Economy: India 1

(→Table ends) |

(→The British Era) |

||

| (154 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| + | '''Several sections from this page have been shifted to '''[[Economy: India 2 (Ministry data)]] | ||

| + | |||

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

|colspan="0"|<div style="font-size:100%"> | |colspan="0"|<div style="font-size:100%"> | ||

| − | This | + | This is a collection of articles archived for the excellence of their content.<br/> |

| − | + | Additional information may please be sent as messages to the Facebook <br/>community, [http://www.facebook.com/Indpaedia Indpaedia.com]. All information used will be gratefully <br/>acknowledged in your name. | |

| − | + | </div> | |

|} | |} | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | =India’s economy: the main trends= | |

| + | ==A.D. 1 to 2003== | ||

| + | See [[Economic history: India]] | ||

| − | + | [[Category:Economy-Industry-Resources|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:Government|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:India|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:Pages with broken file links|ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| − | + | [[Category:Economy-Industry-Resources|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:Government|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:India|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:Pages with broken file links|ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | ||

| − | = | + | ==The British Era== |

| − | India | + | See [[Economic history: India]] |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | [[Category:Economy-Industry-Resources|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:Government|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:India|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| + | [[Category:Pages with broken file links|ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

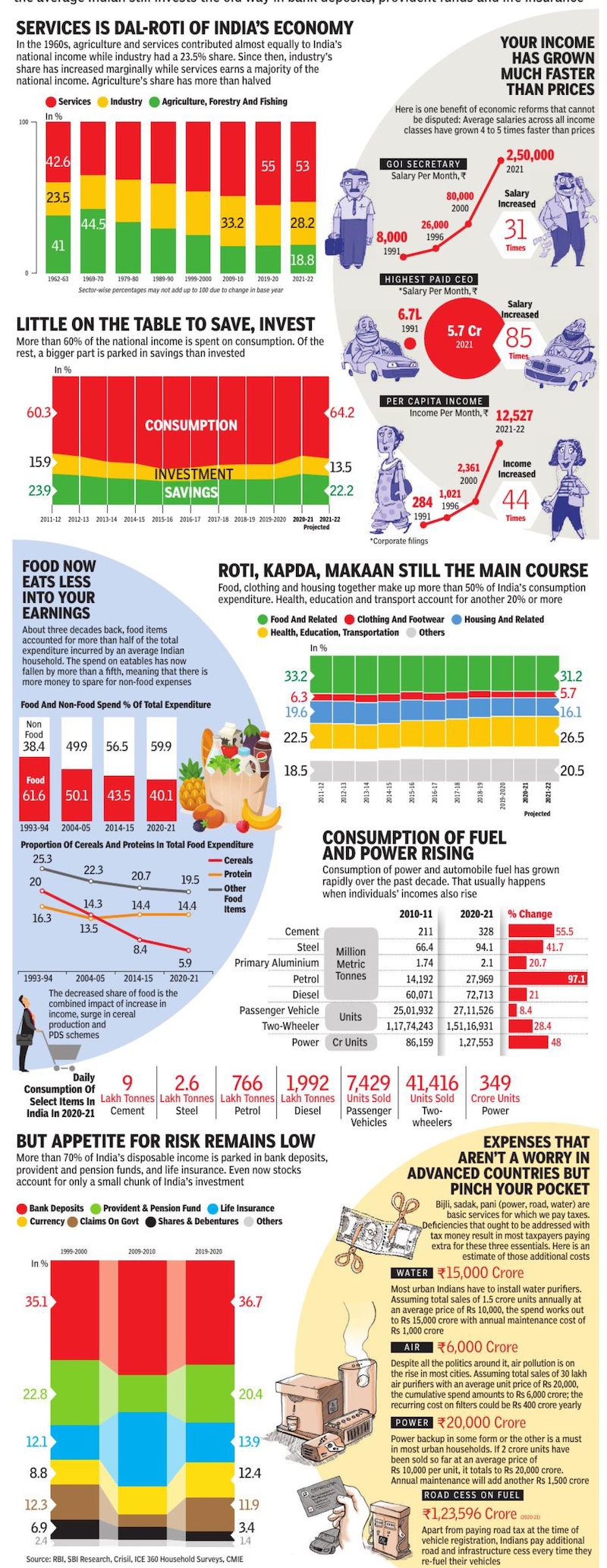

| − | + | ==1962-2021== | |

| − | + | [https://epaper.timesgroup.com/article-share?article=02_02_2022_030_001_cap_TOI February 2, 2022: ''The Times of India''] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | [[File: Indian economy, trends- 1962-2021.jpg|Indian economy, trends- 1962-2021 <br/> From: [https://epaper.timesgroup.com/article-share?article=02_02_2022_030_001_cap_TOI February 2, 2022: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | India | + | |

| − | + | ||

| − | + | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

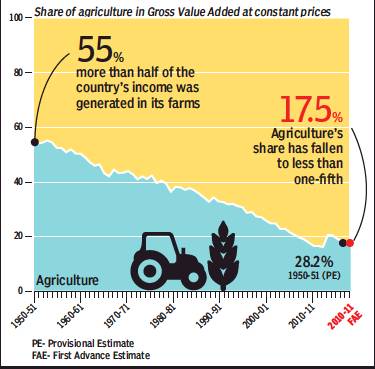

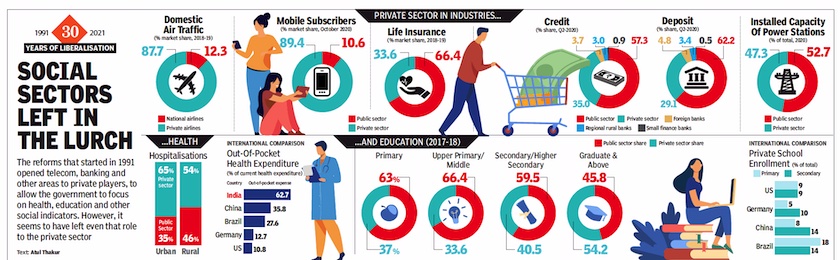

| − | + | Most economies shift from agriculture to services via a vigorous industrial age, but India moved up the ladder from ‘Jai Kisan’ to ‘Hello, World’ without really resting its weight on the rung of industry. Industrial output has never made up more than a third of India’s GDP while services have accounted for more than half for over a decade. Yet, this seemingly young economic profile hides the fact that most Indians still live from hand to mouth, exhausting their earnings on the basic needs of food, housing and transport. And while stock markets soar, the average Indian still invests the old way in bank deposits, provident funds and life insurance | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | BUDGET RESEARCH: Atul Thakur; DESIGN: Nirmal Sharma, Chanchal Mazumder, Sunil Singh, Anil Dinod, Karthic R Iyer, Arya Praharaj, Asheeran Punjabi, Deepti Singh; ADMINISTRATIVE SUPPORT: Sanjay Kalia | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | [[Category:Economy-Industry-Resources|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:Government|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:India|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:Pages with broken file links|ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | ||

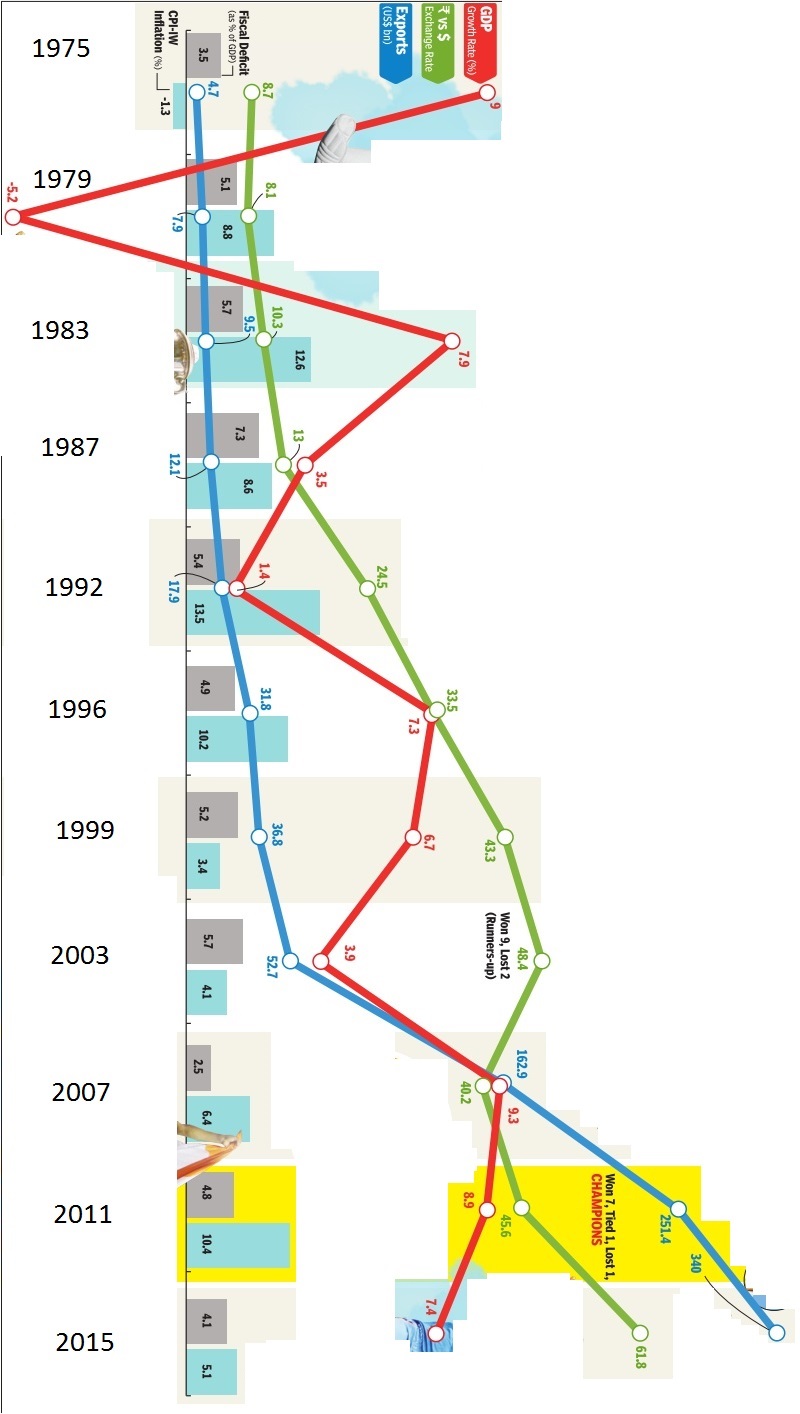

| − | + | ==1975-2015== | |

| − | + | [[File: economy india.jpg|The Indian economy, 1975-2015: GDP, the rupee exchange rate, exports, fiscal deficit and inflation, [http://epaperbeta.timesofindia.com//Gallery.aspx?id=28_02_2015_017_005_003&type=P&artUrl=KEEPING-SCORE-THE-WORLD-CUPS-THE-BUDGET-28022015017005&eid=31808 ''The Times of India'']|frame|500px]] | |

| − | + | See graphic, 'The Indian economy, 1975-2015: GDP, the rupee exchange rate, exports, fiscal deficit and inflation' | |

| − | + | ||

| − | + | ||

| − | + | ||

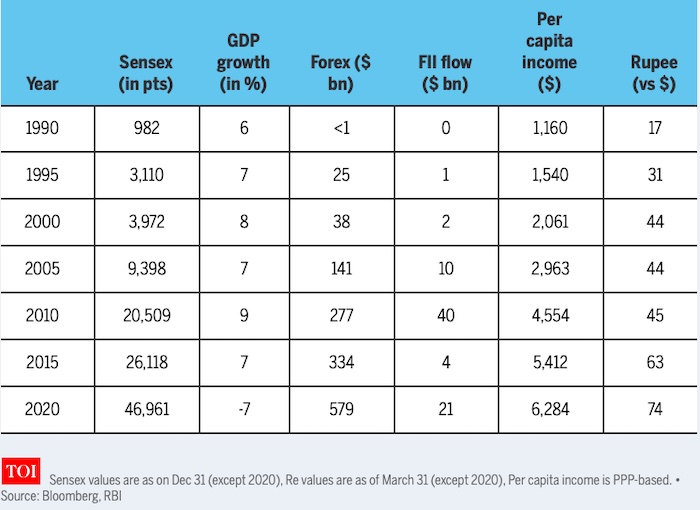

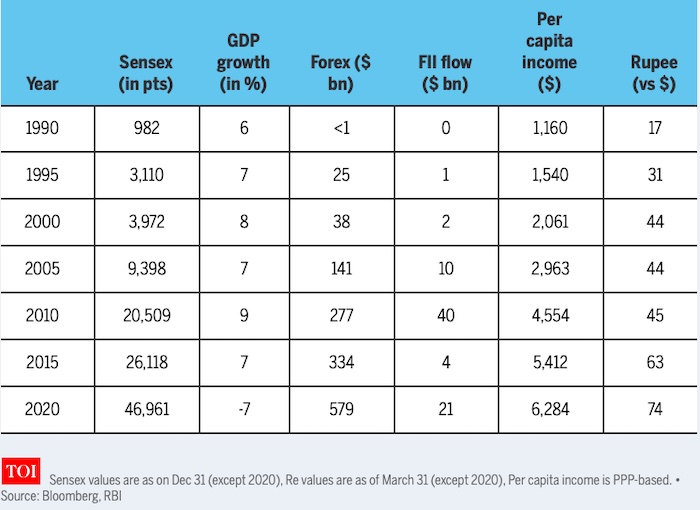

| − | + | ==1990-2020: sensex, per capita income, ₹ vs $, GDP growth, forex, FII flow== | |

| − | + | [[File: India, 1990-2020- sensex, per capita income, ₹ vs $, GDP growth, forex reserves, FII inflow.jpg| India, 1990-2020: sensex, per capita income, ₹ vs $, GDP growth, forex reserves, FII inflow <br/> From: [https://timesofindia.indiatimes.com/business/india-business/sensex-wealth-creation-in-seven-charts/articleshow/79810073.cms December 19, 2020: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | '''See graphic''': | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | '' India, 1990-2020: sensex, per capita income, ₹ vs $, GDP growth, forex reserves, FII inflow '' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | [[Category:Economy-Industry-Resources|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:Government|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:India|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

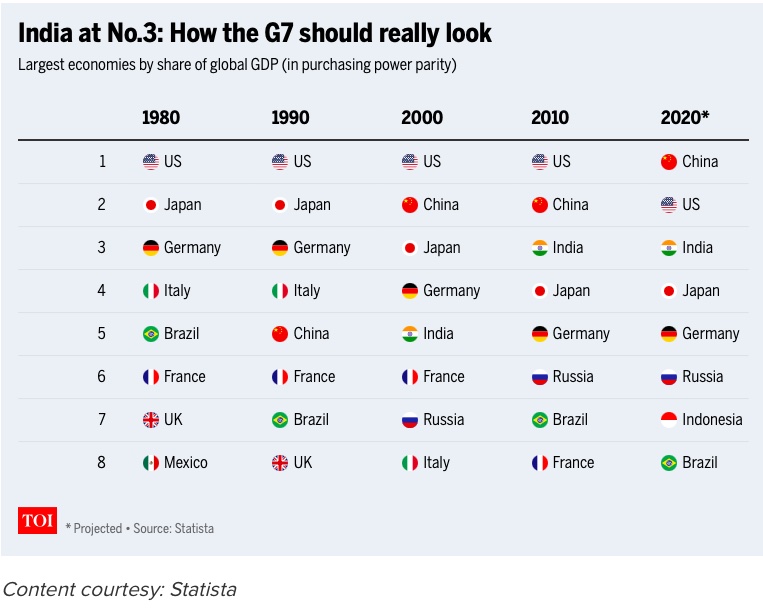

| − | The | + | ==1980-2020== |

| − | + | [[File: The GDP of India (in PPP terms) vis-à-vis the GDPs of the other top 7 economies of the time, 1980-2020.jpg|The GDP of India (in PPP terms) vis-à-vis the GDPs of the other top 7 economies of the time, 1980-2020 <br/> From: [https://timesofindia.indiatimes.com/world/how-the-g7-should-really-look/articleshow/79918482.cms December 23, 2020: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | '''See graphic''': | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | '' The GDP of India (in PPP terms) vis-à-vis the GDPs of the other top 7 economies of the time, 1980-2020 '' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | [[Category:Economy-Industry-Resources|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:Government|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | [[Category:India|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| − | + | ECONOMY: INDIA 1]] | |

| − | + | ||

| − | + | ==1990-2020: sensex, per capita income, ₹ vs $, GDP growth, forex, FII flow== | |

| − | + | [[File: India, 1990-2020- sensex, per capita income, ₹ vs $, GDP growth, forex reserves, FII inflow.jpg| India, 1990-2020: sensex, per capita income, ₹ vs $, GDP growth, forex reserves, FII inflow <br/> From: [https://timesofindia.indiatimes.com/business/india-business/sensex-wealth-creation-in-seven-charts/articleshow/79810073.cms December 19, 2020: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | '''See graphic''': | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | '' India, 1990-2020: sensex, per capita income, ₹ vs $, GDP growth, forex reserves, FII inflow '' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

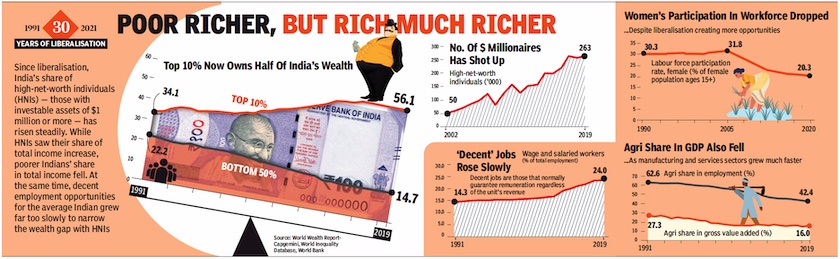

| − | + | ==1991-21: salaries, wealth, share of agriculture, women workers== | |

| − | + | [[File: 1991-21, salaries, wealth, share of agriculture, women workers in India.jpg| 1991-21: salaries, wealth, share of agriculture, women workers in India <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F02%2F02&entity=Ar01009&sk=6EC031B2&mode=image February 2, 2021: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | '''See graphic''': | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | '' 1991-21: salaries, wealth, share of agriculture, women workers in India '' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | [[Category:Economy-Industry-Resources|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:Government|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:India|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:Pages with broken file links|ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

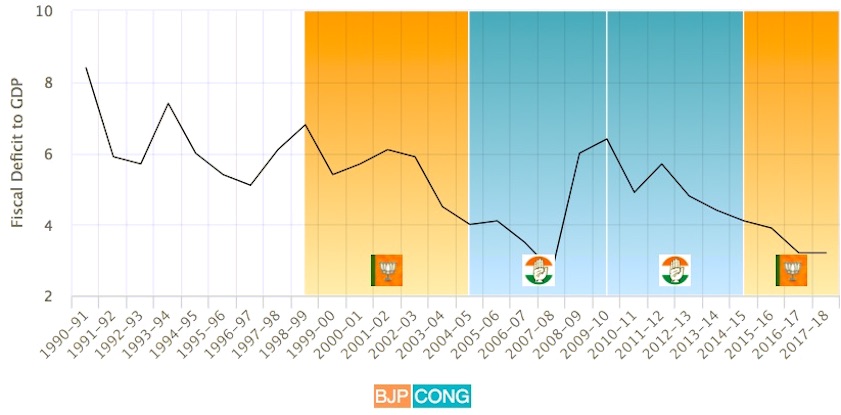

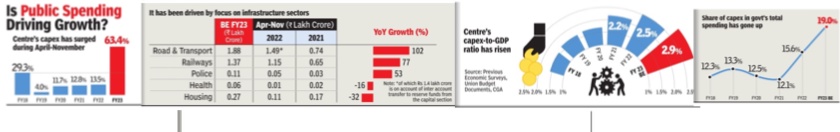

| − | + | ==1997-2018: Fiscal Deficit to GDP== | |

| + | [[File: Fiscal Deficit to GDP, 1997-2018.jpg|Fiscal Deficit to GDP, 1990-2018 <br/> This is the size of the government’s debt as a proportion of the overall size of the economy.Data source for this chart: World Bank <br/> From: [https://timesofindia.indiatimes.com/business/india-business/budget/data-hub January 29, 2018: ''The Times of India'']|frame|500px]] | ||

| − | + | '''See graphic''': | |

| − | + | ''Fiscal Deficit to GDP, 1990-2018'' | |

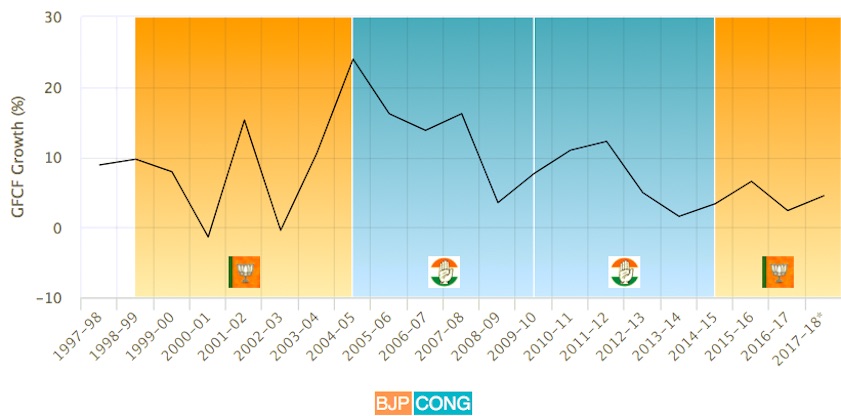

| − | + | ==1997-2018: Gross Fixed Capital Formation (GFCF)== | |

| + | [[File: Gross Fixed Capital Formation (GFCF) is an indicator of how much investment activity is happening in the country and a slowdown on this front does not bode well for overall growth and job creation- 1997-2018.jpg|Gross Fixed Capital Formation (GFCF) is an indicator of how much investment activity is happening in the country and a slowdown on this front does not bode well for overall growth and job creation- 1997-2018 <br/> Data source for this chart: World Bank <br/> From: [https://timesofindia.indiatimes.com/business/india-business/budget/data-hub January 29, 2018: ''The Times of India'']|frame|500px]] | ||

| − | + | '''See graphic''': | |

| − | + | ''Gross Fixed Capital Formation (GFCF) is an indicator of how much investment activity is happening in the country and a slowdown on this front does not bode well for overall growth and job creation- 1997-2018'' | |

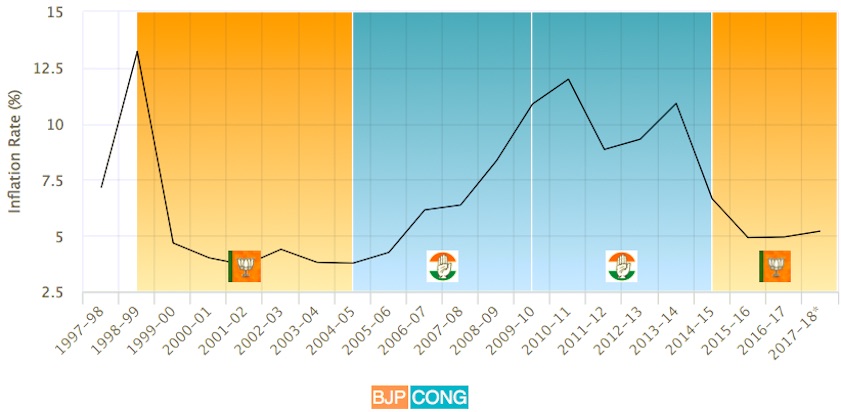

| − | = | + | ==1997-2018: Inflation trend== |

| + | [[File: Inflation trend, 1997-2018.jpg|Inflation trend, 1997-2018 <br/> This is the rate at which the general level of prices in the economy is rising.Data source for this chart: World Bank <br/> From: [https://timesofindia.indiatimes.com/business/india-business/budget/data-hub January 29, 2018: ''The Times of India'']|frame|500px]] | ||

| − | + | '''See graphic''': | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ''Inflation trend, 1997-2018'' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | The | + | ==1997-2018: Unemployment Rate== |

| − | + | [[File: Unemployment Rate, 1997-2018.jpg|Unemployment Rate, 1997-2018 <br/> The unemployment rate measures the proportion of people in the labour force looking for a job but unable to find one.Data source for this chart: World Bank <br/> From: [https://timesofindia.indiatimes.com/business/india-business/budget/data-hub January 29, 2018: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | + | ||

| − | + | '''See graphic''': | |

| − | + | ''Unemployment Rate, 1997-18'' | |

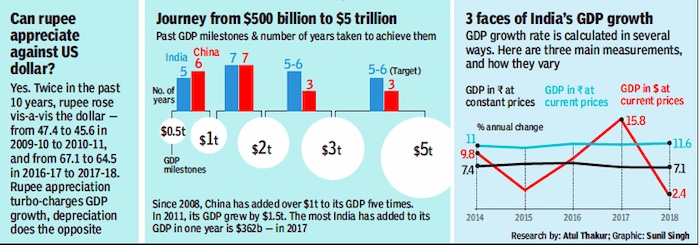

| − | + | ==2009-18: ₹ vs. $/ GDP/ adding $1 trillion to GDP== | |

| + | [[File: 2009-19- The Indian rupee appreciated twice vis-à-vis the US dollar.jpg| i) 2009-19: The Indian rupee appreciated twice vis-à-vis the US dollar; ii) The number of years that it took China and India to add each $1 trillion to their GDPs/ economies; iii) 2014-18: India’s GDP estimated by three different methods. <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F06%2F18&entity=Ar01905&sk=B965B0C0&mode=image June 18, 2019: ''The Times of India'']|frame|500px]] | ||

| − | + | '''See graphic''': | |

| − | + | '' i) 2009-19: The Indian rupee appreciated twice vis-à-vis the US dollar; ii) The number of years that it took China and India to add each $1 trillion to their GDPs/ economies; iii) 2014-18: India’s GDP estimated by three different methods. '' | |

| − | The | + | |

| − | + | ||

| − | + | ||

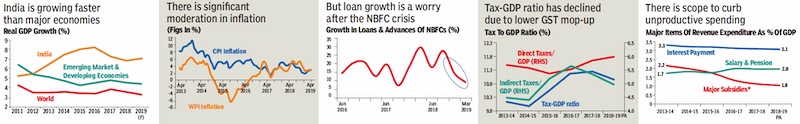

| − | The | + | ==2011/ 13-19== |

| − | + | [[File: The Indian economy, 2013-19, Growth rate vis-à-vis the world, Inflation, Growth in loans and advances of NBFCs, Tax to GDP ratio, Items of revenue expenditure, unproductive expenditure.jpg| The Indian economy, 2013-19: <br/> i)Growth rate vis-à-vis the world; <br/> ii) Inflation; <br/> iii) Growth in loans and advances of NBFCs; <br/> iv) Tax to GDP ratio; <br/> v) Items of revenue expenditure, unproductive expenditure <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F07%2F05&entity=Ar03206&sk=845AA4D9&mode=image July 5, 2019: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | + | ||

| − | |||

| − | + | See graphic, ‘ The Indian economy, 2013-19: <br/> i)Growth rate vis-à-vis the world; <br/> ii) Inflation; <br/> iii) Growth in loans and advances of NBFCs; <br/> iv) Tax to GDP ratio; <br/> v) Items of revenue expenditure, unproductive expenditure ' | |

| − | + | ||

| − | + | ||

| − | + | ||

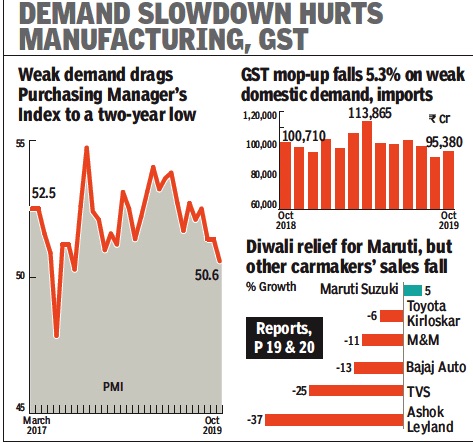

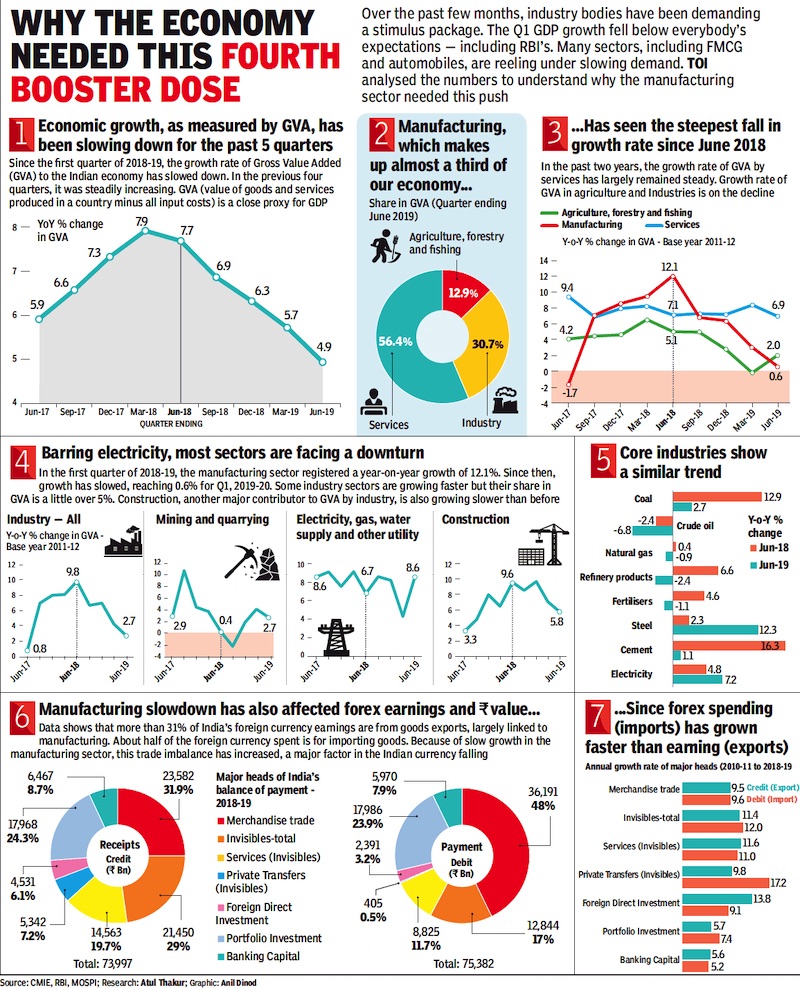

| − | + | ==2017>19: The slowdown in demand == | |

| + | [[File: 2017-19, The slowdown in demand.jpg| 2017>19: The slowdown in demand <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2019/11/02&entity=Ar00516&sk=5DE030E4&mode=image Nov 1, 2019: ''The Times of India'']|frame|500px]] | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | '''See graphic''': | |

| − | + | '' 2017>19: The slowdown in demand '' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | |||

| − | |||

| − | + | [[Category:Economy-Industry-Resources|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:Government|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:India|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:Pages with broken file links|ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| − | + | ==2020, the year of the Covid pandemic== | |

| − | + | [https://timesofindia.indiatimes.com/business/india-business/rbi-sees-v-shaped-recovery-state-of-indian-economy-explained-in-10-charts/articleshow/80409686.cms January 22, 2021: ''The Times of India''] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

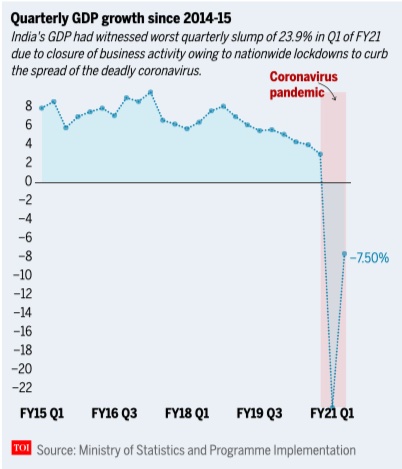

| − | + | [[File: Quarterly GDP growth, 2014-21.jpg|Quarterly GDP growth, 2014-21 <br/> From: [https://timesofindia.indiatimes.com/business/india-business/rbi-sees-v-shaped-recovery-state-of-indian-economy-explained-in-10-charts/articleshow/80409686.cms January 22, 2021: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | in | + | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | '''RBI sees V-shaped recovery: State of Indian economy explained in 10 charts''' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

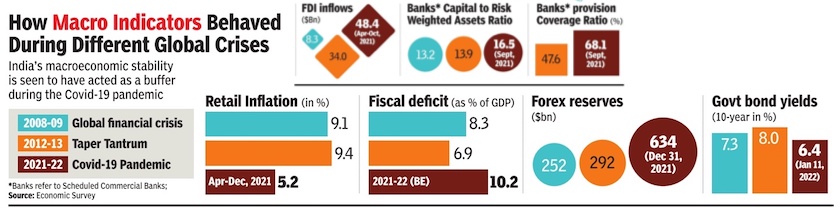

| − | + | NEW DELHI: With domestic activity gradually returning to pre-Covid levels, the Reserve Bank of India (RBI) sees a phoenix-like recovery for the Indian economy. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | According to a recent report published by the central bank, the country's gross domestic product (GDP) is not far from attaining positive growth. It observed that the economy will experience a V-shaped recovery in 2021, where V will stand for vaccine. | |

| − | + | India has already started one of the world’s biggest vaccination drives against Covid-19. It plans to inoculate about 300 million people on priority by year end. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | RBI's report also stated that barring another wave of Covid, the worst is over for India. Hence, policymakers might soon have more room to support the recovery process. | |

| − | + | ''' State of Indian economy ''' | |

| − | + | ||

| − | + | The Covid-19 pandemic has been a human and economic catastrophe for India. Almost one-fourth of the country's economic activity was wiped out due to fall in domestic demand in wake of the strict nationwide lockdowns to curb Covid infections. | |

| − | + | India's GDP dipped a historic 23.9 per cent in the first quarter (Q1) of 2020. The contraction narrowed down to 7.5 per cent in the second quarter (Q2). | |

| − | + | However, so far India seems to have managed the Covid crisis pretty well. | |

| − | + | The first advance estimates of national income for 2020-21 released by the National Statistical Office (NSO) estimated real GDP growth in 2020-21 to be at (-) 7.7 per cent as against (-) 10.3 per cent projected by the International Monetary Fund (IMF) in October 2020. In December 2020, RBI’s monetary policy committee (MPC) had projected GDP to be (-) 7.5 per cent. | |

| − | + | ''' Rise in government expenditure ''' | |

| − | + | Total expenditure of the government surged 48.3 per cent on year-on-year (y-o-y) basis in the month of November. While, capital expenditure shrugged off a three-month contraction and expanded 248.5 per cent. | |

| − | + | This was mainly due to the introduction of the Atmanirbhar Bharat package. | |

| − | + | ''' Revival of imports, exports ''' | |

| − | 7. | + | After contracting for 9 consecutive months, merchandise imports finally experienced a growth of 7.6 per cent (y-o-y) in December 2020. |

| − | + | The revival was led by gold, electronic goods and vegetable oils. Rising imports of pearls and precious stones, machinery, electronic goods and textiles reflect the revival of domestic activity as they are of the nature of intermediate goods in supply chains. This also augurs well for exports going forward. | |

| − | + | This suggests that moribund absorptive capacity of the economy is coming back to life, backed by domestic demand. | |

| − | + | India’s merchandise exports have reached pre-Covid levels and exhibited a growth of 0.1 per cent in December 2020. Non-oil exports actually expanded by 5.6 per cent, marking the fourth consecutive month of positive growth. | |

| − | + | ||

| − | + | '''Financial markets surge''' | |

| − | + | The Covid-19 pandemic dragged the sensex to record low in late March 2020. But, it staged a strong recovery from the lows. Both the BSE and NSE indices finally wrapped up 2020 on a bullish note, with sensex gaining nearly 16 per cent. | |

| − | + | The BSE index jumped almost 91 per cent from its record low of 25,881 to breach the 50,000-mark in just over 10 months. | |

| − | + | ''' IPO market ''' | |

| − | + | During December 2020, the listing of two initial public offerings (IPOs), aggregating Rs 1,351 crore, took the total resource mobilisation through main board IPOs to Rs 15,971 crore during 2020-21 (up to December 2020), marking a sharp rebound from Rs 10,487 crore in the corresponding period of the previous year. | |

| − | + | ||

| − | + | ||

| − | + | Beginning with the first IPO issued in July 2020, healthcare and finance sector companies have garnered the maximum amount of resources among all initial offerings. | |

| − | + | ||

| − | + | ''' Industrial activity ''' | |

| − | + | Although industrial output remains volatile, contracting by 1.9 per cent in November 2020 after a record expansion in October by 4.2 per cent, industrial activity is finally turning around. | |

| − | + | The headline purchasing managers’ index (PMI) manufacturing expanded in December 2020 to 56.4, a tick higher than November’s reading of 56.3. Both new orders and output continued to grow strongly. | |

| − | + | ''' Record GST collections ''' | |

| − | + | The gross Goods and Services Tax (GST) collections touched a record high of over Rs 1.15 lakh crore in December — the highest since the implementation of the regime. The collection indicates that the economy continues to show signs of recovery after a stringent lockdown last year. | |

| − | 1. | + | With this, the GST has also now crossed the psychological Rs 1 lakh crore-mark for the third straight month in the current fiscal. |

| − | |||

| − | |||

| − | + | ''' Fall in government revenue ''' | |

| − | + | Even though GST collections have been at record levels during the year, the pandemic has inflicted a ‘scissor effect’ on government revenues. | |

| − | + | On the one hand, it stretched expenditure on account of fiscal support to the economy that was completely unanticipated at the time of drawing up Budgets for 2020-21. | |

| − | + | On the other, there was contraction in revenues as activity went into complete standstill with lockdowns and other containment measures. | |

| − | + | As a result, the general government gross fiscal deficit (GFD) rose to 14.5 per cent in the first half of 2020-21. | |

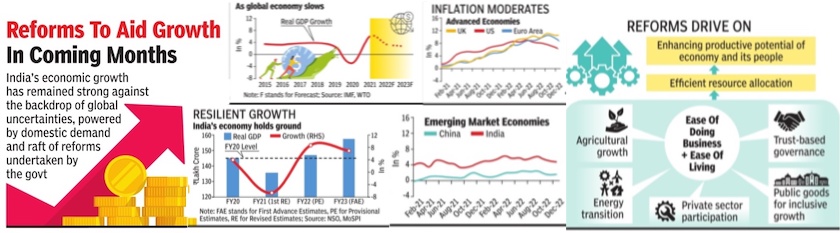

| − | + | ==2015-22== | |

| + | [[File: The Indian economy- the main trends 2015- 2022- A.jpg|The Indian economy- the main trends 2015- 2022/ A <br/> From: [https://epaper.timesgroup.com/article-share?article=01_02_2023_023_014_cap_TOI February 1, 2023: ''The Times of India'']|frame|500px]] | ||

| − | + | [[File: The Indian economy- the main trends 2015- 2022- B.jpg|The Indian economy- the main trends 2015- 2022/ B <br/> From: [https://epaper.timesgroup.com/article-share?article=01_02_2023_024_005_cap_TOI February 1, 2023: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | + | '''See graphics''': | |

| − | + | '' The Indian economy- the main trends 2015- 2022/ A '' | |

| − | + | '' The Indian economy- the main trends 2015- 2022/ B '' | |

| − | + | [[Category:Economy-Industry-Resources|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | |

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:Government|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:India|EECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:Pages with broken file links|ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1ECONOMY: INDIA 1 | ||

| + | ECONOMY: INDIA 1]] | ||

| − | + | =The year-wise position, especially after 2002= | |

| − | + | ||

| − | = | + | |

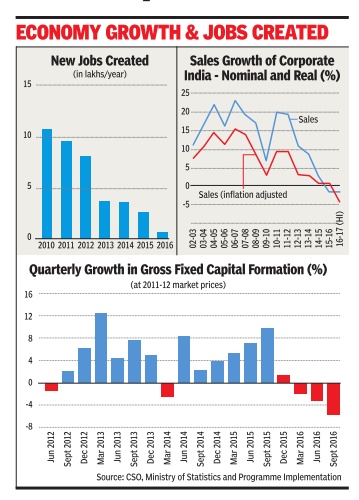

| − | + | [[File: New jobs created in India, 2010-16, Sales Growth of corporate India-Nominal and Real, 2002-17, iii) Quarterly growth in Gross Fixed Capital Formation, Jun 2013- Sept 2016.jpg|i) New jobs created in India, 2010-16; <br/> ii) Sales Growth of corporate India-Nominal and Real (%), 2002-17; <br/> iii) Quarterly growth in Gross Fixed Capital Formation (%), Jun 2013- Sept 2016; [http://epaperbeta.timesofindia.com/Gallery.aspx?id=31_01_2017_013_015_010&type=P&artUrl=Economy-not-in-good-shape-say-former-PM-31012017013015&eid=31808 The Times of India], January 31, 2017|frame|500px]] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | The | + | |

| − | = | + | ==2004- 18== |

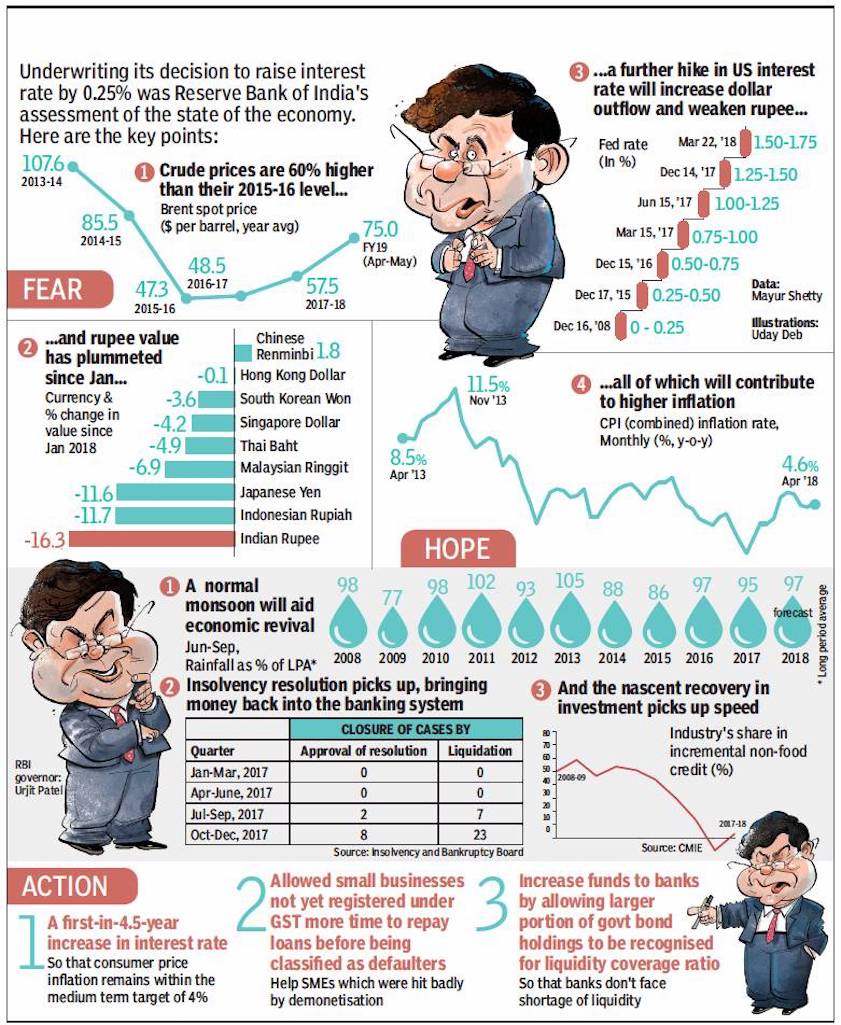

| − | + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F01&entity=Ar02301&sk=005B4784&mode=text Better growth prospects in FY19, but oil a risk: Expert, June 1, 2018: ''The Times of India''] | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

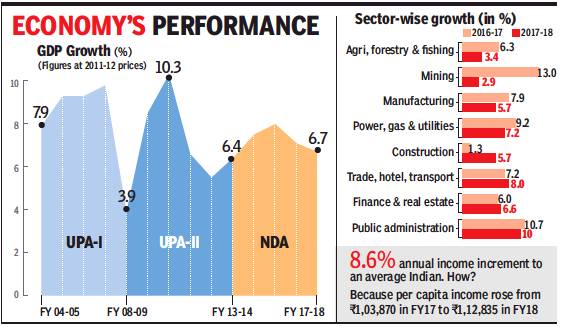

| − | + | [[File: The growth of India’s GDP, 2004- 18, 2016-18; sector-wise growth and growth in per capita income.jpg|The growth of India’s GDP, 2004- 18. <br/> 2016-18 <br/> i) Sector-wise growth, and <br/> Growth in per capita income <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F01&entity=Ar02301&sk=005B4784&mode=text Better growth prospects in FY19, but oil a risk: Expert, June 1, 2018: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | Economists are predicting a further pick-up in activity during the current financial year on the back of higher consumption demand, a stable GST and a surge in investment towards end of the year. But they have identified higher crude oil price and its impact on inflation, current account deficit and overall growth as risk factors that are expected to weigh on RBI’s Monetary Policy Committee (MPC), which meets next week. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | Most economists are predicting a GDP growth rate of 7-7.5%, with a majority closer to the upper end of the band. A few have already lowered their projections, such as Moody’s which cut from 7.5% to 7.3%, citing the impact of crude. But others, including the government, are sticking to their earlier estimates. | |

| − | + | ||

| − | + | “I don’t think we are revising our estimates or the forecast for the current year, which is about 7.5%. We retain it at that level... there is no one-to-one relation between the oil price growth and the GDP growth. There have been various quarters and years when oil prices have gone up but there has been growth also. So, we at this moment feel that we should retain (the growth estimate),” economic affairs secretary Subhash Chandra Garg told reporters after the GDP numbers were released. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | Economists too are bullish at the moment. “The growth is likely to realise from pick-up in consumption, especially rural consumption, with the forecast of normal monsoon, increased public sector spending and uptick in performance of the manufacturing sector in coming quarters. The manufacturing sector, which witnessed improvement in the last three quarters, is expected to benefit in Q1 of FY19 due to favourable base effect. In addition, investment rate has seen some improvement on the quarterly basis and is expected to maintain the momentum going ahead,” said Madan Sabhnavis, economist at CARE, while forecasting 7.5% growth this fiscal. | |

| − | + | Health of the banking sector will also be crucial. “The ability of public sector banks to support lending growth, the risk of monetary tightening and trade wars, and impact of higher crude oil prices on purchasing power of consumers and corporate earnings have emerged as risks,” said Aditi Nayar, principal economist at ICRA. | |

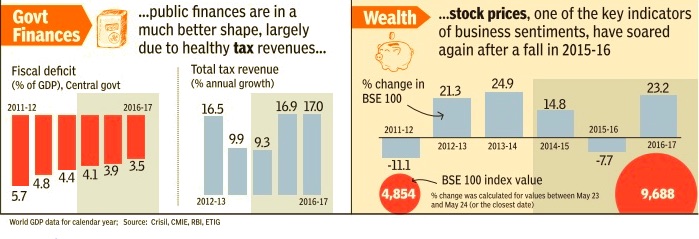

| − | + | ==2004-14 vis-à-vis 2014-18== | |

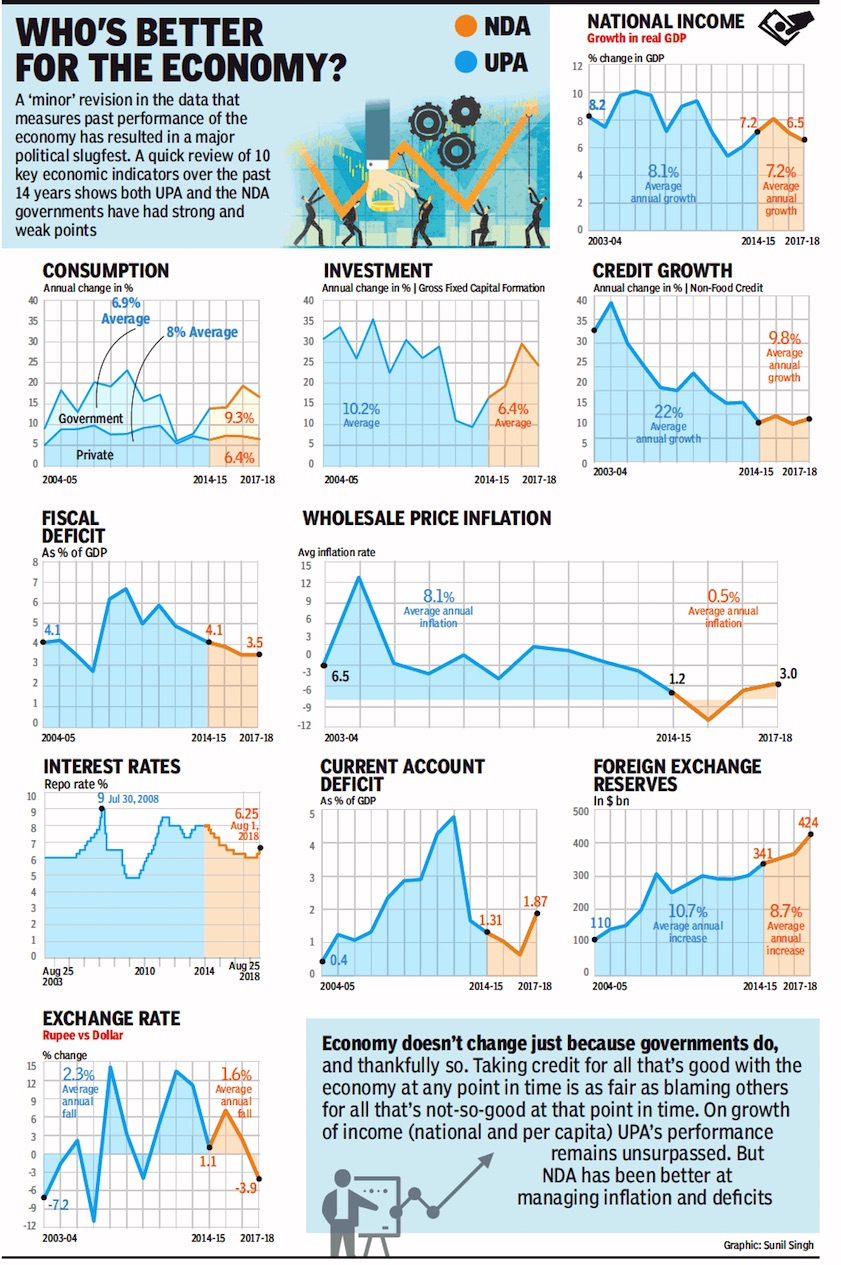

| + | [[File: The Indian economy in 2004-14 vis-à-vis 2014-18- Consumption, Investment, Credit Growth, Fiscal Deficit, Wholesale Price Inflation, Interest Rates, Current account Deficit, Foreign Exchange Reserves.jpg|The Indian economy in 2004-14 vis-à-vis 2014-18-<br/> i) Consumption, <br/> ii) Investment, <br/> iii)Credit Growth, <br/> iv) Fiscal Deficit, <br/> v) Wholesale Price Inflation, <br/> vi) Interest Rates, <br/> vii) Current account Deficit, <br/> viii) Foreign Exchange Reserves <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F08%2F23&entity=Ar00603&sk=60D4143E&mode=image August 23, 2018: ''The Times of India'']|frame|500px]] | ||

| − | + | '''See graphic''': | |

| − | + | ||

| − | + | ''The Indian economy in 2004-14 vis-à-vis 2014-18- Consumption, Investment, Credit Growth, Fiscal Deficit, Wholesale Price Inflation, Interest Rates, Current account Deficit, Foreign Exchange Reserves'' | |

| − | + | ||

| − | + | ===2004-14 (and 1988-89, 1994-2003)=== | |

| + | [https://economictimes.indiatimes.com/news/economy/indicators/india-clocked-10-08-pc-growth-under-manmohan-singhs-tenure-shows-data/articleshow/65444247.cms India clocked 10.08 per cent growth under Manmohan Singh's tenure: Report, August 18, 2018: ''The Economic Times''] | ||

| − | + | [[File: Estimation of average growth- 1994- 2014.jpg|Estimation of average growth- 1994- 2014 <br/> From: [https://economictimes.indiatimes.com/news/economy/indicators/india-clocked-10-08-pc-growth-under-manmohan-singhs-tenure-shows-data/articleshow/65444247.cms India clocked 10.08 per cent growth under Manmohan Singh's tenure: Report, August 18, 2018: ''The Economic Times'']|frame|500px]] | |

| − | |||

| − | |||

| − | + | The numbers have been calculated by a committee set up by the National Statistical Commission. | |

| − | + | India’s economic growth numbers, adjusted for the base year of FY12, show that expansion was marginally higher under the new series after the economy picked up pace in FY04 and generally lower in the preceding years. | |

| − | + | The numbers have been calculated by a committee set up by the National Statistical Commission. Former chief statistician Pronab Sen said the exercise was a good start but that more work was needed. | |

| − | - | + | The report shows real GDP growth touching a high of 10.08% in 2006-07 in terms of factor cost, the highest since liberalisation of the economy in 1991 and the second highest ever, behind 10.2% during the Rajiv Gandhi administration in 1988-89. Under the old series, growth in 2006-07 was 9.57%. |

| − | + | In terms of market prices, the highest growth was 10.78% in 2010-11. | |

| − | + | The new GDP series with FY12 as the base year was begun in 2015 and follows internationally accepted methods based on market prices as opposed to the factor cost method followed earlier and uses corporate numbers to estimate manufacturing output. | |

| − | + | The committee has issued adjusted numbers for the 1994-2014 period. Average growth in first five-year term of the Congress-led United Progressive Alliance (UPA-1), FY05-09, goes up under the new series to 8.37% from 8.03% earlier in terms of market prices. | |

| − | + | ||

| − | 8. | + | In terms of factor cost, the increase is from 8.43% to 8.87%. Average growth during the preceding Bharatiya Janata Party-led National Democratic Alliance administration is down marginally from 5.89% to 5.73%. In terms of factor cost, the decline was from 6.01% to 5.83%. |

| − | + | In the first three years of UPA-2 (FY10-12), the average growth rate goes up from 8.46% to 8.86%. In terms of factor cost, the revision is up from 8.06% to 8.49%. Growth data based on the old series is available till FY12 while the revised series is till FY14. | |

| − | + | The Congress party said growth numbers were better under the UPA. “It proves that like-for-like, the economy under both UPA terms (10-year avg: 8.1%) outperformed the Modi Govt (avg 7.3%),” the party’s official handle tweeted. “The UPA also delivered the only instance of double-digit annual growth in modern Indian history.” | |

| − | + | Over the 1994-95 to 2002-03 period, the restated growth under the new series is lower than GDP estimated according to market prices. | |

| − | + | “Growth is higher in the new back series especially for value-added growth,” said Aditi Nayar, principal economist at ICRA. “There is a fairly secular trend after 2003-04.” | |

| − | + | ||

| − | + | The committee said the deviations were not significant and attributed these to discrepancies. | |

| − | + | “When we look at the growth rates, there are some differences, although not significant and this is largely due to the ‘discrepancy’ variable, which is found to be highly volatile,” it said. | |

| − | + | Former chief statistician Pronab Sen said: “It is a good start but the committee has used some proxies to generate the series so one needs to see how consistent these methods are by themselves.” | |

| − | + | The statistics office has not yet taken a call on the numbers. | |

| − | + | “These are indicative numbers to decide the approach,” said a statistics ministry official. “These will be sent to the advisory committee on national accounts and based on its approval, we will work on sectoral data.” | |

| − | + | Officials of Central Statistics Office were also involved in the recommendations made in the report. NR Bhanumurthy, professor at National Institute of Public Finance and Policy (NIPFP) and member of the committee, said the back series is consistent with the new series and would be helpful for research. | |

| − | + | ONE METHOD The committee has restated the old series using one of the possible three ways--the production shift method. This is different from the method currently followed in compiling GDP data. | |

| − | + | The committee recommended that the other two methods should be also used to calculate the back series and when these numbers become available then “the time series data based on all the three approaches should be compared for their robustness.” | |

| − | + | The CSO has already computed the growth rates of GVA/GDP (gross value added/gross domestic product) estimates from 2004-05 to 2011-12 at current and constant prices using the current methodology. These are tentative estimates that need to be deliberated on by the advisory committee on national accounts, the committee noted in its report, and have not yet been presented. | |

| − | + | ===2004-14 vis-à-vis 2014-19=== | |

| + | [https://www.livemint.com/politics/policy/manmohan-singh-vs-narendra-modi-the-real-india-gdp-growth-story-1555034270688.html Vivek Kaul, Manmohan Singh vs Narendra Modi: The real India growth story, April 12, 2019: ''Livemint''] | ||

| − | |||

| − | ( | + | The quality of India GDP data came into question when GDP growth in FY17 was revised to 8.2%—the highest in any year between FY12 and FY19, despite demonetisation |

| + | GDP growth under Narendra Modi was faster than under Manmohan Singh. The question, though, is: does this pass the basic smell test? | ||

| + | |||

| + | The quality of India’s economic data in general, and gross domestic product (GDP) data in particular, has come in for questioning in recent months. Those questions only acquired more urgency in January, when the GDP growth in 2016-17 was revised to 8.2%—the highest in any year between 2011-12 and 2018-19. | ||

| + | |||

| + | In 2016-17, a large section of the informal economy, which forms a significant portion of the Indian economy, was severely hit by demonetisation. Hence, the question: how did the economy grow at 8.2% during the year? | ||

| + | Between 2009-10 and 2013-14, the period during which Manmohan Singh was the prime minister, the Indian economy grew by 6.7% per year. Between 2014-15 and 2018-19, the Indian economy is supposed to have grown at 7.5% per year. Narendra Modi has been prime minister during this period (from 26 May 2014 onwards). | ||

| + | |||

| + | Hence, the economic growth during the Modi years has been faster in comparison to the growth during the Manmohan Singh years. The question, though, is: does this pass the basic smell test? One way of figuring this out is to take a look at real-time economic indicators which capture the economic decisions of the average Indian. | ||

| + | |||

| + | Since January 2015, when India adopted a new way of calculating the GDP, the growth figure has not been in line with high-frequency economic indicators that reflect the economic decisions of individuals. Unlike GDP growth, the economic indicators used here, from domestic car sales to steel output, are real numbers (except inflation) and not theoretical constructs. So, if domestic car sales are growing, it is a reflection of robust urban consumer demand. If steel production is growing, it shows a robust car industry which uses a lot of steel, and a better physical infrastructure that can be used by individuals, among other things. | ||

| + | |||

| + | Let’s look at 15 economic indicators and see what they suggest. The growth of 11 out of the following 15 economic indicators was better during the second term of Manmohan Singh than Modi’s term. It is worth reminding here that the United Progressive Alliance’s (UPA’s) second term was by all accounts worse than its first term. Hence, we are comparing the worst of Manmohan with the best of Modi. | ||

| + | |||

| + | '''(1) Domestic two-wheeler sales:''' Motorcycle sales during the Manmohan Singh’s era grew by 12.44% per year. In Modi’s era, growth was at 5.35% per year. Scooter sales during Singh’s era grew by 25.7% per year. In Modi’s era, the growth was at 13.21% per year. Scooters sell more in urban India than rural India. Motorcycles sell in both urban as well as rural India. The growth rate of 5.35% per year in motorcycle sales during the Modi years is indicative of the agricultural distress and, accordingly, the slow rise in the consumption power of rural India as well. | ||

| + | |||

| + | '''(2) Domestic car sales:''' Car sales are an important indicator of how urban India is feeling on the economic front, because no one forces anyone to buy a car. When an individual buys a car (or a two-wheeler for that matter), he or she feels confident enough to make a down payment and pay an equated monthly instalment on the car loan. Car sales grew at 4.42% per year during the Modi years in comparison to 7.92% during the Manmohan years. The major jump during the Manmohan Singh years came in 2009-10 and 2010-11, when car sales increased by 25.22% and 29.08%, respectively. | ||

| + | What this again tells us is that urban India, in particular corporate India, has not been very confident on the economic front during the Modi years, irrespective of what they say in public forums. Of course, the growth of cab aggregators Uber and Ola has also played some role in the slowdown of domestic car sales growth in recent years. | ||

| + | |||

| + | '''(3) Domestic tractor sales:''' This is a good indicator of how rich farmers are feeling on the economic front. During the Modi years, the tractor sales are expected to grow at 4.49% per year. In comparison, tractor sales grew by 15.73% per year during the Manmohan years. This shows the presence of agriculture distress hurting farmers during the Modi years. In fact, domestic tractor sales in 2013-14 had stood at 634,000. The sales fell over the next two years, and in 2015-16 stood at 494,000. Since then, they have recovered to 724,000 during April 2018 to February 2019. | ||

| + | |||

| + | '''(4) Incremental retail loans growth:''' This is an indicator of how a reasonably large section of the population is feeling about their economic future. People usually take a loan when they are confident enough about repaying it. This may not be true about loans given to the industry but is true about retail loans (i.e. home loans, vehicle loans, etc.), given that the bad loan rate of retail loans stands at just 2%. Bad loans are loans which haven’t been repaid for 90 days or more. | ||

| + | |||

| + | Retail loans given out by banks during the Modi era are expected to grow at 19.92% per year in comparison to 22.47% per year during the Manmohan era. | ||

| + | |||

| + | '''(5) Airline passenger traffic:''' This is one point that is perpetually brought up by everyone who believes that the Modi government has done well on the economic front. In the Manmohan years, the number of airline passengers grew by 9.20% per year. It is expected to grow at 15.28% per year during the Modi years. | ||

| + | |||

| + | '''(6) Passenger revenues of Indian Railways:''' One point which people forget to mention is the fact that the growth in air travel has come at the cost of people upgrading from travelling by Indian Railways. This has led to a slowdown in the growth of passenger revenue of Indian Railways. In the Manmohan years, this was at 10.81% per year. In the Modi years, it is expected to be at 7.32% per year. | ||

| + | |||

| + | '''(7) Domestic commercial vehicles sales:''' Robust consumer demand should translate into more investment, with companies expanding to cater to the increasing demand. A good way to check whether this is happening or not is to take a look at domestic commercial vehicle sales. Faster sales indicate robust activity on the infrastructure front as well as the industrial front, which ultimately benefits individuals. Commercial vehicles are used to move around finished as well as semi-finished goods. | ||

| + | |||

| + | During the Modi years, commercial vehicles sales grew at 9.74% per year. In the Manmohan years, they had grown at 10.50% per year. In fact, the growth in commercial vehicles sales during the Modi years has been robust, though it might have been slower than that of Manmohan years. This is primarily on account of the road building programme carried out by the Modi government (as we shall see later). | ||

| + | |||

| + | '''(8) Cement production:''' Cement production during the Modi years is expected to grow at 4.32% per year against 7.05% per year during the Manmohan era. The cement consumption has grown at a slow pace during the Modi years despite a massive road building programme. | ||

| + | |||

| + | This essentially tells us two things. First, private sector investment has been slow. Second, the real estate sector, which uses a lot of cement, has been down in the dumps. People aren’t buying new homes. Interestingly, the history of economic development suggests that once people start getting out of agriculture, real estate and construction are the two sectors which they move towards, primarily because both these sectors offer a lot of low-skill jobs. The slow growth in cement production is another indicator that India is not generating enough low-skilled jobs. | ||

| + | |||

| + | '''(9) Consumption of finished steel:''' Steel consumption is another great indicator of the investment scenario in the country, as the construction of any new infrastructure requires steel. And better infrastructure essentially leads to an improvement in the ease of living of individuals. Data from India Brand Equity Foundation, a trust established by the ministry of commerce and industry, suggests consumption of finished steel is expected to increase 5.18% per year during the Modi era, in comparison to 7.18% per year during the Manmohan era. | ||

| + | |||

| + | This is indicative of the fact that the investment scenario in India continues to be dull. A dull investment scenario basically means that enough jobs aren’t being created. It also means that the incomes of those who already have jobs are rising at a slower pace. | ||

| + | |||

| + | '''(10) Income tax growth:''' This is a good indicator of whether the income of individuals working in the formal sector of the economy is growing or not. | ||

| + | |||

| + | The Modi administration has over the years talked a lot about the income tax collections improving significantly. The income tax collections in the Modi years are expected to grow at 16.85% per year. In comparison, the growth in tax revenue in the Manmohan years was 17.53% per year. The government has also talked about the fact that more people are filing income tax returns now than before. While this is true, this hasn’t exactly translated into faster pace of growth in tax revenue. | ||

| + | |||

| + | '''(11) Corporation tax growth:''' Companies pay a higher tax when they sell more stuff, and consequently make a higher profit. They sell more when people consume more. People consume more when they are doing well on the financial front. And that’s possible when the overall economy is doing well. During the Modi years, corporation tax collections are expected to grow by 11.20% per year against 13.09% in the Manmohan years. | ||

| + | |||

| + | '''(12) Consumption of petroleum products:''' The consumption of fuel in an economy which is doing well tends to grow at a faster rate. The consumption of fuel products during the Modi years is expected to grow at 5.91% per year against 3.47% during the Manmohan years. This is another economic indicator that has fared better in the Modi years than the Manmohan years. A simple explanation for this lies in the fact that oil prices were much higher between 2011 and 2014 than they have been since then. | ||

| + | |||

| + | '''(13) Inflation:''' One of the genuine successes of the Modi government has been on the inflation front. In May 2014, when Narendra Modi took over as prime minister, inflation, as measured by the consumer price index (CPI), stood at 7.72%, with food inflation at 9.21%. In February 2019, inflation was at 2.57%, with food prices falling by 0.66%. During 2018-2019, food prices have risen by just 0.13%. | ||

| + | |||

| + | On the flip side, the lack of food inflation is hurting farmers. | ||

| + | |||

| + | '''(14) Household financial savings:''' This is an indicator which tells us how much people are saving. The problem, in this case, is that data is available only from 2011-12 onwards, which is what we will consider. The gross household financial savings when Manmohan Singh was the prime minister grew at 13% per year. In the Modi years (up to 2017-18) they grew by 11.94% per year. As far as net household financial savings (gross household financial savings minus the financial liabilities of households) are concerned, they grew by 13.79% per year in the Manmohan years. In comparison, they grew by 7.38% per year during the Modi years (up to 2016-17). | ||

| + | |||

| + | '''(15) Road construction:''' This is another area where the Modi government has done significantly better than the Manmohan Singh government. As of 31 March 2009, the total length of national highways stood at 70,548 kilometres (km). By 31 March 2014, this had increased to 91,287km, at the rate of 5.29% growth per year. By March 2019, the length of national highways is expected to touch 135,676km, with 10,000km of road expected to be constructed during 2018-19. This means an increase of 8.25% per year. Between April and December, 6,715km had already been built. | ||

| + | |||

| + | To conclude, the Manmohan Singh years come out to be much better than the Modi years, in 11 out of the 15 indicators. | ||

| + | |||

| + | This essentially brings us back to the question: When so many economic indicators grew faster in the second term of Manmohan Singh vis a vis the first term of Modi, why doesn’t this reflect in the GDP growth figures of the two eras? The Modi years growing at a faster pace than the second term of Manmohan doesn’t make much sense. | ||

| + | |||

| + | ==2012-16: fastest growth in 5 years== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Eco-grows-fastest-in-5-years-at-76-01062016027021 ''The Times of India''], Jun 01 2016 | ||

| + | |||

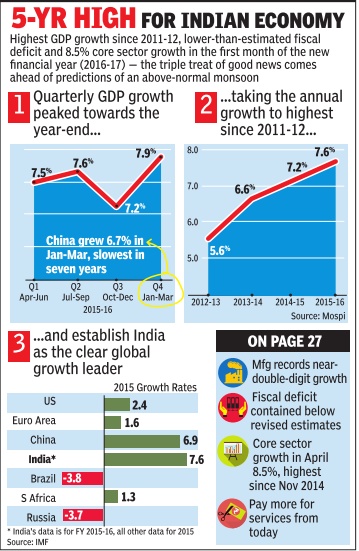

| + | [[File: Economic growth, trends, 2012-16.jpg|Economic growth, trends, 2012-16; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=01_06_2016_001_034_002&type=P&artUrl=5-YR-HIGH-FOR-INDIAN-ECONOMY-01062016001034&eid=31808 ''The Times of India''], June 1, 2016|frame|500px]] | ||

| + | |||

| + | '''Eco grows fastest in 5 years at 7.6%''' | ||

| + | |||

| + | The country's economy grew 7.6% in 2015-16, the fastest in five years, while growth in the fourth quarter clocked 7.9%, keeping India ahead as the fastest growing major economy in the world. | ||

| + | |||

| + | |||

| + | The GDP data also brought cheers for the government, which has completed two years in office and is showcasing revival of the economy as a major achievement. India's 7.9% expansion in JanuaryMarch (fastest in six quarters) is higher than China's 6.7% expansion in the same quarter.In October-December quarter Indian economy grew 7.2%.Growth was powered by strong expansion in the manufacturing, which grew 9.3% in 2015-16 compared to 5.5% in 2014-15 and the farm sector, which clocked a growth of 1.2% in 2015-16 compared to a contraction of 0.2% in the previous year. The growth in the farm sector was despite the impact of a drought. Policy makers lauded the improving health of public finances. “.. India continues to remain a bright spot in the world economy with robust macro-economic and fiscal parameters,“ the finance mini stry said in a statement. Economist said they expect a good monsoon to support improving growth in the months ahead. | ||

| + | |||

| + | |||

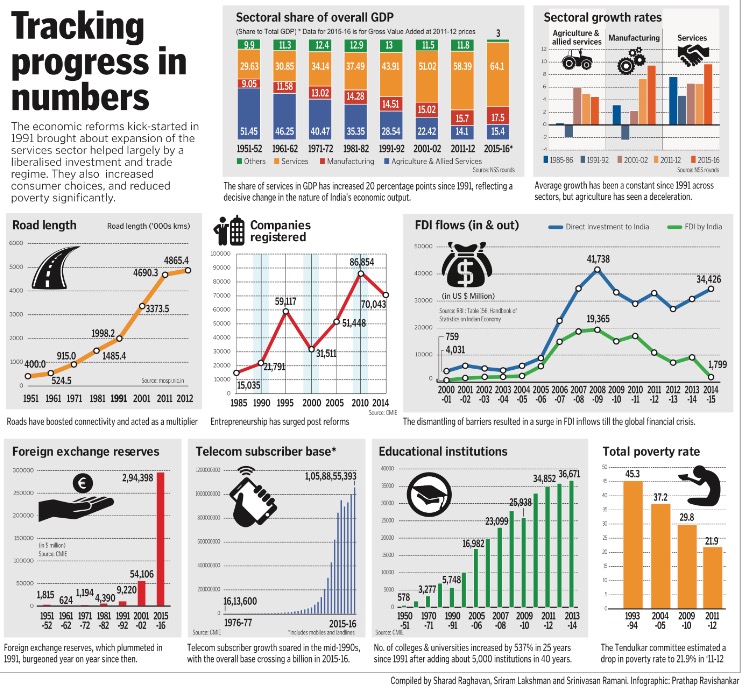

| + | [[File: Indian economy, Some facts regarding GDP, Foreign investment, Domestic infrastructure.jpg|Indian economy: Some facts regarding GDP, Foreign investment, Domestic infrastructure: Graphic courtesy: [http://m.thehindu.com/business/Economy/1991present-tracking-progress-in-numbers/article8891883.ece ''The Hindu''], July 24, 2016|frame|500px]] | ||

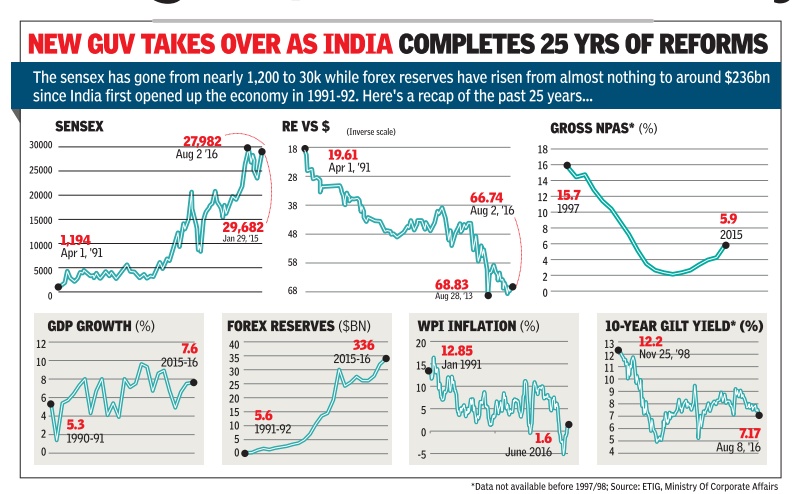

| + | [[File: Economic indicators, India, Sensex, Exchange rate, Gross National Product, GDP growth, Forex Reserves, WPI inflation and 10 year gilt yield.jpg|Economic indicators, India: Sensex, Exchange rate, Gross National Product, GDP growth, Forex Reserves, WPI inflation and 10 year gilt yield; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=21_08_2016_017_006_003&type=P&artUrl=Stocks-to-gain-but-bonds-may-slide-21082016017006&eid=31808 ''The Times of India''], August 21, 2016|frame|500px]] | ||

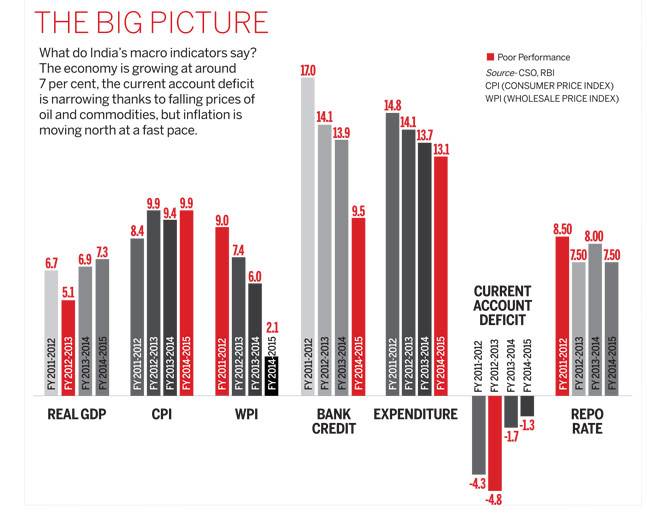

| + | [[File: Real GDP, CPI, WPI, Bank Credit, Expenditure, Current Account Deficit, Repo Rate, 2011-15.jpg|Real GDP, CPI, WPI, Bank Credit, Expenditure, Current Account Deficit, Repo Rate, 2011-15; Graphic courtesy: [http://indiatoday.intoday.in/story/economy-budget-arun-jaitley-narendra-modi-government/1/587099.html ''India Today''], February 15, 2016|frame|500px]] | ||

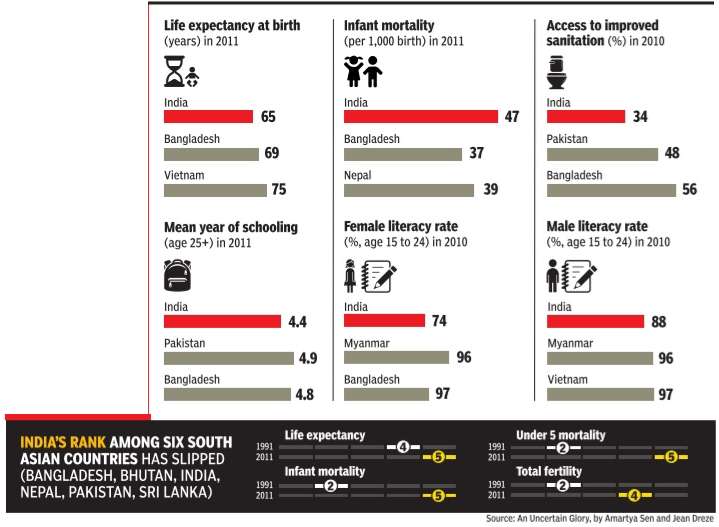

| + | [[File: Life expentency at birth, Infant mortality, Access to improved sanitation, Mean year of schooling, Female literacy rate, Male literacy rate, 2010,2011.jpg|Life expentency at birth, Infant mortality, Access to improved sanitation, Mean year of schooling, Female literacy rate, Male literacy rate, 2010,2011; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=ECONOMIC-GIANT-BECOMING-SOCIAL-PYGMY-02032016016019 ''The Times of India''], March 2, 2016|frame|500px]] | ||

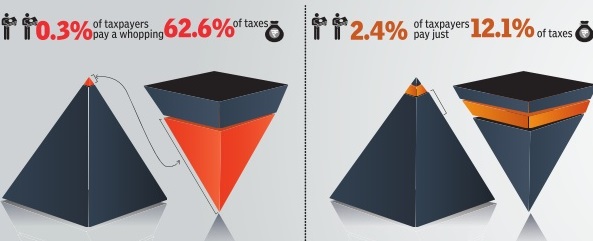

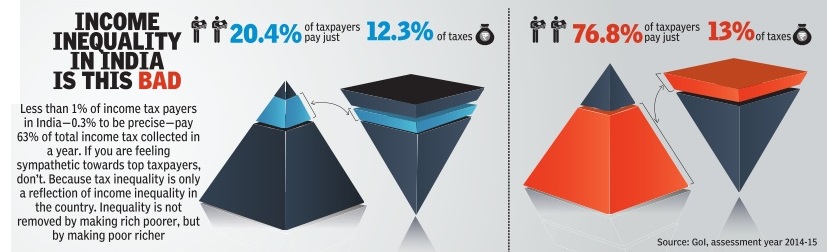

| + | [[File: Income inequalities in India with respect to taxpayers1.jpg|Income inequalities in India with respect to taxpayers; Graphic courtesy: [http://epaperbeta.timesofindia.com//Gallery.aspx?id=01_03_2016_005_023_001&type=P&artUrl=INCOME-INEQUALITY-IN-INDIA-IS-THIS-BAD-01032016005023&eid=31973 ''The Times of India''], March 1, 2016|frame|500px]] | ||

| + | [[File: Income inequalities in India with respect to taxpayers2.jpg| Income inequalities in India with respect to taxpayers; Graphic courtesy: [http://epaperbeta.timesofindia.com//Gallery.aspx?id=01_03_2016_005_023_001&type=P&artUrl=INCOME-INEQUALITY-IN-INDIA-IS-THIS-BAD-01032016005023&eid=31973 ''The Times of India''], March 1, 2016|frame|500px]] | ||

| + | |||

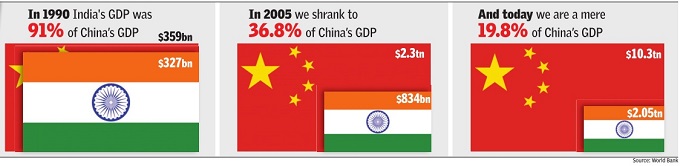

| + | [[File: The Indian economy vis-à-vis the Chinese economy in terms of GDP.jpg| The Indian economy vis-à-vis the Chinese economy in terms of GDP; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31973&articlexml=IN-1990-INDIAS-ECONOMY-WAS-ALMOST-AS-LARGE-01032016015011 ''The Times of India''], March 1, 2016|frame|500px]] | ||

| + | |||

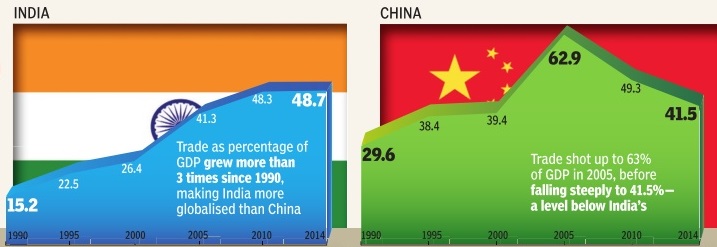

| + | [[File: The Indian economy vis-à-vis the Chinese economy.jpg| The Indian economy vis-à-vis the Chinese economy; Graphic courtesy: [http://epaperbeta.timesofindia.com//Gallery.aspx?id=01_03_2016_014_005_002&type=P&artUrl=INDIAN-ECONOMY-IS-MORE-GLOBALISED-THAN-CHINA-AND-01032016014005&eid=31973 ''The Times of India''], March 1, 2016|frame|500px]] | ||

| + | |||

| + | “With renewed forecast of more than normal monsoon this year, the situation in agriculture is expected to improve significantly , which will eventually lead to revival of consumption demand, especially in rural areas,“ said Madan Sabnavis, chief economist at Care Ratings. | ||

| + | |||

| + | “This in turn should also boost investment sentiment and keep food inflation under control. Also implementation of various government schemes and 7th Pay Commission will have an important bearing. With continued strong performance of the service sector, GDP growth in FY17 should see strong contributions from each sector of the economy . We expect GDP growth in FY17 to be around 7.8%,“ he said. | ||

| + | |||

| + | But the numbers also showed some weak spots such as sluggish investment growth. | ||

| + | |||

| + | “Private consumption has emerged as the bulwark of economy in 2015-16, whereas investment growth has slowed.With excess capacity and high leverage, private consumption demand will have to rise further to pare excess capacity and encourage private investment. With normal monsoon, a mild kick to public sector wages and improved transmission of interest rates, private consumption demand is set to get a boost in 2016-17,“ said D K Joshi, chief economist at Crisil. | ||

| + | |||

| + | ==2014-16: Economic indicators== | ||

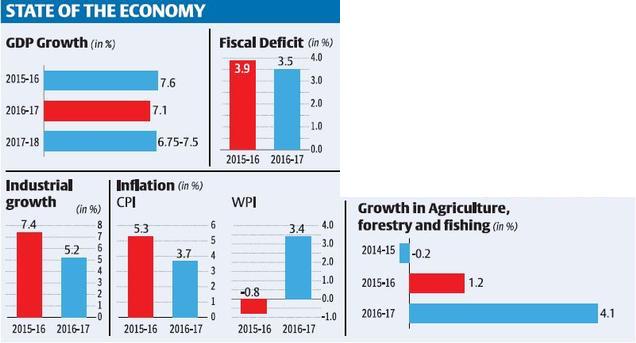

| + | '''See graphic''' | ||

| + | |||

| + | ''Economy, GDP growth, fiscal deficit, industrial growth, inflation and growth in agriculture, forestry and fishing, 2014-17'' | ||

| + | |||

| + | [[File: Economy, GDP growth, fiscal deficit, industrial growth, inflation and growth in agriculture, forestry and fishing, 2014-17.jpg|GDP growth, fiscal deficit, industrial growth, inflation and growth in agriculture, forestry and fishing, 2014-17; Graphic courtesy: [http://www.thehindubusinessline.com/economy/economy/article9512876.ece ''The Hindu Business Line''], Feb 1, 2017|frame|500px]] | ||

| + | |||

| + | ==Facts about Indian economy== | ||

| + | ===2015-16=== | ||

| + | [[http://indiabudget.gov.in/es2016-17/efactindia.pdf The Economic Survey: 2016-17]] | ||

| + | |||

| + | '''Indians on The Move''' | ||

| + | [[File: Annual new migrants (in millions), 2011-16, year-wise.jpg|Annual new migrants (in millions), 2011-16, year-wise; [[http://indiabudget.gov.in/es2016-17/efactindia.pdf The Economic Survey: 2016-17]]|frame|500px]] | ||

| + | |||

| + | |||

| + | New estimates based on railway passenger traf c data reveal annual work-related migration of about 9 million people, almost double what the 2011 Census suggests. | ||

| + | |||

| + | |||

| + | '''Biases in Perception''' | ||

| + | |||

| + | China’s credit rating was upgraded from A+ to AA- in December 2010 while India’s has re- mained unchanged at BBB-. From 2009 to 2015, China’s credit-to-GDP soared from about 142 percent to 205 percent and its growth decelerated. The contrast with India’s indicators is striking. | ||

| + | |||

| + | |||

| + | '''New Evidence on Weak Targeting of Social Programs''' | ||

| + | |||

| + | Welfare spending in India suffers from misallocation: as the pair of charts show, the districts with the most poor (in red on the left) are the ones that suffer from the greatest shortfall of funds (in red on the right) in social programs. The districts accounting for the poorest 40% receive 29% of the total funding. | ||

| + | |||

| + | |||

| + | '''Political Democracy but Fiscal Democracy?''' | ||

| + | |||

| + | India has 7 taxpayers for every 100 voters ranking us 13th amongst 18 of our democratic G-20 peers. | ||

| + | |||

| + | |||

| + | '''India's Distinctive Demographic Dividend''' | ||

| + | |||

| + | India’s share of working age to non-working age population will peak later and at a lower level than that for other countries but last longer. The peak of the growth boost due to the demographic dividend is fast approaching, with peninsular states peaking soon and the hinterland states peaking much later. | ||

| + | |||

| + | |||

| + | '''India Trades More Than China and a Lot Within Itself''' | ||

| + | |||

| + | As of 2011, India’s openness - measured as the ratio of trade in goods and services to GDP has far overtaken China’s, a country famed for using trade as an engine of growth. India’s internal trade to GDP is also comparable to that of other large countries and very different from the caricature of a barrier-riddled economy. | ||

| + | |||

| + | |||

| + | '''Divergence within India, Big Time''' | ||

| + | |||

| + | Spatial dispersion in income is still rising in India in the last decade (2004-14), unlike the rest of the world and even China. That is, despite more porous borders within India than between countries internationally, the forces of “convergence” have been elusive. | ||

| + | |||

| + | |||

| + | '''Property Tax Potential Unexploited''' | ||

| + | |||

| + | Evidence from satellite data indicates that Bengaluru and Jaipur collect only between 5% to 20% of their potential property taxes. | ||

| + | |||

| + | ===2015-16: economy grew 7.9%=== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Eco-grew-79-in-15-16-faster-than-01022017025042 Eco grew 7.9% in '15-16, faster than estimated 7.6%, Feb 01 2017: The Times of India] | ||

| + | |||

| + | [[File: GDP growth, 2012-17 and fiscal deficit, 2013-17.jpg|GDP growth, 2012-17 and fiscal deficit, 2013-17; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Eco-grew-79-in-15-16-faster-than-01022017025042 Eco grew 7.9% in '15-16, faster than estimated 7.6%, Feb 01 2017: The Times of India]|frame|500px]] | ||

| + | |||

| + | The Central Statistics Office (CSO) said the economy grew by 7.9% in 2015-16, a shade faster than previously estimated 7.6%, on account of better perfor mance by the farm and industrial sectors. CSO, however, left the figure for 2014-15 unchanged at 7.2%. | ||

| + | |||

| + | The revised growth rate would be the fastest pace of expansion for the economy in five years as data for the new series introduced in 2011-12 is available now. It would give the government ammunition to counter the Opposition's charge that the NDA's handling of the economy has slowed down the growth rate. | ||

| + | |||

| + | CSO had said that the economy was estimated to grow 7.1% during the current financial year but did not factor in the impact of demonetisation. The Economic Survey , released on Tuesday , however, indicated that the growth rate could slip to 6.5% due to the cash squeeze. | ||

| + | |||

| + | Higher growth rate would push up the base and could result in a further slowdown during the current finnacial year. It would, however, help the government show a better fiscal performance since the base has expanded. | ||

| + | |||

| + | Separate data showed the fiscal deficit up to December-end has touched 94% of the full year estimate of Rs 5.3 lakh crore.Fiscal deficit during April-December 2015 was estimated at 88% of the budget estimate. | ||

| + | |||

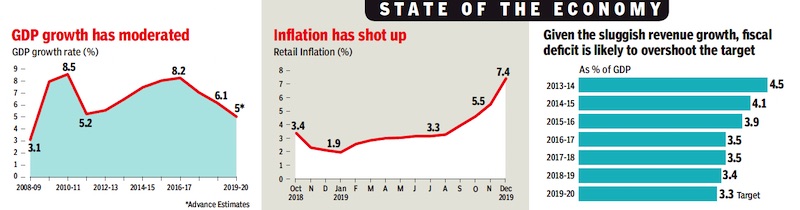

| + | === …vs. 2008-18 (GDP), 2018 (inflation), 2013-18 (deficit)=== | ||

| + | [[File: The Indian economy in 2019-20 vis-à-vis 2008-18 (GDP growth), 2018 (inflation) and 2013-18 (fiscal deficit)..jpg|The Indian economy in 2019-20 vis-à-vis 2008-18 (GDP growth), 2018 (inflation) and 2013-18 (fiscal deficit). <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIM%2F2020%2F02%2F01&entity=Ar02410&sk=2CA57C3B&mode=image February 1, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' The Indian economy in 2019-20 vis-à-vis 2008-18 (GDP growth), 2018 (inflation) and 2013-18 (fiscal deficit). '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|E | ||

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:Government|E | ||

| + | ECONOMY: INDIA 1]] | ||

| + | [[Category:India|E | ||

| + | ECONOMY: INDIA 1]] | ||

| + | |||

| + | ==The economy as in 2017== | ||

| + | [http://timesofindia.indiatimes.com/business/economic-survey/economic-survey-7-interesting-facts-about-india/listshow/56892884.cms The Times of India], January 31, 2017 | ||

| + | |||

| + | |||

| + | For the first time, along with a host of numbers and dry facts, the Economic Survey presented today also highlighted seven curious things about India, ranging from a perception bias against it to a fiscal disparity within it. | ||

| + | |||

| + | 1. | ||

| + | '''Indians on the move''' | ||

| + | |||

| + | New estimates based on railway passenger traffic data reveal annual work-related migration of about 9 million people, almost double what the 2011 Census suggests. | ||

| + | |||

| + | 2. | ||

| + | '''Biases in perception''' | ||

| + | |||

| + | China's credit rating was upgraded from A+ to AA- in December 2010 while India's has remained unchanged at BBB-. From 2009 to 2015, China's credit-to-GDP soared from about 142 percent to 205 percent and its growth decelerated. The contrast with India's indicators is striking. | ||

| + | |||

| + | 3. | ||

| + | '''New evidence on weak targeting of social programs''' | ||

| + | |||

| + | The Survey says that welfare spending in India suffers from misallocation. Districts with the most poor are the ones that suffer from the greatest shortfall of funds in social programs. The districts accounting for the poorest 40% receive 29% of the total funding. | ||

| + | |||

| + | 4. | ||

| + | '''Narrow tax base''' | ||

| + | |||

| + | India has seven taxpayers for every 100 voters, ranking us 13th amongst 18 of our democratic G-20 peers. | ||

| + | |||

| + | 5. | ||

| + | '''India trades more than China''' | ||

| + | |||

| + | As of 2011, India's openness - measured as the ratio of trade in goods and services to GDP - has far overtaken China's. India's internal trade is also comparable to that of other large countries. | ||

| + | |||

| + | 6. | ||

| + | '''India's distinctive demographic dividend''' | ||

| + | |||

| + | There will a steady rise in India's working age population. While it will be slower compared to other countries, it is expected to last for much longer. Peninsular states are fast approaching the peak of the growth boost due to the demographic dividend. | ||

| + | |||

| + | 7. | ||

| + | '''Income divergence within India''' | ||

| + | |||

| + | During the last decade (2004-14), spatial dispersion in income has been on the rise in India, unlike the rest of the world and even China. Despite more porous borders within India than between countries internationally, the geographical graph of per capita income is skewed. | ||

| + | |||

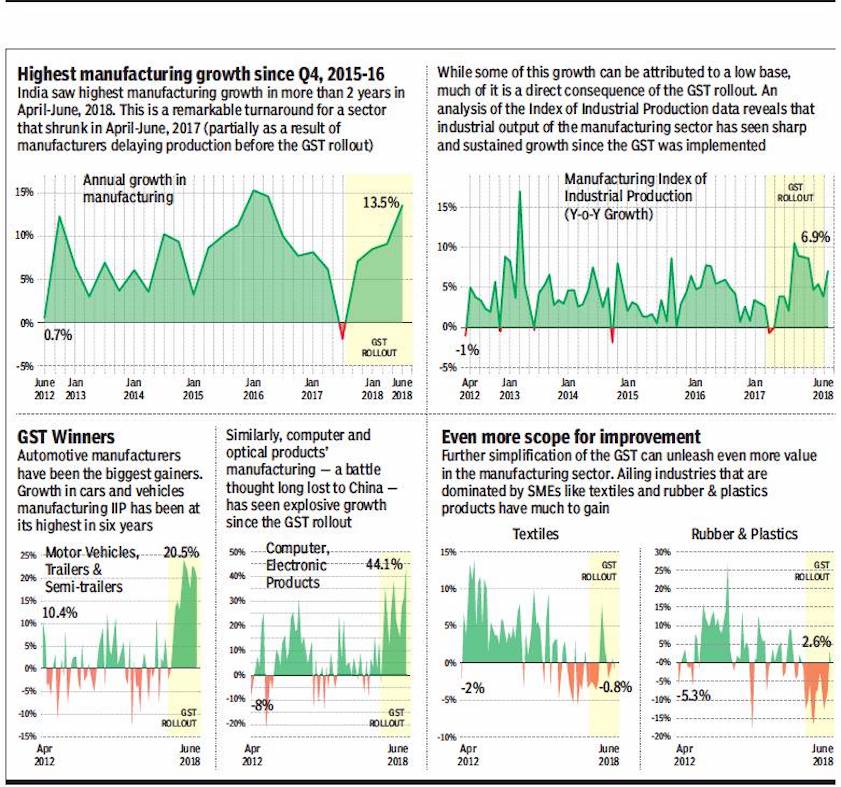

| + | ==2012-18: impact of GST on manufacturing== | ||

| + | [[File: 2012-18- The impact of GST on manufacturing.jpg| 2012-18: The impact of GST on manufacturing <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F09%2F03&entity=Ar01722&sk=B5A31E15&mode=text September 3, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''2012-18- The impact of GST on manufacturing'' | ||

| + | |||

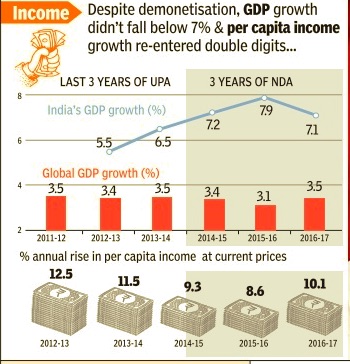

| + | ==Economic indicators: 2012-14 vs. 2014-17== | ||

| + | '''See graphics''': | ||

| + | |||

| + | 1. ''GDP growth, 2011-17, year-wise and % annual rise in per capita income at current prices, 2012-17, year-wise'' | ||

| + | |||

| + | 2. ''Inflation dynamics, 2011-17, year-wise and merchandise exports, 2011-17, FDI inflows, 2013-17, Industrial production, 2012-17, year-wise'' | ||

| + | |||

| + | 3. ''Fiscal deficit, 2011-17, total tax revenue, 2012-17, fluctuations in stock market (BSE), 2011-17, year-wise'' | ||

| + | |||

| + | [[File: GDP growth, 2011-17, year-wise and % annual rise in per capita income at current prices, 2012-17, year-wise.jpg|GDP growth, 2011-17, year-wise and % annual rise in per capita income at current prices, 2012-17, year-wise; [http://epaperbeta.timesofindia.com/Gallery.aspx?id=26_05_2017_018_005_011&type=P&artUrl=Three-Cheers-Modi-Has-Much-To-Celebrate-26052017018005&eid=31808 The Times of India], May 26, 2017|frame|500px]] | ||

| + | |||

| + | [[File: Inflation dynamics, 2011-17, year-wise and merchandise exports, 2011-17, FDI inflows, 2013-17, Industrial production, 2012-17, year-wise.jpg|Inflation dynamics, 2011-17, year-wise and merchandise exports, 2011-17, FDI inflows, 2013-17, Industrial production, 2012-17, year-wise; [http://epaperbeta.timesofindia.com/Gallery.aspx?id=26_05_2017_018_005_011&type=P&artUrl=Three-Cheers-Modi-Has-Much-To-Celebrate-26052017018005&eid=31808 The Times of India], May 26, 2017|frame|500px]] | ||

| + | |||

| + | [[File: Fiscal deficit, 2011-17, total tax revenue, 2012-17, fluctuations in stock market (BSE), 2011-17, year-wise.jpg|Fiscal deficit, 2011-17, total tax revenue, 2012-17, fluctuations in stock market (BSE), 2011-17, year-wise; [http://epaperbeta.timesofindia.com/Gallery.aspx?id=26_05_2017_018_005_011&type=P&artUrl=Three-Cheers-Modi-Has-Much-To-Celebrate-26052017018005&eid=31808 The Times of India], May 26, 2017|frame|500px]] | ||

| + | |||

| + | ==Indicators 2013-18 (inflation, monsoons, crude prices)== | ||

| + | [[File: Inflation in India (CPI)- 2013-18; Performance of monsoons, 2008-17; Value of rupee, Jan- June, 2018; Crude oil prices, 2013-18.jpg|i) Inflation in India (CPI): 2013-18; <br/> ii) Performance of monsoons, 2008-17; <br/> iii) Value of rupee, Jan- June, 2018; <br/> iv) Crude oil prices, 2013-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F08&entity=Ar02207&sk=F51556D9&mode=text June 8, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''i) Inflation in India (CPI): 2013-18; <br/> ii) Performance of monsoons, 2008-17; <br/> iii) Value of rupee, Jan- June, 2018; <br/> iv) Crude oil prices, 2013-18'' | ||

| + | |||

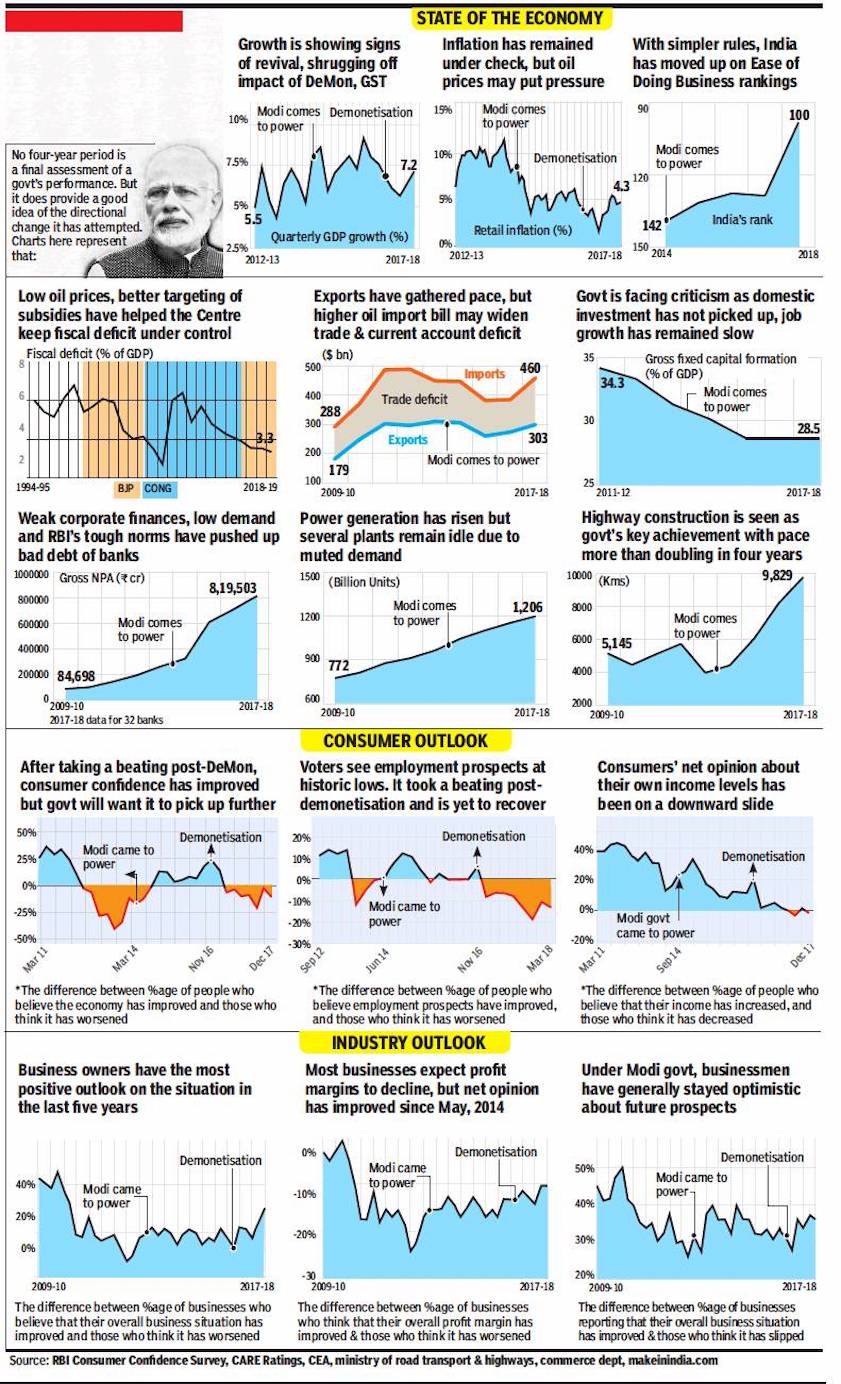

| + | ==2014, May- 2018, May== | ||

| + | [[File: Four years of Modi government an economic report card.jpg|Four years of Modi government an economic report card <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F05%2F26&entity=Ar03020&sk=894DF94B&mode=text May 26, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''Four years of Modi government an economic report card'' | ||

| + | |||

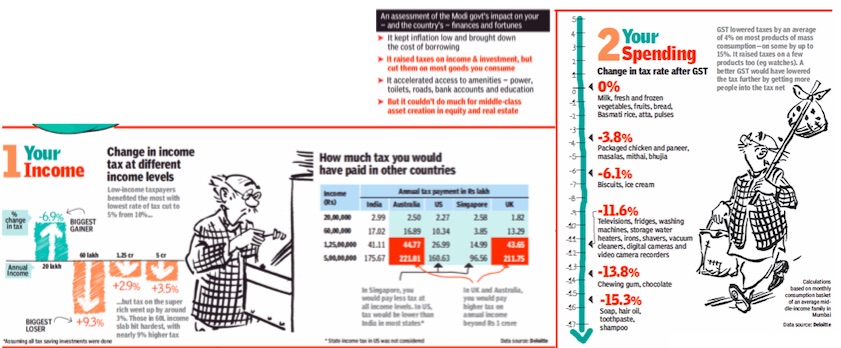

| + | ==2014, May- 2019 Jan== | ||

| + | === For individual Indians=== | ||

| + | [[File: 2014, May- 2019 Jan- an economic report card for individual Indians- i) Income; ii)Spending.jpg|2014, May- 2019 Jan- an economic report card for individual Indians- <br/> i) Income; <br/> ii) Spending <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F02&entity=Ar00801&sk=D9F71FF2&mode=image February 2, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: 2014, May- 2019 Jan- an economic report card for individual Indians- iii) Investment; iv) Wealth from stock market.jpg|2014, May- 2019 Jan- an economic report card for individual Indians- <br/> iii) Investment; <br/> iv) Wealth from stock market <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F02&entity=Ar00801&sk=D9F71FF2&mode=image February 2, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

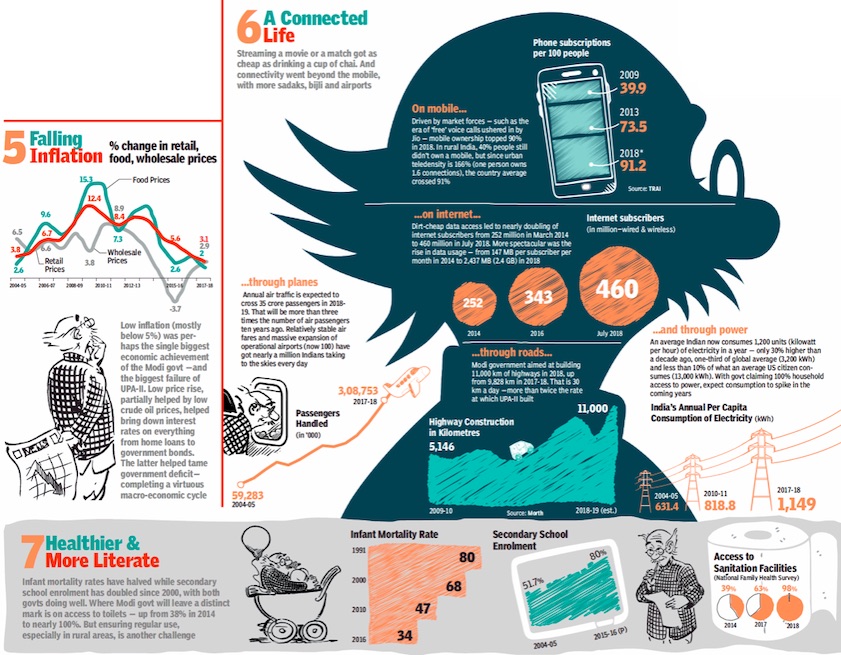

| + | [[File: 2014, May- 2019 Jan- an economic report card for individual Indians- v) Falling inflation; vi) A connected life and vii) healthier and more literate.jpg|2014, May- 2019 Jan- an economic report card for individual Indians- <br/> v) Falling inflation; <br/> vi) A connected life and <br/> vii) healthier and more literate <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F02&entity=Ar00801&sk=D9F71FF2&mode=image February 2, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphics''': | ||

| + | |||

| + | '' 2014, May- 2019 Jan- an economic report card for individual Indians- <br/> i) Income; <br/> ii)Spending '' | ||

| + | |||

| + | ''2014, May- 2019 Jan- an economic report card for individual Indians- <br/> iii) Investment; <br/> iv) Wealth from stock market'' | ||

| + | |||

| + | ''2014, May- 2019 Jan- an economic report card for individual Indians- <br/> v) Falling inflation; <br/> vi) A connected life and <br/> vii) healthier and more literate'' | ||

| + | |||

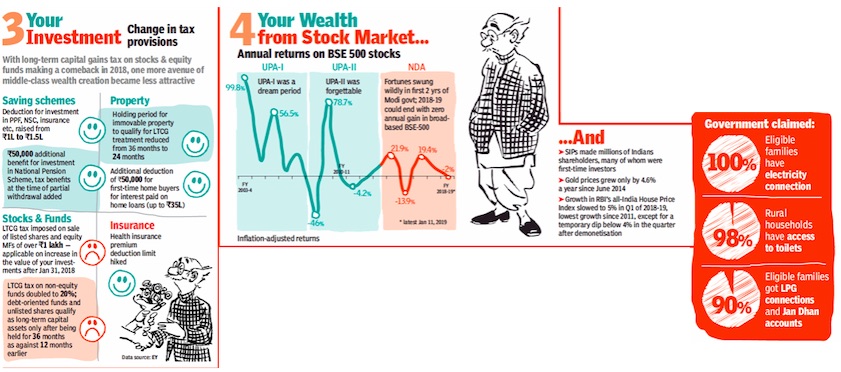

| + | ===For the country as a whole=== | ||

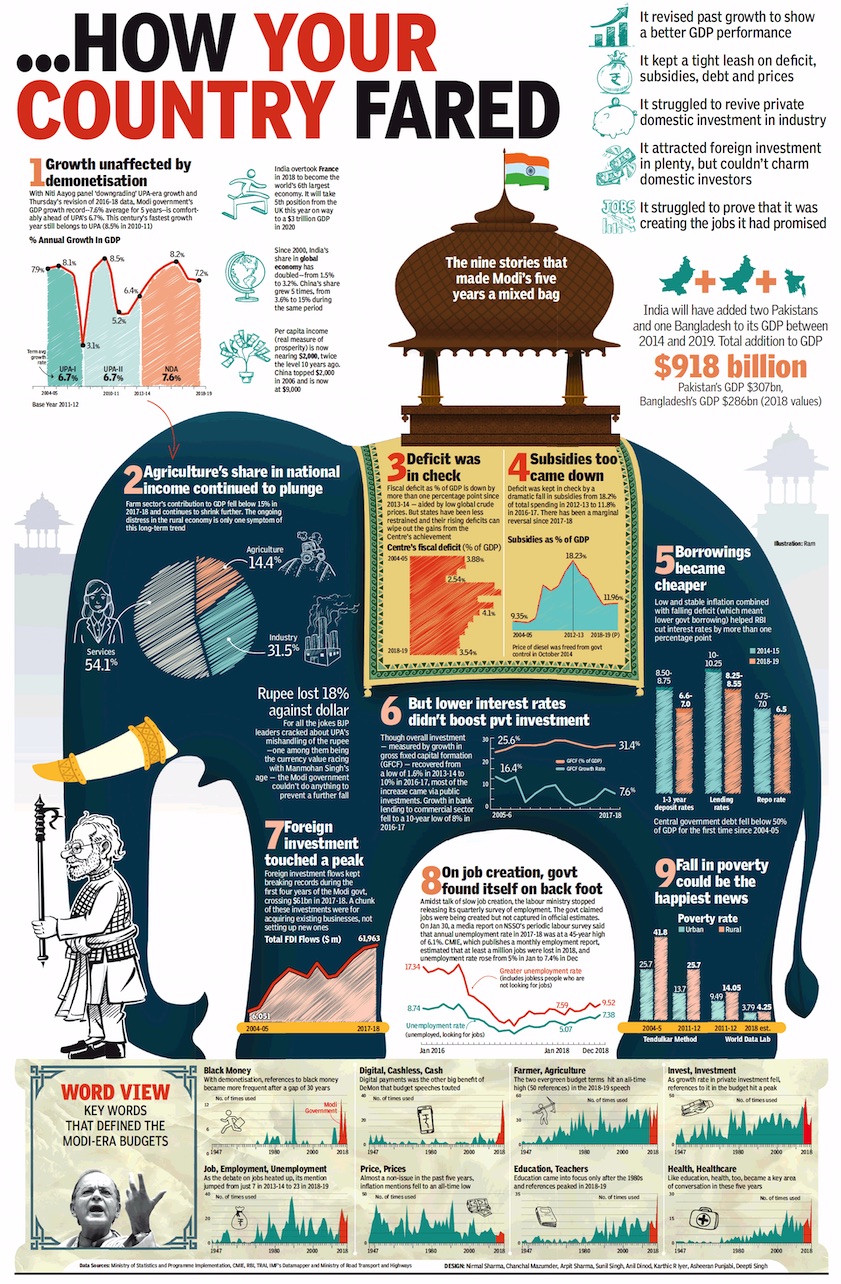

| + | [[File: 2014, May- 2019 Jan- an economic report card for the country as a whole.jpg| 2014, May- 2019 Jan: an economic report card for the country as a whole <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F02&entity=Ar00901&sk=D3CDA767&mode=image February 2, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''2014, May- 2019 Jan: an economic report card for the country as a whole'' | ||

| + | |||

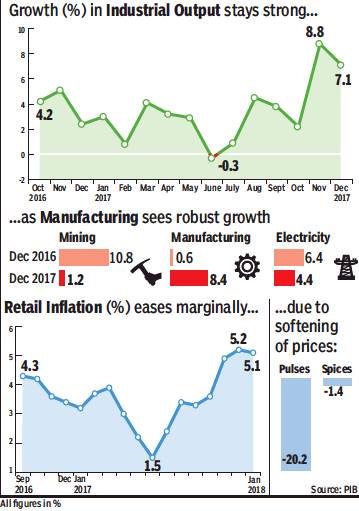

| + | ==Oct 2016- Jan 2018: industry, manufacturing, inflation== | ||

| + | [[File: Oct 2016- Jan 2018- industrial output, manufacturing, and retail inflation in India .jpg|Oct 2016- Jan 2018: industrial output, manufacturing, and retail inflation in India <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F13&entity=Ar02220&sk=4210311F&mode=text Retail prices ease, factory output beats expectations, February 13, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F13&entity=Ar02220&sk=4210311F&mode=text Retail prices ease, factory output beats expectations, February 13, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | Retail inflation cooled in January on the back of slowing food prices, while industrial output growth in December was better than expected, thanks to robust manufacturing and capital goods sectors. | ||

| + | |||

| + | Data released by the Central Statistics Office (CSO) on Monday showed inflation, as measured by the consumer price index (CPI), rose an annual 5.1% in January, slower than previous month’s 5.2%. Consumer food prices also cooled and increased 4.7%, lower than near 5% increase in December. Housing prices remained firm, and surged 8.3% during the month. | ||

| + | |||