Companies/ corporations: India

(→Co-working spaces) |

(→Number of companies) |

||

| (5 intermediate revisions by 2 users not shown) | |||

| Line 187: | Line 187: | ||

In the west, notice periods are limited to a month and, in certain functions, they let the individual go the same day. Earlier, companies were flexible in India and allowed the candidate to go well before three months. With dearth of good talent, they have become rigid on this count. | In the west, notice periods are limited to a month and, in certain functions, they let the individual go the same day. Earlier, companies were flexible in India and allowed the candidate to go well before three months. With dearth of good talent, they have become rigid on this count. | ||

| − | [[Category:Economy-Industry-Resources|P COMPANIES/ CORPORATIONS: INDIA | + | =Increments= |

| + | ==2020== | ||

| + | [[File: Average Increment given by Indian Companies in 2020.jpg|Average Increment given by Indian Companies in 2020 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F02%2F19&entity=Ar02100&sk=5233A0E7&mode=text Shilpa Phadnis, February 19, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Average Increment given by Indian Companies in 2020 '' | ||

| + | |||

| + | |||

| + | [[Category:Economy-Industry-Resources|P COMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIA | ||

COMPANIES/ CORPORATIONS: INDIA]] | COMPANIES/ CORPORATIONS: INDIA]] | ||

| − | [[Category:India| COMPANIES/ CORPORATIONS: INDIA | + | [[Category:India| COMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIA |

| + | COMPANIES/ CORPORATIONS: INDIA]] | ||

| + | [[Category:Pages with broken file links|COMPANIES/ CORPORATIONS: INDIA | ||

| + | COMPANIES/ CORPORATIONS: INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|P COMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIA | ||

| + | COMPANIES/ CORPORATIONS: INDIA]] | ||

| + | [[Category:India| COMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIA | ||

| + | COMPANIES/ CORPORATIONS: INDIA]] | ||

| + | [[Category:Pages with broken file links|COMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIA | ||

COMPANIES/ CORPORATIONS: INDIA]] | COMPANIES/ CORPORATIONS: INDIA]] | ||

| Line 210: | Line 229: | ||

New areas like AI/ML, sensors and robotics, make up more than a quarter of the total revenue of $191 billion | New areas like AI/ML, sensors and robotics, make up more than a quarter of the total revenue of $191 billion | ||

| − | [[Category:Economy-Industry-Resources|P | + | =See also= |

| + | [[Companies/ corporations: India]] | ||

| + | |||

| + | [[Initial Public Offerings (IPOs): India]] | ||

| + | |||

| + | [[Market capitalisation: India]] | ||

| + | |||

| + | [[Banking, India: I]] For The market capitalisation of banks | ||

| + | |||

| + | [[Corporations, corporate performance: India]] | ||

| + | |||

| + | [[Information technology (IT) (business): India]] | ||

| + | |||

| + | [[Mutual Funds: India]] | ||

| + | |||

| + | [[Public Companies, South Asia's Biggest]] | ||

| + | |||

| + | [[Sensex]] | ||

| + | |||

| + | [[The stock market: India]] | ||

| + | |||

| + | [[The Tata Group]] | ||

| + | [[Category:Economy-Industry-Resources|P COMPANIES/ CORPORATIONS: INDIA | ||

| + | COMPANIES/ CORPORATIONS: INDIA]] | ||

| + | [[Category:India| COMPANIES/ CORPORATIONS: INDIA | ||

| + | COMPANIES/ CORPORATIONS: INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|P COMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIA | ||

| + | COMPANIES/ CORPORATIONS: INDIA]] | ||

| + | [[Category:India| COMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIA | ||

| + | COMPANIES/ CORPORATIONS: INDIA]] | ||

| + | [[Category:Pages with broken file links|COMPANIES/ CORPORATIONS: INDIA | ||

| + | COMPANIES/ CORPORATIONS: INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|P COMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIA | ||

| + | COMPANIES/ CORPORATIONS: INDIA]] | ||

| + | [[Category:India| COMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIA | ||

COMPANIES/ CORPORATIONS: INDIA]] | COMPANIES/ CORPORATIONS: INDIA]] | ||

| − | [[Category: | + | [[Category:Pages with broken file links|COMPANIES/ CORPORATIONS: INDIACOMPANIES/ CORPORATIONS: INDIA |

COMPANIES/ CORPORATIONS: INDIA]] | COMPANIES/ CORPORATIONS: INDIA]] | ||

Latest revision as of 09:02, 17 September 2024

This is a collection of articles archived for the excellence of their content. |

Contents |

[edit] Co-working spaces

[edit] Stock of co-working spaces

[edit] 2017-19

From: June 27, 2020: The Times of India

See graphic:

Stock of co-working spaces, 2017-19

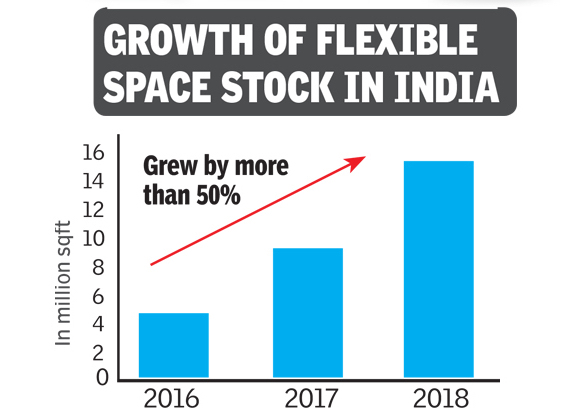

[edit] 2016-18: Flexible office space grows 50%

January 3, 2019: The Times of India

From: January 3, 2019: The Times of India

From: January 3, 2019: The Times of India

Companies continue to implement workplace strategies within their corporate office by providing various types of spaces. Several of them have also tilted towards using third-party flexible spaces recently. In fact, flexible spaces originated as a shared service for startups, but began to be utilised by larger/established corporates to improve the agility of their portfolios amid a volatile business environment. This has resulted in flexible office space operators growing rapidly in India helped by technology and economy, which together have changed tenant behaviour. Flexible spaces have grown rapidly in recent years, reaching a total footprint of under 40 million sqft across Asia Pacific (APAC) by H1 2018 in 16 major cities, which also included three in India. India is now one of the biggest flexible space markets in APAC. The overall stock of flexible space in the country (including all seven Indian cities) increased by about 50%, from almost 10 million sqft in 2017 to about 15 million sqft by Q3 2018. Bengaluru and Delhi-NCR were the largest markets for flexible spaces in India, with a combined share of almost 55%.

[edit] Cities with the most co-working spaces, 2018

July 18, 2018: The Times of India

From: July 18, 2018: The Times of India

See graphic:

The top 5 Indian cities with the most co-working spaces, 2018-19

Co-working operators have leased over 8 million square feet of office space till April 2019 across eight major cities, driven by rising demand for flexible workspaces, particularly from startups. More than 120 co-working operators compete in these cities.

[edit] Rental costs

[edit] 2019: in India’s top 6 cities

From: June 12, 2020: The Times of India

See graphic:

The rent charged for co-working spaces in India’s top 6 cities, presumably as in late 2019 or Jan 2020.

[edit] Flexi-staffing

[edit] India no.5/ 2018

June 19, 2019: The Times of India

India is fifth largest in flexi-staff ing

New Delhi:

India has emerged as the fifth-largest country in flexi-staffing globally after the US, China, Brazil and Japan. Flexistaffing refers to temporary jobs.

The apex body of India’s flexi staffing industry, the Indian Staffing Federation (ISF) on Tuesday said the domestic flexi workforce, pegged at around three million people in 2018, is set to nearly double to around six million by 2021.

While logistics, banking, financial services and insurance (BFSI), IT/ ITeS, retail and the government will account for around half of India’s flexi workforce in 2021, the country’s booming e-commerce market is expected to lead the flexi workforce growth with 54% CAGR.

The report by ISF revealed around seven million jobs were formalised between 2015 and 2018 taking the total number of formal jobs in the country to around 75 million. And, the percentage of casual workers dipped to 68% from 70% during the period. ISF attributed the progress to e-commerce, manufacturing and the government. By 2021, the total number of formal jobs in the country is set to increase to around 100 million.

“With one million youth added to the workforce every month, India’s position and performance in the labour area is of both significance and immense interest to the world.

The last three years have also witnessed some of the most significant reforms and policy shifts in the space that seen accelerated transition from informal to formal employment in the same period,” said ISF president Rituparna Chakraborty.

Goods and services tax (GST) continues to be a key driver for organised flexistaffing industry, said ISF, as it brings in standardisation in tax and eliminates advantage to unorganised staffing companies in terms of price comparability.

[edit] Human resources (HR)

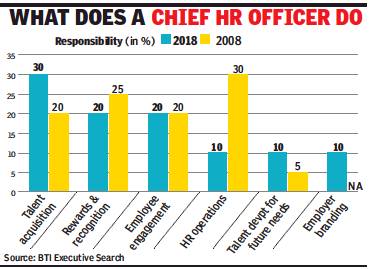

[edit] 2008>18: Changing roles of chief human resources officers

Namrata Singh, How HR heads are leading change, October 19, 2018: The Times of India

From: Namrata Singh, How HR heads are leading change, October 19, 2018: The Times of India

There’s very little that a chief human resources officer (CHRO) today would have in common with one who had the same job a decade ago. Back then, the head of the department needed to know the nuances of labour law and be an ace at managing ops. Today, it’s more the ability to plan for the future of work and align employees to growth that’s essential. Today’s CHRO is also more likely to be younger and a woman, though the scale still tips in favour of men.

“The CHRO’s job has become much more like that of a chief transformation officer,” said Reena Tyagi, who has been leading HR at Cigna TTK Health Insurance for six years. “To succeed, the CHRO must master the attributes that were barely on his or her radar five years ago — embracing disruption, practising agility, solving for organisational structure, employing data analytics, and facilitating new work environments. The companies that get the right employees will greatly improve their chances of being able to take advantage of the big changes afoot in the marketplace.”

If a CHRO spent 20% time on talent acquisition in 2008, this now consumes 30% of his/her time. On the other hand, HR operations have reduced from 30% in 2008 to 10% this year, according to a study covering 100 companies by BTI Executive Search. Today, CHROs are more aligned to the business compared to 2008. This means that they are also judged on planning, engagement and mapping the skills capability for the current and future needs.

James Agrawal, MD, BTI Executive Search/PersolKelly, said, “The role of a CHRO is becoming more strategic in managing and developing talent. It is a clear expectation from CHROs that they must help the business by building and assigning talent, especially key people, and work towards unleashing the organisation’s potential.” He said CHROs are now expected to be both business-savvy and data-savvy. “In recent years, we’ve witnessed an increase in demand for analytical CHROs with good business acumen and experience in managing diverse talent and work environments. Companies are looking for CHROs who are innovative and have long-term vision,” he said.

‘Recession, tech advances have reshaped HR work’

According to the study, disruptions have touched all areas of the CHRO’s traditional portfolio. “From the 2008 recession to major technological advances, the events of the past decade have shaped how we work today,” said Shantanu Das, CHRO, Amway India. “A decade ago, a company’s top future challenges were succession planning and developing skills of leaders. Today’s challenge has moved to acquiring and retaining specialised talent. Conventional HR practices are eroding, giving way to agile thinking and dynamic orientation. The role of a CHRO is a hands-on one and a critical element for success is the pace with which an HR leader can transform the culture to enable higher engagement.”

The average number of years required to become a CHRO has come down from 15-20 years to 12-18 years. Contrary to the belief that HR roles attract more women, at the level of CHRO, men hold sway though the gender ratio has improved from 90:10 in 2008 to 70:30 this year.

“Women are under-represented, particularly in senior leadership teams, but companies are increasingly realising the missed opportunities and are promoting women in leadership roles. Many companies have launched internal programmes to improve recruiting, retention, and promotion of women,” said Tyagi.

Leena Nair, the first woman CHRO at Unilever, is an engineering graduate who chose HR. She combines her engineering and HR skills. In a recent interview to TOI, Nair said: “We have to bring the field of human capital and financial capital together. We use standard measures to ensure we get the best talent from the best places. We measure the mood and morale of people with data analytics. With predictive attrition, we are able to predict which employees we may lose. That has saved us 200 million euros, the cost of unavoidable attrition.”

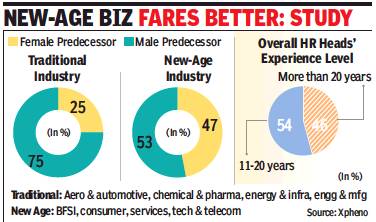

[edit] 2018: Women replace men as HR heads in 60% companies

Namrata Singh, December 25, 2018: The Times of India

From: Namrata Singh, December 25, 2018: The Times of India

The corner office for human resources in India Inc, occupied by the chief HR officer (CHRO), has witnessed an interesting shift with more women replacing men.

Xpheno, a specialist staffing firm, mapped 200 movements of women HR officers over the last few years and found that they had replaced a male incumbent as an HR head in over 60% cases. This indicates stronger action by companies to meet their diversity and inclusion (D&I) requirements, especially at leadership levels, albeit through the HR department.

Interestingly, only 15% among these women have risen vertically to become CHROs. The study reveals the remaining 85% of these movements were external hires. While this means that talent pipelines internally were largely inadequate, the trend demonstrates a priority associated with the gender of choice for the role of CHRO.

Kamal Karanth, co-founder of Xpheno, said, “The interesting aspect this study has thrown up is not about a diversity shift at CHRO corner rooms, but that most organisations still have to go through the external hiring route to get there. Women are a majority in HR departments of most firms. This means the department that has to nurture women to the top is unable to do it. Whereas other organisations find them suitable for a C-suite. That’s a paradox.”

The study was conducted across multiple sectors in organisations having an employee base of over 500. According to the study, MNCs appear to chalk out better career paths for internal candidates, thus creating a better pipeline of women successors as compared to Indian enterprises.

Globally, HR positions are dominated by women and, over the last few years, India has witnessed a similar trend. Shabnam Jussa Gaitonde, HR head of Alembic Pharmaceuticals, said, “Today, we are seeing a shift with several of the HR leader posts being occupied by women, particularly in the metros. One of the reasons for this is, of course, that the pipeline is now available, which was not the case a decade ago.” Gaitonde said the other reason is that the essence of HR lies in the ability to make clear decisions about intangibles — such as personality and potential — that are conventionally strong female characteristics.

On the other hand, Shachi Irde, adviser to Catalyst Inc, a global non-profit working to expand opportunities for women, believes women dominating HR has largely been a myth. “If you look at employee data, you will find that women drop off somewhere in the mid level. What this data is confirming is that HR is no different. Organisations have to look at building stronger talent pipelines and focus on curbing attrition at the intersection of personal and professional priorities,” said Irde.

[edit] HR policies

[edit] Clawback clauses

Namrata Singh, Cos ensure payback if execs flout norms, February 7, 2019: The Times of India

From: Namrata Singh, Cos ensure payback if execs flout norms, February 7, 2019: The Times of India

Provisions To Recall Perks After Resignation Fill Up Contracts

Also Used To Retain Talent

Clawback clauses in employment contracts are in the spotlight following the sacking of Chanda Kochhar as ICICI Bank CEO, and the lender’s decision to get her to repay bonuses since 2009 and even revoke ESOPs.

According to executive search fir ms, there is a growing trend of firms putting several such clawback clauses while hiring senior executives. “When you have a potent combination of various levers to drive performance and delivery — including performanceled incentivesand benefits and perks — it is bound to introduce enhanced complexities in the total annual payout design,” said Hunt Partners managing partner Suresh Raina.

“At the time of departure, all the annual, termbound payouts come into consideration and need a deft and creative handling. The sums involved are large (some are upwards of $75,000) and become a retention tool. Yet the talent hunt leaves few options for the hiring company to find a way to compensate the candidate and, by the time you are done, it looks like a financial contract and less of an employment contract,” added Raina.

ICICI Bank’s compensation policy and contracts, which govern its whole-time directors and senior employees, has a provision of clawback of certain compensation benefits, said an ICICI Bank spokesperson.

Clawback clauses are entered in contracts for a service or benefit provided to an employee, for which the employee has to ensure reciprocity for a certain period, said Mahindra & Mahindra EVP (group human capital & leadership development) Prince Augustin.

Executive Access MD Ronesh Puri said some companies even peg the amount to be clawed back at double of what they would spend on learning and development (L&D) of a senior executive. This comes even as more companies send their senior executives abroad for L&D programmes. “Since such programmes are expensive, companies do not want to lose the trained talent to competition. A clause to claw back the amount if the executive leaves soon after a stipulated period serves as a retention tool,” said Puri.

At junior levels, employers try to achieve a clawback by way of a training bond. Here, the employee is asked to reimburse the expenses incurred by the employer for imparting training if he does not successfully complete a service commitment.

For managerial level positions, the clawback mechanism is structured on the basis of additional payouts (such as bonus or ex gratia) being made to the employee, especially in cases of breach of the code of conduct or employment terms.

“In the practical sense and in a country like India, it remains a challenge for the employer to recover such amounts at the time of the employee’s exit, especially if the amounts are higher than the full and final settlement. Unlike the US where the law (section 304 of the Sarbanes-Oxley Act) allows for clawback for financial misstatements, some of the similar mechanisms adopted by employers are likely to be tested in courts, especially if found to be punitive or unreasonable in nature,” said Nishith Desai Associates leader (HR law) Vikram Shroff.

[edit] Notice period, as in 2019

Namrata Singh, April 20, 2019: The Times of India

From: Namrata Singh, April 20, 2019: The Times of India

A senior-level candidate was recently offered a lead position at a reputed consulting firm. The offer was accepted but the candidate was forced to serve a full three-month notice period, during which, he continued to scout for other opportunities. Around a week before the joining date, the candidate had landed a better opportunity, and this gave him a reason good enough to decline the first offer.

Organisations are strictly adhering to the rule of long notice periods. This, recruitment agencies say, is not only hindering the process of hiring but is also fuelling counter-offers. Companies are increasingly investing in the learning and development of people, which is why losing a candidate and hiring a new one has become a costly affair. Earlier, such notice periods were “bought out” by the company making a hiring pitch when in urgent need for a candidate. Recruitment firms said companies are not keen on accepting such offers.

Joseph Devasia, the India MD of global executive recruitment organisation Antal International, which has lost out on a few opportunities of placing senior-level candidates due to such policies, puts the blame on rigid notice period requirements. “Long notice periods dissuade the candidate from leaving immediately and helps the company to buy time to find the candidate a better role internally. By the end of three months, the company manages to retain the employee with a counter-offer,” said Devasia.

At a consumer products company, a candidate was serving a notice period of three months. After two and a half months, the company offered the candidate a new role and the candidate decided to stay back. “It became difficult to woo the candidate back into the job market,” said Devasia. Given that there is always reluctance on the part of companies to relieve good employees, EMA Partners regional managing partner (Asia) K Sudarshan said it is vital that the candidate is kept engaged throughout the hiring process. “It is important to understand the factors pushing the candidate for the need to change. If it is mere compensation, the candidate can easily be swayed either ways. One needs to ensure the candidate is committed to the opportunity at every step. It can become embarrassing if a candidate has been taken through the final stage of meeting the chairman or, in the case of an MNC, taken to the parent’s headquarters, and then he gets retained with a counter-offer,” said Sudarshan.

“Recently, a counter-offer was made to a candidate who was being hired by a financial services company. The hiring company then matched the counter-offer and the candidate came on board,” said Sudarshan. “There is a correlation between the instances of counter-offers and the sentiment in CXO hiring. Looking at the current scenario, it’s certainly a good market,” he added. Some business ecosystems are developed in such a way that turnaround time, service delivery effectiveness and pricing are critical. GlobalHunt MD Sunil Goel said, “It is important for the organisation to retain the resources for the project or hold them till the time it can smoothly get transited to other employees without impact on customer delivery.”

In the west, notice periods are limited to a month and, in certain functions, they let the individual go the same day. Earlier, companies were flexible in India and allowed the candidate to go well before three months. With dearth of good talent, they have become rigid on this count.

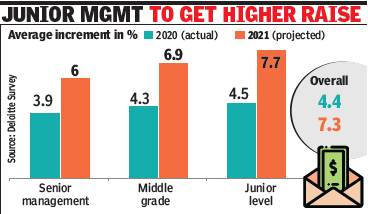

[edit] Increments

[edit] 2020

From: Shilpa Phadnis, February 19, 2021: The Times of India

See graphic:

Average Increment given by Indian Companies in 2020

[edit] Revenues: Digital

[edit] 2015-16; 2020

Shilpa Phadnis & Avik Das, June 11, 2020 The Times of India

Barely three years ago, there were analysts who looked at the advances in technology, in new digital areas like AI/ML, sensors and robotics, and were convinced that Indian IT was not responding to these changes. Some predicted the demise of leaders in Indian IT. It doesn’t look like they are coming true any time soon.

Figures from Indian IT association Nasscom show that the new digital areas crossed the $50-billion revenue milestone in the previous fiscal. That’s more than a quarter of the total revenue of $191 billion. For some leading companies, it’s even higher. For TCS, Infosys and Wipro, digital accounted for 33%, 42% and 41% respectively of their overall revenues for the same fiscal year.

Companies define digital differently, so these numbers are not strictly comparable. But they are nonetheless an indication of the amount of progress made. Nasscom started breaking out digital from 2012 and in that year, digital was merely 4% of the sector’s revenue. In 2015-16, it was estimated at $16-20 billion, or 11-14% of overall IT services revenue.

Phil Fersht, CEO of IT consulting firm HfS Research, said Indian IT companies have created a significant “permission to play” through years of relationship and development of trust. “Today, many Indian IT firms are genuine alternatives to traditional integration firms, such as Deloitte and IBM, to perform high-level digital work, a lot higher up the value stack when compared to five years ago,” he said.

The secret sauce, he believes, lies in their sheer tenacity, love of technology, and rampant entrepreneurship. “I credit Indian IT talent with a marked improvement in learning new programming languages and becoming strong at mastering low-code software, such as RPA, Salesforce and Pega.” Vivek Wadhwa, distinguished fellow at Carnegie Mellon University’s college of engineering at Silicon Valley, was among those who were pessimistic about Indian IT. Today, he says if India’s IT industry had not woken up and reinvented itself, it would be in free fall. “But it did wake up from its slumber and launch a series of new initiatives in new industries,” he says.

New areas like AI/ML, sensors and robotics, make up more than a quarter of the total revenue of $191 billion

[edit] See also

Companies/ corporations: India

Initial Public Offerings (IPOs): India

Banking, India: I For The market capitalisation of banks

Corporations, corporate performance: India

Information technology (IT) (business): India