Rich List, India: 2021

This is a collection of articles archived for the excellence of their content. |

Contents |

2021

February

Mukesh Ambani is again richest Asian as China's Zhong loses $22 billion

NEW DELHI: India’s Mukesh Ambani is back to being the wealthiest person in Asia.

Despite a brutal week for markets, his Reliance Industries Ltd was relatively unscathed as it said it would spin off its oil-to-chemicals business into an independent unit. With a net worth of about $80 billion, Ambani is again richer than Zhong Shanshan, whose bottled-water company tanked a record 20% this week.

The Chinese tycoon is worth $76.6 billion, down more than $22 billion from a peak just last week, according to the Bloomberg Billionaires Index.

Ambani spent most of the past two years leading the ranking of Asia’s richest people, taking over from Alibaba Group Holding Ltd’s Jack Ma. Then the listing of two companies put Zhong on the map: He grabbed the title from Ambani at the end of December and by early 2021 was the sixth-wealthiest person on Earth, surpassing Warren Buffett.

Zhong’s Nongfu Spring Co more than tripled from its initial public offering to a peak in January as investors flocked to consumer shares, while his vaccine maker, Beijing Wantai Biological Pharmacy Enterprise Co, surged as much as 3,757%.

But the rally faded as the Hong Kong and Chinese stock markets were among the world’s biggest decliners this week. Nongfu shares have erased their gains for the year, while Wantai’s posted a record monthly plunge.

Ambani has focused on pivoting his empire to tech and e-commerce, moving away from energy. Last year, he sold stakes in Reliance’s digital and retail units worth $27 billion to investors including Google and Facebook Inc, lifting his fortune by $18 billion.

The spinoff announced this week of the oil-to-chemicals unit -- which accounted for more than 60% of the conglomerate’s revenue in the last fiscal year -- will help the tycoon bring in more investors and expedite a proposed stake sale to Saudi Arabian Oil Co.

Zhong and Ambani are not the only two swapping titles lately. Tesla Inc’s Elon Musk became the world’s richest person at the start of January before Amazon.com Inc's Jeff Bezos regained the No. 1 spot earlier this month as shares of the electronic-car maker tanked.

Musk lost $15 billion alone after he tweeted that the prices of cryptocurrencies seemed high -- just two weeks after Tesla said it invested $1.5 billion in Bitcoin.

May

May 21, 2021: The Times of India

From: May 21, 2021: The Times of India

Adani, with $67bn, is Asia’s 2nd richest

Pips China’s Zhong Shanshan To Be No. 2, Behind Ambani Who Tops The List With $77Bn Net Worth

TIMES NEWS NETWORK

Mumbai:

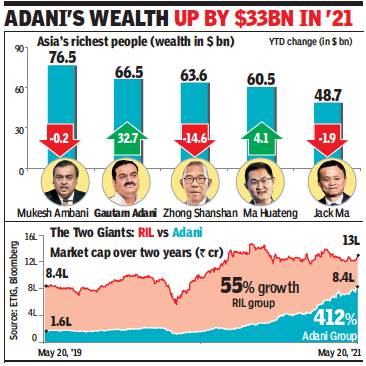

Gautam Adani, the chief of the infrastructure-to-renewable energy conglomerate and the second-richest Indian, is now the second-richest Asian too, behind Reliance Group’s Mukesh Ambani. On Thursday, Adani went past Zhong Shanshan, the head of a China-based beverages-to-pharma conglomerate. Globally, Ambani is the 13th richest, while Adani is at the 14th place.

As of May 20, 2021, Adani’s total net worth was $66.5 billion compared to Zhong Shanshan’s $63.6 billion and Ambani’s $76.5 billion, according to Bloomberg Billionaires Index. Adani’s wealth has surged by $32.7 billion this year, while Ambani has lost $175.5 million, a report by Bloomberg said.

Adani’s meteoric rise in fortunes happened in the last one year since May 2020, as the stock price of each of the group’s six listed companies have galloped northward, BSE data showed. From about $20 billion at the start of May last year, the Adani Group’s aggregate market capitalisation is now nearly $115 billion — a rise of nearly six times. In comparison, the Reliance Group’s aggregate market cap has moved up from nearly $125 billion to a little over $178 billion now.

In the last one year, the stock of Adani Total Gas has rallied 1,145%, the most among all the six group companies. In addition, Adani Enterprises has jumped 827%, Adani Transmission 617%, Adani Green Energy 433% and Adani Power 189%. The least of the gains was recorded in Adani Power stock that has rallied 142%.

Over this one year, the group, which has also been mired in a huge controversy because of a large buyout of a coal mine in Queensland in Australia, has signed a large number of deals in India. As a result, it now has a strong presence in sectors as diverse as ports, airports, energy, resources, logistics, packaged foods, agribusiness, real estate, financial services, gas distribution and defence-related manufacturing.

See also…

Rich List: India <> Rich List: India, 2014: Forbes <>Rich List: India, 2014: Hurun <>Rich List: India, 2015: Forbes <> Rich List: India, 2015: Hurun <>Rich list, India: 2016 <> Rich List: India, 2016: Forbes <> Rich List: India, 2017 <> Rich List: India, 2017: Hurun<> Rich list, India: 2018<> Rich list, India: 2019<> Rich List, India: 2020<> Rich List, India: 2021

Rich list of film artistes: India

…and also

Rich List: Nepal<> Celebrity List: India<> Indian money in HSBC, Switzerland <> Private lives of famous Indians