Rich List: India

See also the Rich Lists of individual years

Rich List: India <> Rich List: India, 2014: Forbes <>Rich List: India, 2014: Hurun <>Rich List: India, 2015: Forbes <> Rich List: India, 2015: Hurun <>Rich list, India: 2016 <> Rich List: India, 2016: Forbes <> Rich List: India, 2017 <> Rich List: India, 2017: Hurun<> Rich list, India: 2018<> Rich list, India: 2019<> Rich List, India: 2020<> Rich List, India: 2021<> Rich List, India: 2022

Rich list of film artistes: India

This is a collection of articles archived for the excellence of their content. |

TRENDS, ANALYSES

History

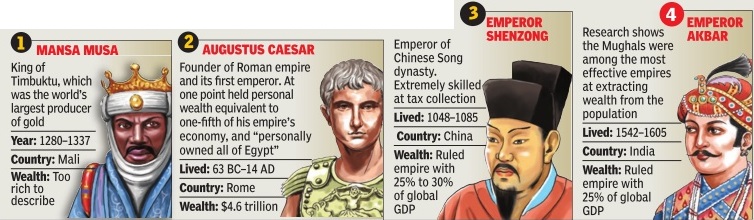

Akbar among the world’s 10 richest ever?

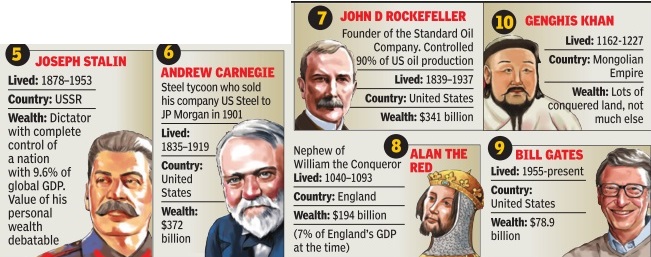

10 richest men in history, January 12, 2018: The Times of India

HIGHLIGHTS

There is an Indian emperor who features among the 10 richest persons of all time

A study revealed that the ruler had 25 per cent of the global GDP in his possession

On January 10, India's richest person Mukesh Ambani was ranked 20th in the list of wealthiest people in the Bloomberg's Billionaires Index. Ambani with his $41.2 billion wealth ranking at No. 20 is of course, no mean feat. But picture this-- there was an Indian emperor, long before our time, who actually features among 10 richest persons of all time.

Money magazine in 2015 compiled a list of richest people of all time by taking an individual's wealth and comparing it to the country's GDP, apart from adjusting for inflation and speaking to hundreds of economists and historians. The study revealed that Emperor Akbar, the third of the Mughal rulers, had 25 per cent of the global GDP in his possession.

In the run up to the budget as the government is focusing on expanding the tax base, finance minister Arun Jaitley can take a few lessons from Akbar as the research describes the Mughal dynasty as one of the most effective empires of all time at extracting wealth from the population. For all those who may sense tyranny, the study also speculates that India's GDP per capita under Akbar was comparable to Elizabethan England.

While it may be a controversial affair to compare the riches across different eras, the research does throw up some really interesting findings. For example, the crown of the 'richest of all time' goes to King Mansa Musa, whose wealth the Money magazine puts as 'too rich to describe'. Musa was the ruler of the ancient city of Timbuktu (in modern day Mali), which used to be the world's largest producer of gold.

Talking of ancient times, the Roman empire of course can't be ignored. Its founder Augustus Caesar was the second richest man of all time. Augustus, whose wealth has been projected at $4.6 trillion is said to have "personally owned all of Egypt". Caesar is also the only ancient ruler (he was in fact born in the BC or Before Christ era) in a list dominated by medieval kings. Apart from Akbar and Musa, the research lists contemporaries like Emperor Shenzong, Genghis Khan and Alan the Red.

However, there are a few entries from modern history like Joseph Stalin and John D Rockefeller. But just as no list of batting records is incomplete without Sir Don Bradman, this hall of fame of rich folks mentions Microsoft founder Bill Gates as the 9th richest since the beginning of time. That though might come in for contention as the Bloomberg's Billionaires Index mentioned above has revealed that Amazon founder Jeff Bezos is worth more than Gates ever was.

Nizam of Hyderabad, 1886-1967

October 16, 2012: The Times of India Hyderabad's last Nizam named all-time richest Indian

The last Nizam of Hyderabad was born in 1886 and ruled Hyderabad till 1947. He continued to be India’s richest man till his death in 1967 (and his heirs till around 1970).

Osman Ali Khan died in 1967 at age of 80.

Mansa Musa I of Mali ? the obscure 14th century African king - was named the richest person in all history, British newspaper 'The Independent' reported today.

With an inflation adjusted fortune of $400 billion, Mansa Musa I would have been considerably richer than the world's current richest man, Carlos Slim, who ranks in 22nd place with a relatively paltry $68 billion.

The list, compiled by the Celebrity Net Worth website, ranks the world's 24 richest people of all time. The list advertises itself as the top 25, but only 24 names appear in the list.

Although the list spans 1,000 years, some aspects of wealth appear consistent throughout history; there are no women on the list, only three members are alive today, and 14 of the top 25 are American.

The list uses the annual 2199.6 per cent rate of inflation to adjust historic fortunes? a formula that means $100 million in 1913 would be equal to $2.299.63 billion today.

Mansa Musa I ruled West Africa's Malian Empire in the early 1300s, making his fortune by exploiting his country's salt and gold production. Second on the list are the Rothschild family, whose descendants are still among the richest people on the planet.

Starting out in banking in the late 18th Century, Mayer Amschel Rothschild's finance house accumulated a total wealth of $350 billion.

Meanwhile, John D Rockefeller, third on the list, is the richest American to have ever lived, worth $340 billion in today's US dollar at the time of his death in 1937.

In comparison, the poorest man on the list is 82-year-old Warren Buffett, who at his peak net worth, before he started giving his fortune to charity, was $64 billion.

2017, Forbes

From November 20, 2017: The Times of India

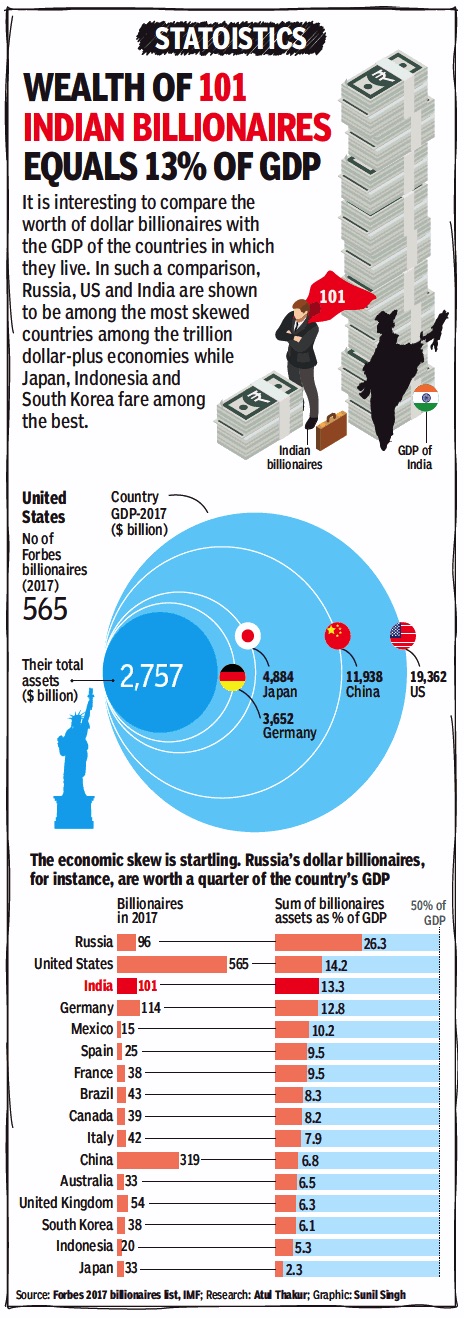

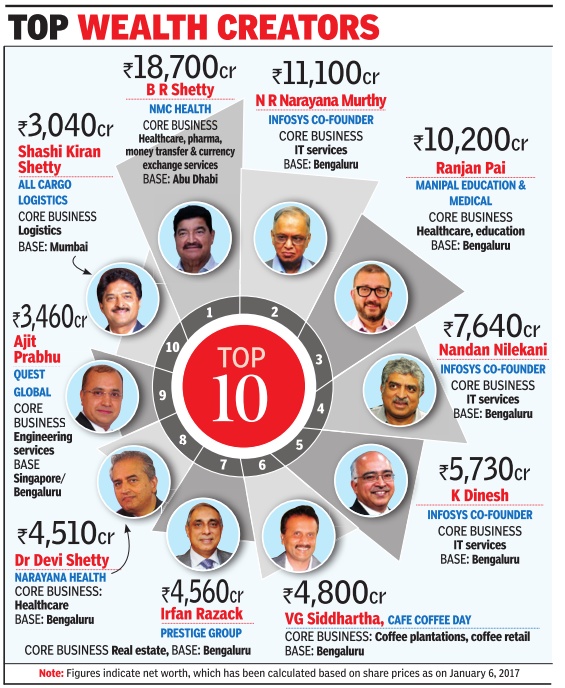

See graphic:

The percentage of the economies of India, China and other major countries, owned by the billionaires of these countries, in 2017.

2017: India’s 2 lakh super-rich worth BSE m-cap of ₹153L cr

February 14, 2018: The Times of India

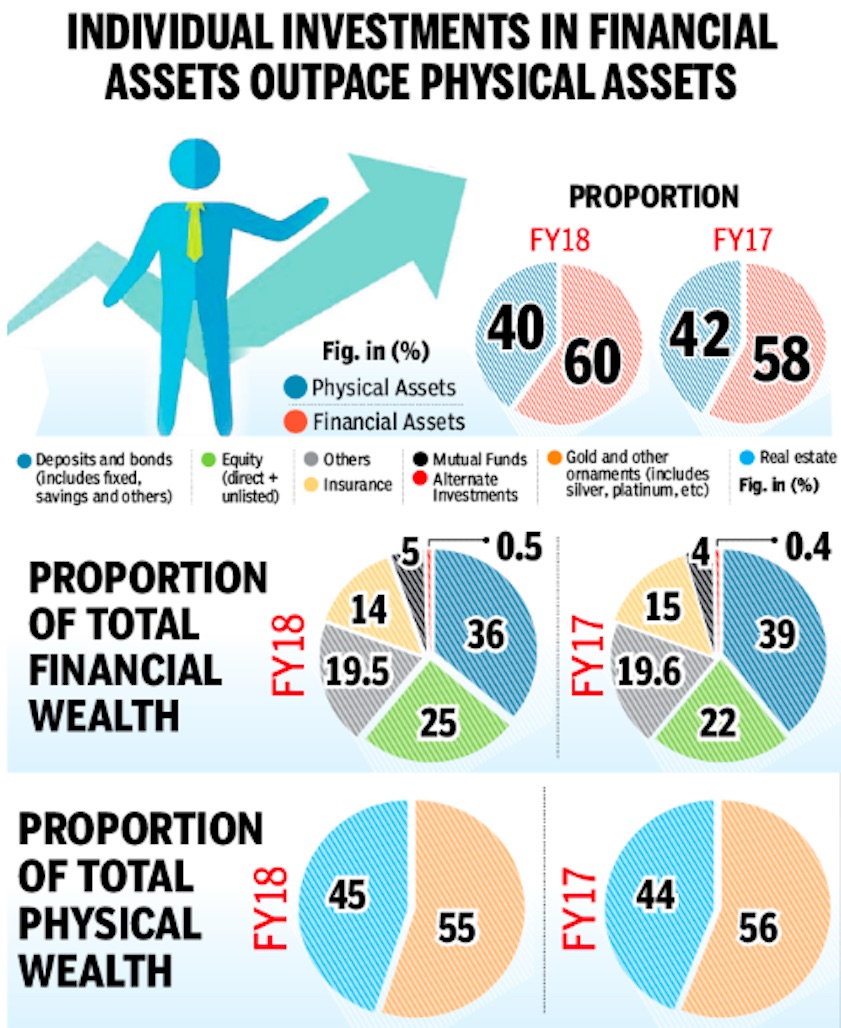

The number of super-rich households in India has grown 12% to nearly 2 lakh in 2017, while their collective net worth grew 5% at Rs 153 lakh crore, nearly equivalent to the market capitalisation of all the companies listed on the BSE, a study of ultra high-net worth individuals (ultra HNIs) in the country noted.

The number of ultra HNIs is expected to more than double to over 3 lakh in five years while the total wealth would also jump more than twofold to Rs 352 lakh crore, the study by Kotak Wealth Management said. It estimated the numbers after taking a minimum net worth of Rs 25 crore as the hurdle rate.

The study had global consultancy major EY was a collaborator. It used data points like India’s GDP growth, savings rate, investments in asset classes like stocks, mutual funds, real estate, gold, bank deposit growth, etc, to estimate the numbers. Titled ‘Top of the Pyramid 2017’, it’s the seventh edition of this annual publication.Interestingly, the study noted that Indians were getting wealthier at a younger age. “About 60% of ultra HNIs surveyed for the report are below 40 years as against 47% interviewed in the earlier edition,” the report noted. Emergence of a large number of this crowd of young super-rich is due to family inheritance, said Jaideep Hansraj, CEO, Kotak Wealth Management & Priority Banking.

Speaking about the current market trend, Hansraj expected investors would prefer to move their investments into debt-market products, as equity markets were “crazy” since the past fortnight.

Talking about investors’ preference for physical assets, Hansraj said that he did not expect investors to return to park their money in gold and real estate. However, investors’ preference for financial assets, which was boosted by the demonetisation in November 2016, would continue, he added.

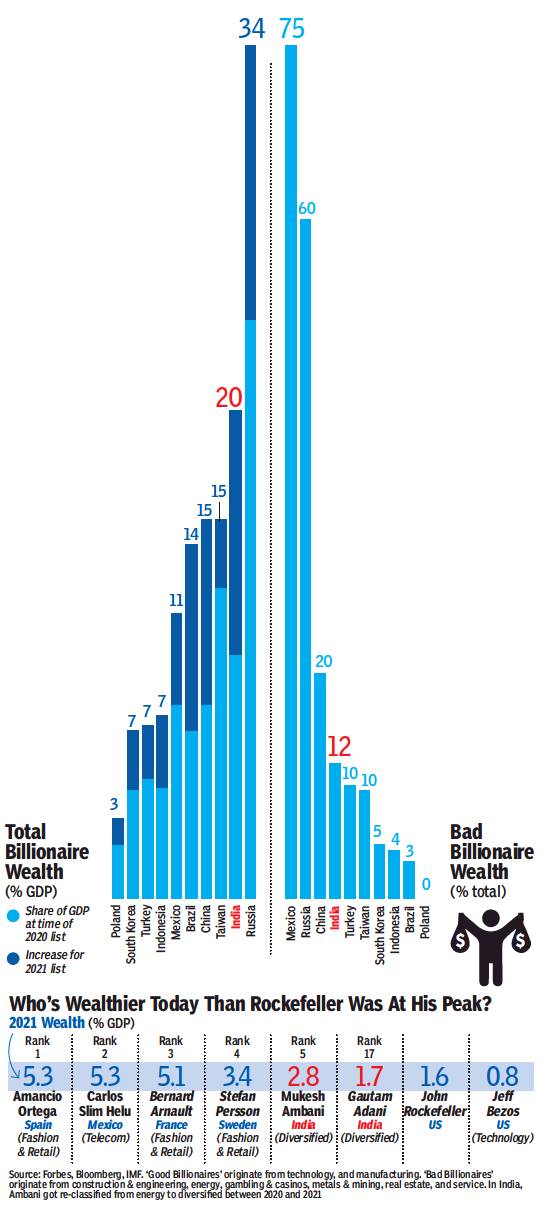

Ruchir Sharma’s good and billionaires, inequality…: 2021

Billionaire Boom: How Covid cash ended up in the wallets of the rich / The Times of India

Excerpts

Billionaire Boom: How Covid cash ended up in the wallets of the rich

Easy money pouring out of central banks is a key driver behind this surge in fortunes, and the resulting wealth inequality

Ruchir Sharma

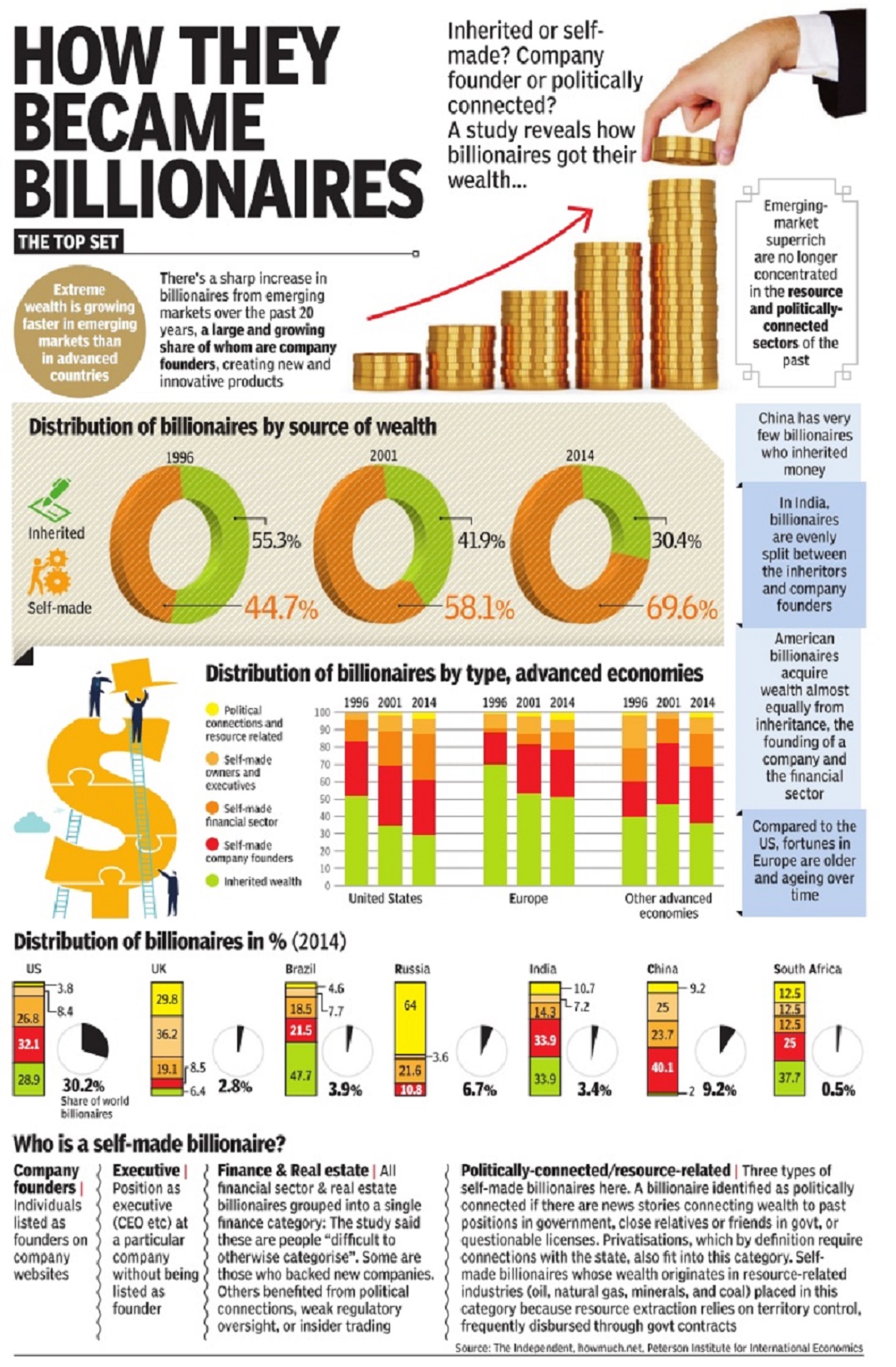

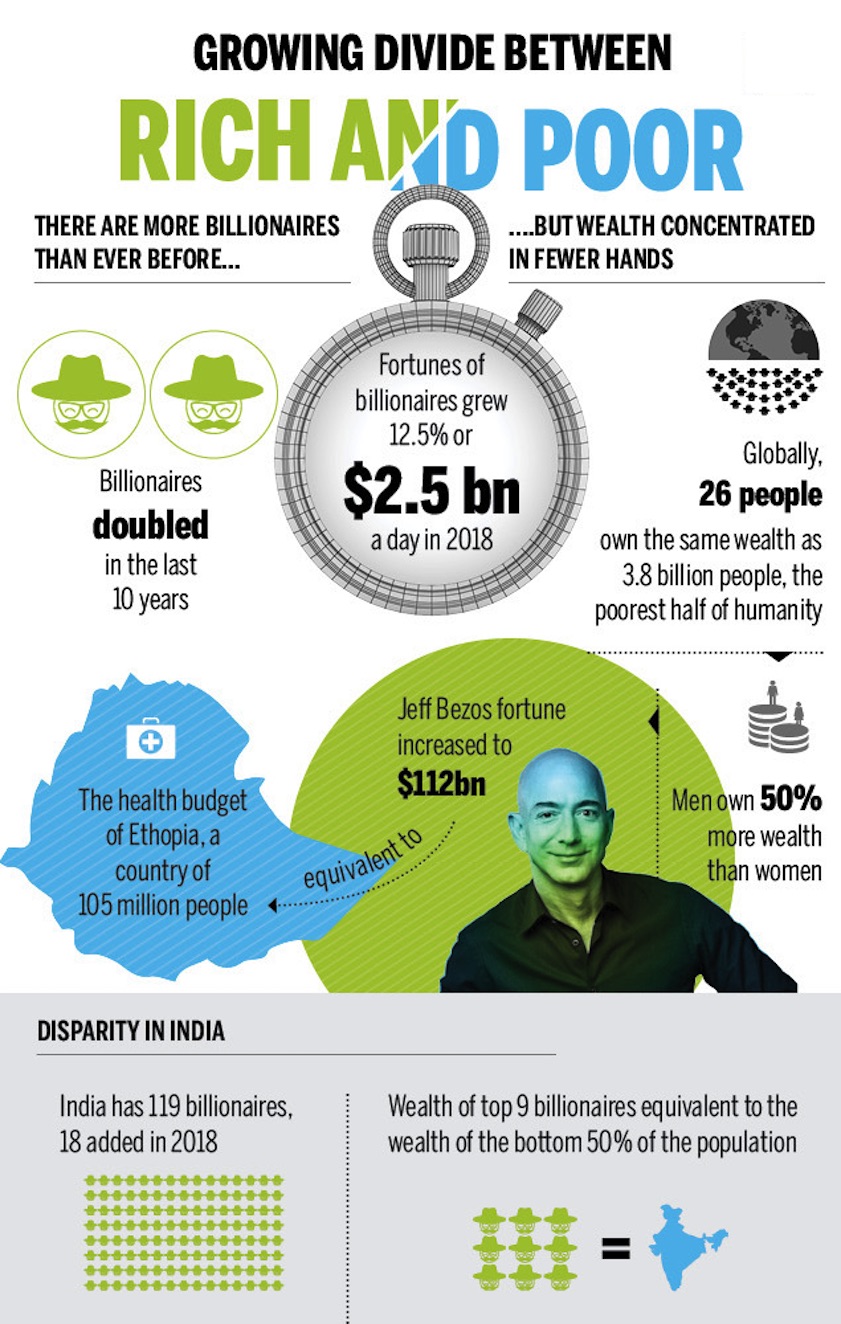

In recent decades, the global population of billionaires rose more than fivefold... Rising inequality was threatening to provoke popular backlashes against capitalism itself.

The pandemic has reinforced this trend.

The billionaire population boomed

On the 2021 Forbes list, … India added 38 for a total of 140, and has surpassed Russia for the third largest population of billionaires in the world.

Although India is relatively poor, billionaire wealth equaled more than 17% of gross domestic product, one of the highest shares in the world, with most of the gains accruing to families in industries prone to crony capitalism.

I distinguish “good” from “bad” billionaire elites by calculating the share of their wealth that comes from generally clean, productive industries — particularly technology and manufacturing — as opposed to industries such as real estate or oil. No doubt, this miscasts many oil or real estate tycoons. But in general those industries are less productive, more prone to corruption, and thus the sight of too many billionaires rising in those fields is more likely to incite populist backlashes.

US: WEALTH IS 20% OF GDP

In contrast to India, America’s billionaire class looked surprisingly well balanced in the early 2010s. Billionaire wealth totalled about 10% of GDP at that time, which was in line with the average for wealthy countries. More importantly, relatively few of the leading US tycoons got their start by inheriting fortunes, or built their wealth in “bad” industries.

By 2015, ,,, billionaire wealth mushroomed again to nearly 20% of GDP.

China [in 2020 ] its billionaire class … nearly doubled as a share of GDP to 15%.

Among the 10 top emerging economies on my list, China is in a virtual tie with Taiwan and South Korea for the leading share of billionaire wealth that comes from “good” industries, at a bit more than 40%.

Only in periods of extreme inequality, such as the robber baron age of the early 20th century, were magnates such as John D Rockefeller targeted as public enemies

There are, however, at least 17 real Rockefellers, from Sweden and France to Russia and India. (See chart) Mukesh Ambani saw his net worth more than double last year to $85 billion, and now ranks fifth on the Rockefeller list with total wealth equal to 2.8 % of India’s GDP; Gautam Adani ranks 17th, with total wealth equal to 1.7% of GDP.

INDIA: MORE TOP-HEAVY

India is also a society at risk. The total wealth of its billionaire class equals nearly 20% of GDP, the second most bloated among emerging nations, after Russia. More than 55% of billionaire wealth is concentrated in family fortunes, second worst after Indonesia. The only good news is that bad billionaire wealth declined as a share of the total last year, as new wealth came in industries such as tech, manufacturing and, particularly, in diversified conglomerates. On the whole, however, the general portrait of a top-heavy elite, perpetuated by inheritance, has not changed radically since I started tracking the billionaires list in India.

The pandemic accelerated many economic and social trends that were already in motion, including the billionaire boom, and the threat of anti-wealth backlashes.

Billionaires’ wealth

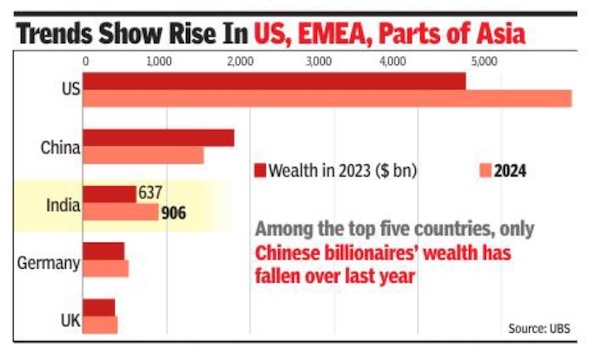

2023-2024: vis-à-vis the previous ten years

Dec 9, 2024: The Times of India

From: Dec 9, 2024: The Times of India

Mumbai : The wealth of Indian billionaires surged 42% to over $905 billion during the last financial year, positioning it as the third largest base behind the US and China, a report by Swiss bank UBS said. In contrast, in China, where the Xi Jinping regime has gone after businesses, billionaires saw an erosion in their net worth.

The UBS Billionaire Ambitions Report said during the last 10 years, the number of Indian billionaires more than doubled to 185, with their combined wealth trebled (rose 263%) at the end of April 2024. Family-led businesses are playing a pivotal role in India’s economic rise. As India breaks into the top tier of global economies, it boasts one of the highest numbers of publicly-listed family-owned businesses, many spanning generations, the report said. This phenomenon has contributed significantly to the surge in Indian billionaires over the past decade.

Rise of billionaire entrepreneurs next decade: Report

Family businesses are spread across a diverse range of sectors — from established conglomerates to new-economy ventures in pharmaceuticals, education technology, financial technology, and food delivery.

While global billionaire wealth growth has slowed, India remains an exception. This is attributed to the continued dynamism of Indian entrepreneurs and the country’s favourable economic environment.

“It’s been a time of exceptional economic growth. During two completed terms in office, Prime Minister Na- rendra Modi’s National Democratic Alliance govt introduced structural reforms that have helped propel the economy to the fifth biggest in the world,” the report said.

This trend is expected to continue, fuelled by rising urbanisation, digitalisation, a growing manufacturing sector, and the ongoing energy transition. India could witness an explosion in billionaire entrepreneurs over the next decade, mirroring China’s trajectory until 2020. In recent years, there has also been debate in the country over growing economic disparity between the rich and the poor.

Between 2015 and 2024, global billionaire wealth surged by 121% to $14 trillion, outpacing the 73% gain in the MSCI AC World Index. The number of billionaires grew from 1,757 to 2,682, peaking at 2,686 in 2021. However, growth has stalled since 2020, with a 1% annual increase in billionaire wealth globally, down from a 10% rate between 2015 and 2020. Regional trends show continued expansion in the US, EMEA, and parts of Asia, particularly India, even as Chinese billionaire wealth fell 16% from its 2020 peak of $2.1 trillion.

Tech billionaires have led the wealth accumulation, tripling their holdings from $788.9 billion in 2015 to $2.4 trillion in 2024, driven by advancements in generative AI, cybersecurity, fintech, and robotics. Industrials billionaires followed, with wealth rising from $480.4 billion to $1.3 trillion due to investments in green technology and reshoring initiatives. In contrast, real estate billionaires lagged, impacted by China’s property correction, the pandemic’s effects on commercial real estate, and rising interest rates in the US and Europe.

Caste, state, religion and the Rich List

As in 2011

Aakar Patel, The peculiar pedigree of the business class, LiveMint, 14 Apr 2011

Forbes magazine has put out a list of the world’s 1,210 billionaires. Fifty-five of them are Indians. A billion dollars is ₹ 4,480 crore. A Baniya is a member of the Vaish caste, originating mainly from Rajasthan and Gujarat.

They are under 1% of India’s population.

[The top 10] Score: Baniyas 8, Rest of India 2. If we consider the Gujaratis Godrej and Premji (from the Lohana caste) as coming from mercantile communities then actually Rest of India wasn’t playing this match so far.

India’s 11th richest man is K.P. Singh of DLF ($7.3 billion). He is the first departure from our trend of mercantile castes. Singh is a peasant [Jaat actually: a community of rural elites and of some Kings: Indpaedia], the most populous caste grouping of India, about 50% of our population [Not really: the Jaats are an elite caste: Indpaedia].

From numbers 11 to 20, there are four Baniyas. They are Anil Agarwal of Vedanta ($6.4 billion), Dilip Shanghvi of Sun Pharma ($6.1 billion), Uday Kotak ($3.2 billion), and Subhash Chandra Goel of Zee, ($2.9 billion). The non-Baniyas are Shiv Nadar of HCL ($5.6 billion), Malvinder and Shivinder Singh of Ranbaxy ($4.1 billion), Kalanithi Maran of Sun TV ($3.5 billion), Mukesh Jagtiani of Landmark ($3 billion) and Pankaj Patel of Cadila ($2.6 billion).

Between 21 and 30, there are five Baniyas. They are Indu Jain of The Times of India ($2.6 billion), Desh Bandhu Gupta of Lupin ($2.1 billion), Sudhir and Samir Mehta of Torrent ($2 billion), Aloke Lohia of Indorama ($2 billion) and Venugopal Dhoot of Videocon ($1.9 billion). The five non-Baniyas are G.M. Rao of GMR ($2.6 billion), Cyrus Poonawalla of the Serum Institute ($2.3 billion), Mumbai builder Rajan Raheja ($2.2 billion), Narayana Murthy ($2 billion) and Gautam Thapar of Avantha ($2 billion). Of the non-Baniyas, three are from mercantile communities: Poonawalla (Parsi), Raheja (Shikarpuri Sindhi) and Thapar (Khatri). Murthy is Brahmin.

Between 31 and 40 are two Baniyas: Rahul Bajaj ($1.6 billion) and Ajay Piramal ($1.4 billion). The non-Baniyas include three Brahmins: Nandan Nilekani ($1.8 billion) and S. Gopalakrishnan ($1.6 billion) of Infosys, and Vijay Mallya ($1.4 billion). Three of the others are from mercantile castes: Chandru Raheja ($1.9 billion), Brijmohan Lall Munjal of Hero Motors ($1.5 billion) and Vikas Oberoi ($1.4 billion). The last two are K. Anji Reddy ($1.5 billion) (from Andhra’s dominant peasant community) and Ajay Kalsi of Indus Gas ($1.7 billion).

Between 41 and 50 are five Baniyas. They are R.P. Goenka ($1.3 billion), Rakesh Jhunjhunwala ($1.2 billion), Brij Bhushan Singhal ($1.2 billion), B.K. Modi ($1.1 billion) and Mumbai builder Mangal Prabhat Lodha ($1.1 billion). The non-Baniyas are Baba Kalyani of Bharat Forge ($1.3 billion), Keshub Mahindra ($1.2 billion), K. Dinesh ($1.2 billion) and S.D. Shibulal ($1.1 billion) of Infosys, and Yusuf Hamied of Cipla ($1.1 billion).

The last five, from 51 to 55, include two Baniyas: Mumbai builder Mofatraj Munot of Kalpataru ($1 billion) and Ashwin Dani of Asian Paints ($1 billion). Two of the others are from mercantile castes: Parsi Anu Aga of Thermax ($1 billion) and Khatri Harindarpal Banga of Noble ($1 billion). Delhi builder Ramesh Chandra of Unitech ($1 billion) ends our list of Indians with a billion dollars or more.

The list has three Parsis, two Muslims and Sikhs in one spot (shared by the Ranbaxy Singhs). Banga is also a Sikh name but Harindarpal is clean-shaven. All of them, except Poonawalla, have inherited their wealth, though in the case of one (Premji), he took a small firm and made it global. There is nobody from the scheduled tribes or castes.

India’s large peasant castes have some representation (Singh, Patel, Reddy), but not much.

There are 26 Baniyas on our list. Many of them inherited their wealth, but just as many (Mittal, Ruias, Adani, Dhoot among others) are self-made.

The list has 16 Rajasthanis, and 13 Gujaratis. Every single Rajasthani is from one caste, Vaish, though they are from two faiths: Hindu and Jain.

Only Gujarat is capable of producing billionaires drawn from four different faiths—Hindu, Parsi, Jain and Muslim—and three different castes: Baniya, Khatri and peasant. This is unique in India and there is something about this secular mercantile culture that produces great men across communities. What is it? Three out of the four biggest leaders of the subcontinent under British rule were Gujarati, and they were drawn from these three castes: Gandhi, Jinnah and Patel. Only 5% of India’s population, Gujaratis don’t have the numbers to dominate its democratic politics. But businesses are not run in democratic fashion. And to rise, you need quality, not quantity.

The heartland of India, where our quantity resides, is missing from this list. Bihar, Bengal, Madhya Pradesh, Odisha, Uttar Pradesh have little or no representation and this does not surprise us.

On the list are 10 south Indians, in proportion to their 20% share of India’s population. The famous five from Infosys are obviously self-made. Of the others, four are first-generation wealthy. This is a good indicator for the future, and it restores some balance in favour of Rest of India.

Two final observations. India’s greatest businessman is not on this list. Why is that? It is because Ratan Tata owns less than 1% of Tata Sons. He is exceptional in every way.

Lastly, how many Baniyas in our top 20 attended the Buffett-Gates meeting to consider giving part of their wealth to philanthropy? Zero.

Aakar Patel is a director with Hill Road Media.

Cities with the most wealth

See Cities of India: the best and the worst> Economic performance

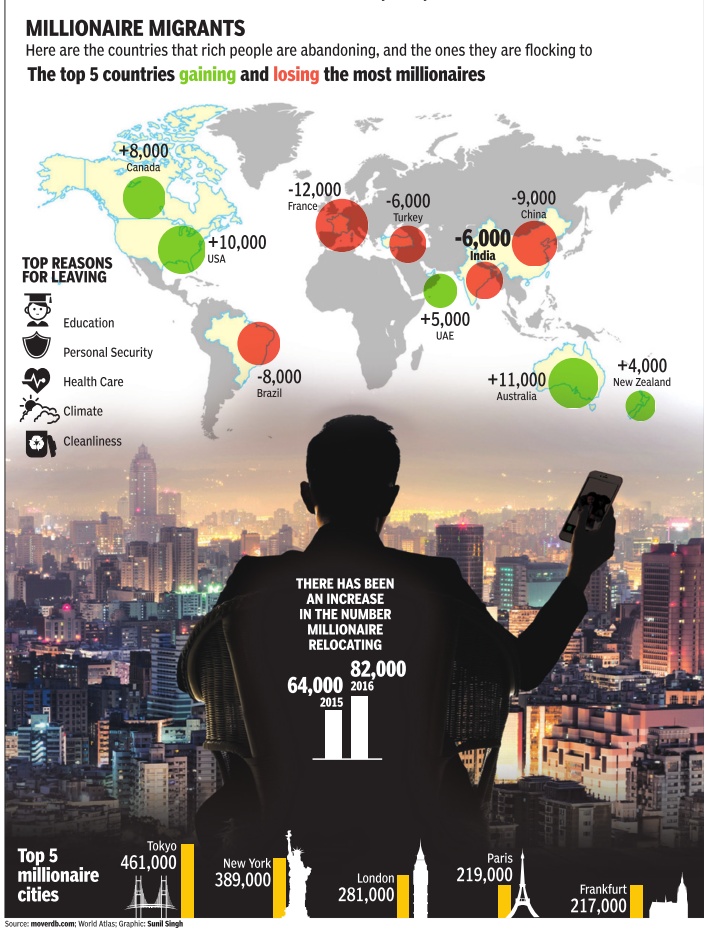

The migration of millionaires

See graphic :

Top 5 countries gaining and losing the most millionaires

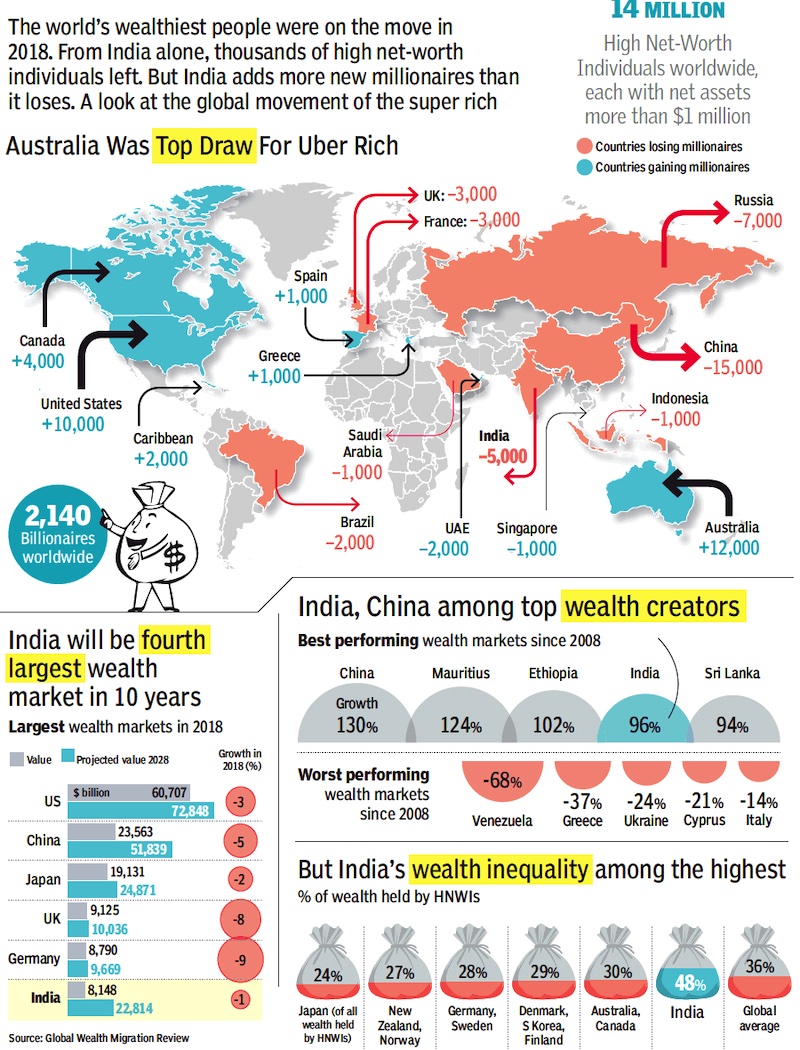

2018

From: May 10, 2019: The Times of India

See graphic, 2018:

The top countries that gained or lost the most millionaires;

The best and worst performing wealth markets, 2008-18,

The largest wealth markets, 2018,

Wealth inequality

2019

Lubna Kably , February 13, 2021: The Times of India

‘Indian rich top world in looking to leave country’

Mumbai:

The Covid may have put international travel plans on the backburner but it has not stopped high net-worth individuals (HNWIs) from shopping for new countries to set up base in — either as long-term residents or citizens.

In 2020, wealthy Indians again topped the list of those making enquiries for ‘residence-by-investment’ or ‘citizenship-by-investment’ programmes. The number of enquiries rose from 2019, said a facilitating agency. Since India does not permit dual citizenship, opting for ‘citizenshipby-investment’ means giving up one’s Indian passport.

The combination of Covid and political turmoil saw the US, in sixth place in 2019, shoot up to the second slot.

About 7,000 wealthy Indians left country in 2019, says report

The third, fourth and fifth spots in terms of enquiries made were taken up by Pakistanis, South Africans and Nigerians, respectively. These details were shared with TOI by Henley & Partners, a global firm engaged in residence and citizenship planning.

As per ‘Global Wealth Migration Review’, issued by New World Wealth, a wealth intelligence firm, Indians were the second largest contingent among the millionaire category to move overseas. Nearly 7,000 wealthy Indians (comprising 2% of the HNWIs) left the country during 2019. It appears that the interest is not waning. “We saw a 62.6% increase in the number of enquiries received from Indians in 2020 as compared to 2019. The base for 2019 was over 1,500 enquiries,” Nirbhay Handa, director and head of global South Asia team, Henley & Partners, told TOI.

Investment-linked migration programmes do not come cheap, but for many, it is much more than just owning a luxury home in an exotic location. It could also mean spreading family assets across several jurisdictions or obtaining better access to a region — say European Union. As per Henley & Partners, the top investment-linked residence and citizenship programmes that Indians enquired about in 2020 were Canada Residency, Portugal Residency, Austria Residency and Austria’s Citizenship programme, Malta Citizenship and Turkey Citizenship. Historically, US, Canada, UK and Australia have been favourites among Indians. “Canada and Australia are key contenders, (but) the processing time for these programmes has become long and the investment amounts higher over time, so Indian HNWIs understand limitations,” says Handa.

The interests of wealthy individuals in India and NRIs differ — the latter is more inclined to opt for ‘citizenshipby-investment’ programmes. The former, with overseas business interests, typically look at European ‘residenceby-investment’ options. The Portugal Golden Residence Permit Program, which requires a minimum investment of Euro 3,50,000 in real estate, is Europe’s most popular programme. NRIs tend to opt for European citizenship programmes. “Aside from the added benefit of better mobility (Austria’s passport, for instance, offers visa-free travel to 187 destinations), the citizenship programmes offered by Malta and Austria also provide the option of settlement anywhere in EU,” says Handa.

International finance centres like Dubai, Hong Kong and Singapore have a large population of professional NRIs. If they are unable to get permanent residency or citizenship in these countries, they keep their options open.

The richest 1% of India’s population

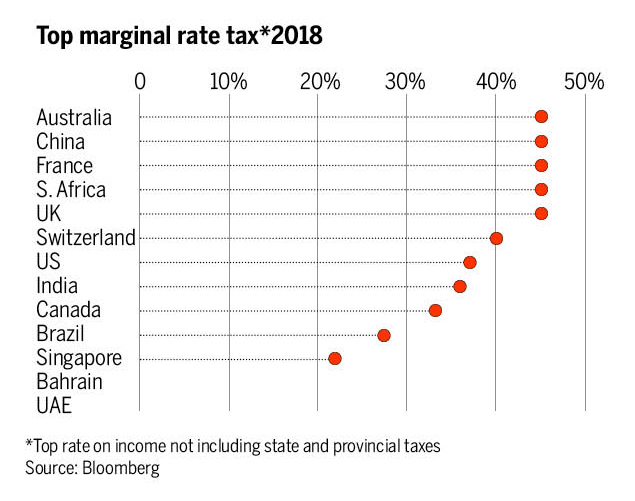

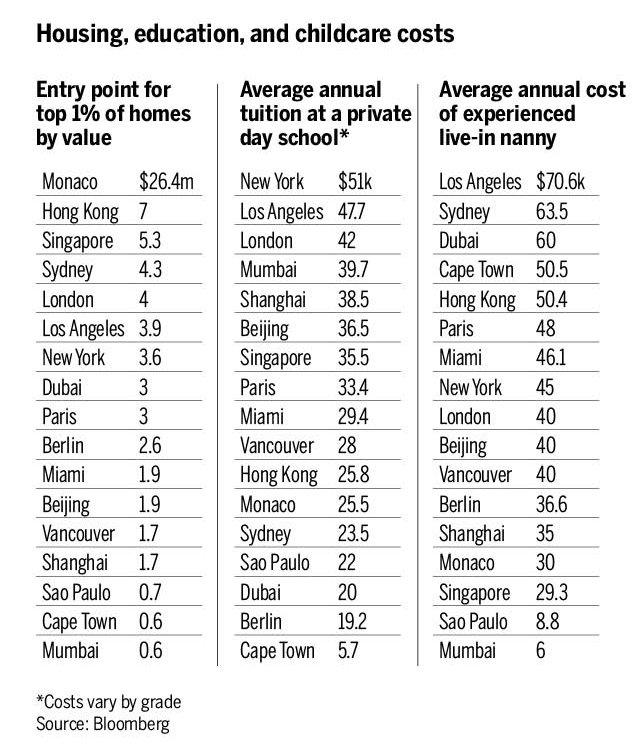

What they earn and spend on; the top marginal tax rate

Bloomberg, This is what it takes to be in the 1% in India, February 10, 2020: The Times of India

From: Bloomberg, This is what it takes to be in the 1% in India, February 10, 2020: The Times of India

From: Bloomberg, This is what it takes to be in the 1% in India, February 10, 2020: The Times of India

From: Bloomberg, This is what it takes to be in the 1% in India, February 10, 2020: The Times of India

NEW DELHI: The "top 1%" is the symbol of wealth and power thanks to a protest movement. Since Occupy Wall Street popularised the term almost a decade ago, inequality has surged, and this exclusive group has only gotten richer and more influential.

Yet the top 1% covers a wide span, from prosperous professionals to billionaires with more wealth than many nations. And the difficulty of making the cut varies greatly depending on where you live.

To join the group in the oil-rich United Arab Emirates (UAE) requires more than $900,000, or 12 times more income than in India, a developing market so populous that the top 1% includes more than 13 million souls. In much of the developed world, an income of $200,000 to $300,000 gets you in the top 1%.

In the US, the wealthy have been pulling away from the middle and working classes, whose incomes have barely grown for the past couple of decades. Inequality is widening even within the ranks of the top 1%. While it takes about $500,000 per year to enter the top 1% of Americans, reaching the 0.1% now requires an annual income of more than $2 million. The threshold for the 0.01% is more than $10 million.

What they owe

Some countries make special efforts to attract the global 1% and their wealth. Singapore and Monaco, for example, have turned themselves into tax shelters where the well-off can live and invest under a lighter tax and regulatory burden. Some nations rich in oil and gas can also afford not to tax the top 1%.

In most of the world, though, politicians use taxes to try to level the playing field between the wealthy and everyone else. In many nations with a progressive income tax, the highest rates apply only to the richest portion of the 1%.

What they spend

The rising wealth of the world’s top 1% has prompted a boom in luxury spending, especially in China. McKinsey & Co estimates spending on personal luxury goods like accessories, jewelry and watches is up 47% since 2012.

Many members of the top 1% have little interest in designer handbags or high-end fashion, of course. Housing, education and child care are far more common expenses for this group, and their costs can vary widely around the world.

A common theme from city to city is a fierce competition for English-speaking international schools, according to Gail Rabasca, executive vice president at relocation consulting firm Chamness WorldWide, as expatriates fight for spots with local children whose parents “want more competitive educational positioning and intercultural awareness for their children.”

The prices for high-end real estate in major global cities jumped from 2010 to 2018, but growth has slowed more recently, said Liam Bailey, global head of research at Knight Frank. The problem is a backlog of supply and a sense that costs are too inflated, he said. “There are limits to how high very wealthy individuals will bid prices.”

Countries with the most millionaires

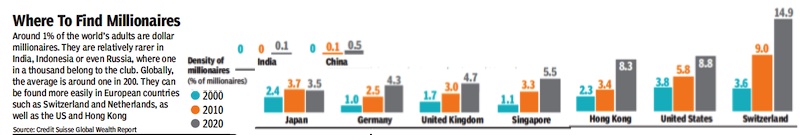

2000>2020

From: July 12, 2021: The Times of India

See graphic:

Millionaires in India and the world, 2000>2020

2018> 19

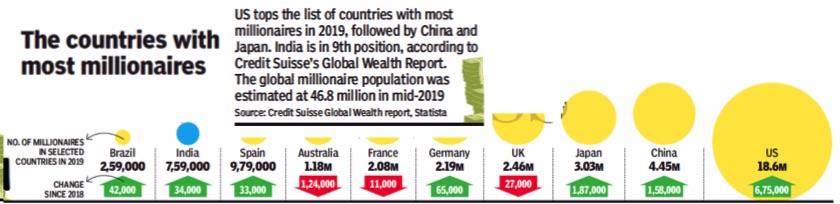

From: Nov 13, 2019: The Times of India

See graphic:

India, Australia, Brazil, China, France, Germany, Japan, the UK and the USA: The countries with the most millionaires in 2018 and 19.

2024: Mumbai tops Asia in no. of billionaires, in 3rd spot globally

March 26, 2024: The Times of India

With 92 billionaires, Mumbai has overtaken Beijing (91) as Asia’s billionaire capital for the first time. It now ranks third globally in terms of billionaires behind New York (119) and London (97), shows a study.

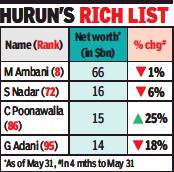

Mumbai’s total billionaire wealth stands at $445 billion, a 47% jump from 2023. China has 814 billionaires against India’s 271, Hurun Research’s 2024 Global Rich List shows. In the global rich list, Reliance Industries’ Mukesh Ambani has maintained his stronghold at the 10th position. The others on the list include Gautam Adani, Shiv Nadar and his family, Cyrus S Poonawalla, Dilip Shanghvi, Kumar Birla and Mangal Prabhat Lodha.

Details

March 26, 2024: The Times of India

From: March 26, 2024: The Times of India

Mumbai:There are now more billionaires in Mumbai’s 603 sq km than there are in Beijing’s over 16,000 sq km. By overtaking the Chinese megalopolis, Mumbai has become Asia’s billionaire capital for the first time.

While China has 814 billionaires compared to India’s 271, Mumbai hosts 92 billionaires against 91 in Beijing, Hurun Research’s 2024 Global Rich List showed. Mumbai now ranks third globally in terms of billionaires after New York, which regained its top status after seven years with 119 billionaires, followed by London with 97.

The Maximum City has managed to overtake China’s political and cultural capital because of the 26 new billionaires it has added in a year. Beijing, in the same time, has seen a 18 erstwhile billionaires drop out of the list on a net basis.

Mumbai’s total billionaire wealth stands at $445 billion, with a 47% increase from the previous year, while Beijing’s total billionaire wealth amounts to $265 billion, a 28% decrease.

Mumbai’s wealth sectors include energy and pharmaceuticals, with billionaires like Mukesh Ambani experiencing significant gains. Real estate player Mangal Prabhat Lodha (and family) was Mumbai’s biggest wealth gainer in percentage terms (116%).

In the global rich list, Indian billionaires have seen a slight drop in world ranking; Mukesh Ambani maintains his stronghold at 10th position with a substantial increase in wealth, primarily attributed to Reliance Industries. Similarly, Gautam Adani’s remarkable surge in wealth propelled him up eight positions globally to the 15th rank.

HCL’s Shiv Nadar and his family witnessed a notable ascent in both wealth and global ranking (up 16 places to 34). Conversely, Serum Institute’s Cyrus S Poonawalla experienced a modest decrease (down 9 places to 55) with total wealth of $82 billion.

Further contributing to India’s billionaire cohort’s dynamics are Sun Pharmaceuticals Dilip Shanghvi (61st position) and Kumar Mangalam Birla (100). Radhakishan Damani’s modest yet steady wealth growth, fuelled by DMart’s success, has seen him move up eight places to 100.

Inheritor clans/ 2nd generation and after

India’s place in Asia/ 2023-24; 2019-14

Bloomberg, February 12, 2024: The Times of India

From: Bloomberg, February 12, 2024: The Times of India

Indian Family Billionaires Lead Asia’s Surge, Hong Kong’s Suffer Reversal

Keep in mind, the list doesn’t include first-gen wealth creators like Jack Ma and Gautam Adani. It also excludes fortunes of single heirs

Over A Quarter Of Asia’s 20 Richest Clans Are Indian

Six of Asia’s 20 richest clans are from India. The divergence is an indication of how the concentration of wealth and power in Asia is shifting as China’s growth slows

Ambani’s Wealth, Reliance Market Cap At Record Highs

Ambani family’s fortune ($103 billion) and RIL stock have both hit record highs in recent weeks The six Indian clans are together worth $219 billion, which is 41% of the total wealth of Asia’s top 20 The stock market boom has also bolstered Mistry, Jindal, Birla and Bajaj fortunes

Number of $-millionaires

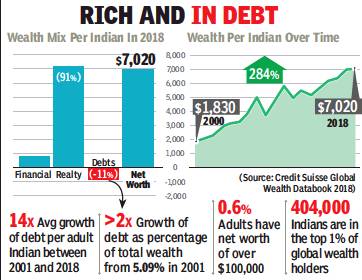

2000-18: wealth per Indian; growth of debt

India has 3.4L $-millionaires with $6tn total wealth: Study, October 19, 2018: The Times of India

From: India has 3.4L $-millionaires with $6tn total wealth: Study, October 19, 2018: The Times of India

Amid rising concern over increasing inequality, the country created a whopping 7,300 more millionaires during the 12 months to mid-2018, taking the total number of dollar-millionaires to 3.43 lakh, who are collectively worth around $6 trillion, says a report.

According to Credit Suisse, the country is home to one of the highest proportions of female billionaires at 18.6% during the period, among the major countries. Of the total dollar-millionaires, 3,400 have wealth over $50 million, while 1,500 have over $100 million each, said the Credit Suisse’s 2018 global wealth report. And the number of the rich as well the inequality is set to widen by over 53% by 2023 when their number is set to cross an estimated 5,26,000 millionaires worth around $8.8 trillion.

The report said Indians’ personal wealth is dominated by property and other real assets, which make up 91% of estimated household assets. Over the past 12 months, non-financial assets grew by 4.3%, accounting for all of the wealth growth in the country, it noted. House-price movements are a proxy for the non-financial component of household assets, which reached a high of 9% for the country.

Globally, the US continues to lead the rich club for the 10th year in a row. During the reporting period too, the US contributed the most to global wealth, adding an $6.3 trillion, taking the total to $98 trillion. Since 2008, the US has been continuing its unbroken run of growth in total wealth and wealth per adult annually. China is home to the second-largest number of wealthy households, having added $2.3 trillion to reach $52 trillion.

2012-17/ Bangladesh, India, Pakistan, growth of ultra HNIs

November 12, 2018: The Times of India

From: November 12, 2018: The Times of India

See graphic:

2012-17/ Bangladesh, China, India, Pakistan, growth of ultra HNIs

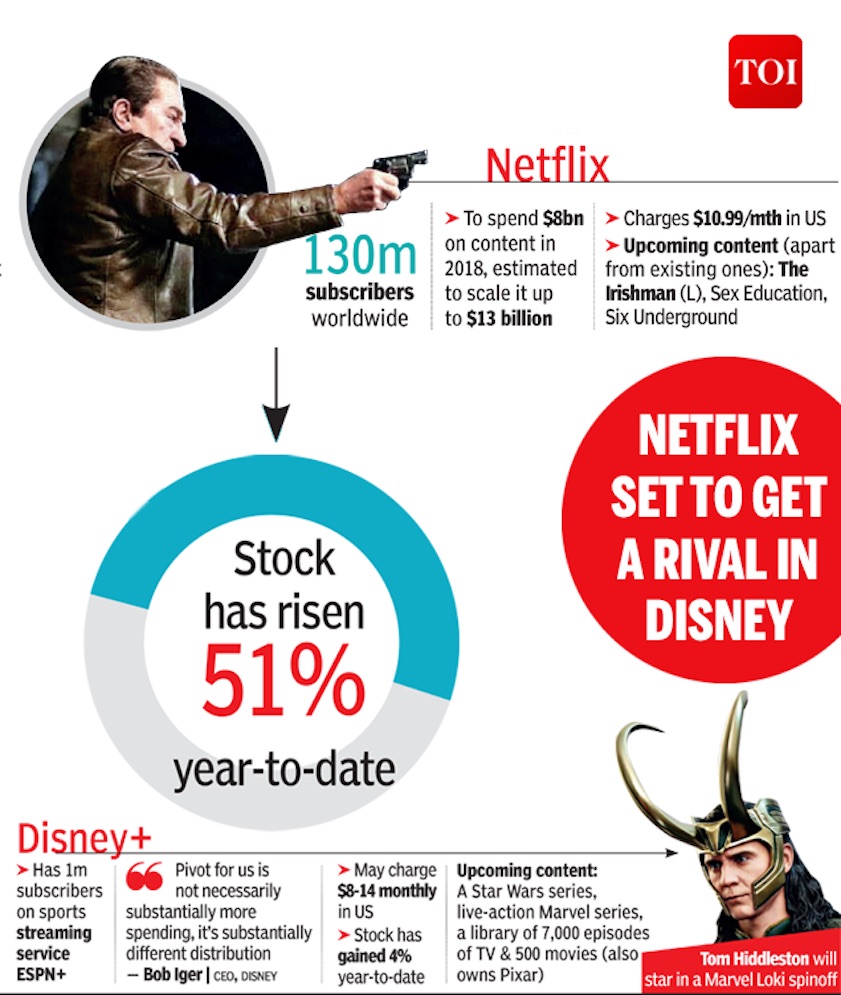

On November 8, 2018, Disney said streaming service will kick off in 2019, pitting it against market leader Netflix and others like Amazon Prime Video and AT&T’s upcoming offer. The service is called Disney+ and will source content from a vast in-house library and also produce original series. Disney content from Netflix will be moved back to the Mouse House, putting pressure on the streaming co. Netflix has been expanding its operations in Asia.

2018: Only 61 have income of over Rs 100 cr

There were only 61 individuals who declared an income of more than Rs 100 crore during assessment year 2017-18, though the number has risen sharply from 38 in the previous year.

This information was provided by minister of state for finance Pon Radhakrishnan to the Lok Sabha in a written reply on Friday.

The number of individuals disclosing a gross total income of more than Rs 100 crore in a year in his/her return of income filed with the Income Tax (I-T) department was 24 in assessment year 2014-15 and since then it has been steadily rising.

The minister also said there was no official/uniform definition of classification of a person as 'billionaire'.

Replying to another question, minister of state for finance Shiv Pratap Shukla said that government is taking action under Benami Properties Transactions Act, and properties valued at Rs 6,900 crore were under attachment by agencies.

"The income tax authorities till December 2018 have identified more than 2,000 benami transactions," he added.

These include, deposits in bank accounts, plots of land, flat and jewellery, he said, adding that provisional attachment of properties have been done in over 1,800 cases.

2020: 6,000 UHNWI Indians worth ₹215cr + each

March 6, 2020: The Times of India

6,000 Indians have ultra-high net worth of over ₹215cr each

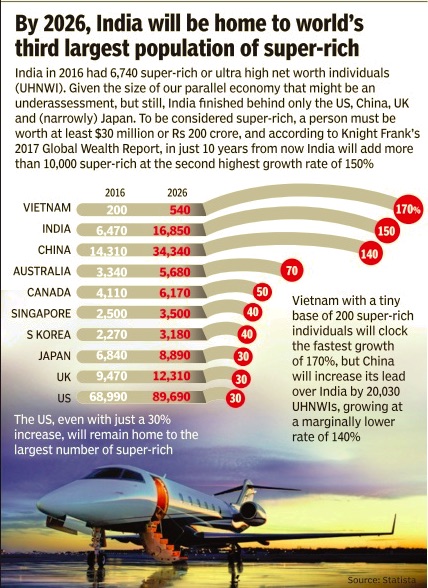

India has 5,986 ultra-high net worth individuals (UHNWI), each with over US$ 30 million (around Rs 215 crore), and it is globally ranked 12th on the list of countries with most such people.

The US dominates the list with over 2.4 lakh UHNWIs, followed by China with 61,587 and Germany 23,078, according to Knight Frank Wealth Report 2020 released Thursday. Globally, over 31,000 new UHNWIs were created in 2019, bringing the total to more than 513,200.

“The number of UHNWIs in India is predicted to grow by 73% in the next five years, almost doubling the count to 10,354 from 5,986 in 2019,” said the report. By 2024, Asia will be the world’s second largest wealth hub outperforming Europe, with a five-year growth forecast of 44%. However, it will reach only half the size of North America’s UHNWI population, which is predicted to rise 22% over the same period.

Inspite of wealth growth and record low interest rates in most advanced economies, the global economic slowdown weighed on prime property prices across the globe. For instance, Mumbai saw a growth of just 0.5% last year, Delhi 4.7% and Bengaluru 2.1%. Frankfurt and Lisbon topped the list with an annual price change of 10.3% and 9.6%, respectively. When it comes to luxury properties, Monaco remains the most expensive city where US$1 million (Rs 7.2 crore) can buy you a mere 16.4 square metre or 176 square feet of space.

Equity most attractive asset class for UHNWIs

Comparatively in Mumbai, you can buy 102.2 sq m or 1,098 sq ft (approximate size of a decent two-bedroom flat in the city). Shishir Baijal, chairman & MD, Knight Frank India, said, “While prime property prices have stayed stable in the past five years, the relative stability of the Indian rupee still allows investors and endusers to buy more prime real estate in India today than in 2015. At -1% for 2020, prime property price growth in Mumbai is expected to face challenges, as the current economic slowdown will continue to influence market liquidity.” Equity investments remained the most attractive asset class for Indian UHNWIs with 83% of them in India plan to increase or maintain their allocations in equities, followed by bonds (77%) and property (51%). So, which are the best cities for UHNWIs to live, invest and do business in? According to the Knight Frank City Wealth Index, New York captured the top spot from London based on wealth, investment and lifestyle. With London in the second spot, Paris, Hong Kong and Los Angeles round out the top five cities. The Luxury Investment Index shows that ‘collectable handbags’ has topped the index, rising in value by 13% over the 12 months to Q4 2019, knocking rare whisky off its number one position. “The index results show that on an annual basis, handbags outperformed both whisky and art, which both recorded growth of 5%,” it said.

US dominates the ranking with over 2.4 lakh UHNWIs, followed by China with 61,587 and Germany 23,078, according to the Knight Frank Wealth Report 2020. The number of UHNWIs in India is predicted to grow by 73% in the next five years, almost doubling the count to 10,354 from 5,986 in 2019.

2021: 1,000+ Indians worth Rs 1,000 crore

Sep 30, 2021: The Times of India

From: Sep 30, 2021: The Times of India

From: Sep 30, 2021: The Times of India

From: Sep 30, 2021: The Times of India

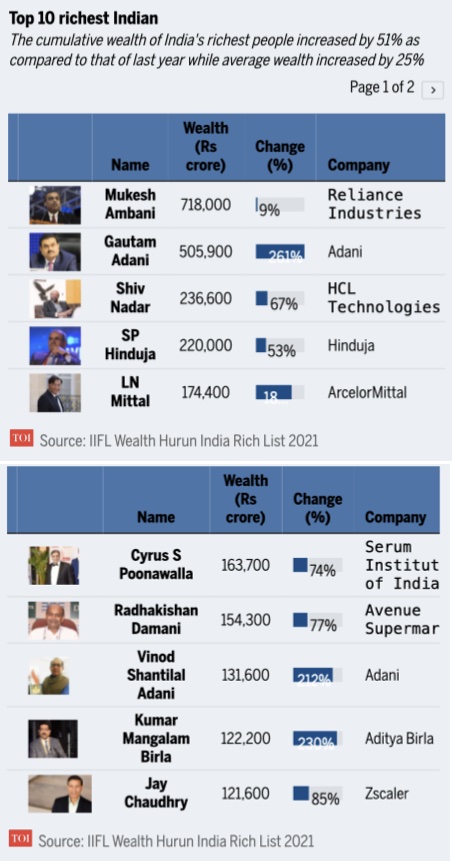

NEW DELHI: For the first time ever, over 1,007 individuals in the country have a net worth of Rs 1,000 crore, the IIFL Wealth Hurun India Rich List 2021 showed.

The report said that India experienced a glorious decade with the richest individuals cumulatively adding Rs 2,020 crore per day -- the fastest wealth creation ever experienced by the country. Out of these 1,007 individuals, 13 of them have more than Rs 1 lakh crore of wealth.

Even amid the pandemic situation which battered the economy, total wealth increased by 51 per cent while average wealth was 25 per cent higher.

Further, 894 individuals saw their wealth increase or stay the same, of which 229 new faces. Number of billionaires also jumped to 237 till September 15 this year.

"The number of entrants in IIFL Wealth Hurun India Rich List has grown 10 times in 10 years -- from just under 100 ten years ago to 1,007 today. At this rate, in 5 years, I expect the list to grow to 3,000 individuals," Anas Rahman Junaid, managing director and chief researcher at Hurun India said. He also noted that the wealth of rich listers fell by 30 per cent within 2 months of the Covid pandemic as economic activities came to a standstill owing to the lockdown.

However, pent up demand accompanied with timely government policies, accentuated investors interest and the Nifty and sensex jumped to all-time highs.

"The bull-market valuation multiples, resulted in 9 out of 10 people in the list witnessing either an increase or retention in their wealth compared to last year, while 116 individuals doubled their wealth,” he added.

Besides, wealth creation has become more decentralised as the number of cities jumped from 10 a decade ago to 76. At this rate, it is expected that the each of the planned 100 smart cities will have a rich lister within 5 years.

India has third largest no. of billionaires

The report further noted that India is third in the world, when it comes to no. of billionaires.

India is adding new billionaires at one of the fastest rates. At present, there are 237 billionaires in the country, 4 times more than what it was 10 years ago. India is also the second fastest growth in the world after China.

Mukesh Ambani retained No. 1 spot for 10th year

Reliance Industries chairman Mukesh Ambani emerged to be richest Indian for the 10th consecutive year.

With 9 per cent jump, his total wealth stood at Rs 7,18,000 crore. RIL became the first Indian company to cross the Rs 16 lakh crore market valuation.

According to Hurun Global 500 most valuable companies 2021, within four decades of operation, RIL has become the 57th most valuable company in the world.

Others in top 5

Adani Group chief Gautam Adani moved up two places to the second place in the latest rankings. He is now the second richest Asian after Ambani, overtaking China's bottled water producer Zhong Shanshan.

HCL Technologies founder Shiv Nadar retained the third spot with 67 per cent rise in his wealth. The company became third IT firm to break through the $10 billion revenue mark. Hinduja Group's SP Hinduja & family held the fourth place with Rs 2,20,000 crore up 53 per cent, while ArcelorMittal chief LN Mittal with Rs 1,74,400 crore held the fifth place.

Four new faces in top 10

The top ten list this year has four new faces, led by steel tycoon Lakshmi Mittal of ArcelorMittal, Kumar Mangalam Birla of the Aditya Birla Group, along with California based Jay Chaudhry of cloud computing and cyber security firm Zscaler.

Richest woman

Among the women, the third generation Godrej family member Smita V Crishna is the richest woman in the list with Rs 31,300 crore (down 3 per cent), followed by Kiran Mazumdar-Shaw (who is also the richest self-made woman in the list) with Rs 28,200 crore, down 11 per cent.

Mumbai preferred city for biggest wealth creators

Mumbai justified its name as the financial capital being home to 255 of the 1,007 super-rich creating 38 more in the year.

The national capital held the second spot by adding 39 to take the number to 167 and Bengaluru with 85, added 18 more in the year. Gujarat added 15 rich listers to overtake Tamil Nadu to the fourth place in the list.

Pharma minted most no. of billionaires

With 130 individuals on the list, the report said that pharmaceutical sector minted the most number of billionaires.

While, chemicals and petrochemicals comprised 98 and 81 were from software and services.

Out of the 130 individuals in pharma sector, 40 of them were billionaires.

The sector witnessed 43 per cent growth in wealth during 2021, up from 36 per cent in 2020.

2021: UHNWIs in India and the world

From: Nov 11, 2022: The Times of India

See graphic:

2021: UHNWIs in India and the world

2017-2025

From: Sep 22, 2025: The Times of India

See graphic:

Millionaires in India, 2017-2025

Projections for 2026

See graphic:

Projections for richlist, 2026, India and the world

Real estate tycoons

As in 2018

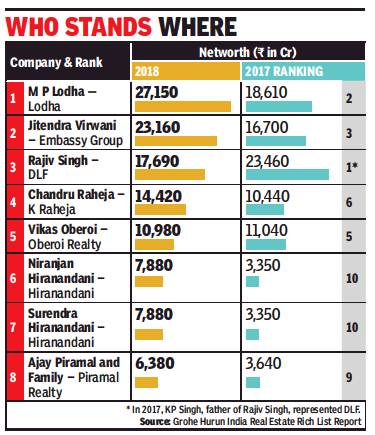

BJP MLA from Malabar Hill, Mangal Prabhat Lodha (62) has been ranked the richest builder in India with a wealth of Rs 27,150 crore, according to the GROHE Hurun India Real Estate Rich List 2018 released on Wednesday. In 2017, he was second with a wealth of Rs 18,610 crore. Jitendra Virwani (52) of Embassy Property Developments, secured the second spot with a wealth of Rs 23,160 crore. In 2017, he was at No. 3 with a wealth of Rs 16,700 crore.

NCR-based DLF's promoter Rajiv Singh featured at No. 3 place with a wealth of Rs 17,690 crore. In 2017, DLF's promoter and Rajiv Singh's father K P Singh was at the top position with a wealth of Rs 23,460 crore. But due to the slowdown in the real estate, in NCR particularly, the fortunes of realtors in the region has taken a hit.

With a fortune of Rs 2,780 crore, Renuka Talwar (62), daughter of DLF chairman K P Singh, is the richest woman in the real estate rich list.

According to the report, Mumbai is the most preferred city of residence for real estate tycoons in India with 35 names hailing from the city, followed by Delhi (22) and Bengaluru (21). Total wealth of the top 100 real estate barons featured in the list accounted for Rs 2,36,610 crore ($32.7 billion) in 2018 - up 27% from 2017 edition's cumulative wealth of Rs 1,86,700 crore ($28.6 billion).

The list was compiled on the basis of net worth of living Indians as on September 30, 2018, when the rate of exchange to the US dollar stood at Rs 72.46. The list relates to Indians only, defined as born or brought up in India.

The report further revealed that 59% of the names featured are first-generation entrepreneurs. Average age of the participants is 59 years, with the youngest being 24 years (Kunal Menda of RMZ) and the eldest at 89 years (Prithvi Raj Singh Oberoi of East India Hotels). "Only four names aged below 40 years were featured in the list - indicating that the experienced and long-standing names build wealth in the long run from this sector in India, said the report.

Nine women featured on the list - with Talwar of DLF being the richest woman ranked at 19. Among the 10 debutants in the list, Rameshwar Rao Jupally of My Home Constructions ranked the highest at 14 among the top 100.

Hurun Report India MD & chief researcher Anas Rahman Junaid said, "The combined wealth of top 100 names listed by us in 2018 stands at $32.3 billion, or in other words, a billion dollars more than the GDP of Cyprus."

Cities with the most real-estate tycoons

As in 2018

Delhi 2nd most preferred city of residence for realty tycoons, November 22, 2018: The Times of India

From: Delhi 2nd most preferred city of residence for realty tycoons, November 22, 2018: The Times of India

BJP MLA from Malabar Hill, Mangal Prabhat Lodha (62) has been ranked the richest builder in India with a wealth of Rs 27,150 crore, according to the GROHE Hurun India Real Estate Rich List 2018 released on Wednesday. In 2017, he was second with a wealth of Rs 18,610 crore. Jitendra Virwani (52) of Embassy Property Developments, secured the second spot with a wealth of Rs 23,160 crore. In 2017, he was at No. 3 with a wealth of Rs 16,700 crore.

NCR-based DLF’s promoter Rajiv Singh featured at No. 3 place with a wealth of Rs 17,690 crore. In 2017, DLF’s promoter and Rajiv Singh’s father K P Singh was at the top position with a wealth of Rs 23,460 crore. But due to the slowdown in the real estate, in NCR particularly, the fortunes of realtors in the region has taken a hit.

With a fortune of Rs 2,780 crore, Renuka Talwar (62), daughter of DLF chairman K P Singh, is the richest woman in the real estate rich list.

According to the report, Mumbai is the most preferred city of residence for real estate tycoons in India with 35 names hailing from the city, followed by Delhi (22) and Bengaluru (21). Total wealth of the top 100 real estate barons featured in the list accounted for Rs 2,36,610 crore ($32.7 billion) in 2018 — up 27% from 2017 edition’s cumulative wealth of Rs 1,86,700 crore ($28.6 billion).

The list was compiled on the basis of net worth of living Indians as on September 30, 2018, when the rate of exchange to the US dollar stood at Rs 72.46. The list relates to Indians only, defined as born or brought up in India.

The report further revealed that 59% of the names featured are first-generation entrepreneurs. Average age of the participants is 59 years, with the youngest being 24 years (Kunal Menda of RMZ) and the eldest at 89 years (Prithvi Raj Singh Oberoi of East India Hotels). “Only four names aged below 40 years were featured in the list — indicating that the experienced and long-standing names build wealth in the long run from this sector in India,’’ said the report.

Nine women featured on the list — with Talwar of DLF being the richest woman ranked at 19. Among the 10 debutants in the list, Rameshwar Rao Jupally of My Home Constructions ranked the highest at 14 among the top 100.

Hurun Report India MD & chief researcher Anas Rahman Junaid said, “The combined wealth of top 100 names listed by us in 2018 stands at $32.3 billion, or in other words, a billion dollars more than the GDP of Cyprus.”

UHNIs/ UHNWIs, city-wise

2020-23: Top 8 cities vis-à-vis other cities

From: April 11, 2024: The Times of India

See graphic:

Ultra-high net worth individuals (UHNWI)/ UHNIs in India’s Top 8 cities vis-à-vis other cities, 2020-23

Women

2025

Cherry Gupta, February 18, 2025: The Indian Express

Top 10 Richest Women in India 2025: India, one of the fastest-growing economies, which is set to be the third largest by 2030, has undergone a transformation. Last year, in 2024, India experienced a boom in wealth creation—ranking third globally in terms of countries with the most number of billionaires.

India has held the position of having the fifth-highest number of female billionaires worldwide, according to a study by City Index.

Indian women are stepping into the limelight, breaking through traditional barriers, and accumulating considerable wealth as they ascend the ranks of the nation’s billionaires.

This year, at the forefront, is Savitri Jindal, who maintained her position from the previous year and, is the wealthiest Indian woman in 2025, boasting a net worth of $38.5 billion.

Furthermore, in a notable mention, the co-founder of Zoho Corp, Radha Vembu‘s impressive leadership, propelled her forward in the ranks, elevating her from 9th to 7th place among India’s wealthiest women in the Forbes Billionaire list for 2025.

Rounding up the list is Falguni Nayar, founder of Nykaa, a popular beauty e-commerce platform which was launched in 2012. A former investment banker, Nayar’s fortune increase by an incredible 963% in 2021.

Top 10 Richest Women in India, as of January 2025

While the women billionaires in India featured in the list are the same as last year, there have been significant shifts in rankings and net worth, as highlighted by the Forbes Billionaires List 2025, reflecting the ever-evolving nature of wealth accumulation.

With the entrepreneurial spirit propelling many women in business today, below are the top 10 Indian women who are not only shaping the future but also establishing their presence as billionaires in India, as of January 2025.

| Rank 2025 | Name | Net Worth (USD) | Company | Global Rank 2025 |

|---|---|---|---|---|

| 1 | Savitri Jindal | $34.3 billion | Jindal Group | 52 |

| 2 | Rekha Jhunjhunwala | $8.0 billion | Titan Company Limited, and others | 356 |

| 3 | Renuka Jagtiani | $5.6 billion | Landmark Group | 592 |

| 4 | Vinod Gupta | $4.7 billion | Havells | 709 |

| 5 | Smita Crishna-Godrej | $3.5 billion | Godrej | 970 |

| 6 | Kiran Mazumdar-Shaw | $3.4 billion | Biocon | 1034 |

| 7 | Radha Vembu | $3.2 billion | Zoho Corporation | 1074 |

| 8 | Anu Aga | $3.1 billion | Thermax | 1107 |

| 9 | Leena Tewari | $3.0 billion | USV Pharma | 1133 |

| 10 | Falguni Nayar | $2.9 billion | Nykaa | 1148 |

Source: Forbes

Note: Since stock prices fluctuate routinely, the net worth might change accordingly. The net worth mentioned is as of January 27, 2025.

B

SOME BROAD YEAR-WISE TRENDS

For details see our annual Rich-list pages, such as

Rich List: India <> Rich List: India, 2014: Forbes <>Rich List: India, 2014: Hurun <>Rich List: India, 2015: Forbes <> Rich List: India, 2015: Hurun <>Rich list, India: 2016 <> Rich List: India, 2016: Forbes <> Rich List: India, 2017 <> Rich List: India, 2017: Hurun<> Rich list, India: 2018<> Rich list, India: 2019<> Rich List, India: 2020<> Rich List, India: 2021

2007-08

Top taxpayers

City Resident Ranks No. 1 With Rs 121cr; Ambani Bros Not In Top 200

Maya, SRK among top taxpayers

Pradeep Thakur | From the Archives of ‘‘The Times of India’’: 2008 August 3, 2008 2008

New Delhi: Mayawati is the top taxpayer among politicians and, in fact, ranks among the 20 top taxpayers in the country. In 2007-08, the Dalit leader shelled out Rs 26.26 crore as income tax, according to the I-T department’s compilation of the top 200 taxpayers’ list.

And King Khan is the top taxpayer among actors. Placed at No. 13, five slots higher than Mayawati, Shah Rukh paid Rs 34.2 crore as income tax in 2007-08. The next actor who is cited among taxpaying notables is Akshay Kumar, who ranks at No. 40 in the list, and paid Rs 13.5 crore as tax.

Sachin Tendulkar is the only cricketer to figure in the top-200 list. He coughed up Rs 8.8 crore as tax, reinforcing the belief that he earns way more than other cricketers as the country’s top sporting brand. Placed 81 in the top-200, Sachin is just ahead of industrialist Kumarmangalam Birla who paid just Rs 48,271 less than the master blaster.

Talking of industrialists, conspicuous by their absence in the top-200 list are the Ambani brothers, Mukesh and Anil. Their mother, Kokilaben, barely makes it to the list at 195, having paid Rs 4.46 crore as tax. The top taxpayer among industrialists is Max’s Analjit Singh who is No. 15 in the list having paid Rs 31.49 crore as tax.

Otherwise, the top taxpayers of the country are not public figures, but obviously guys rolling in the stuff. The country’s top taxpayer is from Delhi who forked out Rs 121 crore as income tax. In the top-10, five are from Mumbai and two from Delhi. Income-tax officials requested TOI not to make public identities of top taxpayers as they are not protected by their celebrity status, and often attract the attention of extortionists.

Coming back to Mayawati, her income, year after year, ostensibly comes from ‘‘gifts’’ from her admirers. Having paid a tax of Rs 26 crore, her personal income this year is estimated in the region of Rs 75-80 crore.

Salman, Ash among top-200 taxpayers

New Delhi: It may be recalled that Kum. Mayawati faces a CBI case for holding assets disproportionate to her known income.

The other interesting names featuring in this year’s list of top-200 taxpayers are, cardio-surgeon Naresh Trehan (Rs 8.4 crore), actor Salman Khan (Rs 7 crore), stamp-paper scamster Abdul Telgi (Rs 6.5 crore), Sanjay Dutt (Rs 5.8 crore), Aishwarya Rai (Rs 5.6 crore), Abhishek Bachchan (who paid just Rs 75,192 less than his wife), industrialist Nandan Nilekani (Rs 5.16 crore), music director-singer Himesh Reshammiya (Rs 4.89 crore), top lawyer Mukul Rohtagi (rs 4.85 crore), actor Aamir Khan (Rs 4.72 crore) and Wipro boss Azim Premji (Rs 4.68 crore).

2000-2015

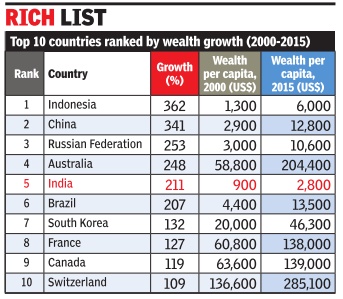

India's wealth rises 211%

The Times of India, Oct 29 2015

Kounteya Sinha

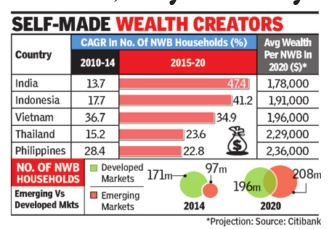

India has seen a whopping 211% increase in its wealth over the last 15 years -much higher than the US, UK, Japan, France, Germany or Brazil. Only four other countries -Indonesia, China, Russia and Australia -have done better than India. Indonesia's wealth increased by 362% while China saw an increase of 341%, Russia 253% and Australia 248%.

Some of the major western countries have seen a marginal increase in their wealth over the last decade and a half. While Japan saw its wealth increase by a modest 39%, it was 41% for the US and 58% for the UK.

In India, wealth per capita increased from $900 in 2000 to $2,800 in 2015. India is now the 10th richest country in the world, ranked according to total individual wealth.“Total individual wealth“ refers to the private wealth held by all the individuals in each country .

The downside, however, is India and Indonesia make it to the top 20 richest list due to their large populations.On a per capita basis, the two countries are quite poor.

When ranked according to per capita wealth, India ranks last in the top 20 countries. According to the New World Wealth's report on the wealthiest 20 countries in the world, when looking at per capita wealth, Switzerland topped the charts with $285,100 per capita wealth followed by Australia ($204400), US ($150600) and UK ($147600). New World Wealth had earlier revealed that Pune was India's fastest growing city with multi-millionaires and seven of the 20 fastest growing cities for the super-rich in Asia Pacific were from India.

Pune saw a whopping 317% growth in the number of multi-millionaires between 2004 and 2014 -the numbers increasing from 60 to 250.Overall, Pune is ranked third fastest growing city for the super-rich in the Asia Pacific region after Ho Chi Minh City in Vietnam, which saw a 400% growth (from 40 to 200), and Jakarta, which recorded a 396% increase (from 280 to 1390) multimillionaires.

Mumbai was ranked fourth fastest city with a 220% increase -840 multimillionaires in 2004 increasing to 2690 in the next 10 years. Hyderabad took the fifth rank with 510 multi-millionaires at present (a 219% increase in the last decade).

Delhi which is home to 1,350 multi-millionaires in 2014 as against 430 in 2004 -recorded an increase by 214%.

2000-19

New billionaires join and/ or replace the old

May 8, 2019: The Times of India

The rise of India's new billionaires and the fall of the old

NEW DELHI: India is going through one of the greatest periods of wealth creation — and destruction — all at the same time.

A new breed of self-made entrepreneurs is vaulting into the ranks of the wealthy, offsetting billions lost by debt-burdened industrialists and members of the country’s old dynasties. The changes are set to help India’s ultra-rich population grow at the world’s fastest pace. It’s a shift shaped partly by a debt-fueled expansion that left businesses from power generation to airlines with $190 billion in soured loans. Over the past few years, Prime Minister Narendra Modi’s government has cracked down on delinquent borrowers, and India’s banks moved to seize their assets, a dramatic change for a country where the wealthy once enjoyed almost complete protection.

While old business clans continue to dominate India’s rich lists, a tenfold expansion in its economy since its opening in the 1990s has spawned new tycoons in fields like technology. The number of billionaires in India more than doubled to 119 between 2013 and 2018, according to Knight Frank. And the country will lead the global growth in ultrahigh net worth individuals, with its numbers rising 39 per cent to 2,697 by 2023, the researcher estimates.

"The business environment has improved over the years," said Charles Dhanaraj, a professor at the Fox School of Business at Temple University in Philadelphia. "The availability of venture capital and private equity has changed the opportunity space for promising businesses. So we should see more of these startups and scaleups in the coming years."

Here are some well-known names who have seen a shift in their fortunes:

Old money

Telecom troubles:

Anil Ambani, the younger brother of Asia’s richest man, inherited some of the newer businesses of Reliance Industries Ltd in 2005 as part of a settlement with older sibling, Mukesh, following the death of their father Dhirubhai Ambani three years earlier. Now, more than a decade later, the younger Ambani has been fending off creditors and fighting multiple cases in courts amid his phone carrier Reliance Communications Ltd’s slide into bankruptcy. A representative for Anil Ambani didn’t comment. The value of his holdings in companies has plunged to about $120 million from a net worth of at least $31 billion in 2008, according to the Bloomberg Billionaires Index.

A boom and crash:

The first-generation entrepreneurs, Shashi and Ravi Ruia, started the Essar Group in 1969 as a construction company. Later they diversified into new businesses, investing about $18 billion between 2008 and 2012. The excessive leverage across the group and some adverse policy actions forced them to sell many of their assets. The Ruia brothers were jointly worth more than $4 billion at the start of 2015, and have since lost their billionaire status, according to the Bloomberg Billionaires Index.

The turbine maker:

Tulsi Tanti’s Suzlon Energy Ltd purchased German REpower Systems for nearly $2 billion in 2007 to be hailed as a global company, but things went downhill from there. Once the world’s top turbine maker, Suzlon’s debt-driven expansion caused one of India’s largest corporate debt default in 2012. Seven years later Tanti is struggling to repair his company’s finances. Tanti, who had a net worth of more than $5.7 billion in 2007, has lost his billionaire status, according to data compiled by Bloomberg.

The beer baron:

After inheriting his father’s liquor empire, Vijay Mallya, started Kingfisher Airlines Ltd. Struggling to repay lenders, the carrier was grounded seven years later. Mallya is currently fighting an extradition case in London after fleeing India. Lenders have sought to recover as much as $1.5 billion from the man known as "the king of good times" for his flamboyant lifestyle.

New money

Retail tycoons:

Binny Bansal and Sachin Bansal, who aren’t related, created Flipkart, India’s largest online retailer, within a decade. Last year, they sold their company to Walmart Inc, becoming billionaires. Binny left shortly after, with Walmart said to have conducted an inquiry into a consensual relationship he had with a woman. He still holds 4 per cent of Flipkart and a board seat. Sachin exited Flipkart at the time of the Walmart acquisition.

The payment guru:

Vijay Shekhar Sharma founded One97 Communications in 2000 when fewer than 10 million Indians were online. Business at his Paytm digital payment unit soared after the government eliminated 500 and 1,000 rupee banknotes at the end of 2016. An August 2018 funding round valued One97 at more than $10 billion, people familiar with the matter said at the time. Sharma currently owns 15 per cent of the company, according to a person familiar with the matter.

Laws of motion:

Byju Raveendran, chief executive of Bangalore-based Think & Learn Pvt, launched the Byju’s K-12 education app in 2015. His videos explain fractions or the laws of motion at a conceptual level, drawing almost 30 million users from 1,700 cities. A December funding round valued it at $3.6 billion. Raveendran, his wife and brother together own about 36 per cent, according to Raveendran.

2013

Indian millionaire households: no.15

India ranks 15th on global wealth list

New York PTI Jun 11 2014

According to Boston Consulting Group's report, India had 175,000 millionaire households in 2013 and is projected to become the seventh wealthiest nation by 2018

India had 175,000 millionaire households in 2013, ranking 15th in the world, according to a wealth report which said the total number of millionaire households in the world rose to 16.3 million last year.

The Boston Consulting Group’s 14th annual report on the global wealth-management industry ‘Riding a Wave of Growth: Global Wealth 2014’ said global private financial wealth grew by 14.6% in 2013 to reach a total of $152 trillion.

The rise was stronger than in 2012, when global wealth grew by 8.7%. The key drivers, for the second consecutive year, were the performance of equity markets.

India ranked 15th last year and had 175,000 millionaire households. Its position improved slightly from 2012 when it had ranked 16 in the world for its number of millionaire households.

India is projected to become the seventh wealthiest nation by 2018. The number of ultra-high-net-worth households in India, those with $100 million or more, stood at 284 last year.

The total number of millionaire households reached 16.3 million in 2013, up strongly from 13.7 million in 2012 and representing 1.1% of all households globally.

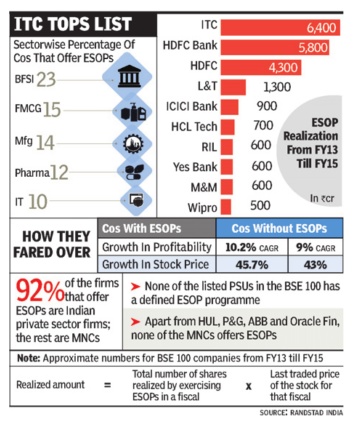

2013-15: ESOP enriches ITC, BFSI, FMCG employees

The Times of India Jan 09 2016

Namrata Singh & Shubham Mukherjee

TNN

Banking, FMCG Execs Book Max Gains On ESOP Accounts

If you thought technology and multinational companies are the best wealth creators for employees at India Inc, think again. Though conventional wisdom drives you to that conclusion, in reality a new breed of wealth creators has emerged ever since the employee stock option plan (ESOP) was pioneered by Infosys in the mid-nineties.

Till about four years back, ESOPs were predominantly concentrated among MNCs and the IT sector. But a TOI study has revealed that over the last three financial years, employees of BFSI (banking and financial services) companies have recorded the maximum returns on their stock options followed by FMCG (fast moving consumer goods) companies. And it's an Indian company , ITC, which leads the list of top 100 listed companies on a cumulative basis.

The study , commissioned to staffing company Randstad India by TOI, on value creation and impact of ESOPs on performance of the BSE 100 companies over the last three financial years reveals that employees of the cigarette-tohotels major recorded the highest realizations cumulatively by exercising stock options (Rs 6,400 crore) followed by HDFC Bank (Rs 5,800 crore) and HDFC (Rs 4,300 crore). MNCs didn't figure high on the list of employee wealth cre ators, with Oracle Financial Services Software ranked No 18. IT sector's top ranker HCL Technologies stood at No 6.

“ITC's record of retaining quality talent has always been ahead of most Indian companies. While the introduction of the ESOP scheme has contributed to reinforcing ITC's talent retention capability , the real benefit has been in enhancing and sustaining the growth of ITC's businesses,“ said Anand Nayak, HR head, ITC.

In India, ESOPs are specifically offered to middle and senior management or employees who have completed a certain tenure in the organization.

L&T chairman A M Naik recently told TOI that his company has created more crore pati employees in India through ESOPs than any other, outside the technology space. L&T stands at No. 4 in the study .

Moorthy K Uppaluri, MD & CEO, Randstad India, feels ESOPs can play a powerful role if organizations leverage them in tandem with other tools for employee engagement and retention. “Typically , ESOPs tend to enhance employee ownership, thus fostering a performance-oriented environment. This can serve as a point of differentiation in the way the company operates and interacts with its stakeholders,“ he said.

2014

2014, Feb: The Hurun Global Rich List 2014 and India

See Rich List: India, 2014: Hurun

2014: Knight Frank's Wealth Report ranks India at no. 6 with 60 billionaires

India to have 4th highest number of billionaires by 2023: Report

Nauzer Bharucha,TNN | Mar 6, 2014

MUMBAI: Number of ultra high net worth individuals in India expected to double over next 10 yrs, rising by 126 per cent in Mumbai alone and around 118 per cent in Delhi. Mumbai is on the 4th spot with a 126 per cent growth among all global cities which is expected to increase from 577 to 1,302 by 2023.

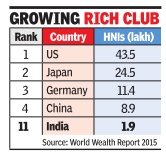

Mumbai retains its position as 16th most expensive city in luxury home sector, according to Knight Frank's 8th edition of the Wealth Report released just now.

"By 2023, only 3 countries in the world, USA, China and Russia will have more billionaires than India," Samantak Das, chief economist and director research, Knight Frank India.

India is now on 6th spot [according to Knight Frank’s Wealth Report] in the top 10 countries for billionaires as of 2013 with 60 billionaires. This number is expected to increase to 119 with a 98 per cent growth by 2023, according to a Knight Frank Wealth Report.

The 2014 Wealth Report, an annual global perspective on prime property and wealth by property management firm Knight Frank, projected that the number of billionaires in India will grow by an exponential 98 per cent to 119 in the year 2023 from 60 billionaires last year.

India will rank fourth after US, China and Russia in 2023 and will have more billionaires than the UK, Germany and France, according to the report.

"Wealth creation in India, the world's third-biggest economy, is also expected to accelerate, with the number of Ultra High Networth Individuals (UHNWIs) forecast to nearly double over the next decade," the report said.

"This reflects the more positive outlook for India's economy after 2013 was marked by capital outflows and a sharp devaluation of the rupee. This tough environment for wealth creation and preservation was reflected in the one per cent decline in the number of UHNWIs in the country during the year," it said.

The report said the number of centa-millionaires (those with $100 million in disposable assets) in India is also projected to grow 99 per cent to 761 in 2023 from 383 last year.

The country will further see an increase of 99 per cent in the number of UHNWIs to 3130 in 2023 from 1576 last year.

The growth of UHNWIs in China and India, coupled with a whopping 144 per cent increase in Indonesia and 166 per cent hike in Vietnam, will help push the total number of UHNWIs in Asia up by 43 per cent to 58,588 by 2023, overtaking the total number in North America.

The number of billionaires in Asia is also forecast to overtake the number in Europe over the next decade.

Asian cities are also expected to see the fastest growth in the number of ultra wealthy individuals over the next decade.

Mumbai will see the fourth highest rate of growth in its UHNWI population between 2013 and 2023, with this number increasing 126 per cent to 1302 in 2023 from 577 last year.

Delhi will closely follow Mumbai and will record the fifth highest growth in its UHNWIs population, which will increase 118 per cent from 147 last year to 321 in the next decade, according to the report.

By 2024, Mumbai is also projected to figure in the top 10 global cities, a ranking which it does not currently have, the report said.

Terrorism tends to occur in densely populated cities and New York, London, Moscow and Mumbai are more risky than Beijing, according to the report

2014, Forbes: India's 100 richest

See Rich List: India, 2014: Forbes

2014: India no. 8 in multi-millionaires

India ranked no. 8 on global list of multi-millionaires

Kounteya.Sinha@timesgroup.com London

The Times of India Aug 06 2014

India has more multi-millionaires than Australia, Russia or France.

The latest wealth index by New World Wealth that looks at multi-millionaires globally -an individual with net assets of at least $10 million -has ranked India eighth in the global rich list below countries like US, China, Germany and UK.

India is home to 14,800 multi-millionaires of which Mumbai is home to the highest number -2,700 -as many as in Munich.

Interestingly, Mumbai is the only Indian entry in the top 30 cities for multi-millionaires. Hong Kong is the city with the largest number of multimillionaires -5,400 followed by New York (14,300), London (9,700), Moscow (7,600), Los Angeles (7,400) and Singapore (6,600).

As far as countries are concerned with the highest number of multi-millionaires, the United States tops the list with 1,83,500 people worth over $10 million followed by China (26,600), Germany (25,400), UK (21,700), Japan (21,000), Switzerland (18,300) and Hong Kong (15,400). Over the past 10 years, worldwide millionaire and multi-millionaire numbers have grown at vastly different rates. Millionaire numbers worldwide have gone up by 58% during this period, whilst multi-millionaire numbers have gone up by 71%. There are currently just over 13 million millionaires in the world (as of June 2014).

Approximately 495,000 of these individuals can be classified as multi-millionaires.

Mere millionaires

Interestingly , when it comes to millionaires, US tops the list followed by Japan and then the UK.

China and India are both significantly lower on this list than they are on the multi-millionaire list and perhaps most notably, Russia which ranks 9th in the world for multi-millionaires, only ranks 18th in the world for millionaires (outside the top 15). The report says “The higher growth of multi-millionaires can be put down to a number of factors including: a widening wealth gap at the top-end, a rising rate of conversion of millionaires into multi-millionaires and strong growth in countries that have a high multi-millionaire to millionaire ratio (the likes of Russia and India)“.

In terms of regional performance, South America was the stand out, with multi-millionaire growth of 265% over the 10 year period. Other top performers included Australasia (182% growth) and Africa (142% growth). In terms of country performance, countries that registered 200% plus growth included Russia, Brazil, China, India, Indonesia, Vietnam and Angola.

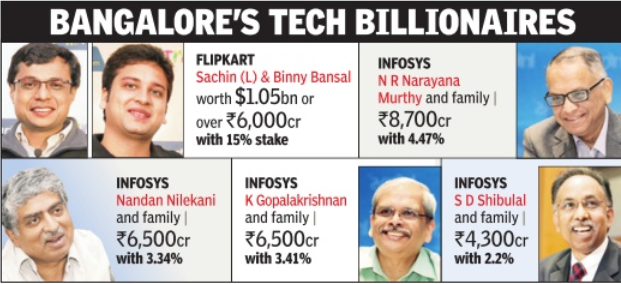

2014: Bangalore's technology billionaires

See chart

2014: Indians abroad/ Diaspora

The UK

2014 Hinduja brothers among UK's top 3 richest families

Kounteya Sinha,TNN | Mar 17, 2014

London-based Indian family - Srichand and Gopichand Hinduja of the Hinduja Group, a multinational conglomerate with a presence in 37 countries with businesses as diverse as trucks and lubricants to banking and healthcare, are among the five richest families in the UK which have together amassed more wealth than 20% of entire British population.

Together worth $10 billion, the Hinduja family along with four other British families have been shown to have more wealth than 12 million poorest Brits.

Britain's five wealthiest people boast a collective worth of £28.2 billion, while the total accumulated by the bottom 20% sat at £28.1 billion.

2014: Indians with over $100m

The Times of India, Jun 17 2015

India ranks 4th globally in 2014, says report

No. of Indians with over $100m hits 928

The number of ultra high net worth (UHNW) individuals in India has more than trebled to 928 in 2014 from 284 in 2013, according to a Boston Consulting Group (BCG) report.Though BCG has clarified that the two figures cannot be compared because there has been a change in methodology , following the new study , India's ranking among countries in terms of the number of UHNW individuals has risen to number four in 2014 from the 13th position in 2013. The report defines individuals with financial wealth (excluding residential properties) of $100 million (Rs 640 crore) as UHNW . BCG executives said, “Currency impacts versus the US dollar (our segments are in US dollars) and methodological changes to the national accounts' data make a comparison between the 2014 and 2015 reports very difficult.“ Going by 2015 methodology , UHNW individuals in India have increased to 928 in 2014 from 800 in 2013.

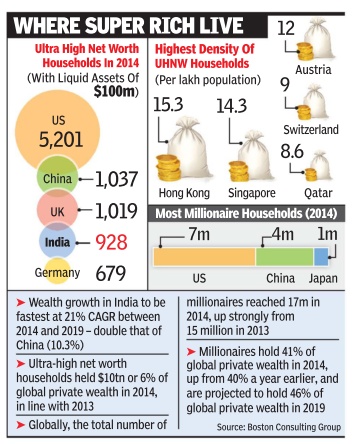

According to BCG, the Asia-Pacific region will be the main driver of increase in global wealth, fuelled by the rich in China and India.What's more, wealth in India is projected to record the fastest growth of 21% between 2014 and 2019 -double the growth rate of the next fastest wealth creator China (10.3%).

In its 2015 wealth report called `Winning the Growth Game', BCG has said that private wealth in China and India showed solid market gains, driven mainly by investments in local equities. China's equity market rose by 38% and India's by 23%.

The US remained the country with the largest number of UHNW households at 5,201, followed by China (1,037), the UK (1,019), India (928), and Germa ny (679). The highest density of UHNW households was found in Hong Kong (15.3 per 100,000 households), followed by Singapore (14.3), Austria (12), Switzerland (9), and Qatar (8.6). UHNW households held $10 trillion, or 6%, of global private wealth in 2014, which was in line with 2013. At a projected CAGR of 12% over the next five years, private wealth held by the UHNW segment will grow to an estimated $18 trillion in 2019.

This top segment is expected to be the fastest growing, in both the number of households and total wealth. The number of households in this segment is projected to grow at a CAGR of 19% over the next five years. “With such a large number of households entering this segment, the average wealth per household is pro jected to decline at a CAGR of 6%,“ the report said.

Private wealth held by the upper high net worth (HNW) segment (those with between $20 million and $100 million) rose by a healthy 34% in 2014 to $9 trillion. Private wealth held by the lower HNW segment (those with between $1 million and $20 million) is expected to grow at a slightly lower rate (7%) over the next five years.

Globally , the total number of millionaire households (those with more than $1 million in private wealth) reached 17 million in 2014, up strongly from 15 million in 2013. The increase was driven primarily by the solid market performance of existing assets, in both the new and old worlds.

2014: Hurun: India Rich List (top 100)

See Rich List: India, 2014: Hurun

The difference between the two Hurun Lists for 2014 is that the first list (mentioned above) was for the whole world and was issued earlier in 2014; Indian names were extracted from the global list, with their global as well as Indian ranks. This, the second list, was issued later in the year, by when some figures had changed, was India-specific and had more Indian names.

2014: 11th most millionaires: World Wealth Report

The Times of India, Sep 16 2015