 20 top taxpayers in the country. In 2007-08, the Dalit leader shelled out Rs 26.26 crore as income tax, according to the I-T department’s compilation of the top 200 taxpayers’ list.

And King Khan is the top taxpayer among actors. Placed at No. 13, five slots higher than Mayawati, Shah Rukh paid Rs 34.2 crore as income tax in 2007-08. The next actor who is cited among taxpaying notables is Akshay Kumar, who ranks at No. 40 in the list, and paid Rs 13.5 crore as tax.

Sachin Tendulkar is the only cricketer to figure in the top-200 list. He coughed up Rs 8.8 crore as tax, reinforcing the belief that he earns way more than other cricketers as the country’s top sporting brand. Placed 81 in the top-200, Sachin is just ahead of industrialist Kumarmangalam Birla who paid just Rs 48,271 less than the master blaster.

Talking of industrialists, conspicuous by their absence in the top-200 list are the Ambani brothers, Mukesh and Anil. Their mother, Kokilaben, barely makes it to the list at 195, having paid Rs 4.46 crore as tax. The top taxpayer among industrialists is Max’s Analjit Singh who is No. 15 in the list having paid Rs 31.49 crore as tax.

Otherwise, the top taxpayers of the country are not public figures, but obviously guys rolling in the stuff. The country’s top taxpayer is from Delhi who forked out Rs 121 crore as income tax. In the top-10, five are from Mumbai and two from Delhi. Income-tax officials requested TOI not to make public identities of top taxpayers as they are not protected by their celebrity status, and often attract the attention of extortionists.

Coming back to Mayawati, her income, year after year, ostensibly comes from ‘‘gifts’’ from her admirers. Having paid a tax of Rs 26 crore, her personal income this year is estimated in the region of Rs 75-80 crore.

Salman, Ash among top-200 taxpayers

New Delhi: It may be recalled that Mayawati faces a CBI case for holding assets disproportionate to her known income.

The other interesting names featuring in this year’s list of top-200 taxpayers are, cardio-surgeon Naresh Trehan (Rs 8.4 crore), actor Salman Khan (Rs 7 crore), stamp-paper scamster Abdul Telgi (Rs 6.5 crore), Sanjay Dutt (Rs 5.8 crore), Aishwarya Rai (Rs 5.6 crore), Abhishek Bachchan (who paid just Rs 75,192 less than his wife), industrialist Nandan Nilekani (Rs 5.16 crore), music director-singer Himesh Reshammiya (Rs 4.89 crore), top lawyer Mukul Rohtagi (rs 4.85 crore), actor Aamir Khan (Rs 4.72 crore) and Wipro boss Azim Premji (Rs 4.68 crore).

2013:Indian millionaire households: no.15

India ranks 15th on global wealth list

New York PTI Jun 11 2014

According to Boston Consulting Group's report, India had 175,000 millionaire households in 2013 and is projected to become the seventh wealthiest nation by 2018

India had 175,000 millionaire households in 2013, ranking 15th in the world, according to a wealth report which said the total number of millionaire households in the world rose to 16.3 million last year.

The Boston Consulting Group’s 14th annual report on the global wealth-management industry ‘Riding a Wave of Growth: Global Wealth 2014’ said global private financial wealth grew by 14.6% in 2013 to reach a total of $152 trillion.

The rise was stronger than in 2012, when global wealth grew by 8.7%. The key drivers, for the second consecutive year, were the performance of equity markets.

India ranked 15th last year and had 175,000 millionaire households. Its position improved slightly from 2012 when it had ranked 16 in the world for its number of millionaire households.

India is projected to become the seventh wealthiest nation by 2018. The number of ultra-high-net-worth households in India, those with $100 million or more, stood at 284 last year.

The total number of millionaire households reached 16.3 million in 2013, up strongly from 13.7 million in 2012 and representing 1.1% of all households globally.

2014, Feb: The Hurun Global Rich List 2014 and India

Highlights

i) India ranks #5 on the Global Rich List with 89 billionaires.

ii) The cumulative worth of Indian billionaires is INR17,33,400 Cr.

iii) Mukesh Ambani of Reliance Industries continues to be the richest Indian with a net worth of INR1,11,800 Cr.

iv) Savitri Jindal, 64 of Jindal Steel and Power is the richest woman in India.

v) Glenn Saldana of Glenmark Pharaceuticals and Nirav Modi of Firestar International are the youngest Indian billionaires at 44.

vi) 15 Indian billionaires now reside outside of India, making India the top country to emigrate out of, followed by US billionaires, several of whom have moved out for tax reasons.

vii) Nepal was the only other South Asian country to find a place on this list of 'dollow billionaires.'

viii) USA And China Dominate with 481 And 358 Billionaires Respectively, Making Up Half The Hurun List. Russia, Uk And India Follow.

ix) US Most Attractive Country For Immigrant Billionaires with 42. China And India Top Countries Producing Billionaires, Which Have Migrated Out, With 99 And 15 Respectively.

Details

On 25 February 2014 Hurun Report today released in Beijing, China the Hurun Global Rich List 2014, a ranking of the US dollar billionaires currently found in the world. Wealth calculations are a snapshot of 17 January 2014. These are the notes on billionaires from India and should be used in context with the Hurun Global Rich List 2014. For any discrepancies in these notes with the Global Rich List, the Global Rich List should prevail.

India ranks #5 on the Global Rich List with 89 billionaires, of which 70 currently reside in India while the rest have migrated to other countries. The billionaire’s considered for the list include those who currently reside in India or are of Indian origin. The cumulative worth of Indian billionaires is INR17,33,400 Cr. The average net worth of India’s richest is INR18,600 Cr; INR6,200 Cr less than the global average. The preferred sectors are manufacturing, TMT and real estate. The sector that rewarded its investors the most was pharma which saw the billionaires invested in it increase their wealth by an average 25%. The average age of the India’s billionaires at 65 is one year older than the average age of the global billionaires. It is very interesting to note that 60% of India’s billionaires are self made.

Mukesh Ambani continues his reign as the richest person in India with a net worth of INR1,11,800 Cr, despite going through a relatively bad year with Reliance Industries stock falling 5% ,combined with rupee depreciating. His wealth came down by INR18,600 Cr in comparison to last year. He dropped 14 positions in the Hurun Global Rich List coming down from #27 to #41.

Lakshmi N Mittal retains his number two position with a net worth of INR1,05,600 Cr. He slipped 13 positions and is currently the 49th richest person in the world. His stock in ArcelorMittal dropped 6% bringing down his wealth by INR6,200 Cr. Lakshmi Mittal is one of the few billionaires who is featured on the top three position of two separate country rich lists - UK and India. Though currently residing in UK, Mittal is of Indian origin therefore shows up as the second richest man in India as well.

Dilip Sanghvi of Sun Pharma had a good year with Sun Pharma stocks going up by 52%. His wealth saw an increase of INR31,100 Cr making him the third richest in India with a personal wealth of INR83,900 Cr along with Azim Premji of Wipro.

Savitri Jindal, 64 of Jindal Steel and Power is the richest woman in India with a net worth of INR32,900 Cr followed by Indu Jain of Bennett Coleman with INR14,300 Cr and Malika Srinivasan of Tafe, who is a new entrant to the list with a net worth of INR6,800 Cr, taking the number of Indian women in the Global Rich List to three.

Glenn Saldana(INR8,100 Cr, rank 1459) of Glenmark Pharmaceuticals at 44 years of age ties for the position of youngest Indian billionaire on the list with Nirav Modi(INR6,200 Cr, rank 1752) of Firestar International, a world famous name in the diamond jewellery industry.

Brijmohan Lall Munjal & Family of Hero MotoCorp is the oldest Indian billionaire at 91 years with a net worth of INR23,600 Cr ,ranking 437 in the world.

There are 25 notable newcomers to the list led by Rishad Nawroji of Godrej with a net worth of INR13,000 Cr, rank 901.

The report said that during the past year the Indian rupee weakened 12 per cent against the US dollar, making it harder for Indians to make the cut-off.

Despite the currency fluctuations, India has improved its position over last year. In the 2014 Hurun global rich list, the country is ranked fifth with 70 billionaires, 17 more than 2013.

Ukrainian-born Leonard Blavatnik and India-born Lakshmi Mittal are the richest people living in the UK.

India: Up one place to No 5 with 70 billionaires, 17 more than 2013. Manufacturing, pharma and TMT are the preferred sectors with 17, 12 and 10 billionaires respectively. Combined wealth of the Indians billionaires comes to US$390bn. Mumbai is headquarters to most of the Indian billionaires.

Mukesh Ambani (US$18bn, rank 41) is the richest Indian. 15 Indians live outside of India, the highest proportion of any country. This past year, the Indian Rupee weakened by 12% against the US Dollar, making it harder for Indians to make the cut-off.

The US has the most number of TMT [Technology, Media and Telecoms] billionaires, followed by China. It is interesting to note that a technology hub like India does not have a TMT billionaire on the Hurun Global Rich List 2014.

Best Performing Industries by Country:

Country | Best performing Industry |Average growth of billionaires for that industry in that country

India | Airlines | 55%

Currency fluctuations against the US Dollar –

Country | % Drop in Currency Vs the US Dollar |Change in average wealth of billionaires from each country

India | 11% | -12%

The Indian rupee was the eighth worst performer among the countries that have dollar billionaires

The seven major countries whose currencies depreciated more than India’s were: Argentina 25%, Indonesia 20% ,Turkey 19%, South Africa 18%, Australia 15%, Japan 15% and Brazil 15%.

The vast majority of India’s billionaires are self-made

60% of India’s billionaires are self-made. Among the notables are Lakshmi N Mittal of ArcelorMittal, Shiv Nadar of HCL Technologie, Sunil Mittal of Bharti Airtel and Dr. Cyrus S Poonawala of Serum Institute. It is worth noting that Dr. Poonawala’s privately held Serum Institute generates profits in excess of IN1,700 Cr annually, sells world’s cheapest vaccines. Were his vaccines to be marked up to market prices his contribution to philanthropy would be quite significant.

The biggest gainers of 2014 amongst Indians in the rich list are Dilip Sanghvi and Shiv Nadar, each adding INR31,100 Cr to their wealth from 2013. Shiv Nadar’s HCL Technologies has gone up in excess of 100% in the past year. KP Singh of DLF has recorded the biggest loss of wealth having lost INR18,600 Cr owing to a 48% drop in the stock prices of DLF bringing him down from #236 to #412 in the Global Rich List.

Of India’s 89 billionaires 61 have their wealth associated with publicly traded companies while 28 are still privately held.

2014: The complete Hurun Rich list of Indian billionaires

|

India Rank |

Global Rank |

Name |

Net worth INR Cr |

Net worth USD Bn |

% Change in USD net worth |

Source |

Country of Residence |

Brought up country |

|

1 |

41↓ |

Mukesh Ambani |

1,11,800 |

18 |

-12.2% |

Reliance Industries |

India |

India |

|

2 |

49↓ |

Lakshmi N Mittal |

1,05,600 |

17 |

-5.6% |

ArcelorMittal |

UK |

India |

|

3 |

77↑ |

Dilip Shanghvi |

83,900 |

14 |

53.4% |

Sun Pharma |

India |

India |

|

3 |

77↑ |

Azim Premji |

83,900 |

14 |

28.6% |

Wipro |

India |

India |

|

5 |

93↑ |

Pallonji Mistry |

74,600 |

12 |

53.8% |

Tata Sons |

India |

India |

|

5 |

93↓ |

SP Hinduja & family |

74,600 |

12 |

-7.7% |

Hinduja Group |

UK |

|

|

7 |

105↑ |

Shiv Nadar |

68,300 |

11 |

71.9% |

Hcl |

India |

India |

|

8 |

170↓ |

Kumar Birla |

47,200 |

8 |

0.0% |

Aditya Birla |

India |

India |

|

9 |

202↓ |

Sunil Mittal & family |

42,200 |

7 |

-16.0% |

Bharti Airtel |

India |

India |

|

10 |

223↓ |

Anil Ambani |

39,800 |

6 |

12.3% |

Reliance Capital |

India |

India |

|

11 |

261↑ |

Dr Cyrus S Poonawalla |

34,800 |

6 |

124.0% |

Serum Institute |

India |

India |

|

12 |

281↓ |

Savitri Jindal & family |

32,900 |

5 |

-15.9% |

Jindal Steel & Power |

India |

India |

|

13 |

290↑ |

Micky Jagtiani |

32,300 |

5 |

26.8% |

Landmark Group |

UAE |

India |

|

14 |

307* |

David Reuben |

31,100 |

5 |

11.1% |

Global Switch |

UK |

India |

|

14 |

307* |

Simon Reuben |

31,100 |

5 |

11.1% |

Global Switch |

UK |

India |

|

16 |

356↓ |

Uday Kotak |

28,000 |

5 |

4.7% |

Kotak Mahindra |

India |

India |

|

17 |

392* |

Jamshyd Godrej |

26,100 |

4 |

50.0% |

Godrej |

India |

|

|

17 |

392↓ |

Adi Godrej |

26,100 |

4 |

-39.1% |

Godrej |

India |

India |

|

19 |

412↓ |

KP Singh |

24,900 |

4 |

-39.4% |

DLF |

India |

India |

|

20 |

437↓ |

Brijmohan Lall Munjal & family |

23,600 |

4 |

5.6% |

Hero Moto Corp |

India |

Pakistan |

|

20 |

437↓ |

Gautam Adani |

23,600 |

4 |

-9.5% |

Adani Enterprise |

India |

India |

|

22 |

514↑ |

Desh Bandhu Gupta |

20,500 |

3 |

37.5% |

Lupin |

India |

|

|

23 |

569↓ |

Rahul Bajaj |

18,600 |

3 |

-14.3% |

Bajaj Auto |

India |

India |

|

24 |

623* |

Ravi Ruia |

17,400 |

3 |

-31.7% |

Essar |

India |

|

|

24 |

623* |

Shashi Ruia |

17,400 |

3 |

-31.7% |

Essar |

India |

|

|

24 |

623↓ |

Subhash Chandra |

17,400 |

3 |

-9.7% |

Zee Entertainment |

India |

India |

|

27 |

652↓ |

Anil Agarwal |

16,800 |

3 |

-12.9% |

Vedanta Resource |

UK |

India |

|

28 |

717↑ |

Prakash Lohia |

15,500 |

3 |

92.3% |

Indorama Ventures |

UK |

India |

|

28 |

717↓ |

Romesh T Wadhwani |

15,500 |

3 |

8.7% |

Symphony Technology |

USA |

India |

|

30 |

761↓ |

Pankaj Patel |

14,900 |

2 |

-7.7% |

Cadila Healthcare |

India |

India |

|

31 |

796↑ |

Indu Jain |

14,300 |

2 |

43.8% |

Bennett Coleman |

India |

|

|

31 |

796↓ |

Ajay Kalsi |

14,300 |

2 |

9.5% |

Indus Gas |

India |

India |

|

31 |

796↓ |

Yusuf Hamied |

14,300 |

2 |

0.0% |

Cipla |

India |

India |

|

31 |

796↓ |

Kalanithi Maran |

14,300 |

2 |

-23.3% |

Sun Network |

India |

India |

|

35 |

853↓ |

Kavitark Ram Shriram |

13,700 |

2 |

-21.4% |

|

USA |

India |

|

36 |

901* |

Rishad Naoroji |

13,000 |

2 |

New |

Godrej |

India |

India |

|

36 |

901↓ |

Malvinder & Shivinder Singh |

13,000 |

2 |

-8.7% |

Fortis Healthcare |

India |

|

|

38 |

954* |

GV Prasad |

12,400 |

2 |

25.0% |

Reddy's Lab |

India |

India |

|

38 |

954↓ |

MA Yousuf Ali |

12,400 |

2 |

5.3% |

Emke Group Of Companies |

UAE |

India |

|

40 |

1056* |

Madhukar Parekh |

11,200 |

2 |

12.5% |

Pidilite |

India |

|

|

40 |

1056↑ |

Vinod Khosla |

11,200 |

2 |

80.0% |

Khosla Ventures |

USA |

India |

|

40 |

1056↓ |

N R Narayan Murthy |

11,200 |

2 |

20.0% |

Infosys |

India |

India |

|

40 |

1056↓ |

Benu Gopal Bangur |

11,200 |

2 |

0.0% |

Shree Cement |

India |

India |

|

40 |

1056↓ |

Rajan Raheja |

11,200 |

2 |

-10.0% |

Hathway Cable |

India |

India |

|

40 |

1056↓ |

Venugopal Dhoot |

11,200 |

2 |

-30.8% |

Videocon |

India |

India |

|

46 |

1137↑ |

Kapil & Rahul Bhatia |

10,600 |

2 |

54.5% |

Indigo |

India |

India |

|

47 |

1209* |

Ravi Pillai |

9,900 |

2 |

New |

Ravi Pillai Group |

UAE |

India |

|

47 |

1209* |

Sudhir & Samir Mehta |

9,900 |

2 |

New |

Torrent Group |

India |

India |

|

47 |

1209↓ |

Manoj Bhargava |

9,900 |

2 |

14.3% |

5 Hour Energy |

USA |

USA |

|

47 |

1209↓ |

Murali Divi |

9,900 |

2 |

14.3% |

Divi's Lab |

India |

|

|

47 |

1209↓ |

Ajay Piramal |

9,900 |

2 |

0.0% |

Piramal Enterprise |

India |

India |

|

47 |

1209↓ |

Ashwin Dani |

9,900 |

2 |

0.0% |

Asian Paints |

India |

|

|

53 |

1282* |

Suhail Rizvi |

9,300 |

2 |

New |

Rizvi Traverse Capital |

USA |

USA |

|

53 |

1282* |

Sunny Varkey |

9,300 |

2 |

New |

Gems Education |

UAE |

UAE |

|

53 |

1282* |

Swraj Paul |

9,300 |

2 |

New |

Caparo Group |

UK |

India |

|

53 |

1282↓ |

Nandan Nilekani |

9,300 |

2 |

15.4% |

Infosys |

India |

India |

|

57 |

1379* |

Vijay Chauhan |

8,700 |

1 |

New |

Parle Products |

India |

India |

|

57 |

1379↓ |

Senapathy Gopalakrihsnan |

8,700 |

1 |

7.7% |

Infosys |

India |

India |

|

57 |

1379↓ |

Brij Bhushan Singal |

8,700 |

1 |

0.0% |

Bhushan Steel |

India |

|

|

60 |

1458* |

Baba Kalyani |

8,100 |

1 |

New |

Bharat Forge |

India |

India |

|

60 |

1458* |

Samprada Singh |

8,100 |

1 |

New |

Alkem Laboratories |

India |

India |

|

60 |

1458* |

TS Kalyanaraman |

8,100 |

1 |

New |

Kalyan Jewellery |

India |

India |

|

60 |

1458* |

Vikram Lal |

8,100 |

1 |

New |

Eicher |

India |

|

|

60 |

1458↓ |

G M Rao |

8,100 |

1 |

18.2% |

GMR |

India |

India |

|

60 |

1458↓ |

Glenn Saldanha |

8,100 |

1 |

8.3% |

Glenmark Pharmaceuticals |

India |

|

|

60 |

1458↓ |

Harsh Mariwala |

8,100 |

1 |

-7.1% |

Marico |

India |

|

|

67 |

1540* |

Bhupendra Kumar Modi |

7,500 |

1 |

New |

Spice Group |

Singapore |

India |

|

67 |

1540* |

Ravi Jaipuria |

7,500 |

1 |

New |

RJ corp |

India |

India |

|

67 |

1540↓ |

Ashwin Choksi |

7,500 |

1 |

0.0% |

Asian Paints |

India |

|

|

67 |

1540↓ |

Gautam Thapar |

7,500 |

1 |

0.0% |

Crompton Greaves |

India |

India |

|

71 |

1641* |

B.R.Shetty |

6,800 |

1 |

New |

NMC Group |

UAE |

India |

|

71 |

1641* |

Lachman Das Mittal |

6,800 |

1 |

New |

Sonalika Group |

India |

Pakistan |

|

71 |

1641* |

Mallika Srinivasan |

6,800 |

1 |

New |

TAFE |

India |

India |

|

71 |

1641* |

Mangal Prabhat Lodha |

6,800 |

1 |

New |

Lodha Developers |

India |

India |

|

71 |

1641* |

Mofatraj Munot |

6,800 |

1 |

New |

Kalpataru |

India |

India |

|

71 |

1641* |

Qimat Rai Gupta |

6,800 |

1 |

New |

Havells India |

India |

India |

|

71 |

1641* |

Rakesh Jhunjhunwala |

6,800 |

1 |

New |

Rare Enterprise |

India |

India |

|

71 |

1641↓ |

Abhay Vakil |

6,800 |

1 |

-8.3% |

Asian Paints |

India |

|

|

71 |

1641↓ |

Aloke Lohia |

6,800 |

1 |

-60.7% |

Indorama Ventures |

Thailand |

India |

|

80 |

1751* |

Dhingra Brothers |

6,200 |

1 |

New |

Berger Paints |

India |

|

|

80 |

1751* |

K Dinesh |

6,200 |

1 |

New |

Infosys |

India |

|

|

80 |

1751* |

Kuldip & Gurbachan Singh Dhingra |

6,200 |

1 |

New |

Berger Paints |

India |

|

|

80 |

1751* |

Niranjan Hiranandani |

6,200 |

1 |

New |

Hiranandani group |

India |

|

|

80 |

1751* |

Nirav Modi |

6,200 |

1 |

New |

Firestar International |

India |

Belgium |

|

80 |

1751* |

Ratan Tata |

6,200 |

1 |

New |

Tata Sons |

India |

India |

|

80 |

1751* |

Sanjay Singal |

6,200 |

1 |

New |

Bhushan Power & Steel |

India |

|

|

80 |

1751↓ |

Anand Mahindra |

6,200 |

1 |

0.0% |

Mahindra & Mahindra |

India |

India |

|

80 |

1751↓ |

Chandru Raheja |

6,200 |

1 |

-9.1% |

Shoppers Stop |

India |

India |

|

80 |

1751↓ |

Shyam & Hari Bhartia |

6,200 |

1 |

-23.1% |

Jubilant Life Science |

India |

|

↑ Rank increase YOY ↓ Rank decrease YOY - No Rank change y * New to Top 20

Source: Hurun Rich List 2014 sponsored by Star River

Indian city list by number of resident billionaires

<

|

Rank |

City of residence |

% of Billionaires |

|

1 |

Mumbai |

49% |

|

2 |

New Delhi |

22% |

|

3 |

Bangalore |

6% |

|

4 |

Ahmedabad |

4% |

|

4 |

Gurgaon |

4% |

|

4 |

Pune |

4% |

|

7 |

Chennai |

3% |

|

7 |

Hyderabad |

3% |

|

9 |

Hisar |

1% |

|

9 |

Hoshiarpur |

1% |

Mumbai is home to the most number of billionaires with 33 of the nine zero club residing there, followed by 15 from Delhi and 4 from Bangalore.

Lists end

Religion-wise beak-up

In the list of 88 Indian ‘dollar billionaires’ all religious minorities were represented, most of them in greater proportion than their share of the population. It would be incorrect to show the Hindus, Jains and Sikhs separately because, apart from centuries of ties, shared places of worship, shared religious practices and festivals, inter-marriages, and common caste- and surnames, there are on the list billionaires who do not wear turbans but have beards and offer prayers at Guudwaras.

Christian

Glenn Saldanha

Jewish

David Reuben

Simon Reuben

Muslim

Azim Premji

Yusuf Hamied

MA Yousuf Ali

Suhail Rizvi

Parsi

Pallonji Mistry

Dr Cyrus S Poonawalla

Jamshyd Godrej

Adi Godrej

Rishad Naoroji

Ratan Tata

2014: Knight Frank's Wealth Report ranks India at no. 6 with 60 billionaires

India to have 4th highest number of billionaires by 2023: Report

Nauzer Bharucha,TNN | Mar 6, 2014

MUMBAI: Number of ultra high net worth individuals in India expected to double over next 10 yrs, rising by 126 per cent in Mumbai alone and around 118 per cent in Delhi. Mumbai is on the 4th spot with a 126 per cent growth among all global cities which is expected to increase from 577 to 1,302 by 2023.

Mumbai retains its position as 16th most expensive city in luxury home sector, according to Knight Frank's 8th edition of the Wealth Report released just now.

"By 2023, only 3 countries in the world, USA, China and Russia will have more billionaires than India," Samantak Das, chief economist and director research, Knight Frank India.

India is now on 6th spot [according to Knight Frank’s Wealth Report] in the top 10 countries for billionaires as of 2013 with 60 billionaires. This number is expected to increase to 119 with a 98 per cent growth by 2023, according to a Knight Frank Wealth Report.

The 2014 Wealth Report, an annual global perspective on prime property and wealth by property management firm Knight Frank, projected that the number of billionaires in India will grow by an exponential 98 per cent to 119 in the year 2023 from 60 billionaires last year.

India will rank fourth after US, China and Russia in 2023 and will have more billionaires than the UK, Germany and France, according to the report.

"Wealth creation in India, the world's third-biggest economy, is also expected to accelerate, with the number of Ultra High Networth Individuals (UHNWIs) forecast to nearly double over the next decade," the report said.

"This reflects the more positive outlook for India's economy after 2013 was marked by capital outflows and a sharp devaluation of the rupee. This tough environment for wealth creation and preservation was reflected in the one per cent decline in the number of UHNWIs in the country during the year," it said.

The report said the number of centa-millionaires (those with $100 million in disposable assets) in India is also projected to grow 99 per cent to 761 in 2023 from 383 last year.

The country will further see an increase of 99 per cent in the number of UHNWIs to 3130 in 2023 from 1576 last year.

The growth of UHNWIs in China and India, coupled with a whopping 144 per cent increase in Indonesia and 166 per cent hike in Vietnam, will help push the total number of UHNWIs in Asia up by 43 per cent to 58,588 by 2023, overtaking the total number in North America.

The number of billionaires in Asia is also forecast to overtake the number in Europe over the next decade.

Asian cities are also expected to see the fastest growth in the number of ultra wealthy individuals over the next decade.

Mumbai will see the fourth highest rate of growth in its UHNWI population between 2013 and 2023, with this number increasing 126 per cent to 1302 in 2023 from 577 last year.

Delhi will closely follow Mumbai and will record the fifth highest growth in its UHNWIs population, which will increase 118 per cent from 147 last year to 321 in the next decade, according to the report.

By 2024, Mumbai is also projected to figure in the top 10 global cities, a ranking which it does not currently have, the report said.

Terrorism tends to occur in densely populated cities and New York, London, Moscow and Mumbai are more risky than Beijing, according to the report

2014, Forbes: India's 100 richest

For further details, see Forbes

This list includes those who are of Indian origin but are not Indian citizens

|

Rank |

Name |

Net worth |

Source of wealth |

|

1 |

Mukesh Ambani |

$23.6 B |

petrochemicals, oil & gas |

|

2 |

Dilip Shanghvi |

$18 B |

pharmaceuticals |

|

3 |

Azim Premji |

$16.4 B |

software |

|

4 |

Pallonji Mistry |

$15.9 B |

construction |

|

5 |

Lakshmi Mittal |

$15.8 B |

steel |

|

6 |

Hinduja Brothers |

$13.3 B |

diversified |

|

7 |

Shiv Nadar |

$12.5 B |

information technology |

|

8 |

Family Godrej |

$11.6 B |

consumer products |

|

9 |

Kumar Birla |

$9.2 B |

commodities |

|

10 |

Sunil Mittal |

$7.8 B |

telecom |

|

11 |

Gautam Adani |

$7.1 B |

commodities, infrastructure |

|

12 |

Savitri Jindal |

$6.4 B |

steel |

|

13 |

Anil Ambani |

$6.3 B |

diversified |

|

14 |

Cyrus Poonawalla |

$6.2 B |

vaccines |

|

15 |

Uday Kotak |

$6.1 B |

banking |

|

16 |

Shashi & Ravi Ruia |

$5.9 B |

diversified |

|

17 |

Micky Jagtiani |

$5.1 B |

retail |

|

18 |

Anand Burman |

$4.9 B |

consumer goods |

|

19 |

Desh Bandhu Gupta |

$4.8 B |

pharmaceuticals |

|

20 |

Bajaj Family |

$4.1 B |

motorcycles |

|

21 |

Subhash Chandra |

$4 B |

media |

|

22 |

Kushal Pal Singh |

$3.9 B |

real estate |

|

23 |

Brijmohan Lall Munjal |

$3.7 B |

motorcycles |

|

24 |

Anil Agarwal |

$3.5 B |

mining, metals |

|

25 |

Benu Gopal Bangur |

$3.3 B |

cement |

|

26 |

Pankaj Patel |

$3.2 B |

pharmaceuticals |

|

27 |

Mangal Prabhat Lodha |

$3.1 B |

real estate |

|

28 |

Yusuf Hamied |

$3 B |

pharmceuticals |

|

29 |

Vikram Lal |

$3 B |

automobiles |

|

30 |

Ravi Pillai |

$2.8 B |

construction |

|

31 |

Indu Jain |

$2.6 B |

media |

|

32 |

Sudhir & Samir Mehta |

$2.5 B |

diversified |

|

33 |

Rajan Raheja |

$2.5 B |

diversified |

|

34 |

Madhukar Parekh |

$2.4 B |

adhesives |

|

35 |

Vijay Chauhan |

$2.4 B |

biscuits |

|

36 |

Vivek Chaand Sehgal |

$2.4 B |

auto parts |

|

37 |

Malvinder & Shivinder Singh |

$2.3 B |

healthcare |

|

38 |

Kalanithi Maran |

$2.3 B |

media |

|

39 |

Baba Kalyani |

$2.3 B |

engineering |

|

40 |

M.A. Yusuff Ali |

$2.3 B |

retail |

|

41 |

Reddy Family |

$2.2 B |

pharma |

|

42 |

Chandru Raheja |

$2.1 B |

real estate |

|

43 |

Venugopal Dhoot |

$2.1 B |

electronics |

|

44 |

Ajay Piramal |

$2.1 B |

pharmaceuticals |

|

45 |

Murali Divi |

$2 B |

pharmaceuticals |

|

46 |

Harsh Mariwala |

$2 B |

consumer goods |

|

47 |

Amalgamations family |

$2 B |

tractors |

|

48 |

Qimat Rai Gupta |

$2 B |

electrical equipment |

|

49 |

Kuldip Singh & Gurbachan Singh Dhingra |

$1.9 B |

paints |

|

50 |

Kapil & Rahul Bhatia |

$1.9 B |

airlines |

|

51 |

Rakesh Jhunjhunwala |

$1.9 B |

investments |

|

52 |

Samprada Singh |

$1.9 B |

pharma |

|

53 |

N.R. Narayana Murthy |

$1.8 B |

software services |

|

54 |

P.V. Ramprasad Reddy |

$1.8 B |

- |

|

55 |

Sunny Varkey |

$1.8 B |

education |

|

56 |

Ashwin Dani |

$1.8 B |

paints |

|

57 |

Ranjan Pai |

$1.8 B |

education |

|

58 |

Ashwin Choksi |

$1.7 B |

paints |

|

59 |

Glenn Saldanha |

$1.7 B |

pharmaceuticals |

|

60 |

Ravi Jaipuria |

$1.7 B |

soft drinks |

|

61 |

Abhay Vakil |

$1.6 B |

paints |

|

62 |

Jitendra Virwani |

$1.6 B |

real estate |

|

63 |

Nirav Modi |

$1.5 B |

diamond jewelry |

|

64 |

Senapathy Gopalakrishnan |

$1.5 B |

software |

|

65 |

Lachhman Das Mittal |

$1.5 B |

tractors |

|

66 |

Nandan Nilekani |

$1.5 B |

software services |

|

67 |

Mofatraj Munot |

$1.5 B |

real estate |

|

68 |

Ramesh Juneja |

$1.5 B |

pharmaceuticals |

|

69 |

Sanjiv Goenka |

$1.4 B |

diversified |

|

70 |

P.N.C. Menon |

$1.4 B |

real estate |

|

71 |

Devendra Jain |

$1.3 B |

chemicals |

|

72 |

Murugappa Family |

$1.3 B |

diversified |

|

73 |

Dilip & Anand Surana |

$1.3 B |

pharmaceuticals |

|

74 |

Anand Mahindra |

$1.3 B |

automobiles |

|

75 |

V.G. Siddhartha |

$1.3 B |

retail |

|

76 |

Habil Khorakiwala |

$1.3 B |

pharmaceuticals |

|

77 |

Irfan Razack |

$1.2 B |

real estate |

|

78 |

Murli Dhar & Bimal Gyanchandani |

$1.2 B |

detergents |

|

79 |

Niranjan Hiranandani |

$1.2 B |

real estate |

|

80 |

Hasmukh Chudgar |

$1.2 B |

pharma |

|

81 |

Kiran Mazumdar-Shaw |

$1.2 B |

biotechnology |

|

82 |

Harsh Goenka |

$1.2 B |

diversified |

|

83 |

Surendra Hiranandani |

$1.2 B |

real estate |

|

84 |

Vikas Oberoi |

$1.2 B |

real estate |

|

85 |

Ajay Kalsi |

$1.2 B |

oil and gas |

|

86 |

B.R. Shetty |

$1.1 B |

healthcare |

|

87 |

T.S. Kalyanaraman |

$1.1 B |

jewelry |

|

88 |

Rajesh Mehta |

$1.1 B |

gold |

|

89 |

K. Dinesh |

$1.1 B |

software services |

|

90 |

Rajendra Agarwal |

$1.1 B |

pharmaceuticals |

|

91 |

Abhay Firodia |

$1.1 B |

automobiles |

|

92 |

MG George Muthoot |

$1.1 B |

financial services |

|

93 |

Sanjay Singal |

$1.1 B |

steel |

|

94 |

Anu Aga |

$1.1 B |

engineering |

|

95 |

Azad Moopen |

$1.1 B |

healthcare |

|

96 |

Hari & Shyam Bhartia |

$1 B |

diversified |

|

97 |

Sameer Gehlaut |

$1 B |

finance |

|

98 |

G. M. Rao |

$1 B |

infrastructure |

|

99 |

S.D. Shibulal |

$1 B |

software services |

|

100 |

Radhakishan Damani |

$1 B |

investments, retail |

2014, Sept: Forbes

Vijay Mallya drops out of India's 100 richest club

PTI | Sep 25, 2014

i) Fortunes of India’s uber-rich have seen a significant growth since 2013. The combined net worth of India's 100 wealthiest is USD 346 billion, up from more than a third from USD 259 billion in 2013, thanks to soaring stock markets which have gained 28 per cent since January 2014.

ii) With a record USD 1 billion as the minimum net worth in 2014, as many as 11 persons dropped out of 2014's list

iii) UB Group chairman Vijay Mallya is no longer a member of India's 100 richest club.

iv) The drop-offs in 2014 also include, Brij Bhushan Singal, whose Bhushan Steel's shares tanked after son Neeraj was arrested in a corruption scandal, Forbes said.

2014: India no. 8 in multi-millionaires

India ranked no. 8 on global list of multi-millionaires

Kounteya.Sinha@timesgroup.com London

The Times of India Aug 06 2014

India has more multi-millionaires than Australia, Russia or France.

The latest wealth index by New World Wealth that looks at multi-millionaires globally -an individual with net assets of at least $10 million -has ranked India eighth in the global rich list below countries like US, China, Germany and UK.

India is home to 14,800 multi-millionaires of which Mumbai is home to the highest number -2,700 -as many as in Munich.

Interestingly, Mumbai is the only Indian entry in the top 30 cities for multi-millionaires. Hong Kong is the city with the largest number of multimillionaires -5,400 followed by New York (14,300), London (9,700), Moscow (7,600), Los Angeles (7,400) and Singapore (6,600).

As far as countries are concerned with the highest number of multi-millionaires, the United States tops the list with 1,83,500 people worth over $10 million followed by China (26,600), Germany (25,400), UK (21,700), Japan (21,000), Switzerland (18,300) and Hong Kong (15,400). Over the past 10 years, worldwide millionaire and multi-millionaire numbers have grown at vastly different rates. Millionaire numbers worldwide have gone up by 58% during this period, whilst multi-millionaire numbers have gone up by 71%. There are currently just over 13 million millionaires in the world (as of June 2014).

Approximately 495,000 of these individuals can be classified as multi-millionaires.

Mere millionaires

Interestingly , when it comes to millionaires, US tops the list followed by Japan and then the UK.

China and India are both significantly lower on this list than they are on the multi-millionaire list and perhaps most notably, Russia which ranks 9th in the world for multi-millionaires, only ranks 18th in the world for millionaires (outside the top 15). The report says “The higher growth of multi-millionaires can be put down to a number of factors including: a widening wealth gap at the top-end, a rising rate of conversion of millionaires into multi-millionaires and strong growth in countries that have a high multi-millionaire to millionaire ratio (the likes of Russia and India)“.

In terms of regional performance, South America was the stand out, with multi-millionaire growth of 265% over the 10 year period. Other top performers included Australasia (182% growth) and Africa (142% growth). In terms of country performance, countries that registered 200% plus growth included Russia, Brazil, China, India, Indonesia, Vietnam and Angola.

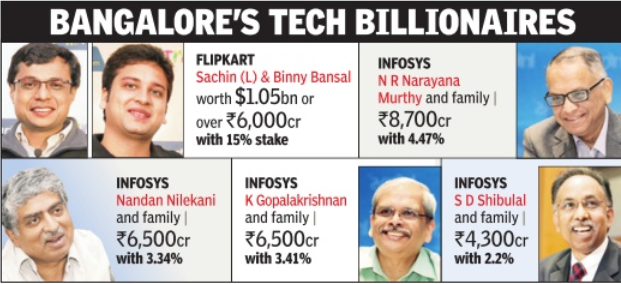

2014: Bangalore's technology billionaires

See chart

2014: Indians abroad/ Diaspora

The UK

2014 Hinduja brothers among UK's top 3 richest families

Kounteya Sinha,TNN | Mar 17, 2014

London-based Indian family - Srichand and Gopichand Hinduja of the Hinduja Group, a multinational conglomerate with a presence in 37 countries with businesses as diverse as trucks and lubricants to banking and healthcare, are among the five richest families in the UK which have together amassed more wealth than 20% of entire British population.

Together worth $10 billion, the Hinduja family along with four other British families have been shown to have more wealth than 12 million poorest Brits.

Britain's five wealthiest people boast a collective worth of £28.2 billion, while the total accumulated by the bottom 20% sat at £28.1 billion.

2014: Indians with over $100m

The Times of India, Jun 17 2015

India ranks 4th globally in 2014, says report

No. of Indians with over $100m hits 928

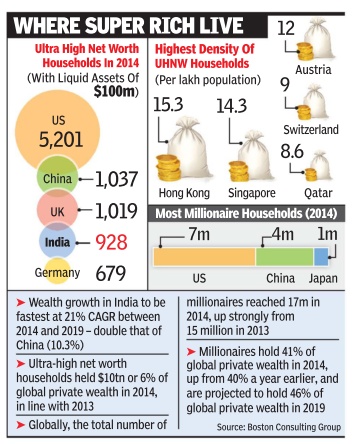

The number of ultra high net worth (UHNW) individuals in India has more than trebled to 928 in 2014 from 284 in 2013, according to a Boston Consulting Group (BCG) report.Though BCG has clarified that the two figures cannot be compared because there has been a change in methodology , following the new study , India's ranking among countries in terms of the number of UHNW individuals has risen to number four in 2014 from the 13th position in 2013. The report defines individuals with financial wealth (excluding residential properties) of $100 million (Rs 640 crore) as UHNW . BCG executives said, “Currency impacts versus the US dollar (our segments are in US dollars) and methodological changes to the national accounts' data make a comparison between the 2014 and 2015 reports very difficult.“ Going by 2015 methodology , UHNW individuals in India have increased to 928 in 2014 from 800 in 2013.

According to BCG, the Asia-Pacific region will be the main driver of increase in global wealth, fuelled by the rich in China and India.What's more, wealth in India is projected to record the fastest growth of 21% between 2014 and 2019 -double the growth rate of the next fastest wealth creator China (10.3%).

In its 2015 wealth report called `Winning the Growth Game', BCG has said that private wealth in China and India showed solid market gains, driven mainly by investments in local equities. China's equity market rose by 38% and India's by 23%.

The US remained the country with the largest number of UHNW households at 5,201, followed by China (1,037), the UK (1,019), India (928), and Germa ny (679). The highest density of UHNW households was found in Hong Kong (15.3 per 100,000 households), followed by Singapore (14.3), Austria (12), Switzerland (9), and Qatar (8.6). UHNW households held $10 trillion, or 6%, of global private wealth in 2014, which was in line with 2013. At a projected CAGR of 12% over the next five years, private wealth held by the UHNW segment will grow to an estimated $18 trillion in 2019.

This top segment is expected to be the fastest growing, in both the number of households and total wealth. The number of households in this segment is projected to grow at a CAGR of 19% over the next five years. “With such a large number of households entering this segment, the average wealth per household is pro jected to decline at a CAGR of 6%,“ the report said.

Private wealth held by the upper high net worth (HNW) segment (those with between $20 million and $100 million) rose by a healthy 34% in 2014 to $9 trillion. Private wealth held by the lower HNW segment (those with between $1 million and $20 million) is expected to grow at a slightly lower rate (7%) over the next five years.

Globally , the total number of millionaire households (those with more than $1 million in private wealth) reached 17 million in 2014, up strongly from 15 million in 2013. The increase was driven primarily by the solid market performance of existing assets, in both the new and old worlds.

2015, Forbes: India no.4

This list was released in March 2015; therefore, it mainly pertains to 2014.

India's billionaire population fourth highest

TNN | Mar 3, 2015 The Times of India/ PTI

India's billionaire wealth much above country's fiscal deficit

The number of Indian billionaires has increased to 90 with a total wealth of $294 billion, registering a significant jump over last year when there were 56 billionaires with a collective net worth of $191.5 billion.

NEW YORK: According to the latest Forbes rich list for the year 2015, India is home to the fourth largest number of billionaires across the world. US tops the charts followed by China and Germany.

However, there are only five Indians figuring among the 100 wealthiest across the world.

Registering a significant jump over the last year when there were 56 billionaires with a collective net worth of $191.5 billion, the number of Indian billionaires has increased to 90 with a total wealth of $294 billion.

In comparison, the US has as many as 536 billionaires, followed by 213 from China and 103 from Germany.

Meanwhile, the ranks of the world's wealthiest defied global economic turmoil and expanded yet again despite plunging oil prices and a weakened euro.

Among the BRIC countries India is home to the second largest number of billionaires after China. China had 213 super rich people, worth $565 billion, followed by India (90, $294 billion), Brazil (54, $181 billion) and Russia (88, $337 billion).

Moreover, five Indian women have made it to the Forbes list of the world's billionaires that saw a record number of women this year.

The number of Indian women in this year's list witnessed an increase over last year, when only two Indian women were included on the Forbes billionaire list.

24 Indians with $3.4bn plus

Source: Forbes

The following is a complete list of the 24 Indian citizens who figured in the Forbes list of the 550-odd richest people of the world.

|

Global rank |

Name |

Net worth |

Age |

Source of wealth |

|

039 |

Mukesh Ambani |

$21 B |

57 |

petrochemicals, oil & gas |

|

044 |

Dilip Shanghvi |

$20 B |

59 |

pharmaceuticals |

|

048 |

Azim Premji |

$19.1 B |

69 |

software |

|

066 |

Shiv Nadar |

$14.8 B |

69 |

information technology |

|

082 |

Lakshmi Mittal |

$13.5 B |

64 |

steel |

|

142 |

Kumar Birla |

$9 B |

47 |

commodities |

|

185 |

Uday Kotak |

$7.2 B |

55 |

banking |

|

208 |

Gautam Adani |

$6.6 B |

52 |

commodities, infrastructure |

|

208 |

Sunil Mittal |

$6.6 B |

57 |

telecom |

|

208 |

Cyrus Poonawalla |

$6.6 B |

73 |

vaccines |

|

254 |

Desh Bandhu Gupta |

$5.8 B |

77 |

pharmaceuticals |

|

283 |

Savitri Jindal |

$5.3 B |

64 |

steel |

|

291 |

Micky Jagtiani |

$5.2 B |

63 |

retail |

|

330 |

Adi Godrej |

$4.8 B |

72 |

consumer goods |

|

330 |

Jamshyd Godrej |

$4.8 B |

66 |

consumer goods |

|

360 |

Shashi & Ravi Ruia |

$4.5 B |

- |

diversified |

|

393 |

Subhash Chandra |

$4.2 B |

64 |

media |

|

405 |

Benu Gopal Bangur |

$4.1 B |

83 |

cement |

|

418 |

Anil Ambani |

$4 B |

55 |

diversified |

|

435 |

Vikram Lal |

$3.9 B |

72 |

motorcycles |

|

435 |

Pankaj Patel |

$3.9 B |

61 |

pharmaceuticals |

|

452 |

Brijmohan Lall Munjal |

$3.8 B |

91 |

motorcycles |

|

512 |

Mangal Prabhat Lodha |

$3.4 B |

59 |

real estate |

|

512 |

Kushal Pal Singh |

$3.4 B |

83 |

real estate |

Five women with $1bn+

Rank 283 Savitri Jindal $5.3 B 64 steel

Rank 603 Indu Jain $3 B 78 media

Rank 1312 Anu Aga $1.5 B 72 engineering

Rank 1533 Vinod Gupta $1.2 B 69 electrical equipment

Rank 1741 Kiran Mazumdar-Shaw $1 B 61 biotechnology

Diaspora

This list includes only the obvious names that Indpaedia volunteers could think of. Omitted names can be sent to the Facebook page, Indpaedia.com. They will be cross-checked before publication.

Rank 55 Pallonji Mistry $16.3 B 85 construction Ireland

Rank 69 Hinduja Brothers $14.5 B ? diversified United Kingdom

Rank 341 Sri Prakash Lohia $4.7 B 62 polyester Indonesia

2015, February: Sanghvi is no. 1

The Times of India Feb 20 2015

Partha Sinha

Dilip Shanghvi, the 59-year-old promoter of Sun Pharma, appears to have overtaken Mukesh Ambani (57) of Reliance Industries Ltd as the richest Indian if one goes by promoter holdings in the listed companies of the two groups. The Gujaratborn and Kolkata-educated Shanghvi, by virtue of his over 63% holding in three companies -Sun Pharma, Sun Pharma Advanced Re search and Ranbaxy Labs -is worth about Rs 1.46 lakh crore ($23.42 billion at an exchange rate of 62.34 per dollar).

In comparison, Ambani, through his 45% holdings in two group companies -RIL and Reliance Industrial Infrastructure -was worth Rs 1.32 lakh crore ($21.2 billion), according to data compiled by TOI from the Bombay Stock Exchange (BSE).

If one adds the 23% stake in wind energy major Su zlon, that Shanghvi and his family is in the process of acquiring, his wealth would be nearly Rs 1.48 lakh crore ($23.7 billion).

However, Bloom berg's Billionaire Index still ranks the RIL boss as the richest Indian and 33rd globally with a net worth of $21.9 bn, and Sanghvi as the second richest (39th globally) at $19.7 bn, ahead of Azim Premji ($18 bn) and Pallonji Mistry (16.6 bn). In the last one year the Sun Pharma stock has gained 50% to become the most valued pharmaceuticals company in India and one of the top five in the world. As a result Shanghvi, who started the company in 1982 with a seed capital of Rs 10,000, has become the richest drug maker in the world.

His fortunes were also boosted by his acquisition of Ranbaxy Labs from its Japanese owners and sharp gains in Sun Pharma Ad vanced Research, the group drug R&D arm that was hived off as a separate company from the group's flagship a few years ago. In the last one month, while the Sun Pharma stock has gained about 5% to its current price of Rs 918, Sun Pharma Advanced Research jumped 50% to Rs 374. Ranbaxy too has gained about 10% to Rs 709 to add to Sanghvi's wealth at a fast clip.

During the same period, RIL has gained about 3% while Reliance Industrial Infra has fallen marginally .

According to Hurun India rich list published last year, Ambani held on to his position as the richest man in India with a fortune of Rs 1.65 lakh crore, up 37% from last year.Shangvi shot up to No 2, overtaking L N Mittal for the first time, after seeing his wealth grow 43% to Rs 1.29 lakh crore.

2015, March: Forbes’ update

Two days after publishing its rich list for 2015, a Forbes’ 'real time' update on 4 March 2015 ranked Shanghvi the richest Indian (global rank: 37/ $21.5 b), with Mukesh Ambani ($20.4 b) at no.2 (global rank: 43) and Azim Premji at no.3 (global rank: 47) among Indians.

2015: UK regional Asian rich list

The Times of India, May 19 2015

An Indian-origin entrepreneur nicknamed `Chicken King' for running UK's largest poultry business has topped the Asian Rich List for the Midlands region of England with an estimated wealth of £1.35 billion. Ranjit Boparan, the founder and owner of 2 Sisters Food Group, has topped the Asian Rich List -Midlands, published by the Asian Media & Marketing Group (AMG), for a second consecutive year with an overall increase of £50 million over 2014. Leading NRI industrialists Lord Swraj Paul and his son Angad, whose Caparo Group has significant business presence in the Midlands region north of London, was ranked second with an estimated £725 million.

Vedanta Resources founder-chairman Anil Agarwal (£370million), Abdul Rashid and Aziz Tayub (£200million) of the wholesale Crown Crest Group and Shiraz Tejani (£150million) of the manufacturing group LPC complete the year's top five. “The list shows the remarkable resilience and diversity of Asian businesses in the UK. Despite the challenges of the general economy many business leaders in the community have seen opportunity and potential and moved quickly to capitalize.

“It is an inspiring picture and one that should energise entrepreneurs everywhere,“ said Shailesh Solanki, executive editor of AMG and one of a panel of four experts who examined British Asian wealth.

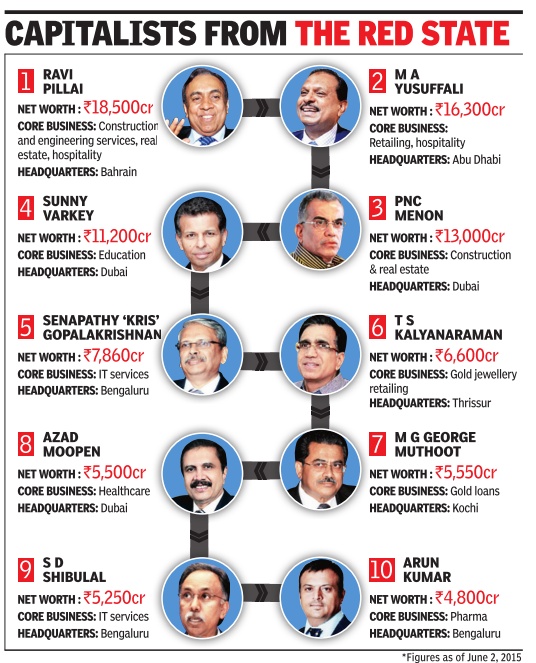

June 2015: Billionaires from Kerala

The Times of India, Jun 04 2015

Shenoy Karun

THE TOP 10: WORLD'S RICHEST MALAYALIS - Billionaires from the Backwaters

Kerala is not just God's own country, where tourism and tradition define its global appeal. Wealth and entrepreneurship also distinguish Malayalis on the global map. The Times of India brings you a list of the 10 richest Malayalis on the basis of their net worth

Even as his wealth has multiplied, M A Yus suffali, the world's second-richest Ma layali with headquarters in Abu Dhabi and a net worth of about Rs16,300 crore, makes it a point to stay connected to his small-town roots.His 113 hypermarkets spread across nine countries rake in around Rs37,000 crore annually .“Around 24,000 out of 32,000 employees are from Kerala; 4,000 are from my own village Nattika,“ Yusuffali says. “Do you know that I don't have to pay for fish back in my native village? I have given jobs to the youth from all communities, some of whom are from fishermen's families.So, when I'm around, their parents always make sure that I get fresh fish.“ A unique aspect is the composition of this rich list--it cuts across religions. Many in the list, including the top three, are self-made. Coming from a milieu where money-making was almost considered a sin, their small trader background was often their only capital when they started. The list of the 10 richest Malayalis is as diverse as it is impressive. The core businesses of these magnates range from construction, retail and jewellery to education, banking and software.

Billionaires rarely talk about their wealth. Almost all the businessmen on our original shortlist were happy to speak to TOI until we started asking them about their personal wealth. One of them deflected us by saying, “I didn't worry about riches as long as I have appam and egg curry on my breakfast table.“

That made our life a lot more difficult, because most of them own either private or closelyheld companies which are not listed on stock exchanges and therefore do not lend themselves to ready estimates of their market value. So, our Malayali rich list is born not out of any one standardized methodology but a mix of valuation processes like street or stock market value, and peer comparison. We also relied on company data; interviews with promoters, competitors, investors and analysts; and background checks. In cases where we could not get the exact value of wealth, we have tried to arrive at its fair value (please see accompanying report on methodology). Our calculations also do not take into account assets such as private residential properties and art collections. They are, at best, ballpark estimates. But they do convey a sense of what our richlisters are worth.

Emirs From Kerala

Ravi Pillai, chairman of the Bahrain-headquartered RP Group, tops the list with a net worth of Rs18,500 crore (see Top 10); much of the wealth of this construction tycoon comes from the profits of Nasser S AlHajri Corporation (NSH), a company he founded in 1978 in Saudi Arabia. Says Pillai, “I was a contractor with public enterprises in Kerala before I came to the Middle East. A strike at one of the undertakings forced me to look for opportunity elsewhere. Of the 500 people working with me, I took 200 to Saudi Arabia. If the strike hadn't happened, I wouldn't have made my fortune.“ Half of those who figure in the Top 10 made their fortunes in the Middle East in the 1970s. Partly , this has to do with the fact that despite new-found oil reserves, the region was quite backward then and lacked local initiative.

Yusuffali created a retail empire that originated in the UAE. He recalls those early days: “I landed in Dubai in a ship named Dumra on December 31, 1973. I found Abu Dhabi a town without a steady supply of electricity or a proper sewage system. Whenever temperatures rose sometimes up to 52 degree Celsius, along with 84% humidity we used to sleep on the roof.“

Pillai is a first-generation entrepreneur with roots in Chavara, near Kollam; his parents were farmers. Between NSH and 25 other companies he owns, they generate revenues of Rs26,800 crore annually. Other than construction, Pillai has a strong presence in travel and tourism, healthcare and education, mainly in India and the Middle East.

Often called 'Ambani of the Gulf', Pillai shot into limelight when he acquired Leela Resorts in Kovalam from the Mumbaibased family of C P Krishnan Nair, who was for decades one of the best-known faces of Malayali entrepreneurship. (For the last few years Capt Nair's elder son Vivek has been working hard to reduce the group's large debt burden.) P N C Menon is the thirdrichest Malayali in the world with a net worth of Rs13,000 crore. His holding company, the Dubai-headquartered PNC Investments, generated revenues of 1.2 billion dirham (Rs2,107 crore) during 2013, with net profits of 88.4 million Dhs (Rs150crore). Having lost his father when he was 10, Menon discontinued college to become an interior designer at Thrissur where his father once ran a small business. One day in 1976 his fortunes changed when he met Brig Gen Suleiman Al-Adawi from Oman in the lobby of a Kochi hotel. The general invited him to Muscat where the duo founded an interior design firm with a bank loan of 3,000 riyals. Talk of the right connection!

Small Towns, Big Dreams

Yusuffali's companies gen e r a t e d r eve n u e s o f Rs37,000 crore in 2014. He learnt the tricks of the trade during his four-year stay in Ahmedabad, where his paternal uncle ran a general store. In 1973, he moved to Abu Dhabi where his father and uncle ran MK Stores, a kirana shop. “In 1983 came my first foreign trip.With 10 years of experience in retailing, I went to Singapore, Sydney , Brisbane, Melbourne and Perth. Australia's supermarkets impressed me the most. I decided to set up big supermarkets in Abu Dhabi instead of small grocery shops,“ Yusuffali says.

Running In The Family

Their businesses couldn't be more different but a common thread unites T S Kalyanaraman, George Muthoot and Sunny Varkey their families gave them a foundation on which to build their futures.

Varkey , who has a net worth of Rs11,200 crore, is fourth on the list. A second-generation entrepreneur, Varkey came to Dubai in 1959 at the age of two along with his banker father.During their free time, his parents gave English lessons to workers; their efforts culminated in a formal school Our Own English High School.When his father retired in 1980, Varkey took over the reins of the organisation and started expanding, spurred by the belief that there was a huge potential for quality education not only in the Middle East, or on the subcontinent, but also in developed countries. His company Gems Education, headquartered in Dubai, operates a global network of schools and pre-schools in the Middle East, Africa, various parts of Asia, the UK and the US.

A third-generation businessman, Kalyanaraman started helping his father right from school, in the family's textile business. In 1993, he ventured into gold jewellery retail, which pushed him into the list of billionaires. As chairman and MD of the Thrissur-headquartered Kalyan Jewellers, Kalyanaraman is sixth in the list with an estimated net worth of Rs6,600 crore. His company generated revenues of Rs 7,400 crore in 2014. During that time, private equity firm Warburg Pincus invested Rs 1,200 crore in the company for a minority stake.T he company now has 77 stores in India, the UAE and Kuwait, and plans to open 16 more by March 2016. Says Kalya naraman, “I never expected to be rich like this. While I first started a jewellery showroom in 1993, I was using an Ambassador. Then, I used a Maruti 800. Now, between me and my two sons, we own three Rolls Royces“. And then are his private jets (but more of that later).

M G George Muthoot, chairman of Muthoot Group, takes seventh position with a net worth of Rs5,550 crore. Between Muthoot and his 12 family members, they own 29.8 crore shares of Muthoot Finance, the largest gold loan company in the country . Muthoot is a thirdgeneration businessman with origins in Kozhencherry, a small town south-east of Kochi, where his group is headquartered. A graduate in mechanical engineering from the Manipal Institute of Technology , he entered the business in the 1970s. The group has since spread into education, healthcare, IT, plantations, travel and tourism, and power generation.In Kerala, gold loans have become synonymous with Muthoot Finance.

Class Act

Senapathy`Kris' Gopala krishnan, co-founder and one-time CEO of Infosys, India's second-larg est software firm, is the fifthrichest Malayali. Along with wife Sudha and daughter Meghana, he holds more than 3.9 crore shares of the company , with an estimated market cap of Rs7,860 crore. A graduate in physics from the University of Kerala, Gopalakrishan did his master's in computer science at the Indian Institute of TechnologyMadras.

Like Gopalakrishnan, S D Shibulal, another co-founder of Infosys (and the last of the owner-CEOs), comes in ninth in the rich list with a net worth of Rs5,250 crore. He, too, is a product of the University of Kerala, where he did his master's in physics. In Shibulal's case, the street value of his 2.3 crore shares of Infosys and that of his wife and children have been added up to calculate his net worth, along with the value of his more than 700 apartments in the US.

Azad Moopen, chairman of the Dubai-headquartered Aster DM Healthcare LLC, is in the eighth position with a net worth of Rs5,500 crore. An MB BS gold medallist, he started his career as a lecturer at the Cali cut Medical College in 1982 before arriving in Dubai five years later. Aster Group now operates close to 260 hospitals and pharmacies in the Middle East and India. Moopen also owns a medical college in Wayanad district of Kerala. Moopen told TOI, “Everybody in my family , including my father and brothers, have been in business. I was an exception; I went into academics.“ But clearly , business ran in his blood, too.

In tenth position is Arun Kumar, founder and group CEO of Strides Arcolab, a pharma company . With roots in Kollam district, he was brought up in Ooty , worked in Mumbai, and shifted the headquarters of the company he founded 25 years ago to Bengaluru. In 2013, his company sold Agila Specialties, one of its divisions, to US pharma giant Mylan for $1.75 billion.According to industry sources, he has sold businesses worth $2.2 billion in the past three years. His personal net worth is estimated at Rs4,800 crore. He still controls Strides Arcolab, along with Sequent Scientific and Alivira Animal Health. Agnus Capital, his family's investment vehicle, has stakes in a number of high-value start-ups.

Sprawling Empires

The scale of operations of the Malayali barons from the Middle East is immense. Some of them operate in almost all continents. It is estimated that nearly 7.1 lakh customers walk into Yusuffali's Lulu hypermarkets daily, mainly in the Middle East. His company sources from 51 countries and has set up procurement offices in 36 nations around the world. Likewise, Ravi Pillai also operates across a vast geography from Africa to Australia, employing 90,000 people. “Within two months, we'll have 1 lakh employees as we are recruiting 10,000 workers for our projects in Kuwait,“ says Pillai.

They may not be deliber ately ostentatious but all these magnates live luxuriously and peripatetically.Yusuffali's staff keeps 40 cars, including a fleet of Rolls Royces, BMWs and Mercedes-Benzes, and a private executive jet Embraer Legacy 650 waiting for him in Dubai or Kochi. And wherever needed, he rents helicopters locally for short trips. Apart from residential homes in Abu Dhabi, London and Kochi, he owns commercial properties in London, Muscat, Doha, Mumbai and New Delhi. Kalyanaraman owns two jets, an Embraer Phenom 100 and an Embraer Legacy 650, as well as a Bell 427 helicopter, which allow him to hop between his stores.

2015

Sportsmen

The highest paid actors

Amitabh Bachchan, Salman Khan and Akshay Kumar among the world's top ten highest-paid actors

Bollywood stars Amitabh Bachchan, Salman Khan and Akshay Kumar are among the world's top ten highest-paid actors in Forbes first global list of actors from Hollywood to Hong Kong and Bollywood, reports IANS. Big B and Salman entered the list jointly in seventh place, with estimated earnings of $33.5 million in the past year. Akshay Kumar follows behind in ninth place with $32.5 million. Amitabh Bachchan: The legendary actor who went through a slump when his production company ABCL went bankrupt and the actor had to start from scratch. Kaun Banega Crorepati came as blessing in disguise and ever since, there's no looking back for the shahenshah of Bollywood. One of the highest paid actors of Bollywood, Big B is much in demand when it comes to films, event launches and endorsements. According to the Forbes India Celebrity 100 list, Amitabh Bachchan makes it to the 5th position and as of October, 2013, the actor earns Rs 147.5 crore.

Bollywood stars Shah Rukh Khan (18) and Ranbir Kapoor (30) with estimated earnings of $26 Million and $15 Million respectively, also made it to the Forbes list. Bollywood stalwart Amitabh Bachchan has starred in more than 150 films in his career spanning 50 years. He continues to earn top rupee for his roles in flicks such 2014's Bhoothnath Returns, Forbes noted.

See also

Celebrity List: India<> Rich List: India <> Rich List: Nepal<> Indian money in HSBC, Switzerland