Public Companies, South Asia's Biggest

This is a collection of articles archived for the excellence of their content. |

Contents |

2014: Forbes

India home to 54 of world's largest, most powerful public companies: Forbes magazine

PTI | May 8, 2014

Values calculated May 2014

NEW YORK: Mukesh Ambani-led Reliance Industries leads the pack of 54 Indian companies in Forbes' annual list of the world's 2000 largest and most powerful public companies, with Chinese companies occupying the top three slots on the list.

The Forbes 'Global 2000' is a comprehensive list of the world's largest, most powerful public companies, as measured by revenues, profits, assets and market value.

China is home to the world's top three biggest public companies and five of the top 10.

The US retains its dominance as the country with the most Global 2000 companies at 564.

Japan trails the US with 225 companies in aggregate.

India is home to 54 of the world's biggest companies.

Reliance Industries is ranked 135 on the list with a market value of 50.9 billion dollars and 72.8 billion dollars in sales as on May 2014.

Reliance is followed by State Bank of India which is ranked 155 and has a 23.6 billion dollars market value.

The other Indian companies on the list are Oil and Natural Gas ranked 176, ICICI Bank (304), Tata Motors (332), Indian Oil (416), HDFC Bank (422), Coal India (428), Larsen & Toubro (500), Tata Consultancy Services (543), Bharti Airtel (625), Axis Bank (630), Infosys (727), Bank of Baroda (801), Mahindra & Mahindra (803), ITC (830), Wipro (849), Bharat Heavy Electricals (873), GAIL India (955), Tata Steel (983) and Power Grid of India (1011).

Also making the list are Bharat Petroleum (1045), HCL Technologies (1153), Hindustan Petroleum (1211), Adani Enterprises (1233), Kotak Mahindra Bank (1255), Sun Pharma Industries (1294), Steel Authority of India (1329), Bajaj Auto (1499), Hero Motocorp (1912), Jindal Steel & Power (1955), Grasim Industries (1981) and JSW Steel (1990).

2014: The complete list for South Asia

Forbes: The World's Biggest Public Companies

Afghanistan

Nil

Bangladesh

Nil

Bhutan

Nil

India

|

Rank |

Company |

Country |

Sales |

Profits |

Assets |

Market Value |

|

135 |

Reliance Industries |

India |

$72.8 B |

$3.8 B |

$67.2 B |

$50.9 B |

|

155 |

State Bank of India |

India |

$37.1 B |

$3.3 B |

$376.8 B |

$23.6 B |

|

176 |

Oil & Natural Gas |

India |

$29.6 B |

$4.5 B |

$53.8 B |

$46.4 B |

|

304 |

ICICI Bank |

India |

$13.3 B |

$1.8 B |

$124.2 B |

$23.7 B |

|

332 |

Tata Motors |

India |

$34.5 B |

$1.8 B |

$32.4 B |

$19.9 B |

|

416 |

Indian Oil |

India |

$74.6 B |

$0.8 B |

$43.7 B |

$11.1 B |

|

422 |

HDFC Bank |

India |

$7.9 B |

$1.3 B |

$75 B |

$29.6 B |

|

424 |

NTPC |

India |

$12.3 B |

$2.3 B |

$35.5 B |

$16.8 B |

|

428 |

Coal India |

India |

$12.6 B |

$3.2 B |

$18.4 B |

$30.6 B |

|

500 |

Larsen & Toubro |

India |

$13.5 B |

$1 B |

$26.7 B |

$19.8 B |

|

535 |

HDFC |

India |

$6.6 B |

$1.2 B |

$43.5 B |

$23.2 B |

|

543 |

Tata Consultancy Services |

India |

$13.1 B |

$3 B |

$9.2 B |

$71.2 B |

|

625 |

Bharti Airtel |

India |

$14.3 B |

$0.4 B |

$29.2 B |

$21.1 B |

|

630 |

Axis Bank |

India |

$6.3 B |

$1 B |

$62.7 B |

$11.5 B |

|

727 |

Infosys |

India |

$8.1 B |

$1.7 B |

$8.7 B |

$31.7 B |

|

795 |

Punjab National Bank |

India |

$8.7 B |

$0.9 B |

$91.4 B |

$4.5 B |

|

801 |

Bank of Baroda |

India |

$7.5 B |

$0.9 B |

$102.9 B |

$5.2 B |

|

803 |

Mahindra & Mahindra |

India |

$12.4 B |

$0.7 B |

$14.1 B |

$9.9 B |

|

830 |

ITC |

India |

$5.8 B |

$1.4 B |

$6.6 B |

$46.9 B |

|

849 |

Wipro |

India |

$7.1 B |

$1.2 B |

$7.8 B |

$23.1 B |

|

873 |

Bharat Heavy Electricals |

India |

$8.9 B |

$1.2 B |

$13.2 B |

$8 B |

|

955 |

GAIL India |

India |

$9.3 B |

$0.8 B |

$12.2 B |

$8 B |

|

957 |

Hindalco Industries |

India |

$14.6 B |

$0.6 B |

$22.7 B |

$4.8 B |

|

967 |

Canara Bank |

India |

$6.9 B |

$0.5 B |

$77.2 B |

$2 B |

|

976 |

Bank of India |

India |

$6.6 B |

$0.5 B |

$84 B |

$2.4 B |

|

983 |

Tata Steel |

India |

$23.8 B |

$-1.3 B |

$27.2 B |

$6.5 B |

|

1011 |

Power Grid of India |

India |

$2.4 B |

$0.8 B |

$22 B |

$9.5 B |

|

1045 |

Bharat Petroleum |

India |

$40.3 B |

$0.3 B |

$14.9 B |

$5.4 B |

|

1153 |

HCL Technologies |

India |

$4.7 B |

$0.7 B |

$4.2 B |

$16.6 B |

|

1211 |

Hindustan Petroleum |

India |

$35 B |

$0.1 B |

$17.1 B |

$1.7 B |

|

1226 |

Power Finance |

India |

$3.2 B |

$0.8 B |

$31.2 B |

$4.2 B |

|

1229 |

Union Bank of India |

India |

$5.2 B |

$0.4 B |

$57.6 B |

$1.4 B |

|

1233 |

Adani Enterprises |

India |

$8.6 B |

$0.3 B |

$19.5 B |

$6.5 B |

|

1255 |

Kotak Mahindra Bank |

India |

$2.9 B |

$0.4 B |

$18.3 B |

$9.9 B |

|

1290 |

IDBI Bank |

India |

$5.2 B |

$0.3 B |

$59.4 B |

$1.7 B |

|

1294 |

Sun Pharma Industries |

India |

$2.1 B |

$0.5 B |

$4.1 B |

$19.9 B |

|

1329 |

Steel Authority of India |

India |

$8.2 B |

$0.4 B |

$15.9 B |

$4.9 B |

|

1339 |

Rural Electrification |

India |

$2.5 B |

$0.7 B |

$24 B |

$3.7 B |

|

1365 |

NMDC |

India |

$1.9 B |

$1 B |

$5.4 B |

$9.1 B |

|

1439 |

Syndicate Bank |

India |

$3.4 B |

$0.4 B |

$39.8 B |

$1 B |

|

1499 |

Bajaj Auto |

India |

$3.6 B |

$0.6 B |

$2.4 B |

$10 B |

|

1638 |

Central Bank of India |

India |

$4.3 B |

$0.2 B |

$49.5 B |

$1.1 B |

|

1736 |

Indian Bank |

India |

$2.8 B |

$0.3 B |

$30 B |

$0.9 B |

|

1750 |

Indian Overseas Bank |

India |

$4.1 B |

$0.1 B |

$41.9 B |

$1 B |

|

1790 |

Corporation Bank |

India |

$3.1 B |

$0.3 B |

$35.6 B |

$0.8 B |

|

1810 |

Allahabad Bank |

India |

$3.5 B |

$0.2 B |

$37.7 B |

$0.8 B |

|

1860 |

UCO Bank |

India |

$3.2 B |

$0.1 B |

$33.9 B |

$1.2 B |

|

1876 |

Oriental Bank of Commerce |

India |

$3.5 B |

$0.2 B |

$32.2 B |

$1.1 B |

|

1902 |

NHPC |

India |

$1.1 B |

$0.5 B |

$12 B |

$3.6 B |

|

1912 |

Hero Motocorp |

India |

$4.2 B |

$0.4 B |

$1.6 B |

$7.5 B |

|

1955 |

Jindal Steel & Power |

India |

$3.5 B |

$0.5 B |

$10.4 B |

$4.6 B |

|

1975 |

Andhra Bank |

India |

$2.7 B |

$0.2 B |

$27.2 B |

$0.6 B |

|

1981 |

Grasim Industries |

India |

$5.1 B |

$0.5 B |

$7.4 B |

$4.4 B |

|

1990 |

JSW Steel |

India |

$7 B |

$0.2 B |

$12.1 B |

$4.1 B |

Maldives

Nil

Myanmar

Nil

Nepal

Nil

Pakistan

|

Rank |

Company |

Country |

Sales |

Profits |

Assets |

Market Value |

|

1279 |

Oil & Gas Development |

Pakistan |

$2.4 B |

$1.1 B |

$4.6 B |

$10.8 B |

|

1995 |

Pakistan State Oil |

Pakistan |

$11.6 B |

$0.2 B |

$3.3 B |

$1.1 B |

Sri Lanka

Nil

2014: India's biggest IT and other companies

See chart

HDFC

The Times of India May 10, 2015

HDFC among world's top 10 list of consumer finance firms

The country-wise position

India

Mortgage lender HDFC has emerged as the only Indian company among the world's 10 biggest consumer financial services firms, after giants like American Express, Visa and Mastercard.

HDFC is ranked 7th on the list, compiled by business magazine Forbes, where American Express is placed on the top, followed by Capital One Financial, Visa, Discover Financial Services and Orix in the top-five. Mastercard is ranked sixth. HDFC is followed by CIT Group of US at eighth position, Taiwan's Hua Nan Financial at 9th and China's Franshion Properties is at the 10th place.

Others ranked lower include Samsung Card, Kaisa Group, Orient, Nelnet, Jabal Omar Development and KWG Property. The list is part of Forbes' annual compilation of 2,000 biggest and most powerful companies globally, which includes a total of 56 companies from India across various sectors. In the overall list, HDFC is ranked 485th, while Mukesh Ambani-led Reliance Industries leads the pack of the Indian companies at 142nd overall position. Among other sector-specific lists, there is no Indian entity on the list of biggest major banks topped by China's ICBC. For the regional banks, China Construction Bank tops the chart, while India's SBI is ranked 22nd, ICICI Bank is at 29th place and HDFC Bank is at 40th position.

For Oil and Gas sector, Reliance Industries is ranked 15th globally, while ExxonMobil is on the top. In Computer Services, Google tops the list and India's TCS is at 7th place, followed by Coginzant at 9th and Infosys at 10th position. The overall list is dominated by the companies from the US and China. India has added two companies to its last year's tally. Among Indian companies on the overall list, Reliance Industries is followed by SBI, ONGC, Tata Motors, ICICI Bank, Indian Oil, HDFC Bank, NTPC, HDFC, TCS and Bharti Airtel, among others. Forbes said the list ranks the companies on the basis of a composite score of their revenues, profits, assets and market value

Pakistan

Pakistan had two companies in the world’s Top 2000 in the year 2014. in 2015, one Pakistani company (Pakistan State Oil, which was at no. 1995 in 2014) dropped out of the list

Other South Asian countries

Nil, as in 2014.

2015: The complete list for South Asia

Forbes: The World’s Biggest Public Companies

India

|

Global Rank |

Indian rank |

Company |

Sales |

Profits |

Assets |

Market Value |

|

142 |

1 |

Reliance Industries |

$71.7 B |

$3.7 B |

$76.6 B |

$42.9 B |

|

152 |

2 |

State Bank of India |

$40.8 B |

$2.3 B |

$400.6 B |

$33 B |

|

183 |

3 |

Oil & Natural Gas |

$28.7 B |

$4.4 B |

$59.3 B |

$43.7 B |

|

263 |

4 |

Tata Motors |

$42.3 B |

$2.7 B |

$37.4 B |

$28.8 B |

|

283 |

5 |

ICICI Bank |

$14.2 B |

$1.9 B |

$124.8 B |

$30 B |

|

349 |

6 |

Indian Oil |

$74.3 B |

$1.2 B |

$44.7 B |

$14.6 B |

|

376 |

7 |

HDFC Bank |

$8.4 B |

$1.4 B |

$84.3 B |

$41.6 B |

|

431 |

8 |

NTPC |

$12.9 B |

$1.9 B |

$35.4 B |

$20.2 B |

|

485 |

9 |

HDFC |

$6.8 B |

$1.4 B |

$51.9 B |

$33.7 B |

|

485 |

10 |

Tata Consultancy Services |

$15.1 B |

$3.5 B |

$11 B |

$80.3 B |

|

490 |

11 |

Coal India |

$11.7 B |

$2.3 B |

$17.8 B |

$36.7 B |

|

506 |

12 |

Bharti Airtel |

$15 B |

$801 M |

$30.8 B |

$25.8 B |

|

515 |

13 |

Larsen & Toubro |

$14.2 B |

$811 M |

$28.7 B |

$26.3 B |

|

558 |

14 |

Axis Bank |

$6.4 B |

$1 B |

$64.7 B |

$21.7 B |

|

672 |

15 |

Infosys |

$8.6 B |

$2 B |

$10 B |

$40.2 B |

|

757 |

16 |

Bharat Petroleum |

$40.6 B |

$647 M |

$15.1 B |

$9.3 B |

|

811 |

17 |

Wipro |

$7.6 B |

$1.4 B |

$9.1 B |

$24.7 B |

|

814 |

18 |

Mahindra & Mahindra |

$11.6 B |

$708 M |

$14.7 B |

$12.4 B |

|

832 |

19 |

Bank of Baroda |

$7.6 B |

$828 M |

$113.3 B |

$5.7 B |

|

839 |

20 |

ITC |

$5.8 B |

$1.5 B |

$6.9 B |

$44 B |

|

896 |

21 |

Punjab National Bank |

$8.2 B |

$599 M |

$96.3 B |

$4.3 B |

|

903 |

22 |

Tata Steel |

$24.1 B |

$456 M |

$27.9 B |

$5 B |

|

944 |

23 |

Adani Enterprises |

$10.6 B |

$368 M |

$20.9 B |

$11.1 B |

|

980 |

24 |

Power Grid of India |

$2.6 B |

$753 M |

$24.3 B |

$12.5 B |

|

982 |

25 |

Bank of India |

$7 B |

$494 M |

$96.8 B |

$2.1 B |

|

1007 |

26 |

HCL Technologies |

$5.2 B |

$1.1 B |

$5 B |

$21.1 B |

|

1018 |

27 |

GAIL India |

$10.2 B |

$792 M |

$11.2 B |

$8.2 B |

|

1026 |

28 |

Canara Bank |

$7.1 B |

$436 M |

$84 B |

$2.9 B |

|

1100 |

29 |

Kotak Mahindra Bank |

$3.3 B |

$408 M |

$21.8 B |

$17.4 B |

|

1128 |

30 |

Hindalco Industries |

$14.4 B |

$360 M |

$23.6 B |

$4.5 B |

|

1166 |

31 |

Bharat Heavy Electricals |

$6.5 B |

$580 M |

$12.6 B |

$9.3 B |

|

1173 |

32 |

Power Finance |

$3.6 B |

$904 M |

$32.5 B |

$5.9 B |

|

1225 |

33 |

Sun Pharma Industries |

$2.8 B |

$520 M |

$5.1 B |

$39 B |

|

1247 |

34 |

Hindustan Petroleum |

$36.1 B |

$179 M |

$16.6 B |

$3.6 B |

|

1310 |

35 |

Rural Electrification |

$2.9 B |

$785 M |

$26.3 B |

$5.3 B |

|

1383 |

36 |

Steel Authority of India |

$7.7 B |

$439 M |

$15.7 B |

$4.6 B |

|

1432 |

37 |

Union Bank of India |

$5.4 B |

$277 M |

$59.4 B |

$1.6 B |

|

1483 |

38 |

NMDC |

$2 B |

$1.1 B |

$5.3 B |

$8.2 B |

|

1512 |

39 |

Idea Cellular |

$4.9 B |

$466 M |

$8.1 B |

$11.2 B |

|

1525 |

40 |

IDBI Bank |

$4.9 B |

$191 M |

$55.2 B |

$1.9 B |

|

1580 |

41 |

Lupin |

$2.1 B |

$395 M |

$1.9 B |

$15.1 B |

|

1635 |

42 |

Bajaj Auto |

$3.3 B |

$559 M |

$2.6 B |

$9.5 B |

|

1635 |

43 |

Syndicate Bank |

$3.3 B |

$307 M |

$42.4 B |

$1 B |

|

1663 |

44 |

Central Bank of India |

$4.4 B |

$-201 M |

$48.6 B |

$2.5 B |

|

1711 |

45 |

Indian Overseas Bank |

$4.2 B |

$100 M |

$45.5 B |

$843 M |

|

1717 |

46 |

Mahanagar Telephone Nigam |

$573 M |

$1.3 B |

$4.8 B |

$201 M |

|

1729 |

47 |

Tech Mahindra |

$3.5 B |

$454 M |

$2.7 B |

$9.9 B |

|

1796 |

48 |

JSW Steel |

$8.5 B |

$75 M |

$13.1 B |

$3.5 B |

|

1801 |

49 |

UCO Bank |

$3.5 B |

$199 M |

$38.2 B |

$1.1 B |

|

1814 |

50 |

Corporation Bank |

$3.2 B |

$94 M |

$37.2 B |

$681 M |

|

1818 |

51 |

Allahabad Bank |

$3.5 B |

$197 M |

$37 B |

$880 M |

|

1858 |

52 |

Oriental Bank of Commerce |

$3.6 B |

$162 M |

$34.1 B |

$1 B |

|

1894 |

53 |

Indian Bank |

$2.8 B |

$197 M |

$31.4 B |

$1.3 B |

|

1946 |

54 |

Dr. Reddy's Laboratories |

$2.4 B |

$357 M |

$2.9 B |

$10.1 B |

|

1955 |

55 |

Andhra Bank |

$2.7 B |

$73 M |

$28.4 B |

$752 M |

|

1987 |

56 |

IndusInd Bank |

$1.9 B |

$278 M |

$14.9 B |

$7.8 B |

Pakistan

|

Global Rank |

Pakistan rank |

Company |

Sales |

Profits |

Assets |

Market Value |

|

#1553 |

1 |

Oil & Gas Development |

$2.5 B |

$1 B |

$5.2 B |

$7.3 B |

Indian companies in world's 500 largest companies

2015

The Times of India, July 23, 2015

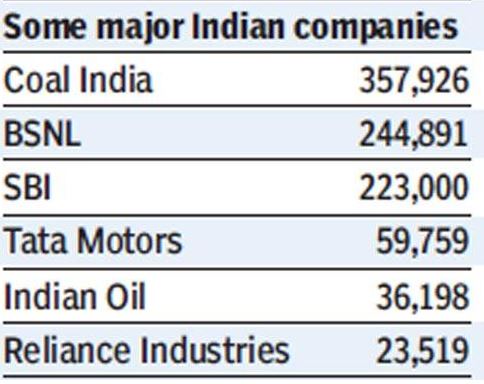

See graphics:

Indian companies in world's 500 largest companies

Some facts: Fortune Global 500

2017: HCL, TCS, Wipro rise in engg ranking

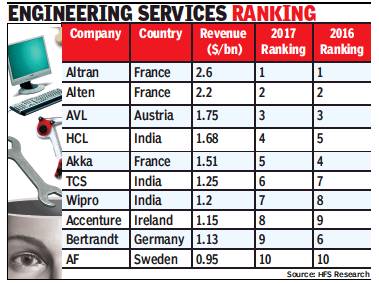

Shilpa Phadnis, HCL, TCS, Wipro up in engg services ranking, August 23, 2018: The Times of India

From: Shilpa Phadnis, HCL, TCS, Wipro up in engg services ranking, August 23, 2018: The Times of India

Segment Fastest Growing In Outsourcing Biz, Expanded 13% In 2017, Says Nasscom

HCL, TCS and Wipro have all risen one rank up in HFS Research’s latest list of the world’s top engineering service providers. European players continue to dominate this space. The ranking has 27 European firms and 9 Indian firms in the top 50. French companies Altran and Alten led the ranking, the two registering revenues of $2.6 billion and $2.2 billion respectively.

Nine players have over $1 billion in revenue from engineering services — including Altran, Alten, AVL, HCL, Akka, TCS, Wipro, Accenture, and Bertrandt. HCL Tech is now in the 4th spot with a revenue of $1.68 billion from engineering services. TCS with $1.25 billion is in the 6th spot, while Wipro with $1.2 billion in the 7th spot.

Engineering services has been a bright spot in the overall outsourcing business in recent years. IT industry body Nasscom said that in 2017, Indian engineering services exports grew by 13%, much higher than the growth in IT services exports, at 6%, and BPM exports, at 8%. Cognizant, Infosys, and Tech Mahindra have over $700 million in revenues coming from this space.

Aricent (acquired by Altran last year), L&T Tech, Cyient, Quest Global Persistent Systems, Tata Elxsi, Mindtree, Happiest Minds, and Sasken are other prominent Indiabased players in engineering services.

Product engineering refers to the process of designing and developing a device, assembly, or system. A lot of such engineering is now outsourced to specialised players. HFS Research SVP and managing director Pareekh Jain said there is a reason to the European dominance in outsourced product-engineering services. “Product-engineering is a core business activity for enterprises which many were unwilling to outsource in the early days of outsourcing, unlike transactional IT Services and BPO services which are not core activities and can be better managed by experts. Product manufacturers’ ‘secret sauce’ that has kept them competitive has traditionally been their internal design and make capability,” he said.

Jain said the outsourcing trend started with Airbus, which wanted to accelerate its product development to compete with Boeing and started leveraging local outsourcing partners to access their expertise. This led to the scaling up of the French engineering outsourcing industry. Similarly, the German automotive firms started outsourcing to local outsourcing partners to accelerate product development to compete with US and Japanese automotive companies.

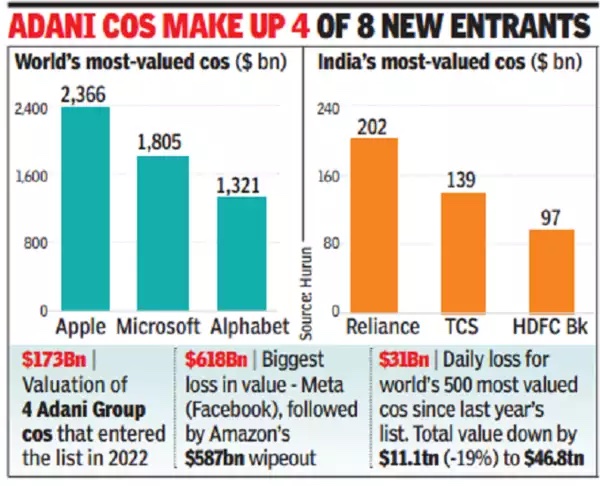

2022, Hurun

TNN, Dec 10, 2022: The Times of India

From: TNN, Dec 10, 2022: The Times of India

MUMBAI: India has 20 companies in the Hurun list of world’s 500 most valuable companies, increasing the previous year’s tally by eight. India moved up four places to rank fifth in the list behind the US, China, Japan and the UK.

India was an exception with the sensex rising 12% during the year. Four companies controlled by billionaire Gautam Adani made the Hurun Global 500 list for the first time: Adani Enterprises (worth $46 billion), Adani Transmission ($44 billion); Adani Total Gas ($43 billion) and Adani Green Energy ($40 billion). Founded in 2014, Adani Transmission is among the youngest on the list.

Of the 20 Indian companies in the list, 11 are based in Mumbai and four in Ahmedabad. Reliance Industries is the most valuable company (worth $202 billion), followed by TCS ($139 billion) and HDFC Bank ($97 billion). Financial Services led the way with seven companies, followed by software & services and energy with three companies each. The valuation cut-off for the top 500 has fallen 23% in 2022 to $28 billion compared to $36.6 billion last year. Overall, the top 500 companies lost $11.1 trillion (19%) of their value due to a decline in share prices.

Apple continued to be the most valuable company in the world (worth $2.4 trillion), though its value is down 3% from the previous year. Microsoft retained second place with a valuation of $1.8 trillion, down 15% from the previous year.

Financial services sector was the biggest contributor to the list with 21% or 104 companies, led by United Health Group, Visa and JP Morgan Chase. Energy sector was the biggest winner.

Market capitalisation

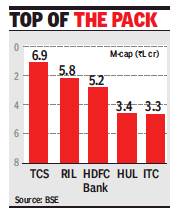

2018: TCS 1st Indian co. to cross ₹7L-cr

May 26, 2018: The Times of India

From: May 26, 2018: The Times of India

Software services major Tata Consultancy Services (TCS) became the first Indian company to achieve a market valuation of Rs 7 lakh crore in intraday trades. But it closed the session a tad off that mark at Rs 6.9 lakh crore.

Earlier, its market cap touched a high of Rs 7.03 lakh crore. Some time ago this month, TCS had become the first Indian company to reach the $100-billion market cap mark. So far, the flagship from the Tata Group remains the only Indian company to achieve these two milestones.

In recent weeks, with the Indian rupee showing weakness against other major currencies, the stock prices of software exporters have been on an upswing. This is because the depreciation of the rupee directly translates into higher revenues for exporters who bill most of their foreign clients in dollars.

So far this year, TCS’ stock price has gained about 33% compared to a 20% rise in the BSE’s IT index and a 2.6% gain in the sensex. The IT major has been mainly boosted by strong results and helped by the weakness of the Indian currency.

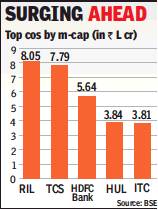

In terms of market cap, TCS is followed by Reliance Industries with Rs 5.8 lakh crore, HDFC Bank with Rs 5.2 lakh crore, HUL with Rs 3.4 lakh crore and ITC with Rs 3.3 lakh crore.

2018, Aug: RIL 1st Indian co. to cross ₹8L-cr

August 24, 2018: The Times of India

From: August 24, 2018: The Times of India

Reliance Industries (RIL) became the first Indian company to cross the Rs 8-lakh-crore market capitalisation mark, while its stock hit a fresh 52-week high. The stock closed nearly 2% higher at Rs 1,270 on the BSE. During the session, the scrip touched a 52-week high of Rs 1,274. The surge in the counter has pegged the company’s market valuation at Rs 8,04,691 crore at the end of the day’s session.

The oil-to-telecom conglomerate was among the top gainers on the BSE sensex, which closed at a fresh lifetime high of 38,337 on Thursday — up 51 points or 0.1%. The 30-share index scaled an alltime intra-day high of 38,488 in early trades. However, it succumbed to profit-booking and slipped to 38,227, before finally ending at 38,337.

The sensex bettered its previous record closing of 38,286 reached on August 21. The gauge has gained 622 points in the previous three sessions (the stock markets were shut on Wednesday on account of Bakri Eid). The broader NSE Nifty also rose 12 points, or 0.1%, to finish at 11,583 — surpassing its previous record closing of 11,571 hit on August 21.

According to market experts, the RIL stock has been on an uptrend after the company announced aggressive business plans at its AGM last month, including the launch of its fibre-to-thehome service, GigaFiber.

On July 13, RIL’s market valuation had briefly surged past the Rs 7-lakhcrore mark, making it the second company after IT bellwether TCS to achieve this milestone. On July 12, it crossed the $100-billion market capitalisation mark for the first time in the last 10 years. Again on July 20, RIL’s market capitalisation surged past Rs 7-lakh-crore mark.

TCS’ market valuation had in May surged past Rs 7 lakh crore. RIL is also the country’s most valued company in terms of market capitalisation. It is followed by TCS, which has a valuation of Rs 7,79,287 crore.

In the broader stock market, L&T was the biggest gainer among sensex components, spurting 2.3% after it approved a proposal to buy back six crore shares amounting to Rs 9,000 crore. Foreign portfolio investors bought shares worth just over Rs 254 crore and domestic institutional investors bought equities worth Rs 198 crore

See also…

Rich List: India <> Rich List: India, 2014: Forbes <>Rich List: India, 2014: Hurun <>Rich List: India, 2015: Forbes <> Rich List: India, 2015: Hurun

…and also

Rich List: Nepal<> Celebrity List: India<> Indian money in HSBC, Switzerland <> Private lives of famous Indians