Rich list, India: 2018

(→Details) |

|||

| Line 8: | Line 8: | ||

[[Category:India |R ]] | [[Category:India |R ]] | ||

[[Category:Economy-Industry-Resources |R ]] | [[Category:Economy-Industry-Resources |R ]] | ||

| + | |||

| + | =Change in wealth= | ||

| + | ==India’s 23 richest lose 21 billion== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/indias-23-richest-people-take-hit-with-21-billion-in-losses-in-2018/articleshow/67204725.cms India's 23 richest people take hit with $21 billion in losses in 2018, December 22, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | The world's fastest growing source of mega-wealth hit a speed bump in 2018. | ||

| + | |||

| + | The 128 people in Asia with enough money to crack the 500-member Bloomberg Billionaires Index lost a combined $137 billion in 2018, the first time wealth in the region has dropped since the ranking started in 2012. | ||

| + | |||

| + | Global trade tensions and concerns that stock valuations are too frothy hammered some of the area's biggest fortunes. China's tech sector was hit particularly hard, while India and South Korea weren't spared. The declines occurred even as banks and money managers aggressively stepped up efforts to cater to Asia's richest. Asian equities retreated again on Friday, with benchmarks slipping in Japan, China and Australia. | ||

| + | |||

| + | "Difficult stock market conditions this year and the uncertainty of the trade tensions likely have been a challenge to many businesses," said Philip Wyatt, a Hong Kong-based economist for UBS Group AG, who doesn't see the downdraft continuing through 2019 or significantly reducing the ranks of billionaires. Conditions are actually ripe for the region to create more of the mega rich as new technologies attract private capital and government support, he said. | ||

| + | |||

| + | For now, though, fear in the market is trampling fortunes. More than two-thirds of the 40 Chinese on the Bloomberg ranking saw their wealth dwindle. Wanda Group's Wang Jianlin, whose property conglomerate is selling assets to cut debt, lost $10.8 billion, the most of anyone in Asia. | ||

| + | |||

| + | JD.com founder Richard Liu, who was arrested in the US in August for less than 24 hours on suspicion of rape before being released, took the heaviest losses in percentage terms, with his wealth cut almost in half to $4.8 billion. Liu won't be charged, authorities in Minneapolis said Friday. | ||

| + | |||

| + | India's 23 richest people, meanwhile, saw $21 billion vanish. Lakshmi Mittal, who controls the world's largest steelmaker, led the way, losing $5.6 billion, or 29 percent of his net worth, followed by Dilip Shanghvi, the founder of Sun Pharmaceutical Industries, the world's fourth-largest generic drugmaker, whose wealth declined $4.6 billion. | ||

| + | |||

| + | South Korea's tycoons didn't escape the carnage either. The market rout lopped $17.2 billion from the fortunes of the country's seven richest people. The father and son who control Samsung Electronics, Lee Kun-Hee and son Jay Y Lee, account for more than a third of that decline. | ||

| + | |||

| + | In Hong Kong, titans of real estate took a big hit. Li Ka-shing, who retired as chairman of CK Hutchison and CK Asset in March, lost $6 billion in 2018, while Lee Shau Kee, the city's second-richest person, ends the year about $3.3 billion poorer. | ||

| + | |||

| + | There were still plenty of winners to emerge from the wreckage of 2018. | ||

| + | |||

| + | Lei Jun, the chairman of Chinese smartphone maker Xiaomi Corp., added $8.7 billion, with a July initial public offering catapulting him into the Top 100 of the Bloomberg index after he started the year outside the ranking. The IPO also turned three of his co-founders into billionaires. | ||

| + | |||

| + | Japan's richest person, Tadashi Yanai, added $6.3 billion to his fortune as shares of Fast Retailing Co., the world's largest apparel retailer, surged 30 percent. India's Mukesh Ambani added $4 billion to his fortune and eclipsed Alibaba Group Holding Ltd.'s Jack Ma as Asia's richest person, thanks in part to the performance of Reliance Industries Ltd. | ||

| + | |||

| + | Among the winners, the Bloomberg Billionaires Index added new members in technology, consumer, biotech and pharmaceuticals. | ||

| + | |||

| + | E-commerce platform Pinduoduo Inc.'s Colin Huang was the second-largest winner in the region, adding $6.6 billion to his net worth. China's third largest online retailer was targeted by short seller Blue Orca Capital in November for overstating financials, though its shares traded higher that week as the company denied the accusation and posted strong growth in sales. While most of the newcomers to Asia's ranks of billionaires are from China, there are five from Korea and four from Japan. Two new billionaires were identified in Southeast Asia. The household "must-have" fish sauce condiment saw Nguyen Dang Quang, chairman of Vietnam's consumer giant Masan Group, join the ultra-rich club. Indonesian real estate mogul Donald Sihombing, who works 20 hours a day, also joined the list. | ||

| + | |||

| + | At least six Asian billionaires died, leaving behind a total of $29 billion. | ||

| + | |||

| + | Walter Kwok, the former chairman of Hong Kong’s biggest real estate developer Sun Hung Kai Properties Ltd. who was worth $9.1 billion, died in October at the age of 68. His two sons inherited a $3 billion stake from the company, according to regulatory filings. Vichai Srivaddhanaprabha, the founder of Thailand’s duty-free giant King Power Group, was killed in a helicopter crash in October. He owned English Premier League team Leicester City. | ||

=Growth of wealth= | =Growth of wealth= | ||

Revision as of 18:28, 23 December 2018

This is a collection of articles archived for the excellence of their content. |

Contents |

Change in wealth

India’s 23 richest lose 21 billion

The world's fastest growing source of mega-wealth hit a speed bump in 2018.

The 128 people in Asia with enough money to crack the 500-member Bloomberg Billionaires Index lost a combined $137 billion in 2018, the first time wealth in the region has dropped since the ranking started in 2012.

Global trade tensions and concerns that stock valuations are too frothy hammered some of the area's biggest fortunes. China's tech sector was hit particularly hard, while India and South Korea weren't spared. The declines occurred even as banks and money managers aggressively stepped up efforts to cater to Asia's richest. Asian equities retreated again on Friday, with benchmarks slipping in Japan, China and Australia.

"Difficult stock market conditions this year and the uncertainty of the trade tensions likely have been a challenge to many businesses," said Philip Wyatt, a Hong Kong-based economist for UBS Group AG, who doesn't see the downdraft continuing through 2019 or significantly reducing the ranks of billionaires. Conditions are actually ripe for the region to create more of the mega rich as new technologies attract private capital and government support, he said.

For now, though, fear in the market is trampling fortunes. More than two-thirds of the 40 Chinese on the Bloomberg ranking saw their wealth dwindle. Wanda Group's Wang Jianlin, whose property conglomerate is selling assets to cut debt, lost $10.8 billion, the most of anyone in Asia.

JD.com founder Richard Liu, who was arrested in the US in August for less than 24 hours on suspicion of rape before being released, took the heaviest losses in percentage terms, with his wealth cut almost in half to $4.8 billion. Liu won't be charged, authorities in Minneapolis said Friday.

India's 23 richest people, meanwhile, saw $21 billion vanish. Lakshmi Mittal, who controls the world's largest steelmaker, led the way, losing $5.6 billion, or 29 percent of his net worth, followed by Dilip Shanghvi, the founder of Sun Pharmaceutical Industries, the world's fourth-largest generic drugmaker, whose wealth declined $4.6 billion.

South Korea's tycoons didn't escape the carnage either. The market rout lopped $17.2 billion from the fortunes of the country's seven richest people. The father and son who control Samsung Electronics, Lee Kun-Hee and son Jay Y Lee, account for more than a third of that decline.

In Hong Kong, titans of real estate took a big hit. Li Ka-shing, who retired as chairman of CK Hutchison and CK Asset in March, lost $6 billion in 2018, while Lee Shau Kee, the city's second-richest person, ends the year about $3.3 billion poorer.

There were still plenty of winners to emerge from the wreckage of 2018.

Lei Jun, the chairman of Chinese smartphone maker Xiaomi Corp., added $8.7 billion, with a July initial public offering catapulting him into the Top 100 of the Bloomberg index after he started the year outside the ranking. The IPO also turned three of his co-founders into billionaires.

Japan's richest person, Tadashi Yanai, added $6.3 billion to his fortune as shares of Fast Retailing Co., the world's largest apparel retailer, surged 30 percent. India's Mukesh Ambani added $4 billion to his fortune and eclipsed Alibaba Group Holding Ltd.'s Jack Ma as Asia's richest person, thanks in part to the performance of Reliance Industries Ltd.

Among the winners, the Bloomberg Billionaires Index added new members in technology, consumer, biotech and pharmaceuticals.

E-commerce platform Pinduoduo Inc.'s Colin Huang was the second-largest winner in the region, adding $6.6 billion to his net worth. China's third largest online retailer was targeted by short seller Blue Orca Capital in November for overstating financials, though its shares traded higher that week as the company denied the accusation and posted strong growth in sales. While most of the newcomers to Asia's ranks of billionaires are from China, there are five from Korea and four from Japan. Two new billionaires were identified in Southeast Asia. The household "must-have" fish sauce condiment saw Nguyen Dang Quang, chairman of Vietnam's consumer giant Masan Group, join the ultra-rich club. Indonesian real estate mogul Donald Sihombing, who works 20 hours a day, also joined the list.

At least six Asian billionaires died, leaving behind a total of $29 billion.

Walter Kwok, the former chairman of Hong Kong’s biggest real estate developer Sun Hung Kai Properties Ltd. who was worth $9.1 billion, died in October at the age of 68. His two sons inherited a $3 billion stake from the company, according to regulatory filings. Vichai Srivaddhanaprabha, the founder of Thailand’s duty-free giant King Power Group, was killed in a helicopter crash in October. He owned English Premier League team Leicester City.

Growth of wealth

Indian billionaires’ wealth grows 18% in ’17

Allirajan M, Indian billionaires’ wealth grows 18% in ’17, June 16, 2018: The Times of India

The ultra-rich are getting wealthier at a faster pace in the country. At 18%, persons with a wealth of more than $1 billion saw the highest growth in their fortunes during between 2016 and 2017, according to Boston Consulting Group’s (BCG) ‘Global Wealth Report 2018’.

In all, around 50 persons, who have a fortune of more than $1 billion, had a 16% share in total wealth in India at the end of 2017. This was much higher than the share billionaires have at the global level as well as in the Apac (excluding Japan) region. While billionaires accounted for only 7% of the wealth globally, they controlled 9% of the wealth in Apac.

Persons with a fortune of $100 million-$1 billion saw their wealth increase by 17% during the year. The year 2017 saw one of the strongest growth in total personal wealth around the globe, with India seeing a 15% rise compared to 2016. Total personal wealth in India is expected to register a CAGR of 13% between 2017 and 2022 to reach around $5 trillion in 2022 from about $3 trillion in 2017. Globally, total personal wealth is expected to record a CAGR of 7% to reach $281 trillion.

20% rise in Indian dollar millionaires

June 19, 2018: The Times of India

HIGHLIGHTS

The report said the number of high net worth individuals (HNIs) grew 20.4 per cent to 2.63 lakh people

HNI is defined as one who has investable assets of over $1 million, it said

Despite adverse impact on GST implementation, India saw a 20 per cent increase in both the number of dollar millionaires and their wealth in 2017 to emerge as the fastest growing market for high net population, a report said today.

The report, which comes amid growing concerns over social ramifications of asymmetry in wealth distribution, said the number of high net worth individuals grew 20.4 per cent to 2.63 lakh people, while their collective wealth grew 21 per cent to over $1 trillion.

"India was the fastest-growing market globally," the report by French tech firm Capgemini said.

The country's growth on both the number of HNIs and wealth is faster than the global average of 11.2 per cent and 12 per cent, respectively, the report by French tech firm Capgemini said.

The US, Japan, Germany and China are the biggest HNI markets in the world, it said, adding that the show in 2017 has increased India's ranking to 11th.

A HNI is defined as one who has investable assets of over $1 million, it said.

One of the major reasons for the growth was an over 50 per cent surge in market capitalisation during the year, along with an average 4.8 per cent increase in realty prices and the 6.7 per cent GDP expansion, which is faster than the world.

There was an adverse effect on wealth due to the implementation of Goods and Services Tax in July, but the report called it "transitory".

Other factors, like the monetary policy being steady, impact of demonetisation wearing off and higher savings rate helped in wealth creation, it said.

It can be noted that in January, a study had stated that the top 1 per cent of the over 1.2 billion population had cornered 73 per cent of the overall wealth generated during the year.

Besides, 67 crore Indians comprising the population's poorest half saw their wealth rise by just 1 per cent, as per the survey released by the international rights group Oxfam ahead of the annual World Economic Forum had said.

Literacy/ Education

9 (non-Indian) tech leaders who made it big without a college degree

Gadgets Now, June 4, 2018: The Times of India

For most of us, good education is a top-most priority. Having a college degree is almost universally accepted as one of the basic requirements for landing a good job and generally, being successful in life.

But that’s not always the case. Especially in the technology industry, there have been many visionaries who created something new and different that took the world by storm. These people have gone on to earn billions of dollars, and have their names etched forever in modern history.

Here are 9 such leaders of the tech industry, who made it big despite not having a college degree.

Steve Jobs

Steve Jobs dropped out of Reed College in 1972 when he was just 19 years old. He then went on to create innovative products and gadgets like iPhone, iPod and Mac. Among the most-loved tech CEOs of all time, Jobs stepped down from his position due to his illness.

Bill Gates

Co-founder of Microsoft and currently the world’s richest man, Bill Gates dropped out of Harvard University in 1975, when he was 20. Along with Paul Allen, he founded Microsoft – which is the largest software company in the world today, and develops everything from computing devices and gaming consoles to productivity software and operating systems.

Mark Zuckerberg

You probably already know about Zuckerberg dropping out of Harvard to create Facebook, but this list can’t be complete without him. He dropped out of college in his sophomore year at 20 years of age to focus solely on Facebook. Since 2004, he has been the CEO of Facebook, which is the largest social media network in the world today.

Travis Kalanick

Travis Kalanick is the man who has changed the way we book cab rides. The co-founder and CEO of Uber, Kalanick dropped out of UCLA at the age of 21. Although that was in 1998, Uber was founded in 2009. Before that, Kalanick helped Dan Rodrigues set up his company Scour Inc., and later started his own venture Red Swoosh with Michael Todd.

Michael Dell

When it comes to PCs, laptops and servers, Dell is a world-renowned brand. But not everyone knows the name that always comes up. not mention Dell. But not everyone knows the name behind the company - Michael Dell. He dropped out of the University of Texas when he was in his freshman year.

Although Dell majored in Biology, he realized that computers were his true calling. In 1984, Dell Computer Corporation was founded. Michael Dell is also the youngest CEO to make it to the Fortune 500 list.

Larry Ellison

Co-founder of Oracle, Larry Ellison shifted his focus from education to work when he was just 20 years old. He first dropped out of University of Illinois Urbana-Champaign when his adoptive mother passed away. The next semester, Ellison enrolled in the University of Chicago but dropped out of there too. He founded Oracle in 1977.

Jan Koum

Jan Koum is the creator of WhatsApp, which is probably the most popular instant messaging app in the world today. He was a math and computer science major at San Jose State University, before dropping out at the age of 21 to work for Yahoo. He continued his stint with Yahoo for 9 years before founding WhatsApp.

Jack Dorsey

The current CEO and among the founding members of microblogging website Twitter, Jack Dorsey went to Missouri University of Science and Technology. From there, he took a transfer to New York University, eventually dropping out to create Twitter.

Evan Williams

Evan Williams is one of the co-founders of Twitter. Prior to Twitter, he co-founded Odeo, a podcasting company. He continues to be on the board of Twitter, and also creating blogging platform called Medium in 2012.

Statistics

The top 13

Komal Mohan, April 23, 2018: The Times of India

Fortune magazine recently came out with its World’s Greatest Leaders 2018 list and ranked the richest Indian Mukesh Ambani 24th. The magazine in the list mentioned that Ambani has "in less than two years, brought mobile data to the masses - and completely upended the country's telecom market", Ambani is no stranger to be on such lists as even on Forbes World Billionaires list he has always been omnipresent. The Forbes World’s Billionaires list also had 13 other Indian billionaires from the list, who owe (some part of it) their wealth to the technology industry.

Here's over to richest Indian 'tech' billionaires in the country ...

Mukesh Ambani

Net worth - $40.1 billion

Global ranking - 19

Reliance Industries chairman Mukesh Ambani is the richest Indian in the Forbes’ 2018 ‘World’s Billionaires’ list. Ambani has topped the list for 11th year in a row. His telecom company Reliance Jio has changed the contours of the Indian telecom segment, triggering a bruising price war.

Azim Premji

Net worth - $18.8 billion

Global ranking - 58

The second Indian on the list is Azim Premji, the founder and chairman of India's third-largest software company Wipro. Premji had to give up his studies at Stanford University to takeover the family's cooking oil business in 1966 after his father's sudden death. He later expanded the company into software business. With an innovation centre in Silicon Valley, Wipro focuses on developing new technologies and collaborating with startups.

Shiv Nadar

Net worth - $14.6 billion

Global ranking - 98

Next on the list is Shiv Nadar, the co-founder of India's fourth-largest information technology company HCL. Nadar is one of India's leading most-prominent philanthropists and has donated $662 million to his Shiv Nadar Foundation.

Sunil Mittal

Net worth - $8.8 billion

Global ranking - 176

Telecom baron Sunil Mittal is the next Indian billionaire on the list. Chairman of one the India's largest telecom company Bharti Airtel, with almost 400 million customers, Mittal also owns Airtel Payments Bank, a joint venture with Kotak Mahindra Bank.

Anil Ambani

Net worth - $2.7 billion

Global ranking - 887

The younger Ambani scion Anil Ambani, has an empire with interests in financial services, media and infrastructure. Anil Ambani recently agreed to sell his debt-laden Reliance Communication's wireless assets to Reliance Jio, owned by his brother Mukesh Ambani, for an estimated $3 billion.

Vinod & Anil Rai Gupta

Net worth - $2.2 billion

Global ranking - 1103

This mother and son duo run one of the India's largest electrical equipment company, Havells India. The company makes everything from electrical and lighting fixtures to fans, refrigerators and washing machines.

NR Narayana Murthy

Net worth - $2.1 billion

Global ranking - 1157

Infosys co-founder NR Narayana Murthy ranks next on the list. Murthy stepped down as chairman of the software giant in the year 2011. He was recently in news after 'bitter spat' with former Infosys CEO Vishal Sikka. The resignation of Sikka led to a management shakeup in the company leading to the return of co-founder Nandan Nilekani as non-executive chairman.

Nandan Nilekani

Net worth - $1.9 billion

Global ranking - 1284

Another Infoscian on the list is Nandan Nilekani. One of the Infosys' co-founders, Nilekani left Infosys in the year 2009. However, he was brought back as non-executive chairman in August 2017 after a boardroom shakeup at the company. He is also credited of being the architect of India's identity card scheme Aadhaar.

Senapathy Gopalakrishnan

Net worth - $1.8 billion

Global ranking - 1339

Next on the list is another co-founder of the IT giant Infosys, Senapathy Kris Gopalakrishnan. Gopalakrishnan retired from the company in the year 2014 and since then has held various positions during his tenure including that of CEO and vice-chairman. Since then, he has invested in almost 63 startups, including 17 companies through his business incubator Axilor Ventures.

Vijay Shekhar Sharma

Net worth - $1.7 billion

Global ranking - 1394

Founder of the digital wallet company Paytm, Vijay Shekhar Sharma owns 16% of Paytm, which according to Forbes is now valued at $9.4 billion. Paytm has been the biggest beneficiary of demonetisation announced by the Union government in November 2016. The company claims to have 250 million registered users and process 7 million transactions daily.

K Dinesh

Net worth - $1.4 billion

Global ranking - 1650

The next on the list too is an Infosys co-founder, K Dinesh. Dinesh stepped down from the company's board in 2011 and has since devoted himself to philanthropy.

Dinesh Nandwana

Net worth - $1.4 billion

Global ranking - 1650

At No. 1650, along with K Dinesh, is Dinesh Nandwana. He is the CEO and managing director of e-governance services company Vakrangee Ltd that has 38,000-plus outlets.

SD Shibulal

Net worth - $1.2 billion

Global ranking - 1867

Last on this list is another Infosys co-founder SD Shibulal who stepped down as the company's CEO in 2014, but still holds a small stake in the company. With his former Infosys colleague Senapathy Gopalakrishnan, Shibulal co-founded business incubator Axilor Ventures.

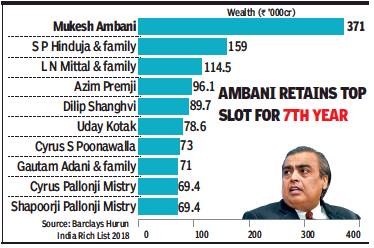

The Barclays Hurun list (summary)

At a time when policymakers are grappling on how to reduce inequalities, a wealth report revealed that there has been a 34 per cent increase in the number of Indians having a net worth of Rs 1,000 crore or more.

These individuals collectively own $719 billion, which is about a quarter of the nation's GDP.

Led by Reliance Industries chairman Mukesh Ambani with a net worth of Rs 3.71 trillion, there were 831 Indians with a net worth of Rs 1,000 crore or more in 2018, which is 214 individuals more than the 2017 list, according to a Barclays-Hurun India rich list.

A January 2018 report presented by Oxfam at the World Economic Forum had expressed concern on the rising inequalities, stating that 1 per cent of the country's population holds 73 per cent of the wealth.

Mumbai, the financial capital, which presents stark contrasts like housing the largest slums in the continent as also costliest mansions like Ambani's Antilla, has the highest number of contribution to the rich list at 233, followed by the national capital at 163 and Bengaluru at 70.

Anas Rahman Junaid, managing director and chief researcher at Hurun India, says the country is the fastest growing when it comes to people entering the rich list.

"The number of Rs 1,000 crore-plus wealthy Indians have nearly doubled in the past two years - from 339 in 2016 to 831 in 2018," he said.

From a demographic perspective, the average age in the list is 60, with 24-year-old Ritesh Agarwal of Oravel Stays, which runs Oyo Rooms, being the youngest and 95-year-old Dharam Pal Gulati of the masala brand MDH being the eldest.

There was a massive 157 per cent spike in the number of women in the list, which grew to 136.

Pharma sector promoters/executives dominate the list with a 13.7 per cent occupancy, followed by software and services at 7.9 per cent and fast moving consumer goods at 6.4 per cent.

Nine individuals in the list saw a doubling of wealth in 2018, with Krishna Kumar Bangur of Graphite India being the biggest gainer with a 430 per cent jump in his personal fortunes.

The report

BARCLAYS- The Hurun India Report

Details

September 26, 2018: The Times of India

From: September 26, 2018: The Times of India

The number of rich with wealth of over Rs 1,000 crore has gone up to 831 individuals in 2018 — up 214 from last year, according to the Barclays Hurun India Rich List. While Mukesh Ambani continues to be the richest Indian for the seventh year running with a wealth of Rs 3.7 lakh crore, Cyrus Pallonji Mistry and Shapoorji Pallonji Mistry have entered the top ten richest Indians, mainly due to a 56% increase in the price of TCS shares — which account for 67% of Tata Sons market capitalisation. The Mistrys hold about 18% in Tata Sons.

Ambani has widened the gap between himself and others following a 47% increase in the share price of Reliance Industries. Ambani’s wealth is more than the combined wealth of the next three — S P Hinduja & family, L N Mittal & family and Azim Premji. Over the last year, Ambani’s wealth increased by Rs 300 crore a day. The Hinduja group has made their entry into the top 10 by directly grabbing the number two slot. Shiv Nadar of HCL Computers and Acharya Balkrishna of Patanjali are the two to have dropped out of the top 10 list in 2017. Zerodha’s Nithin Kamath became the first bootstrapped startup founder to make it to the dollar billionaire list.

Unveiling the India Rich List, Hurun Report India MD and chief researcher Anas Rahman Junaid said that those in the jewellery business saw wealth destruction of nearly Rs 19,000 crore, thanks to the perception following the Nirav Modi scam. Those in the FMCG business added Rs 11,500 crore to their wealth largely due to the jump in rural consumption. The export-driven businesses of pharma and software continued to be the biggest generators of wealth.

The wealth of the rich with over Rs 1,000 crore net worth totals to Rs 49 lakh crore, which is more than the country’s gross domestic product (GDP) in the first quarter. The cut-off date for the 2018 list was July. However, since July the rupee has depreciated 6%. As a result, the number of dollar billionaires is down to 134 compared to 141 on the cut-off date and 136 last year.

See also…

Rich List: India <> Rich List: India, 2014: Forbes <>Rich List: India, 2014: Hurun <>Rich List: India, 2015: Forbes <> Rich List: India, 2015: Hurun <>Rich list, India: 2016 <> Rich List: India, 2016: Forbes <> Rich List: India, 2017 <> Rich List: India, 2017: Hurun<> Rich list, India: 2018

Rich list of film artistes: India

…and also

Rich List: Nepal<> Celebrity List: India<> Indian money in HSBC, Switzerland <> Private lives of famous Indians